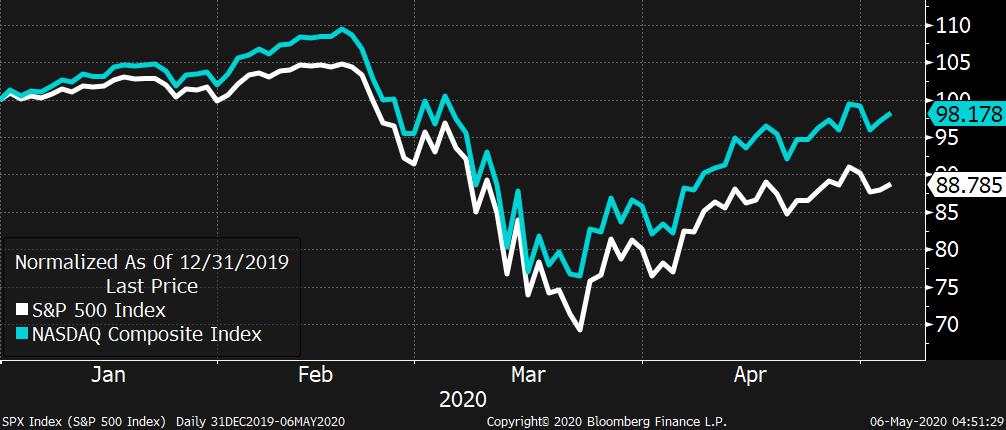

Trump pushes for fast economic reopening, EU faces deepest downturn in its history and Treasury to announce a lot of new debt issuance. Enough"There'll be more death" was President Donald Trump's grim assessment as he pushed for the U.S. economy to open as soon as possible. He added that if cases did rebound it would be like a "fire" that could be extinguished "fast." While he didn't give an exact timeline, he said he is pivoting to "phase two" -- a step that will include disbanding of the White House coronavirus task force. Experts say the public health consequences from reopening the economy will take a few weeks to be confirmed, with the current lockdown proving effective in reducing the spread of the virus. Record slowdownWhile Trump seeks to minimize the damage to the U.S. economy, over in Europe projections released by the European Commission this morning suggest the euro-area region is set for a record 7.7% contraction this year. Differing growth rates among countries in the common-currency area could put the future of the euro at risk, it warned. Yesterday's German court ruling is also adding to uncertainty over whether the response from the ECB can remain as effective as it has been to date. New debtThe fiscal burden of the pandemic in the U.S. will become clear this morning when the Treasury Department announces its quarterly refunding needs. It is expected to boost auctions of 3-, 10- and 30-year instruments and announce the first 20-year bond since 1986. Analysts see the deficit for this year passing $4 trillion, with massive bond issuances every quarter into 2021. Markets risePresident Trump's push to reopen the U.S. economy coupled with the unwinding of shutdown measures across the world are helping stocks extend gains. Overnight, the MSCI Asia Pacific ex-Japan Index added 0.5%. In Europe, the Stoxx 600 Index had gained 0.3% by 5:50 a.m. Eastern Time with investors favoring defensive stocks. S&P 500 futures pointed to a higher open, the 10-year Treasury yield was at 0.676% and oil was over $25 barrel. Coming up...While everyone expects Friday's payrolls number to be awful, there may be a hint on just how awful, in this morning's ADP employment change data at 8:15 a.m. The Treasury refunding announcement is at 8:30 a.m. The oil market will keep a close eye on U.S. crude inventories at 10:30 a.m. Richmond Fed President Thomas Barkin and Atlanta Fed President Raphael Bostic speak later. PayPal Holdings Inc., CVS Health Corp., General Motors Co. and Fitbit Inc. are among the many companies reporting results. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningIn recent days, I've seen more people say things like "but seriously, what's up with the stock market?" because the levels of major equity indexes just don't seem to align with the devastation of the real economy. It really is astonishing. Here is the largest real economic shock in modern history, and the S&P 500 is off just 11.2% this year. The NASDAQ is down just 1.8%. So with the caveat that nobody really knows the answer to anything, here's how I'd answer the question of "what's up with the stock market?" in no particular order:

1. The Fed has intervened in a massive way in credit markets to forestall a run on the corporate sector. This hasn't prevented every bankruptcy (far from it) but the aggressive action, and the implication that it could do more if conditions warrant it, removes some tail risk from the system.

2. Fiscal policy has been in some sense impressive. In a note that came out Sunday evening, Goldman's top economist Jan Hatzius wrote that "disposable personal income is likely to register slightly positive growth for this year" because the unemployment insurance expansion has been so robust. Think about this. With unemployment going into the teens, Hatzius believes that the government will ply workers with enough support to actually grow disposable personal income. His prediction is predicated on the passage of a Phase 4, so that's not a done deal yet, but still.

3. Tech. Note the stats above about the S&P 500 and the NASDAQ. It just so happens that this peculiar crisis has not been particularly disruptive to big tech companies, and in some cases, their models are absolutely booming (like Amazon). And of course, big tech companies already accounted for a huge share of S&P market cap going into the crisis. That's flattered total index returns. If you look at other sectors (energy, airlines, hotels, real estate etc.) the carnage is way deeper, with returns in some cases worse than -60%. 4. Something else to think about is the implications if they pull it off. Imagine, for a second, that between the Fed and the barely functional Congress, that policymakers actually can prevent this shock from turning into a prolonged depression. That would be an incredible demonstration of their ability to slay the beast, and arguably would justify even higher multiples. Again, this is TBD. They might not pull it off.

5. Finally, while the virus curve in the U.S. is depressingly stubborn, there is more optimism about a vaccine coming sooner rather than later, at least compared to expectations from two months ago. It's extremely easy to imagine how this could blow up, and make the current crop of investors look naively optimistic about what this crisis will do to the economy, earnings and stocks. But for now, those factors would be how I'd explain what we've seen so far.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Hello there, just became alert to your blog through Google, and found that it’s truly informative. I am going to watch out for brussels. I will appreciate if you continue this in future. A lot of people will be benefited from your writing. Cheers! 5 hour course online

ReplyDelete