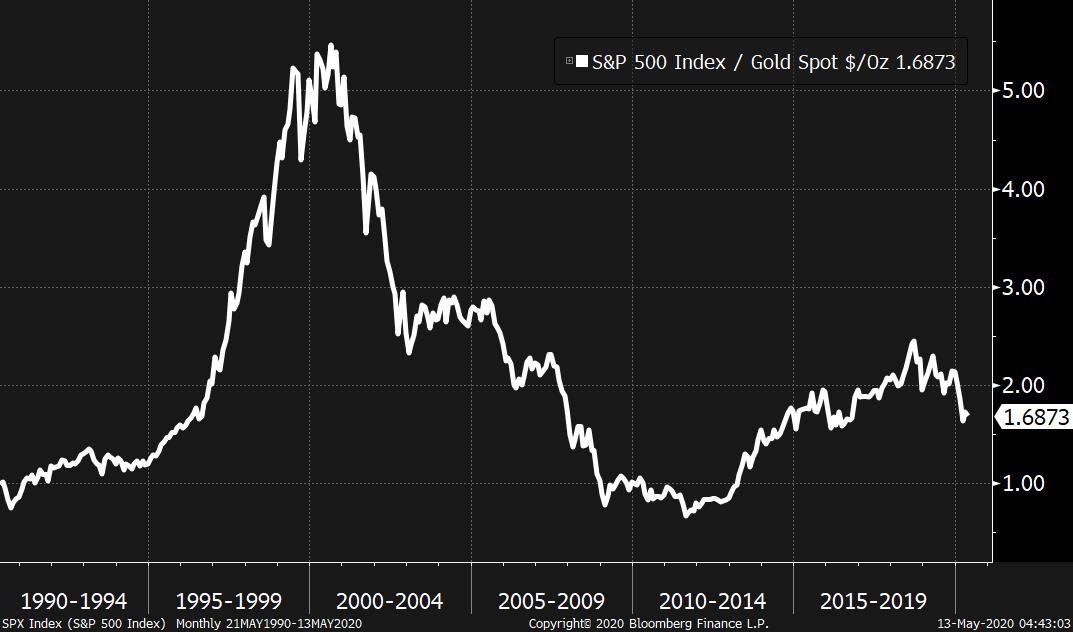

| Fauci comments add to Trump's woes, Powell gives an assessment of the economy, and oil holds near five-week high ahead of inventories. Set back Opening the economy too soon risks new coronavirus outbreaks, Anthony Fauci testified yesterday to a Senate committee. The warning runs against President Donald Trump's moves to quickly get the economy back on track. Trump, facing Supreme Court arguments over publication of his tax returns and falling poll numbers in key states, is responding with his customary gusto. Powell Federal Reserve Chairman Jerome Powell will speak at a virtual event with the Peterson Institute for International Economics in Washington at 9:00 a.m. Eastern Time this morning as policymakers continue to search for ways to counter the worst effects of the lockdown. One thing that has become a hot topic is negative rates, which Trump tweeted approvingly about yesterday. Powell has pushed back before, with economists expecting him to continue to prefer stimulating via the Fed's balance sheet while calling for more fiscal support. Oil data Crude held near a five-week high this morning as investors await U.S. inventory data expected to show the first drop in stored oil since February. The head of the International Energy Agency warned demand for the commodity could remain below pre-coronavirus levels for another year. Later this morning OPEC publishes its monthly report. While the recent run-up in prices has been welcomed by Trump, it's still down almost 60% this year. Markets mixed The warning from Fauci and dire economic outlooks from regional Fed chiefs helped send the S&P 500 Index more than 2% lower yesterday. The risk-off mood dissipated during the Asia session, with the MSCI Asia Pacific Index adding 0.2% overnight. In Europe, the Stoxx 600 Index had dropped 1.1% by 5:50 a.m. with banks among the worst performers after more disappointing earnings. S&P 500 futures pointed to a small rebound at the open, the 10-year Treasury yield was at 0.669% and gold was broadly unchanged. Coming up... U.S. PPI data for April is published at 8:30 a.m. with a drop further into negative territory expected on the headline number. The Treasury is selling $22 billion of 30-year bonds later, with sales of the 20-year instrument expected to restart next week. The House panel on coronavirus holds a briefing at 3:00 p.m. Cisco Systems Inc. earnings will be watched later to see how much of a hit sales have taken in the lockdown. What we've been reading This is what's caught our eye over the weekend. And finally, here's what Joe's interested in this morning I've written about it several times before, but I've always been a fan of the looking at the ratio of the S&P 500 to gold. It's such a pure and simple expression of optimism versus pessimism. When you bet on stocks you're betting on humans endeavoring to do productive things. When you bet on a shiny inert metal you're betting on a shiny inert metal. Here's the long term chart of the two compared.  The chart peaked in 2000, which was really the peak in worldwide optimism. Not just tech stocks, but world peace, world trade, and a bunch of everything else. Then the optimism faded for over a decade amid terrorism, war and a financial crisis. The ratio started rising again in late 2011 which is also when the U.S. housing market started to rebound.

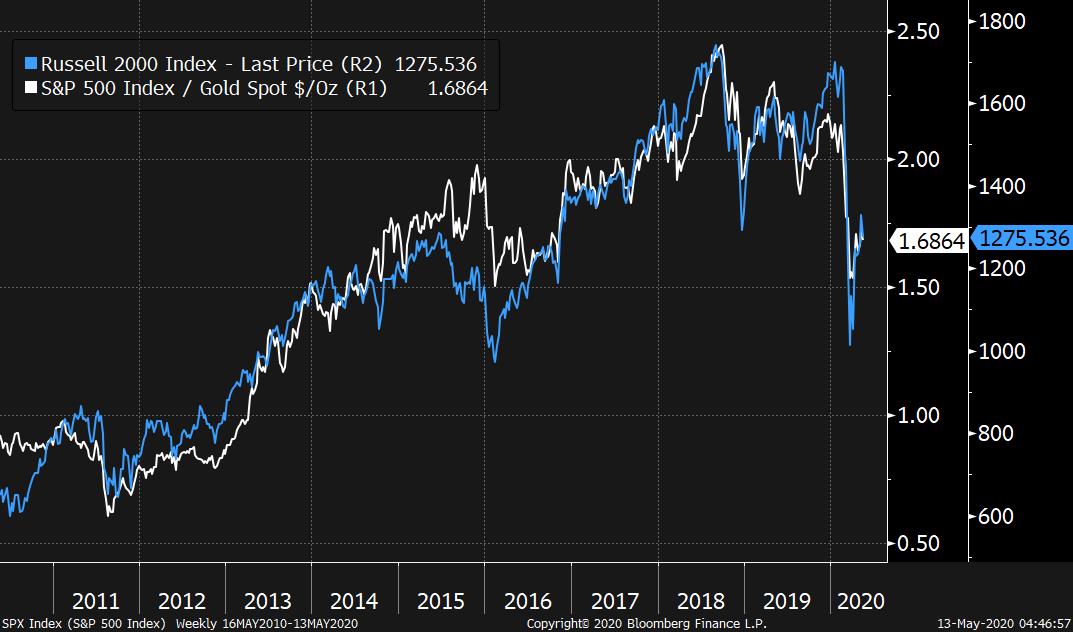

What's also interesting -- and clear in retrospect -- is that the optimism cycle that started in 2011 didn't just come to a screeching end in early March. The optimism cycle ended in the middle of 2018. This was in the wake of the tax cuts (late 2017) and the early 2018 budget deal, which actually boosted spending substantially. Not only did the stocks/gold ratio peak then, but so did the Russell 2000 small cap index, which never regained its 2018 peak. An overlay of the stocks/gold ratio against small cap stocks is shockingly consistent.  Clearly the economy was still expanding and adding jobs up until recently, and there's no reason that couldn't have been sustained, absent the pandemic, with the continued use of smart policy. Nonetheless, in retrospect, enthusiasm over the tax cuts and spending hikes marked the peak of the 2011-2018 rising optimism cycle. Since then it's been fading --some of which may be due to have been trade anxiety -- and then of course the pandemic has crushed it, with these key measures now well off their 2018 highs. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment