| Pressure for more fiscal stimulus, warning on reopenings, and Wuhan to test everyone. Wait and see President Donald Trump's administration may face fresh pressure to provide new economic stimulus as reopenings continue. The House may vote for more spending on Friday, but the coalition that existed across the aisle that saw trillions poured into the economy in March is starting to come apart. Treasury Secretary Steven Mnuchin suggested that it would be prudent to wait a few weeks before deciding on further measures to give time for the already announced packages to have an effect. No rush The need for more cash may become pressing if the reopening of the economy has to be slowed or reversed. Dr. Anthony Fauci is among top health officials who will address a Senate committee later today, and he indicated that he will issue a stern warning about moving too fast in returning activity to normal. Trump yesterday said that the U.S. had prevailed in testing as he continues to push for a resumption in economic activity. Test everyone The Chinese city of Wuhan where the coronavirus outbreak began will test all 11 million residents after the first new cases were reported there since the lockdown ended on April 8. As measures continue to ease in Europe, confusion reigns in the U.K. where Prime Minister Boris Johnson further muddied the waters yesterday with what seemed like a walkback of some of the reopening moves announced on Sunday. Sweden announced a tightening of some measures after deaths in care homes spiraled. Spain became the latest country to announce a 14-day quarantine period for overseas visitors. Markets quiet Investors remain cautious as an uptick in cases in several nations and fears about moving too soon in easing restrictions weighed on sentiment. Overnight, the MSCI Asia Pacific Index slipped 0.6% while Japan's Topix index closed 0.3% lower. In Europe, the Stoxx 600 Index was 0.2% higher at 5:50 a.m. Eastern Time in a fairly subdued session. S&P 500 futures were slightly lower, the 10-year Treasury yield was at 0.71% and oil rose. Coming up... U.S. consumer prices are expected to have fallen 0.8% in April, following on from March's 0.4% decline. Core inflation may also show a drop when the data is published at 8:30 a.m. Health officials begin their Senate testimony at 10:00 a.m. The WASDE crop report is at 12:00 p.m. The budget deficit for April is at 2:00 pm. St. Louis Fed President James Bullard, Minneapolis Fed President Neel Kashkari, Philadelphia Fed President Patrick Harker, Fed Vice Chair for Supervision Randal Quarles and Cleveland Fed President Loretta Mester all speak today. What we've been reading This is what's caught our eye over the weekend. And finally, here's what Joe's interested in this morning Yesterday I detailed my big concern about the U.S. economy and what happens next. In a nutshell: As of the April jobs report, layoffs have overwhelmingly affected lower-paid, service industry workers, many technically identified as temporary. And in the meantime, it's possible that the expanded Unemployment Insurance has done a reasonably good job of replacing lost household income. This has allowed the economy to hang in there by a thread, even amidst so much devastation. If or when layoffs start to climb more aggressively up the income ladder, UI would increasingly fail to replace lost wages, and demand would really begin to get clobbered, creating a downward economic spiral. That's the fear. However, it's worth pointing out that in any crisis there's always a dread of the next shoe to drop. The Great Financial Crisis had all kinds of aftershocks that didn't materaliaze. Remember the wave of municipal defaults that never came to be?

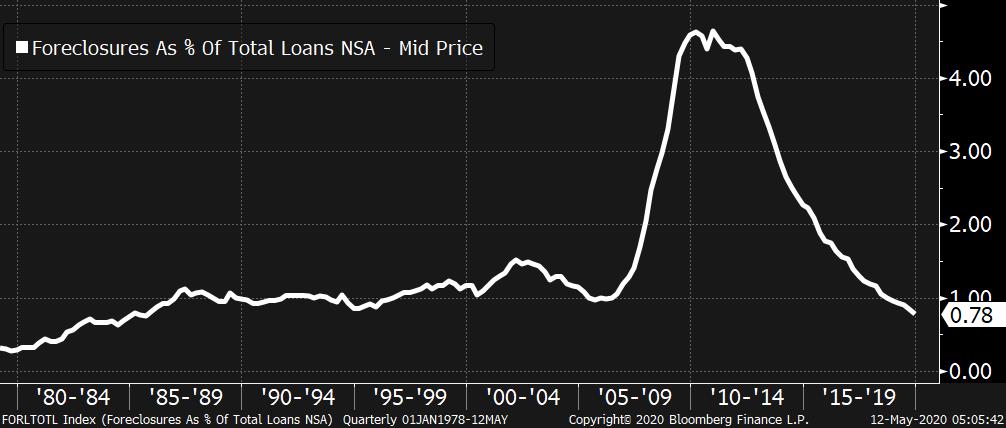

Also in the immediate wake of the crisis, a bunch of smart people warned that a second foreclosure crisis was brewing in the form of Option ARM mortgages. The idea was that pre-crisis, borrowers had taken out mortgages with teaser rates that were scheduled to reset in 2011 and 2012, causing payments to balloon and foreclosures to soar as people couldn't make payments. That didn't happen either. It's easy to see all kinds of horrible knock-on effects from the devastation at any point in time -- but worth remembering that easy forecasts don't always come to be.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment