| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here.

Good morning. Initial enthusiasm for a U.S. virus vaccine is waning, the U.K. government has had a tough 24 hours and European stock futures are edging lower. Here's what's moving markets. Vaccine Excitement Fades Excitement around potential coronavirus vaccines faded as after a report from the health publication Stat highlighted the early nature of trial data for Moderna Inc.'s treatment that pushed broader markets higher at the start of the week. Stat cited the lack of a press release from the U.S. National Institutes of Allergy and Infectious Diseases, which partnered with Moderna on the trial, as well as experts who said they were waiting to see more data from the company before drawing a conclusion. Moderna shares closed down 10%. U.K. Woes It's not been an ideal 24 hours for the U.K. government, which became embroiled in an ugly row over its coronavirus response, after a minister suggested mistakes were down to the "wrong" advice from scientific advisers. The comments came just as Britain's deaths linked to coronavirus passed 40,000, making it the first nation in Europe to reach the threshold. Meanwhile, Chancellor of the Exchequer Rishi Sunak warned that "it isn't obvious that there will be an immediate bounce back" for the economy, and as if that wasn't enough to deal with, trade talks with the European have descended into acrimony. Missing The Boat If you've missed the rebound in European equities, it might be a little late to get in on the game now. Strategists only expect the Euro Stoxx 50 Index, which tracks the biggest bluechips, to rise another 3.8% from Monday's closing level to 3,023 by the end of the year, according to the average response in a poll by Bloomberg News. That will still leave the benchmark down 19% in 2020. Futures are edging lower this morning after a mixed session in Asia. Over in the U.S., extreme behavior is everywhere. Oil Out Of Abyss Just a few weeks ago, crude oil was akin to industrial waste in some parts of the world, something you had to pay people to take away. Now prices are surging, up about 70% in New York since the start of May. The turnaround, which has been welcomed from Riyadh and Moscow to the White House, came quicker than most people were expecting but wasn't easy. Painful OPEC+ production cuts and the world's risky first steps out of coronavirus lockdown have lifted the market out of the abyss of negative prices, but either of them could falter. Prices have steadied this morning. Coming Up… U.K. inflation statistics for April are due to be released as the debate around negative rates continues, while euro area consumer confidence is expected to have slid again. The European Commission publishes economic policy recommendations for member states and the U.S. Federal Reserve releases minutes from its April meeting where it held interest rates as they were. This morning, earnings come from U.K. retailer Marks & Spencer Group Plc. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Mark Cudmore is interested in this morning Like a teenager rebelling against the smothering love of over-protective parents, gold may upset a lot of people in the weeks ahead.

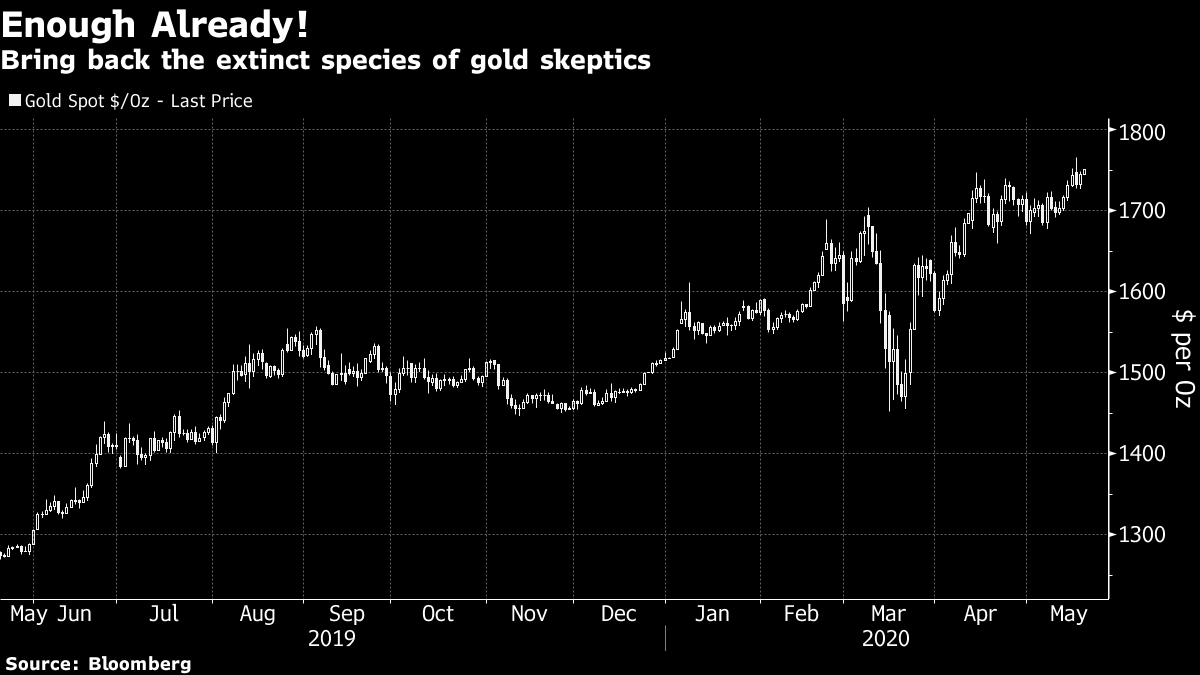

I've rarely seen such a consensus view as bullish gold right now. It's entirely logical, given that central banks are spewing free cash in the form of stimulus programs and the world is blighted by a pandemic not seen for 100 years. Add in U.S.-China trade tensions and the usual dose of other political concerns and it seems a good time to hang out in haven assets.

The problem is that these are all stale drivers by now. Shock-and-awe policy support was the theme for March and April. Investors are becoming inured to virus news. And U.S.-China tensions have become the norm since Donald Trump assumed the presidency. Assets generally trade on marginal news -- this gold rally needs something fresh soon or there may be a nasty correction in store.  Mark Cudmore is a Bloomberg macro strategist and the Managing Editor of the Markets Live blog. Bloomberg Terminal users can follow him there at MLIV. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Clos |

Post a Comment