| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here.

Good morning. A European Union virus aid package earned crucial support, Donald Trump stepped up his threats against the World Health Organization and equity futures are pointing higher again. Here's what's moving markets. EU Breakthrough German Chancellor Angela Merkel and French President Emmanuel Macron agreed to support a 500 billion-euro ($546 billion) aid package to help the European Union recover from the coronavirus in a major step toward tighter integration. Merkel said that Germany would accept a fund within the framework of the EU budget, financed by additional borrowing, that would make grants to member states that have been hardest hit by the virus. Crucially, she said the bonds issued by the European Commission would be repaid from the EU budget, the lion's share of which is covered by Germany. Italian bonds jumped on the proposal. Trump's WHO Threats President Donald Trump escalated his threats against the World Health Organization over its handling of the pandemic, saying he would permanently cut U.S. funding if it does not make sweeping reforms.

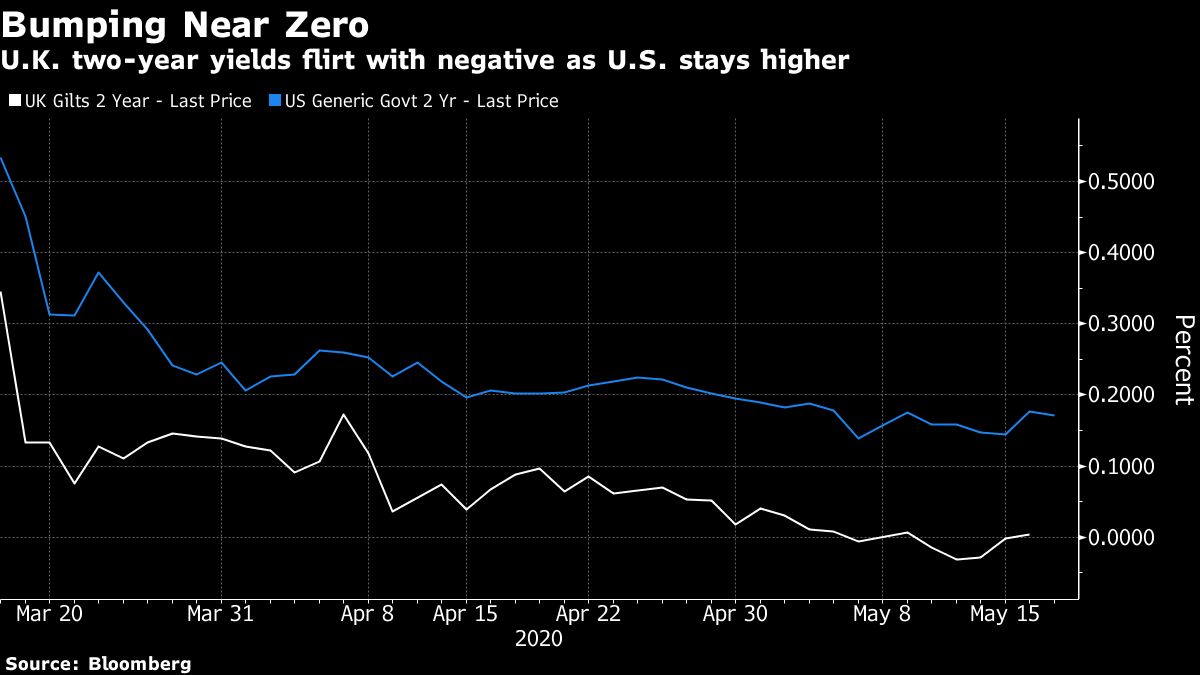

The agency must demonstrate "independence from China," according to a letter, which the president posted on Twitter late Monday. The update comes as Trump revealed he is taking hydroxychloroquine, the anti-malaria drug he's promoted as a treatment for coronavirus infection, despite government warnings that it can cause serious side effects. Stocks Green European stock futures are slightly higher again after the Europe Stoxx 600 index had its best day since late March, partly due to optimism about a vaccine as an experimental drug from U.S. biotechnology company Moderna Inc. showed signs that it can create an immune-system response to fend off the new coronavirus. China, meanwhile, pledged on Monday to make its treatment a global public good once one is available, in a sign that President Xi Jinping is seeking to defuse criticism of Beijing's response to the pandemic. Elsewhere, oil's June contract held gains following a three-day rally in its last session before expiring. U.K. Rate Path Sterling is edging higher against the dollar for a second day despite the Bank of England's debate over negative interest rates stepping up a gear. Policy maker Silvana Tenreyro noted negative rates have had a positive effect elsewhere after the central bank's chief economist, Andy Haldane, said in a weekend interview that sub-zero rates are something officials need to be looking at. Some traders are now betting on negative rates in the U.K. by the end of the year. Meanwhile, in Westminster, pressure is mounting on Boris Johnson to publish the scientific advice behind Britain's response to the pandemic. Coming Up… U.K. unemployment is forecast to have edged up in March, though the real damage will have begun the following month. Elsewhere, expect the German ZEW economic sentiment index to have plunged this month, and U.S. Federal Reserve Chairman Jerome Powell testifies before the Senate Banking Committee later, having said last night that the central bank is prepared to use its full range of tools to help the U.S. economy recover. U.S. retail giant Walmart Inc. provides an earnings update later, as does British cigarette-maker Imperial Brands Plc, and, finally, note that short-selling of equities can resume in several countries from today. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Chris Anstey is interested in this morning A colleague at Bloomberg has a tag-line on her messages that says "Where there's smoke, there may be fire. Or it may just be smoke." It's an interesting twist on the well-known phrase, and I wonder if it's applicable to the recent comments from the Bank of England about negative interest rates. As a long-time observer of Japan's economy, I came into the coronavirus crisis skeptical that policy makers would opt for negative rates as a policy tool. They have in the past four years done little good for Japan, and their introduction proved if anything a setback for the Bank of Japan's goals. When the BOJ, European Central Bank and the Riksbank all avoided taking policy rates more deeply negative (or in Sweden's case back into negative territory) it reinforced my view. The Reserve Bank of New Zealand is another that's potentially open to negative rates, but it was quite telling when last week the RBNZ said it would take until the end of 2020 for the (small) banking system in the antipodean country to be prepared for such a move. Again, it suggests that negative rates are something like hydroxychloroquine – unproven in fighting the disease, but proven to have some pretty darned serious negative side effects. So what gives with the BOE? Evercore ISI analysts reckon that the recent comments are designed to preserve negative rates as an option, with the effect of bringing down money market rates. If negative rates are an option, then short-term yields and swaps can come down ever closer to zero, doing that extra bit to impart stimulus in the financial system. Will the BOE actually go down that route? Probably not, Evercore says. But you can see with the relative drop in two-year gilt yields versus Treasuries that markets view it as more likely there than across the Atlantic.  Chris Anstey is managing editor for cross asset coverage in Tokyo Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close |

This Information is really good and informative. Thanks for it.

ReplyDeleteCheck below links and get useful information.

UTI AMCL IPO