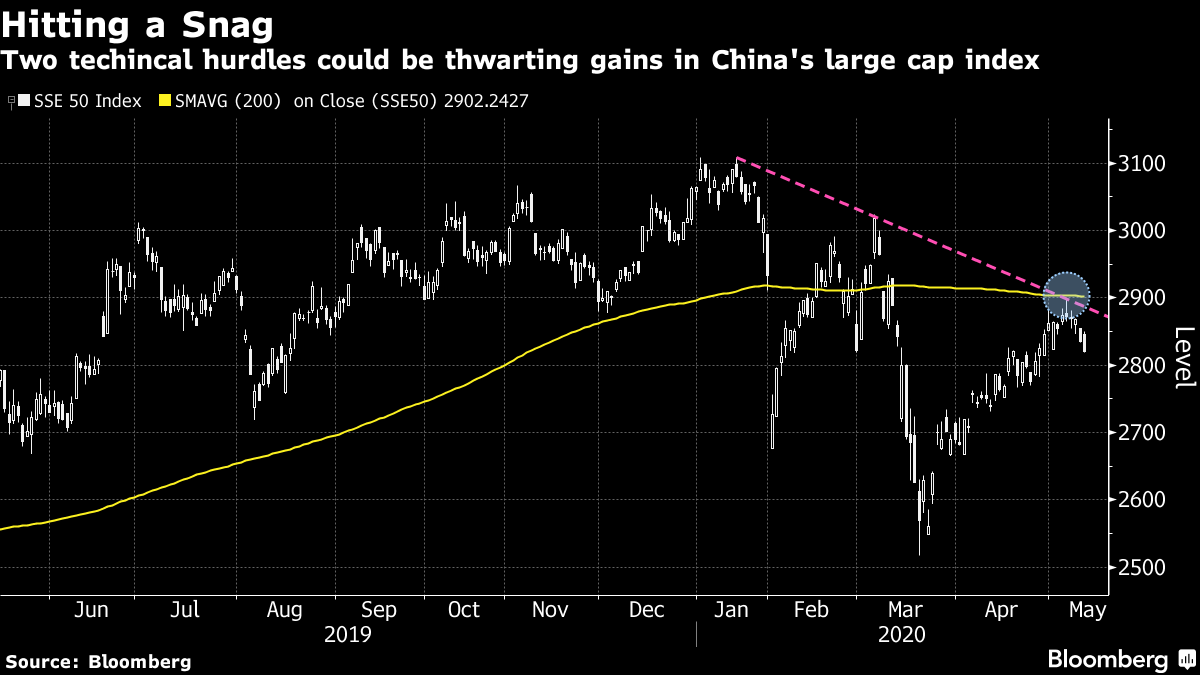

| Good morning. U.S.-China tensions are simmering, a U.K. drugmaker has plans for a virus vaccine, and Federal Reserve Chairman Jerome Powell warned of a prolonged economic recovery. Here's what's moving markets. U.S.-China Friction U.S.-China tensions are in the spotlight again this week. The Trump administration stepped up its campaign of blaming China for the coronavirus pandemic, with an aide suggesting Beijing sent airline passengers to spread the infection worldwide. China, meanwhile, criticized new U.S. export restrictions targeting firms like Huawei Technologies Co. and vowed to take all necessary measures to defend its companies. Finally, U.S. Secretary of State Mike Pompeo warned China against interfering with the work of U.S. journalists in Hong Kong. AstraZeneca Vaccine Hopes Britain is the latest focus of Covid-19 vaccine hopes as AstraZeneca Plc aims to make as many as 30 million doses available to the U.K. by September, and has committed to delivering 100 million doses this year, if the inoculation -- which is already being studied in humans -- is successful. In the meantime, Europe continues to embark on a period of uneasy coexistence with the virus as countries ease lockdowns. In their latest updates, the U.K. and Italy reported the fewest deaths since March, while France saw the most fatalities in three weeks. Powell Interview The U.S. economy's recovery from Covid-19 could stretch until the end of next year, according to Federal Reserve Chairman Jerome Powell. "For the economy to fully recover people will have to be fully confident, and that may have to await the arrival of a vaccine," Powell said in comments aired on CBS's "Face the Nation" and "60 Minutes" shows. He once again batted away the idea of using negative interest rates, saying they're "probably not an appropriate or useful policy for us here in the United States." Futures Higher U.S. and European stock futures advanced along with Asian equities as investors took some encouragement from signs of businesses reopening across major economies. Here's a look at why European stocks are cheap versus U.S. equities, and here's where global investors are placing bets right now. Oil rose above $30 a barrel for the first time in two months as producers in the U.S. and elsewhere continued to cut activity. Coming Up… Bank of England policymaker Silvana Tenreyro speaks after the pound's worst week since March as renewed Brexit concerns add to the virus fallout. In earnings, Ryanair Holdings Plc expects to book a loss of more than 200 million euros ($216 million) for the June quarter, and said it received a 600 million-pound ($726 million) loan backed by the U.K. government. Elsewhere, SoftBank Group Corp. is in talks to sell a significant portion of its stake in T-Mobile U.S. Inc. to Deutsche Telekom AG, Dow Jones reported, citing unidentified people familiar. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Adam Haigh is interested in this morning A lot rests on China's National People's Congress gathering later this week. Now scheduled for May 22, many traders hope that the meeting will offer more guidance on stimulus programs. It couldn't come at a more testing time for stock-market sentiment, with the recent rally appearing to stall at the 200-day moving average on the Shanghai Stock Exchange SSE 50 Index of large-cap equities. Data on Friday painted a mixed picture of China's post-lockdown recovery, with industrial production improving in April while retail consumption remained sluggish. One risk heading into the NPC is that the authorities underestimate the continued damage being inflicted on Asia's largest economy. If they underwhelm with any resulting package, markets may be swift to offer their view and equities could find a quick retracement from their recent rally.  Adam Haigh is a cross-asset reporter and editor for Bloomberg News in Sydney. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Clos |

Post a Comment