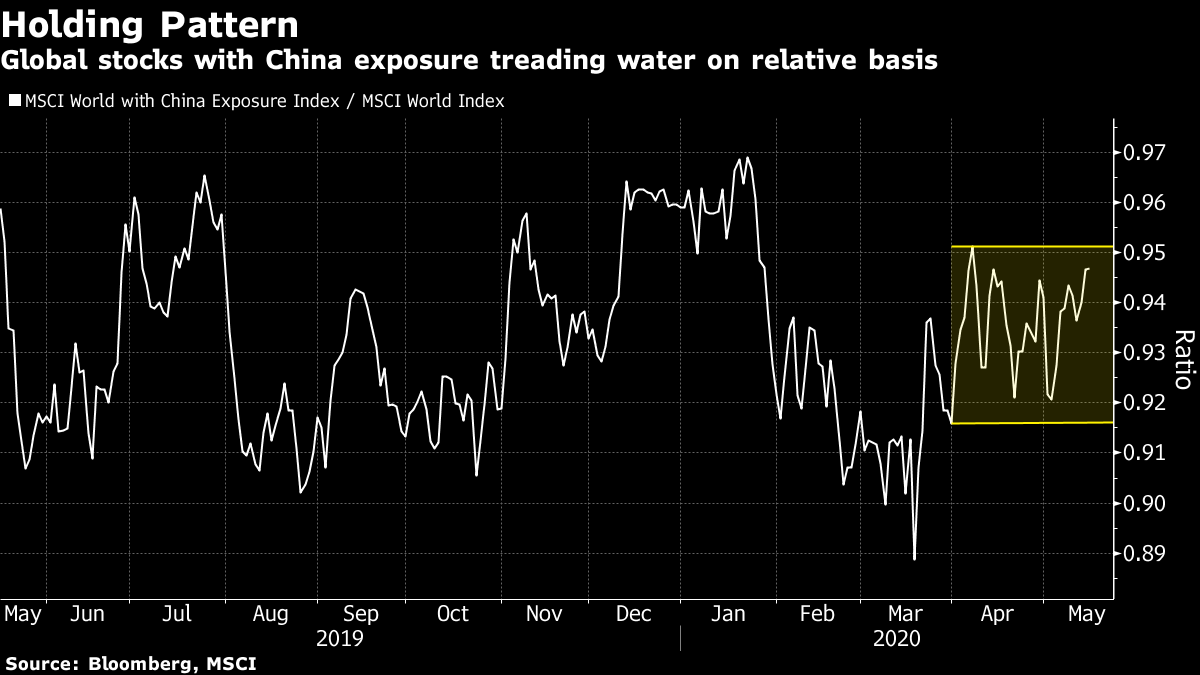

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. German economic data arrives, the U.S. continues to cope with the virus hit and Brexit rears its head once again. Here's what's moving markets. Germany's Economy German GDP tops the agenda for Europe, detailing the pandemic hit delivered to an economy that was already showing cracks before the outbreak and that could be held back by its reliance on international supply chains. The government has also been told that airline Deutsche Lufthansa AG needs a bailout and protection from foreign takeovers. Italian deaths and new cases rose ahead of plans to further ease lockdown restrictions in a country being watched very closely for any signs of a second wave. That's despite the view that daily virus counts mean little in a post-lockdown world. Eastern Europe, meanwhile, is likely headed toward the worst economic slump it has experienced since the end of communism, with data due from Poland and Hungary on Friday. Stockpiling The U.S. government is stepping up stockpiling of medicines in order to prepare for future virus flare-ups as it eases lockdown restrictions. Economists will be closely watching the reopening in Georgia as a bellwether for national plans to ease lockdowns, with no spike in deaths or hospitalizations so far, amid warnings that American cities will lose $360 billion of revenue through to 2022 and a Federal Reserve survey confirming that it is the poorest in society being hit the hardest by the effects of the pandemic. And bubbling in the background are growing tensions with China and the potential for the worst-case scenarios in trade relations between the two countries to become reality. Brexit's Back The pandemic has pushed Brexit to the sidelines but Friday will see the European Union and the U.K. give an update on the progress made so far. Ahead of that, things seem tense. The EU has threatened the U.K. with a lawsuit over the freedom of movement of people, a reminder of how Britain remains tied to its rules four months after leaving the bloc. The U.K. government is also doubling down on its negotiating red lines, sticking with the view that the EU should offer a trade deal using precedent from its existing agreements with other countries. It's all another headache for the struggling pound and domestic stocks contending with the economic battering the virus has delivered. Bonds Governments around the world have sold an avalanche of bonds to raise money to shore up their economies and it has been eaten up by the market so far, but this could change if central banks pull back on quantitative easing. Next week, the market will even get the chance to buy 20-year Treasuries for the first time and UBS Group AG has predicted the U.S. municipal bond market is about to face its biggest financial storm ever. Elsewhere, banks' currency trading revenue is rocketing, the Swiss franc is heading towards a point where it may test the central bank's resolve, and dealmakers are hoping activity will pick up in the second half. Coming Up… Stocks in Asia drifted and European stock futures are higher as we come to the end of a rocky week. Oil is set for a third weekly gain on tentative signs that the market is slowly rebalancing. It's a relatively data-heavy day, with Chinese industrial data already in and improving, though retail sales remain weak. German GDP will top the bill in Europe before U.S. industrial production and retail sales numbers. Earnings are lighter, however, with the attention likely to be pulled by jewelry and watches giant Richemont and by U.K. bookmaker William Hill Plc. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning Traders barely blinked at the mixed bag of economic data from China Friday — global stocks were little changed in the immediate aftermath of better industrial output figures and weaker retail ones. In fact, it seems investors have been on the fence about the world's second-largest economy for a couple of months now. An MSCI gauge of global stocks with the greatest sales exposure to China has settled into a narrow relative trading range versus the broader market — neither out- nor under-performing. Even the evident strains in the U.S.-China relationship hasn't led to any discernible extra weakness in global companies most exposed to Chinese growth. That could be premature — the increasingly vocal feud between President Donald Trump and China is likely to get noisier as the U.S. election approaches in November. On Thursday, Trump said he doesn't want to speak with Xi Jinping and the U.S. would "save $500 billion" if it cut off ties with China. And even if Chinese industry is getting back to business, there is no guarantee its end customers — both domestic and international — will quickly follow suit. It's an uncertain time for companies with significant China exposure, all the more so given the fresh trade-war rhetoric, and that uncertainty doesn't seem to be priced into their stocks just yet.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment