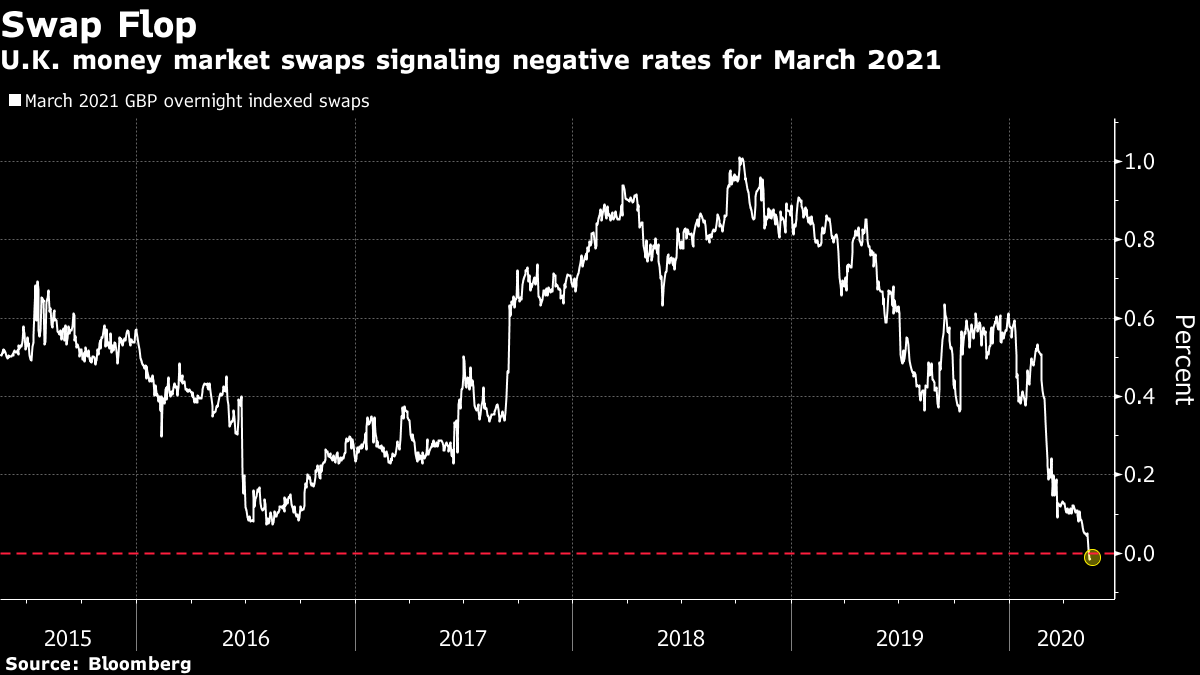

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. European authorities are stepping up to battle the economic slump, the negative rates debate rages on and Europe's IPO market wakes up. Here's what's moving markets. Low Point The European Central Bank signaled the economy has hit the low point of the virus-driven slump, though what the path to recovery will look like remains uncertain. The European Commission says it is working on an "ambitious" plan to help economies recover from the downturn amid worries the virus is driving a deeper rift between Europe's northern and southern countries. Italy's government passed its long-delayed 55 billion-euro stimulus package, and Germany's economy is also struggling but was creaking before the pandemic hit. In the U.K., which took a heavy GDP hit in March, the pressure on Prime Minister Boris Johnson over his handling of the crisis is rising, while health authorities have approved Roche Holding AG's antibody test, a key step for the government as it looks to ease lockdown restrictions. Friction Friction between the U.S. and China is firmly back on the agenda. The U.S. has claimed Chinese hackers are attempting to steal research on virus vaccines and treatment, Republicans want a new panel to investigate the actions of the World Health Organization and China in the early stages of the pandemic, and President Donald Trump extended an order curbing Huawei Technologies Co.'s access to the U.S. market. Trump is showing signs of frayed nerves amid the pressure of responding to the virus combined with falling poll numbers in an election year. Not to mention the pertinent question -- particularly given accuracy concerns about the tests the White House is using -- about what happens if the president tests positive for the virus. Negative Rates Traders around the world are forging ahead with bets that rates will go negative from the U.S. to New Zealand. Trump tweeted this week that negative rates would be a "gift," but Federal Reserve Chairman Jerome Powell pushed back against the notion, while saying that fiscal and monetary policymakers need to rise to the challenge of dealing with the unprecedented risks the virus has brought. One thing Covid-19 has done, however, is reinforce the position of the dollar's supremacy among global currencies, dealing a blow to the yuan and therefore China's soft power. In equities, a chorus of Wall Street heavyweights are now saying that stocks are vastly overvalued. Zoom Boom If you are looking for a sector which has clearly benefited from lockdowns and remote working, it'd be tough to find a better example than video-conferencing. Norwegian firm Pexip Holding AS will debut on the Oslo market on Thursday, seeking to capitalize on the booming demand for remote working software exemplified by Zoom Video Communications Inc. becoming a household name despite recently coming under fire for its handling of client data and privacy. A deluge of equity financing deals ensured that European capital markets have been anything but quiet since much of the continent went into lockdown in March. Yet the IPO market remained firmly frosted over. Pexip will help thaw it. Coming Up… Asian stocks declined and European stock futures are pointing lower again, though U.S. futures are a touch higher. WTI crude oil is hovering around the $25-a-barrel mark as investors weigh up a long and uncertain road ahead. The European Central Bank's economic bulletin arrives later and eyes will be glued to U.S. jobless claims once again, with Goldman Sachs revising up its prediction for the peak unemployment rate to 25%. German payments firm Wirecard AG, U.K. wealth manager Hargreaves Lansdown Plc and medicines and chemicals group Merck KGaA top the earnings bill, plus watch for reaction to carmakers Fiat Chrysler Automobiles NV and PSA Group scrapping dividends tied to their merger. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning The recent debate over the adoption of negative rates is not just a U.S. phenomenon. In the U.K. too traders are betting on a move below zero — for the first time in history. Money market swaps, which are used to bet on interest-rate moves, are now signaling negative U.K. rates for March of next year. Kiwi investors also see their benchmark falling through zero — something policy makers in New Zealand have openly contemplated — and its worth remembering that even Federal Reserve Chairman Jerome Powell didn't fully rule out the option in comments this week. With the evidence still mixed on whether negative rates do much to help boost economic growth, one thing is clear — they are not great news for investors in banks. Japanese banks have long warned that negative rates have battered loan profitability and reduced their incentive to lend, and their European counterparts have similar gripes. Japan's Topix bank index has lagged its market by over 40% since short-term rates went below zero at the start of 2016, and the Euro Stoxx banks gauge has underperformed the regional benchmark by over 60% since June 2014 when the ECB went negative.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment