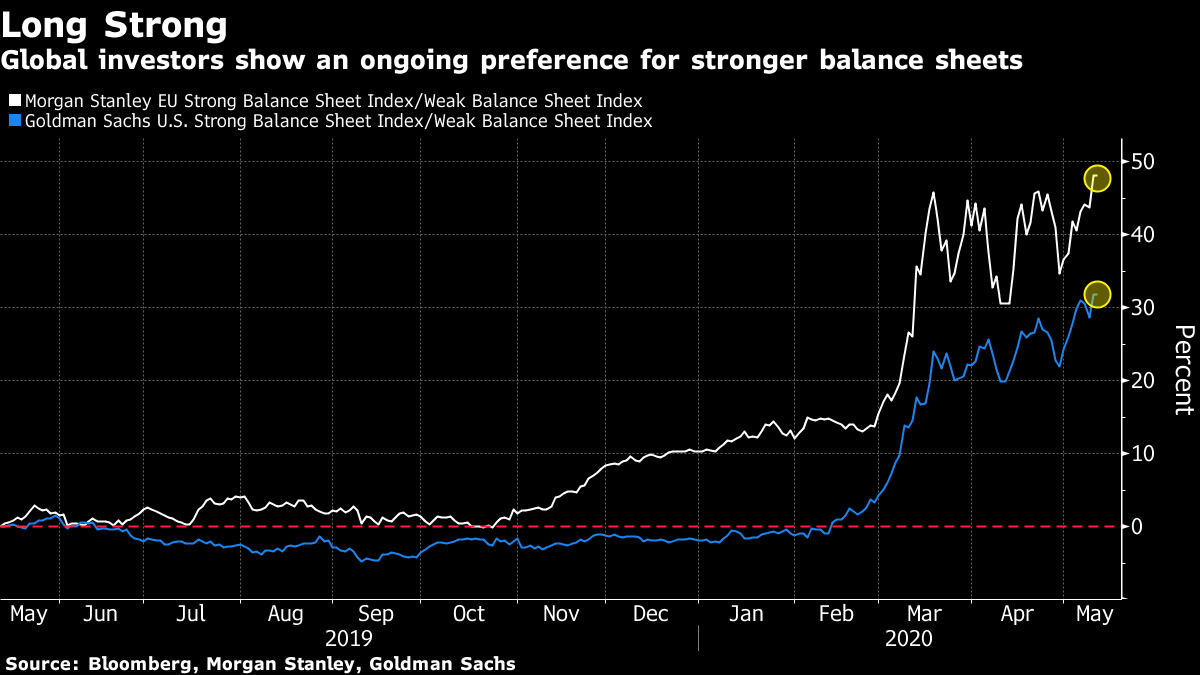

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. Europe faces teething pains in reopening, Trump praises testing and there are tentative signs of an oil recovery. Here's what's moving markets. European Reopening The process of restarting Europe's economy is underway and got a jittery reception from markets, with stocks falling amid fears of a potential second wave of infections forcing countries back into lockdowns. French virus deaths increased, while new cases in Italy were at the lowest in more than two months. Poland, the economy seen as most resilient to the coronavirus in the European Union, may be headed for a U-shaped recovery after hitting the bottom in April. The U.K. was told to plan for a new normal which may last a year or more, but Prime Minister Boris Johnson's toned down plans seem to have mostly caused confusion. `Prevailed' U.S. President Donald Trump told a news conference that the U.S. has "prevailed," and later said this only referred to the success the country has had in rolling out testing as deaths topped 80,000. Some U.S. Republicans are moving closer to giving their backing to a new $500 billion aid package for states battered by the economic implications of the virus. The U.S. Federal Reserve pushed back against market expectations that rates will go negative, with some officials expecting the central bank will have to do more before this crisis is over. The Federal Reserve's lending package, meanwhile, is designed to deter cash-strapped local governments from using it, underlining the central bank's desire to be lender of last resort. Stocks Outlook For all the worries about potential second waves and mistakes being made in easing lockdowns, stocks continue to be mostly untethered to this reality. A preference for tech and biotech stocks has pushed the relative strength of the Nasdaq against the Dow Jones Industrial Average to a twenty-year high, though Goldman Sachs thinks stocks are set for a hefty drop after a FOMO-driven rally. The sell-in-May mantra looks set to continue in emerging markets while funding costs in Europe eased somewhat following a three-day rising streak. Crude Recovery Crude oil prices edged a little higher as demand continued to show signs of recovery amid lockdown easings and following Monday's pledge from Saudi Arabia to cut production as it undergoes a radical economic makeover. All eyes will be on Saudi Aramco's earnings report due later today. In the U.S., shale oil drillers are starting to reopen wells on the view that the price slump has bottomed out. Meanwhile, oil majors have been warned their climate goals don't go far enough and the hot U.S. solar market has been an unlikely casualty of the oil bust. Coming Up… European and U.S. futures drifted lower along with Asian stocks as traders assess the many and various challenges involved in countries easing their lockdowns. China factory data showed ongoing weakness in its economy, with deflation continuing and consumer price gains slowing. It's a light day for European economic data but earnings rev up once more, topped by numbers from German insurer Allianz SE and U.K. telecoms firm Vodafone Group Plc. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning As the "bear market rally" versus "new bull run" argument continues to rage, one thing is clear — investors are not prepared to compromise on perceived safety. Both in the U.S. and Europe, gauges of stocks with strong balance sheets have just hit a fresh relative high against their weaker capitalized peers. That suggests that even if investors are prepared to do a little bottom fishing, they are sticking close to shore and not ready to risk the deeper waters. The desire for security is also evident outside of equities. Cash continues to pour into gold exchange-traded funds, with 2020 inflows already exceeding any full year on record. The premium on safety suggests the burden of proof still lies with those betting that a new bull market is underway. Fear of missing out still seems to be the main driving force for recent stock gains. Until investors show they are comfortable taking on board a little more risk, stocks look vulnerable to a rapid retreat.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment