What's to L-U-V?

EDITOR'S NOTE

One of my least favorite topics of discussion in any recovery is what "shape" the rebound will take.

It's not because it isn't useful; it is! I just get tired of hearing about it. Here we go again with the L-shaped vs. V-shaped discussion, I can't help but think. Each recovery has its own variations; sometimes the "hockey stick" analogy comes up, for instance. This time around, the "U-shaped" rebound is a current favorite.

To clarify, we're talking about what the GDP charts will look like. A V-shaped rebound is the best news; a quick, sharp recovery. These can be so strong as to invoke the whole "will-it-be-inflationary" discussion. The L-shaped is bad news; it means the contraction stops, but there's not much growth to speak of. When I think about the years 2011 through 2016, I think about the "L." There's a lot of worry about double-dip recessions, a lot of talk about "secular stagnation," etc.

The "U" that we're hearing about now would be a decent outcome; you still get the upturn, it's just delayed a bit. The trouble is, I'm not convinced the "U" has much of a track record to speak of in terms of actually working. I'll have to ask more about this.

In any case, in comes the brilliant David Zervos with a more specific way of analyzing how this rebound might "shape" up: as an L, a U, and a V, depending on the company and sector. The "L," unfortunately, is for junk-rated businesses or those carrying a lot of debt, that can't cope well or for long with this loss of revenue. The "U" is for your typical "Main Street" business; restaurants, retail, dry cleaners, banks (again, that have kept their balance sheets in decent shape). And the "V" is for investment grade corporate America, which is a promising sign.

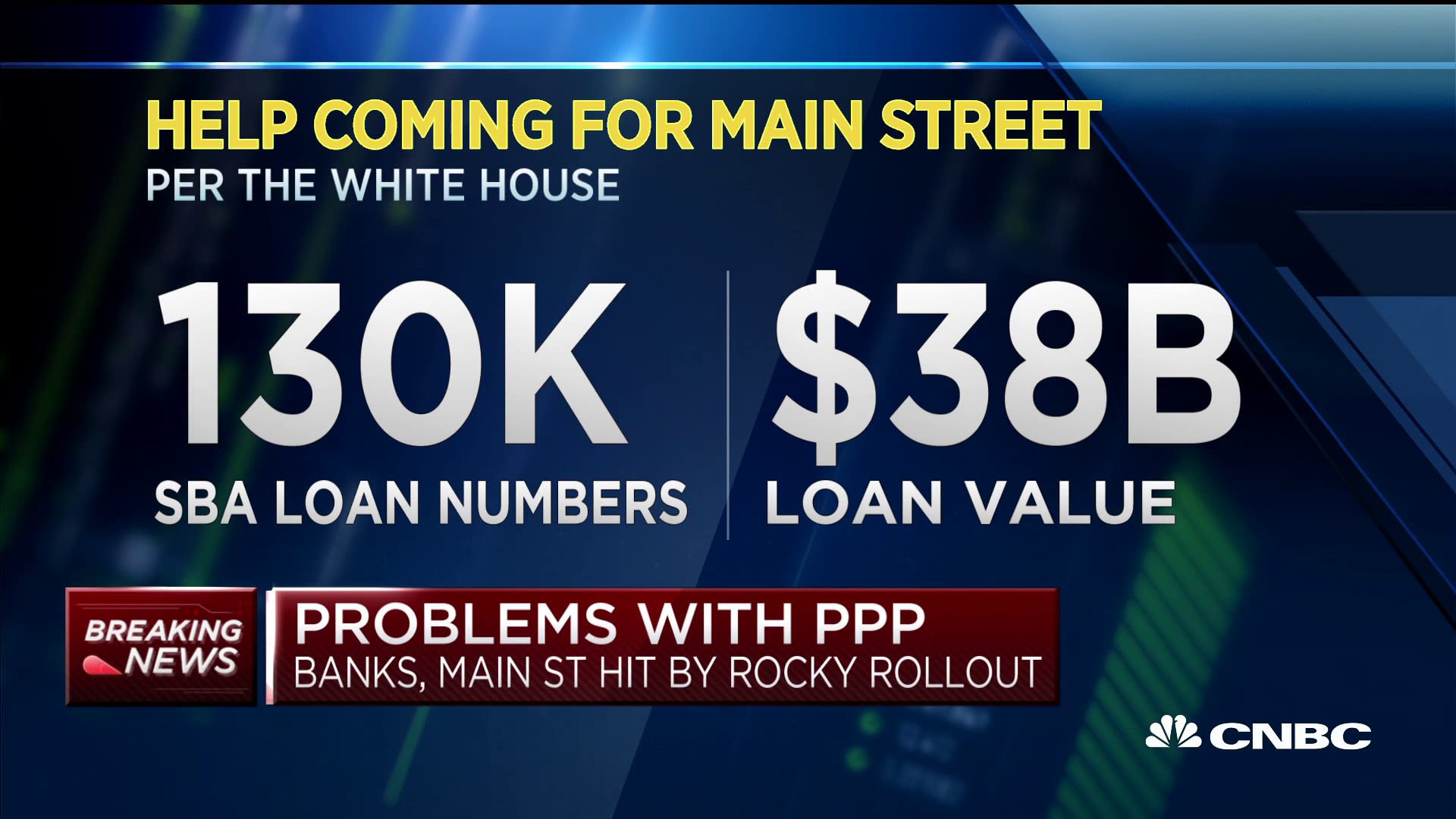

Thus, says Zervos, the government's response to this crisis makes a lot of sense; the Fed is providing investment grade corporate debt with plenty of liquidity, is building out massive "Marshall Plan" relief for small and Main Street businesses, and is more or less leaving alone heavily indebted sectors like commercial real estate, junk bonds, and levered loans. Help the strongest, not the weakest, survive, seems to be the mantra. If you're an investor in one of those overleveraged areas, be warned.

The Powell Fed had come under plenty of criticism in its early years for its tone-deaf moves; insisting on one path only to finally reverse course under intense market pressure but then not reversing course quite enough to calm markets. Or sometimes the market would like the Fed's statement but then get all confused by something that Powell said at the press conference, and so on.

Well, the Powell Fed has certainly risen to this particular challenge. It reminds me of the coincidence that Ben Bernanke, a Great Depression scholar, wound up helming the Fed during the Great Recession. Now you have a lawyer, a close friend of the Treasury Secretary, leading the Fed through this tricky and unprecedented time of needing to support "good" American businesses while not bailing out the "bad." It's a true stroke of luck, or Providence.

It's also a promising sign at a time when we sorely need them. And now we're told that Senate leader Mitch McConnell is working to secure more money for the $350 billion small biz lending program that began on Friday; Senator Rubio has suggested at least $200 billion more is needed. If our leaders can get this right, they might just be able to deliver a recovery to L-U-V.

See you at 1 p.m!

Kelly

KEY STORIES

IN CASE YOU MISSED IT

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Post a Comment