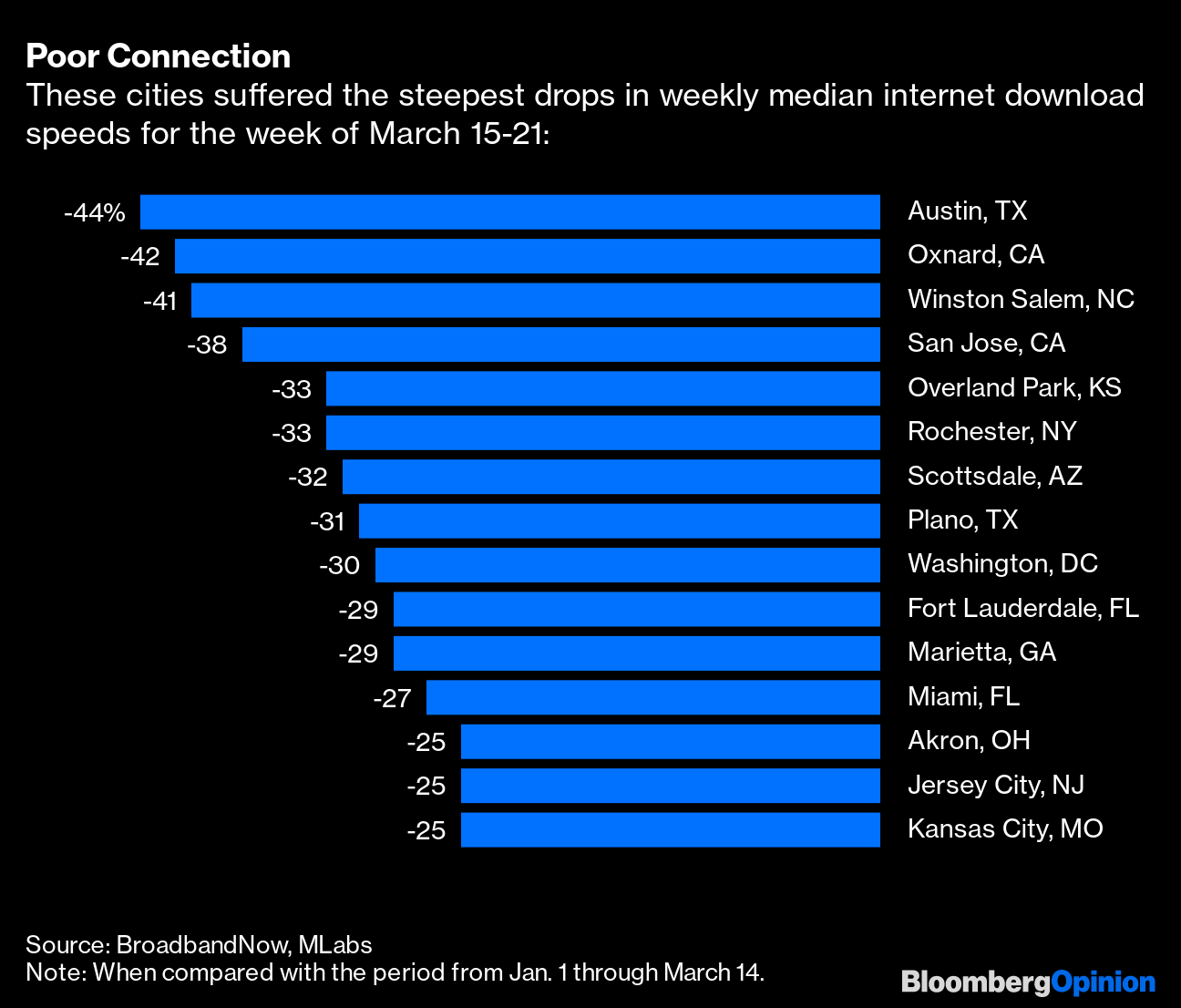

| This is Bloomberg Opinion Today, a Trader Joe's line of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  We're not home yet. Photographer: Sean Gallup/Getty Images Europe Beware That Light at the End of the Tunnel The whole world right now is basically that kid on a car trip asking "Are we there yet?" Except we're in our houses, not going anywhere. Like that kid, we'll simply have to be patient, on a time scale measured in months rather than SpongeBob episodes. Also like that kid, most of us find this idea fundamentally unacceptable and ache get on with normal life. But even in Wuhan, China — where the coronavirus pandemic began and where travel restrictions were today lifted after a months-long lockdown — "normal" is still distant. For one thing, people there have no idea how many asymptomatic carriers walk among them, spreading a disease a new study suggests moves twice as quickly as we thought. We lack reliable data about not only infections but also the real economic impact throughout China, writes Shuli Ren. Without such baselines, it's hard for investors or anybody else to get too excited about China's tiptoe toward normalcy. Beyond China, there are signs of of infections peaking from Europe to New York, fueling a days-long stock market rally. But these reeds of hope are painfully thin, with deaths soaring and infection rates merely growing more slowly. In the U.S., we'll need much more testing and better treatments before we can safely end lockdowns, writes Mohamed El-Erian. Returning to normalcy too soon risks a resurgence of the disease, defeating the whole purpose. For now, there are still fewer testing swabs available than there are toilet-paper rolls, writes Michael Lewis. Until this changes, he and other California hikers will fear encountering other humans more than they fear mountain lions. Italy hopes to end its lockdowns relatively soon, but also lacks the testing capacity to do so, writes Ferdinando Giugliano. And the government hasn't exactly shown mastery of handling either the pandemic or the economic fallout. Even Austria, which handled its outbreak effectively, is only reopening in phases, writes Lionel Laurent. This along with the fact that its neighbors are still shuttered means "normal" is months away, at least. We'll watch many more SpongeBobs before we reach our destination. Further Virus-Fighting Reading: Sure, Stocks Might Look Cheap Now The stock market's rally makes sense if you think of it as forecasting a middle-distant future where economic growth returns. Just don't be fooled into thinking this bet is a bargain; the market has become a big value trap, warns Robert Burgess. Stocks looked awfully cheap at the bottom, but companies haven't even begun to cut earnings forecasts yet. When they do, stocks will suddenly appear much less cheap, and less appealing to boot. And comparing this selloff to those of the past suggests the bottom's not in yet, writes John Authers. History is the stock investor's friend in at least one way, though, notes Nir Kaissar: Dividends may be slashed for a bit during the crisis, but should bounce back quickly enough. Oil's on a Slippery Slope Today's stock rally was brought to you partly by a surge in oil prices, sparked by optimism about an OPEC+ meeting tomorrow. Investors expect Saudi Arabia and Russia to have a kumbaya moment, ending their disastrously timed price war by cutting production to lift prices. But even if this crisis is overcome, Saudi Arabia still faces a grim future of falling demand, rising competition and faltering U.S. support, warns Liam Denning. Today's oil savior could be tomorrow's trouble spot. Anyway, Christoph Ruehl argues it's a bad idea for big players to helicopter-parent the oil market so aggressively. It will hurt competition in the long run and will slow the economic recovery in the short run. How Not to Do the Next Stimulus The depth of the economic swoon has us throwing wads of money into the abyss; the latest $2 trillion stimulus package was still in diapers when we started prepping the next one. Trouble is, many ideas being floated for it are based more on ideology than current needs, from capital-gains tax cuts to SALT cap lifts, writes Noah Smith. Some of these could actually be harmful. Infrastructure spending sounds more palatable and has broad bipartisan support. That crumbling railroad tunnel doesn't care about your party; it just wants to kill you. But infrastructure spending is also ill-suited for the current moment, warns Ramesh Ponnuru. In fact, crafting an effective infrastructure bill is nearly impossible even in normal times. A more immediate priority is fixing the many errors of the previous stimulus bills and making sure we don't add new ones, writes Karl Smith. Telltale Charts The Internet is mostly managing the strain so far of the whole country working and schooling from home, but some places have it worse than others, writes Tara Lachapelle.  The pandemic has annihilated Hollywood's box-office take, writes Ben Schott.  Further Reading Trump is using the cover of the pandemic to further gut the rule of law by firing inspector generals. — Noah Feldman Small colleges have been dancing on the edge of the volcano for years. This will push many into it. — Brian Chappatta China is helping Israel while the U.S. is too distracted by its own problems. Israelis will remember it. — Zev Chafets Iran would only have misused a $5 billion IMF loan. There are better ways to help it fight the virus. — Bobby Ghosh The Luckin Coffee fiasco will probably end the good times for Chinese listings in the U.S. — Nisha Gopalan This is the time for hedge funds to shine by loading up on risk, but risk managers must be especially vigilant now. — Mark Gilbert ICYMI Bernie Sanders ended his run for the White House. Trader Joe's has not been having a good pandemic. Animals are retaking the world from locked-down humans. Kickers How to mine your home for precious metals. (h/t Mike Smedley) A 500-year-old manuscript has the earliest known use of the "f" word. (h/t Scott Kominers) "Tiger King" is a moral failure. (And I almost feel guilty for enjoying it.) Miss going into work? Here's an office-noise generator. Note: Please send office noise and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment