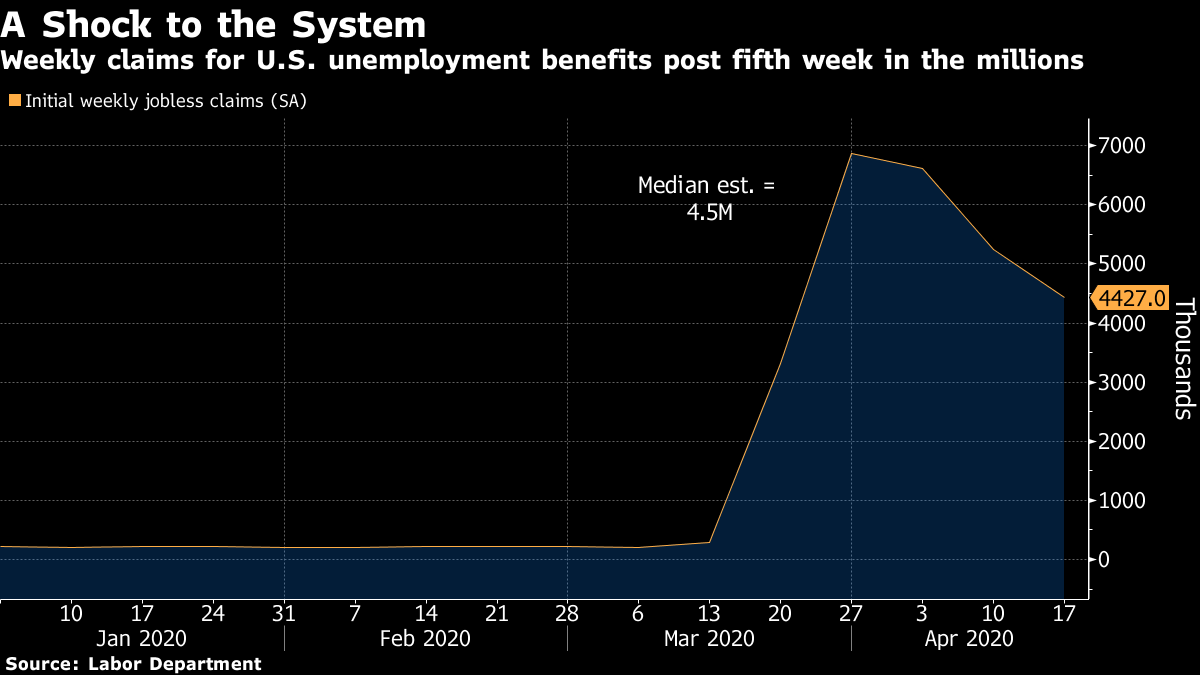

| New cases of the coronavirus are slowing in the U.S., but it's still a mixed picture. China stock strategists are hunting for new winners as momentum fades. And Gilead shares were whipsawed for the second time in a week after a leaked summary of its Covid-19 drug indicated that it was a failure. Here are some of the things people in markets are talking about today. U.S. cases rose at the slowest pace in three weeks, but California reported the most fatalities in one 24-hour period. New York's hospitalizations were relatively flat, which Governor Andrew Cuomo said "is not great news." As President Donald Trump offers a muddled response and ad hoc policy swings, his public support is sliding. Spain reported the greatest number of new cases and fatalities in almost a week, while the U.K. reported its biggest weekly tally for 20 years on Tuesday. All over Europe, the virus is leading countries to reach unwanted milestones: new death toll records. Still, Germany is one European bright spot and in Italy, recoveries from the coronavirus overtook new infections for the first time. Analysts are warning that Indonesia's relatively lax social-distancing measures mean its economy will take much longer to recover than others in Southeast Asia, while Japan seeks to extend its Golden Week holiday to tame the spread of the virus. Cases around the world have topped 2.6 million, with deaths exceeding 187,000. Here's how Bloomberg is mapping the spread. Gilead shares were whipsawed for the second time in a week after a summary of a Chinese trial of its Covid-19 drug remdesivir appeared to show that it was a failure. The synopsis, which the company and a scientist working on the trial said didn't fairly represent the actual results, saw Gilead's shares closed down 4.3% to $77.78 on Thursday in New York. The World Health Organization, which has been helping coordinate the global response to the virus, said it accidentally posted the results on a website that helps track therapies for the disease. The summary indicated that the drug wasn't associated with patients getting better more quickly; and 13.9% of patients getting the drug died, versus 12.8% getting standard care. Meanwhile, company analysts are now offering a broad range of views on the inadvertently leaked abstract. Asian stocks looked set for a mixed start to trading after a U.S. rally faltered on a report a leading experimental coronavirus drug performed poorly in a test. Oil climbed back above $16 a barrel as traders eye a production slowdown that has resulted from the coronavirus-led weaker demand environment. Futures dipped in Tokyo and rose in Hong Kong and Australia. The S&P 500 erased a 1.6% gain to end little changed, putting a pause on a rebound in global stocks following two weeks of strong gains as investors assess a flurry of earnings reports along with economic data and the latest news on the virus. Data from the U.S. showed total job losses now exceed 26 million in the wake of the economic shutdown prompted by the pandemic. Treasuries edged higher and the dollar was mostly lower against its G-10 peers. A stock market suddenly lacking direction has given China strategists an opening to try to divine the next winners. Momentum on the Shanghai Composite Index has waned after the benchmark rose about 7% from last month's low. The gauge trades below its 50-day moving average and is well under a relative-strength measure that warns stocks are hot. Turnover has plunged to less than half of its peak this year. This period of relative steadiness has given market watchers the opportunity to dig into company financials and government plans to find stocks that could pay off even as China and the rest of the world fight through the virus pandemic. Here's what market watchers say to look for when picking the next winners. Considering the complexity of oil at the moment, maybe it's fortunate that regulations now restrict making fresh bearish bets against U.S. Oil Fund, the biggest exchange-traded fund tracking oil. Besides an opinion on ultra-volatile oil prices, a trader needs a view on the price impact of its ever-changing mix of futures contracts, as well as an improbably nuanced understanding of how ETFs work now that it has suspended share issuance. All while the company prepares for a reverse split. Strangely, none of this seems to be doing anything to dissuade retail investors from their love affair with the security and a belief they can use it to profit on oil's recovery. But with the fund's holdings in crude contracts apt to change at any time without notice, anyone wading into USO should realize it has stopped being a direct bet on the direction of prices, according to Cantor Fitzgerald. "Given the way disclosures are currently being given by the fund, it's almost unanalyzable, because you don't have a sense of what the weighting along the futures curve is," said Peter Cecchini, Cantor's chief market strategist. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Tracy's interested in this morning One of the key tenets of Richard Koo's famous balance-sheet recession idea is that the near-death experience of a severe debt crisis can affect the behavior of people (and companies) long after the event itself. They can be wary and even fearful of borrowing for years. Clearly the current economic crisis is not a balance-sheet recession per se, but it does share some similarities when it comes to that behavioral aspect. Today, the focal point isn't debt, but savings. Having a financial buffer makes all the difference right now.  It's almost certain that the shock of disappearing cash flow as millions lose their jobs, combined with the emotional stress of a global pandemic, will change attitudes towards saving going forward. Joe Weisenthal and I have just recorded a new episode of the Odd Lots podcast with Koo where he lays all this out in depth. That should come out in a week or two — subscribe here so you don't miss it. You can follow Bloomberg's Tracy Alloway at @tracyalloway. For the latest virus news, sign up for our daily podcast and newsletter. |

Post a Comment