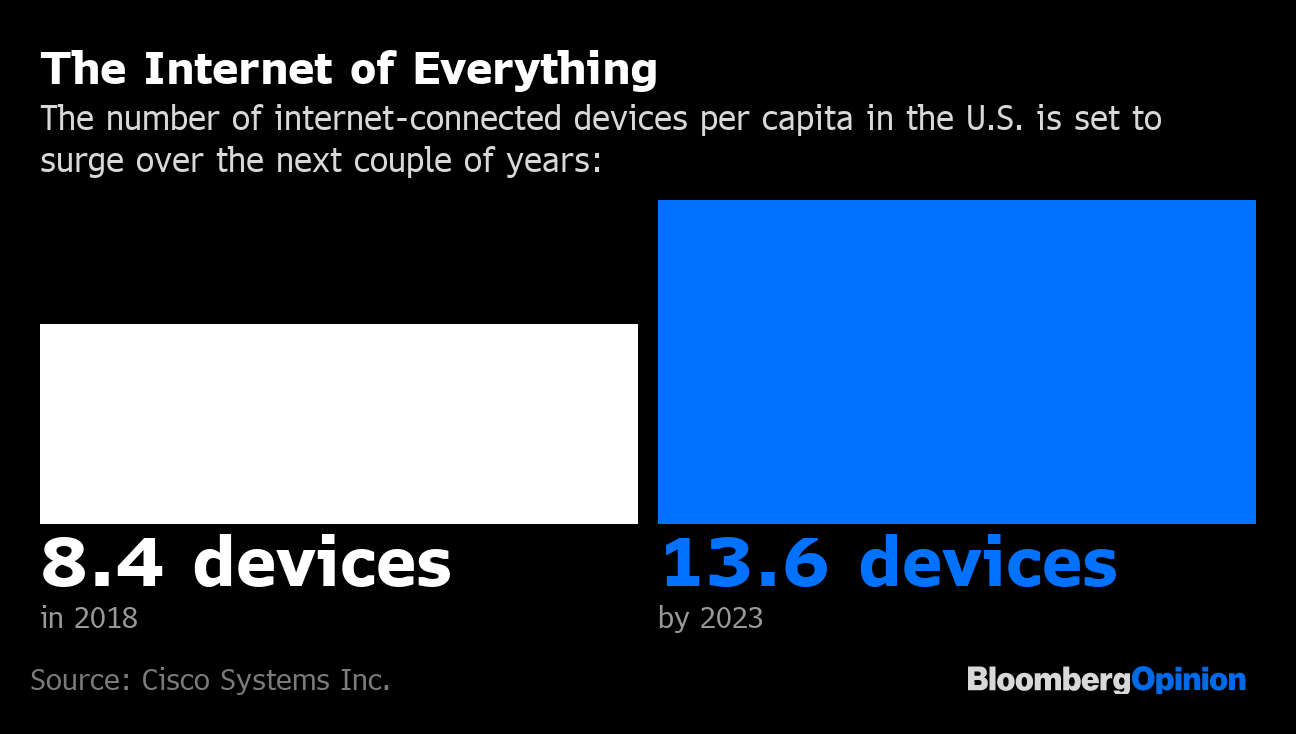

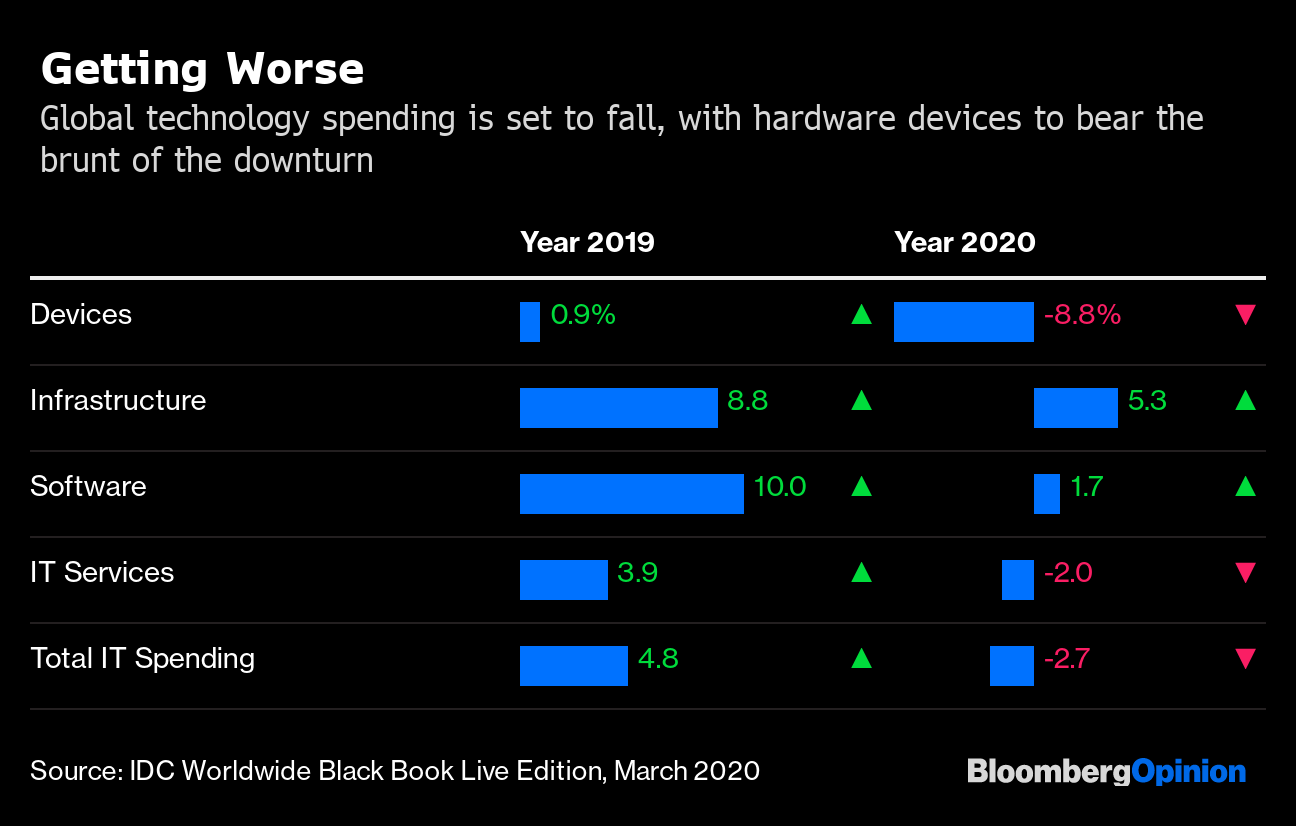

| This is Bloomberg Opinion Today, a bailout plan of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  The whole country, basically. Photographer: JOHANNES EISELE/AFP/Getty Images No Moral Hazards in Economic Foxholes Desperate times call for desperate measures, and these are desperate times for the economy, triggered by the desperate public-health crisis of a global pandemic. In the past three weeks, nearly 17 million Americans have filed for unemployment benefits. That's roughly 10% of the workforce, meaning the unemployment rate is at least 14% and probably higher, a number not seen since the Great Depression. Congressional relief measures have mainly reinforced the standard mechanism for handling unemployment, which is tantamount to duct-taping some wings on a Buick and calling it a fighter jet. In the next stimulus round, we should instead feed money to companies to keep people on payrolls so they'll keep spending and be ready to work when the economy reopens, writes Noah Smith. You might complain that's paying people to sit around and play "Animal Crossing," but so what? That's a low price for avoiding a depression. Our time frames are all messed up here, too. We keep hoping/assuming we'll reopen the economy in a matter of months, but that will depend on far more testing and contact tracing than we've managed so far. In fact, a huge testing effort must be part of the next stimulus round, argues Michael R. Strain. But Narayana Kocherlakota doubts this government is capable of making this work, possibly because he reads the news. So we must assume we'll be dealing with off-and-on lockdowns well into 2021, or until we get a miracle treatment or vaccine, whichever comes first. We'll need much more help from the government and from the Federal Reserve. Fortunately, the Fed at least has risen to the challenge, including a $2.3 trillion lending bonanza announced today, conveniently timed to coincide with the jobless claims report. The Fed is now involved in just about every part of the bond market, writes Brian Chappatta, from municipal debt to CMBS and even recently junk-rated companies, or "fallen angels." This probably drove many longtime Fed haters to their fainting couches, and we sure don't want it to last forever. But again, desperate times, etc. In buying fallen angels, the Fed has even taken Matt Levine's advice and ignored credit-rating companies, briskly solving that annoying leftover problem from the 2008 crisis by simply pretending it doesn't exist. Is this a perfect solution? Who cares? The Bank of England, meanwhile, is making gold bugs weep even harder by kinda-sorta monetizing new U.K. debt. Oh noes, muh moral hazards and all that, but again, this is not the time to worry about such niceties, writes Marcus Ashworth. Similarly, the European Central Bank buying Italian debt may get the stinkeye from hawkish Germans, but it's avoiding a credit crisis, Marcus writes in a second column. In fact, the only way to keep a post-virus Europe from falling apart will be for rich nations to suck it up and share the risks with poor ones, write Elena Carletti, Marco Pagano, Loriana Pelizzon and Marti Subrahmanyam. It sounds so crazy it just might work. Further Economics Reading: Telemedicine, remote learning and working from home could boost the economy's long-term productivity. — Karl Smith Bonus We-Forgot-to-Add-the-Link-Yesterday Reading: Virus peak or no peak, restarting the economy too soon will unleash the pandemic and wreck the economy again. — Mohamed El-Erian Watch That Cookie Jar Of course, this move-fast-and-break-things approach to economic policy leaves room for mistakes and shenanigans. The small-business lending program in the latest stimulus bill hasn't been working so well, and the portions are too small. Democrats and Republicans are already tussling over how to expand it. That stimulus package also included a lesser-known provision offering relief to owners of franchises of big national chains such as McDonald's, notes Timothy L. O'Brien. Lobbying hard for this provision was Representative Kevin Hern of Oklahoma, who — you might want to sit down for this — just happens to own a chain of McDonald's franchises. All companies lobby all the time, but this crisis clarifies lobbying isn't enough. Government bailouts are far more politically palatable if they go to companies that aren't mustache-twirling villains of capitalism, writes Conor Sen. Those that pay taxes, treat workers well, provide an essential service, don't pollute too much and don't strip the copper plumbing just to pay rich shareholders are typically better bailout recipients. This Isn't a Magic Coronavirus Bullet Yet One way we could theoretically end lockdowns without proven Covid-19 treatments or a vaccine is with antibody testing. This could possibly identify millions of people with immunity. But Faye Flam warns we're not currently capable of widespread antibody testing. We'd also have to make sure people with antibodies weren't still contagious and that they were truly immune. Meanwhile, hand-washing, social-distancing and public mask-wearing are still the best tools for fighting the virus. You may be like President Donald Trump and feel awkward about wearing a mask around other people, but Cass Sunstein suggests we can make it less socially weird if everybody does it. Consider it a civic duty. 2020: The Socially Distanced Election It says a lot about the insanity of our times that Joe Biden wrapping up the Democratic presidential nomination barely merited a mention yesterday. There's a lot going on! He's also frankly not that exciting a candidate — which helps explain how he won the nomination. Yes, he got incredibly lucky, writes Jonathan Bernstein, but he also won over the broad center of the party, demonstrating a skill for coalition-building that could help him if he actually gets the job. Trump apparently thinks keeping people from voting by mail in November will help him beat Biden, but he might be wrong, suggests Noah Feldman. And letting an election happen this year without endangering public health should be a bipartisan concern. Telltale Charts You may have noticed how having, say, two adults and three children using the Wi-Fi all at once, all day long, makes your internet experience awful. Well, take heart: Wi-Fi 6 is coming to solve that problem, writes Tara Lachapelle. Unfortunately, it won't help your current quarantine, but maybe in the next pandemic.  China's tech giants may have survived China's lockdown, but now comes the truly hard part, warns Tim Culpan: dealing with a global recession.  Further Reading We had another LTCM-like hedge-fund blowup last month. — John Authers The shipping industry can't rotate exhausted sailors off ships, further straining the global supply chain. — Adam Minter Norwegian Air was in trouble even before the virus; now it's having an existential crisis. — Chris Bryant California Governor Gavin Newsom declared independence from the Trump administration, in a sign of things to come. — Francis Wilkinson ICYMI Boris Johnson left the ICU. New York virus hospitalizations plunged. Saudi Arabia and Russia ended their oil-price war. Kickers A temporal circuit of brain activity supports consciousness. We have photo evidence of jets created by colliding galaxies. Why explore the moon? The three equations for a happy life. Note: The newsletter will be off tomorrow, returning on Saturday. Please send moon rocks and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment