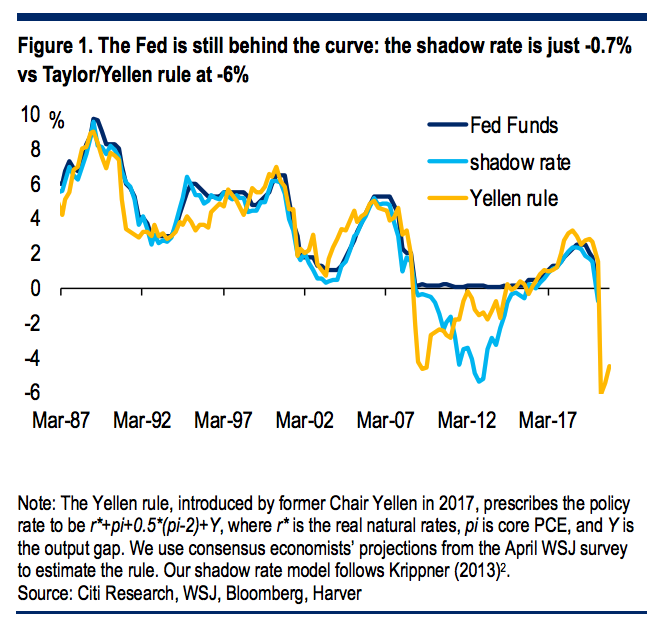

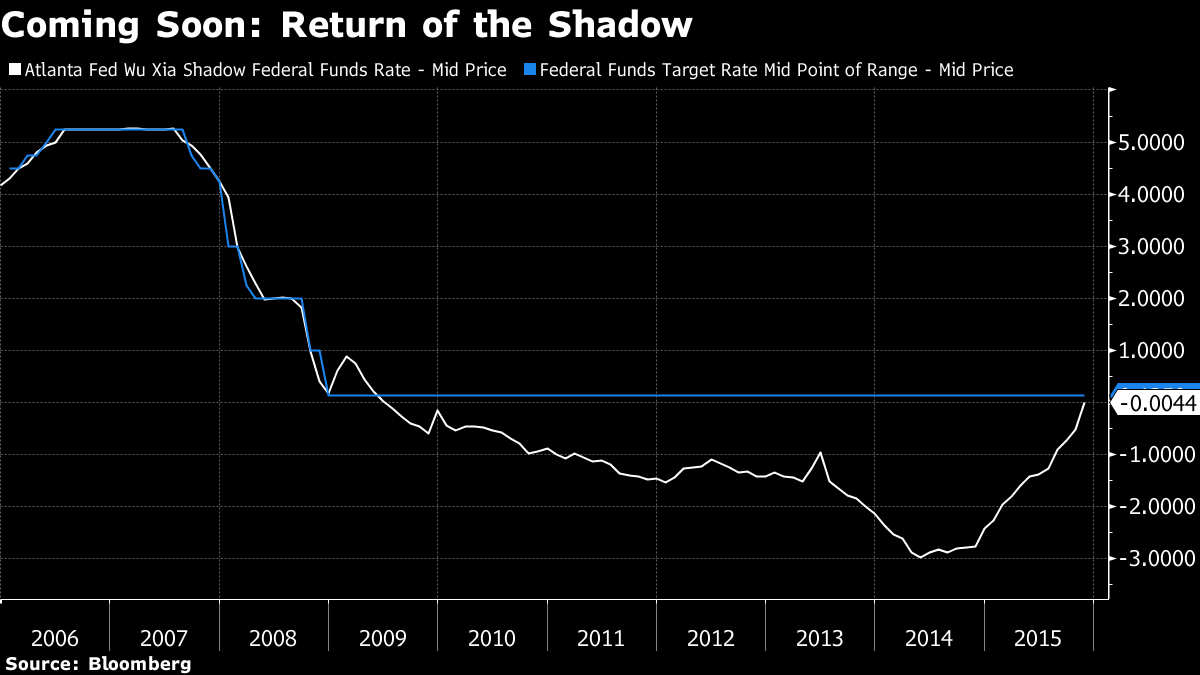

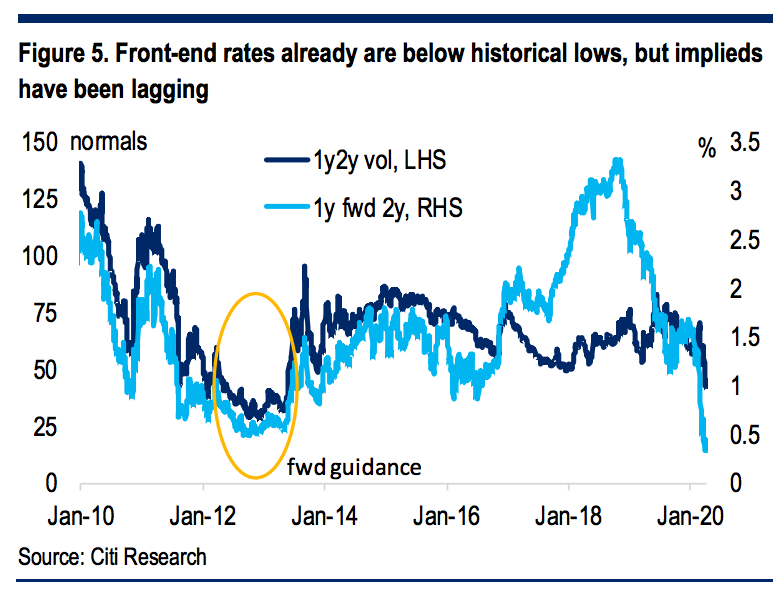

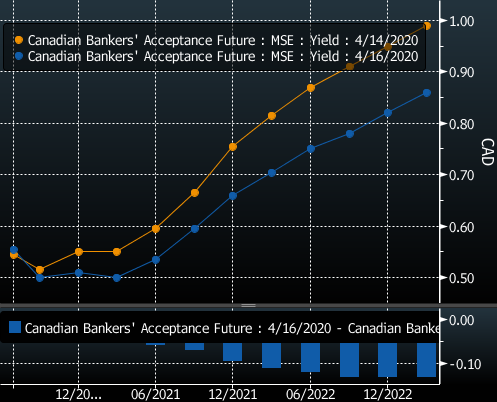

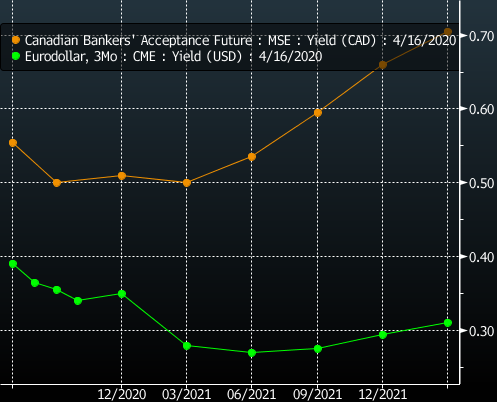

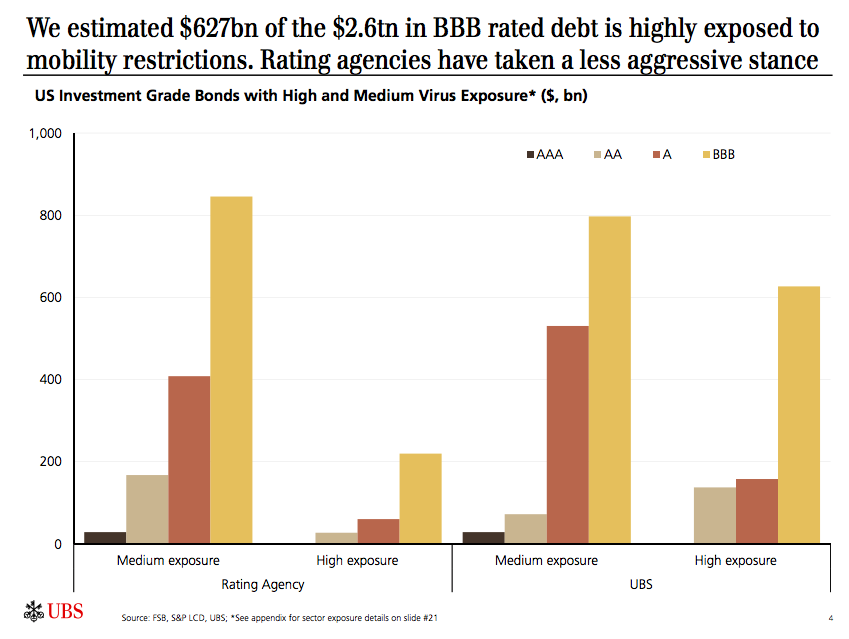

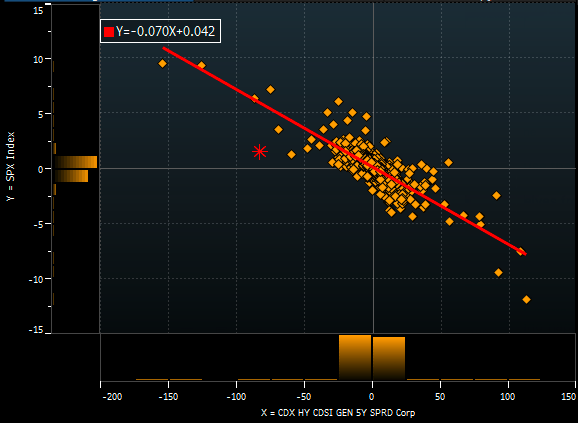

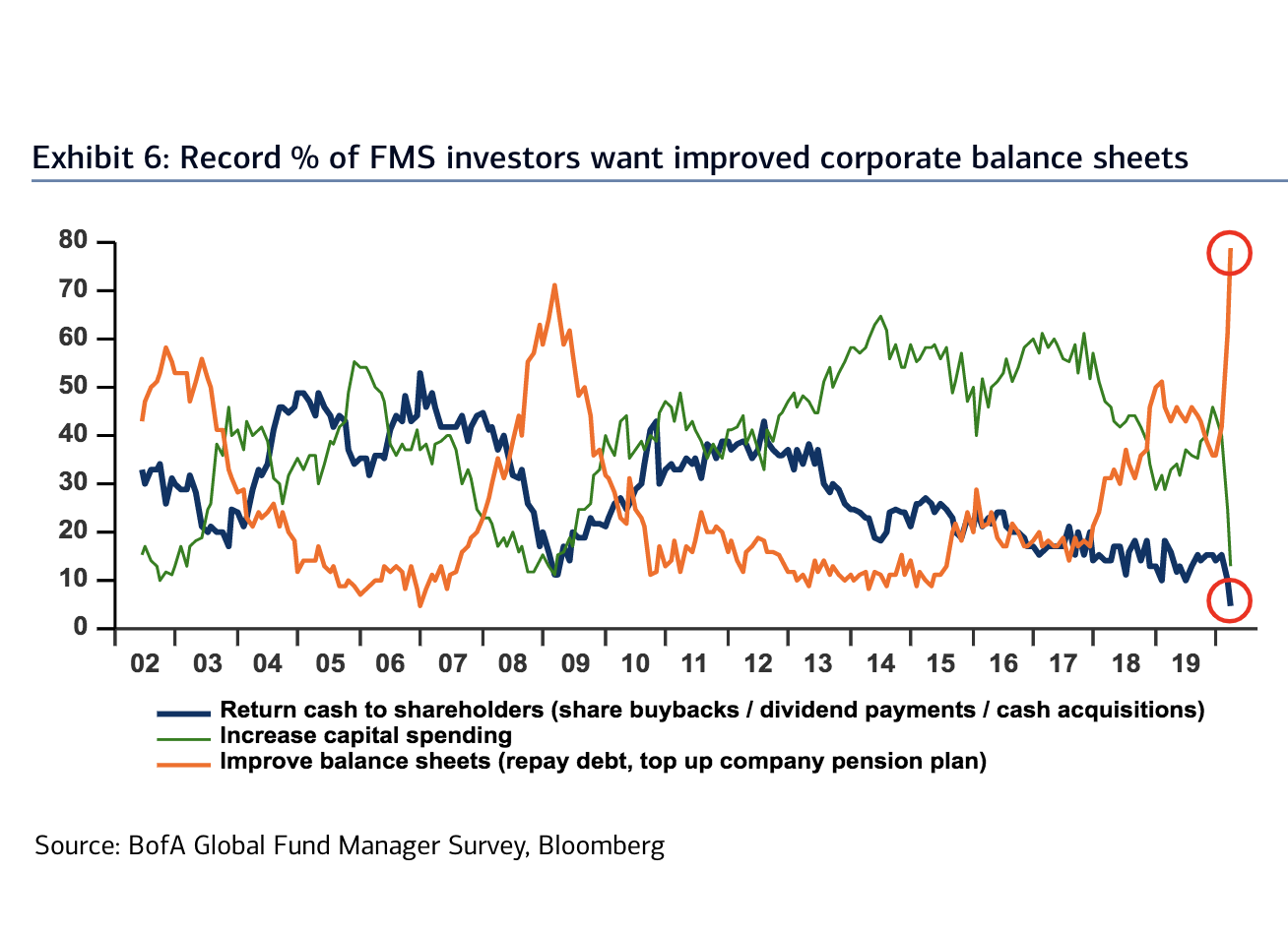

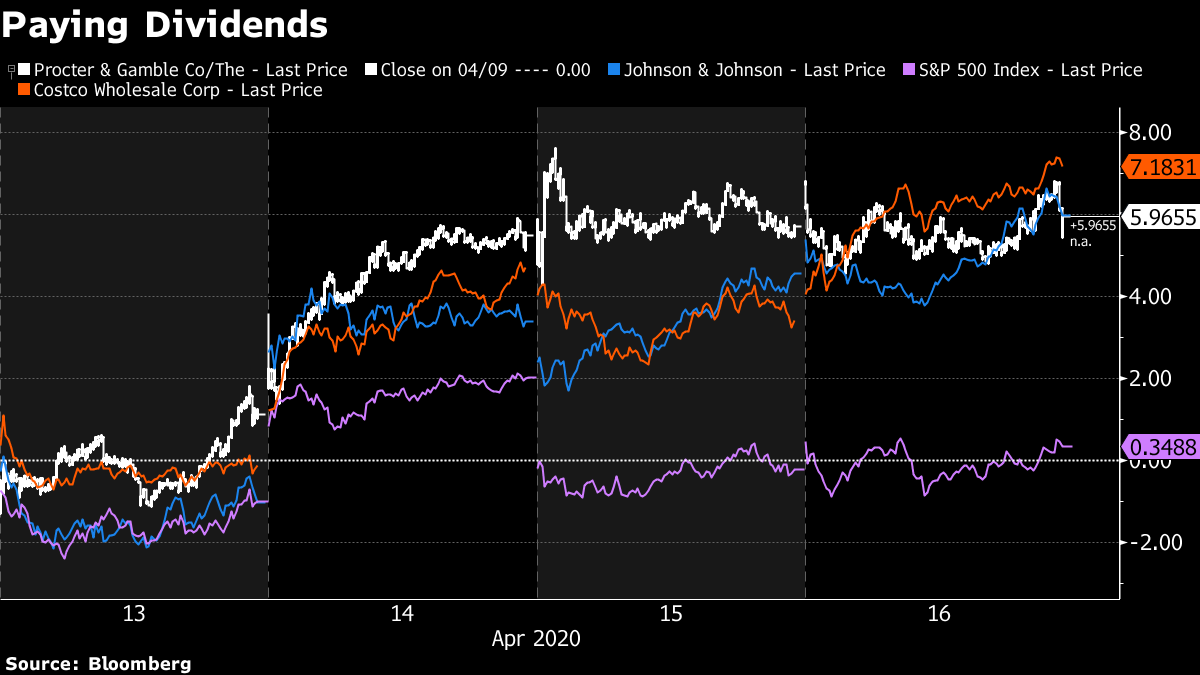

| Welcome to the Weekly Fix, the newsletter thinking about how central bank forward guidance meshes with the most uncertain economic environment in our lifetimes. –Luke Kawa, Cross-Asset Reporter Shadow Boxing What more can the Federal Reserve do? With all the mortgage-backed securities the Fed owns, the central bank has been able to throw more than a few kitchen sinks in an attempt to mitigate the downside risks to the economy from the coronavirus and support the economic expansion that will follow. Nonetheless, Citigroup takes a top-down approach in arguing that more is warranted, even after the Fed's balance sheet jumped by about $2 trillion since the end of February with many more asset purchases in the offing. "We argue that monetary policy in the U.S. is still excessively tight given the size of the growth shock," writes strategist Ruslan Bikbov. "Although Fed Chair Powell argued last week that monetary policy is 'just in the right place', we don't find this assessment compelling." Bikbov makes his case by employing a version of the Taylor Rule (with tweaks from former Fed Chair Janet Yellen) and a so-called estimate of the "shadow" rate borrowed from St. Louis Fed chief Jim Bullard that adjusts the nominal policy rate by subtracting the value of a call option for holding cash once rates are at zero. The "Yellen Rule" points to a warranted policy rate of -6% this quarter – lower than in the financial crisis, while the Bullard shadow rate is just -0.7% at present, and retreated as low as -5% in 2012.  Citigroup Citigroup Another way of judging the relative degree of accommodation provided by the Federal Reserve will soon be reintroduced. A separate shadow rate developed by Jing Cynthia Wu and Fan Dora Xia, which adjusts the policy rate for the effects of unconventional stimulus, went as low as -2.99% following the financial crisis. In an email message, Dr. Wu confirmed the Wu-Xia shadow federal funds rate will be updated when the underlying data for the tail end of March are available.  "The Fed is still way behind the curve, in our view," writes Bikbov. The next easing steps will involve explicit forward guidance linked to inflation and/or unemployment outcomes, and the potential for yield curve control for medium-term rates in the second half of this year or in 2021. A previous edition of this newsletter highlighted how interest rate volatility at the front of the curve was depressed, but could sink even lower given the previous experience at the ZLB. Bikbov augments that argument by adding another dimension: forward volatilities at the front-end. The former supports the idea that rates will stay low; the latter shows relatively more unease.  Citigroup Citigroup Evercore ISI head of central bank strategy Krishna Guha also sees a "missing link" in Federal Reserve policy at this juncture: the lack of formalized forward guidance. "The unique two-phase nature of the current episode – in which policy has to play defense during the phase-one virus shutdown and can only stimulate activity in the second phase post shutdown means future commitments are even more important than they are in a normal downturn when the current settings of policy can effectively stimulate activity today," writes Guha. He thinks the Federal Reserve will make a commitment to keeping rates at zero until the economy has returned to full employment and 2% inflation on a sustained basis, with an asset purchasing program linked to the achievement of these goals. Q-Eh The Bank of Canada broadened the list of assets it will purchase this week, adding provincial bonds and investment-grade corporate debt. The central bank declined to produce numerical projections, as is customary with the release of a Monetary Policy Report. Instead, the central bank presented two scenarios – a relatively V-shaped recovery assuming containment measures are lifted soon, and a more prolonged malaise in the event they linger for longer. Economist Ted Carmichael reached back to his experiences in the late 1970s, utilizing two tools foreign to millennials (a ruler and pencil) to turn the BoC's scenarios into numerical form. Based on his analysis, even the optimistic case for real GDP in 2020 (-6.5%) is worse than even the dourest private sector forecast. The BoC's pessimistic scenario points to a 19% contraction. "No wonder the Bank of Canada decided not to publish numerical projections!" he writes. "Doing so would probably have been a shock to the already battered confidence of Canadian businesses and consumers." Enhanced asset purchases and an acknowledgement of the magnitude of economic downturn in progress were sufficient to flatten the Bankers' Acceptances Futures (BAX) curve, suggesting traders are growing more confident that the central bank will be on hold at 25 basis points for a longer period of time.  The Bank of Canada continued to frame these operations as LSAPs (large scale asset purchases) rather than QE (quantitative easing). Governor Stephen Poloz said they look the same, but the distinction is in the objective of the operations. LSAPs are to "bring more order to financial markets," whereas usually the objective for QE is framed around a longer-term interest rate objective, and said yield curve control is in this family, he said. "The Bank needs to communicate how it would characterize success in this program," wrote Ian Pollick ahead of this event. "We believe some type of yield-curve-control (YCC) program will soon be required to restrict the level of yields that most impact the economy, like in the 5-year sector." Apparently, success in its program right now just refers to restoring normal market functioning, which is a rather vague goal that is difficult to adjudicate. Drawing such a straight line between QE and YCC, as Poloz did, is questionable. QE uses quantities (it's right there in the name!) to influence longer-term yields and financial conditions broadly through the portfolio rebalancing channel, and yield curve control is concerned with prices – not quantities. Research has shown that the long end of the yield curve in small open economies is dominated by global factors, Senior Deputy Governor Carolyn Wilkins said, but that a central bank would be able to exert more control around the three-to-five-year portion of the curve. For Canada, that might be all the central bank really needs to control, as the dominant mortgage product is the five-year fixed rate (which hasn't fallen in sympathy with the decline in sovereign yields). What Poloz's answer does reveal is how much unconventional central bank policy is designed to work as a signaling device and affect investor psychology. The governor would see himself as providing more monetary stimulus by doing the exact same thing, but describing it with a two-letter acronym rather than a four-letter one. This signaling device can be strengthened by marrying bond buys to future interest rate policy. Right now, all the Bank of Canada is saying is that asset purchases "will be adjusted as conditions warrant, but will continue until the economic recovery is well underway." In the case of the Federal Reserve's asset purchasing program amid the financial crisis, bond buys reinforced that policy rates would remain at ultra-low levels, a form of forward guidance. The taper tantrum of 2013 pulled forward expectations on when Fed liftoff would occur. The Bank of Canada has yet to formally link its asset purchases to rate policy or introduce explicit forward guidance, like Governor Mark Carney did back in 2009. That may be a function of the depths of the uncertainty facing the Bank that precludes it from releasing numerical forecasts. But this lack of forward guidance may be one reason why the BAX curve remains much steeper than the Eurodollar curve, even after the recent flattening.  What's also interesting about the central bank's framing around its asset purchase program. From the statement, this is the preamble to the announced tweaks: "The next challenge for markets will be managing increased demand for near-term financing by federal and provincial governments, and businesses and households. The situation calls for special actions by the central bank." It's rare to see a central bank directly link asset purchases to bond issuance, effectively copping to monetizing the deficit. Separately, policymakers also upped the maximum share of government bills it would take down at auction to 40% from 25%. And "directly creating money for the government" is not an ability that all central banks have, as J.P. Koning reminds us. Blame COVID19 for Downgrades A report from S&P Global Ratings crystalizes the logic of the Federal Reserve's desire to put a bed under fallen angels: Potential bond downgrades (issuers rated 'AAA' to 'B-' with negative rating outlooks or ratings on CreditWatch negative) rose sharply to a 10-year high of 860 on March 25, from 649 as of Feb. 28, on a combination of COVID-19 and a sharp decline in oil prices. The count of potential bond downgrades facing direct or indirect effects from the COVID-19 fallout is 277, roughly one-third of total potential downgrades. On a gross basis, 82% of the increase in potential downgrades "have ratings that are exposed to risks stemming from COVID-19." UBS takes a more downcast view than ratings companies in quantifying the magnitude of the exposure among potential fallen angels.  UBS UBS If the goal is to keep the economy "on ice," as Matt Klein aptly put it, freezing credit ratings in a bid to avoid arbitrarily amplifying financial stress on select companies makes a whole lot of sense. The day the Fed announced this foray, HY 5Y CDX proceeded to have its most anomalous outperformance of the S&P 500 in the former's history.  Bloomberg Bloomberg Investors proceeded to add $7.7 billion to junk bond funds in the week ending April 15, a record. In one way it's "follow the Fed," but in another it's worth noting that investors were hunting for bargains in high yield ahead of that. The $7.1 billion in fund inflows during the week ending April 1 was the record prior to the most recent figures. The primary junk market was showing signs of thawing ahead of the Fed's move after a paltry $4.2 billion in March issuance. But this greases the wheels of the asset class pretty well – and the central bank hasn't even had to play in this sandbox yet. Of course, that doesn't mean there aren't still critics of the Fed's plan, particularly when it comes to high-yield ETFs – although many of the same criticisms could apply to investment grade ETFs! Read More: Howard Marks Bemoans Fed Help for Junk Bonds, Leveraged Debt Related News: Marks's Oaktree Seeks $15 Billion for Biggest Distress Fund Ever Paying Dividends Somewhat predictably, Bank of America's April survey of fund managers showed a record low share of respondents (5%) wanted to see companies boost shareholder returns (via buybacks, dividends, or M&A). Conversely, a record high 79% want management to focus on improving corporate balance sheets.  BofA Securities BofA Securities Ironically, at this juncture there's a large swath of firms for whom "improve balance sheet" means "add more leverage to bolster your current position," as the deluge of issuance indicates. However, upon any return to quasi-normalcy and economic expansion, the scars from this crisis could result in a lingering focus on deleveraging among Corporate America. That has negative implications for future growth and equity market returns. "The flood of money going into corporate bonds is a near-term positive because it is allowing many companies to survive and term out their debt," writes Brian Reynolds, chief market strategist at Reynolds Strategy LLC. "That corporate balance sheet transformation is a longer-term negative, as we believe companies will have to focus on debt buybacks, not stock buybacks, in the next cycle." If this comes to pass, and as past experience with the zero lower bound dents any optimism that may be embedded in longer-term borrowing costs relative to 2009, there's a clear advantage for companies able to credibly retain a focus on returning money to shareholders. Three companies that hiked their dividends this week – Procter & Gamble, Johnson & Johnson, and Costco – are all trouncing the S&P 500. So much for fund managers seeking balance sheet improvements over shareholder-friendly actions!  |

Post a Comment