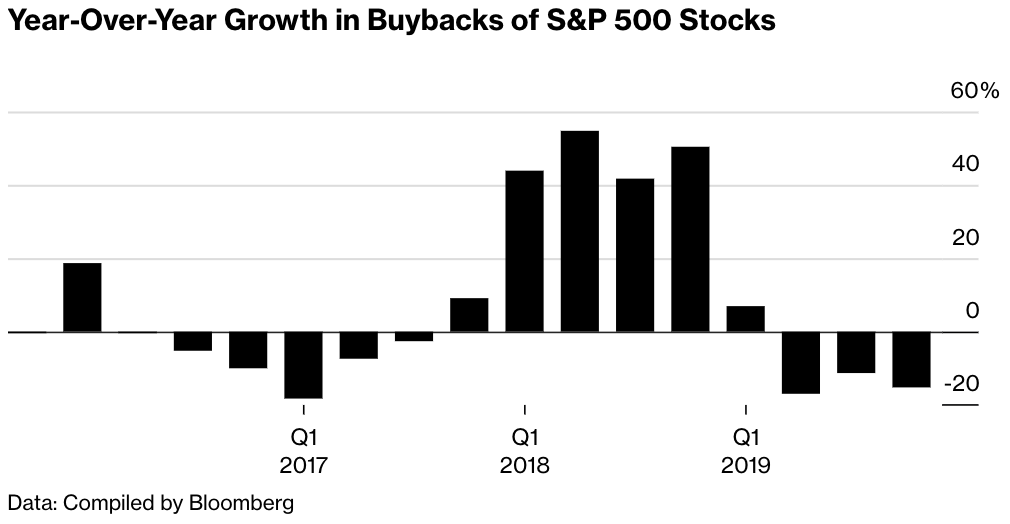

| Cases of coronavirus in New York State surged past China's Hubei province, making it the new epicenter. Hong Kong is proving to be a rare place where dividend bets aren't being slashed. And Australia's government will charter planes full of products such as rock lobster, beef and dairy to key markets in Asia. Here are some of the things people in markets are talking about today. New York state reported a 9,300 increase in coronavirus cases on Tuesday to 76,000, surging past China's Hubei province, the former epicenter and the virus' place of origin. New York has the lion's share of infections in the U.S., which, as a country, now has the most cases in the pandemic after eclipsing China last week. China's epidemic, now contained to a few new domestic cases after a two-month battle, was largely confined to Hubei province, which had 67,801 cases as of March 30. New York has a population only a third of Hubei's — 20 million people reside in New York state while 60 million live in Hubei. Still, New York is faring better in terms of their death toll: it exceeds 1,500 there, while it's more than 3,100 in Hubei. Over in China, the government revealed a further 1,541 symptom-free virus cases under pressure from growing criticism over China's failure to disclose their full number. Here is the latest update. Stocks in Asia looked set to kick off the new quarter in a mixed fashion as investors examine data showing tentative signs that China's economy is beginning to recover against the deteriorating situation in the U.S. The S&P 500 Index ended near the session lows, futures in Japan and Hong Kong edged lower, while contracts in Australia rose. In China, a private reading on the country's manufacturing sector that's due Wednesday is expected to show a rebound for March, while treasuries edged higher. Global stocks are coming off their worst quarter since the end of 2008, tumbling 22%. That's enticed some investors back into equities, but with the volatility gauge remaining significantly elevated, many expect further declines. Meanwhile, the Aussie is set for a comeback after a brutal quarter on stimulus bets. Elsewhere, crude rose 1.9% and gold was up 0.1%. Based on financial contracts betting on future dividend rates, it looks like the Hong Kong stock slump spurred by fears of a global economic recession may have gone too far. Contracts allowing traders to speculate on dividend levels in the Hang Seng Index imply a cut of about 10% in 2020, compared to more than 20% for the S&P 500 and about 50% for the euro area benchmark, according to calculations using futures maturing in December. While the Hang Seng gauge has lost 16% since the start of the year, expectations for payout growth have fallen about 11%, futures prices showed as of Tuesday's close in Hong Kong. The gap reflects optimism that many companies listed in the city will be encouraged to distribute their profits to shareholders. Abu Dhabi's crown prince Sheikh Mohammed bin Zayed Al Nayhan and Indonesian president Joko Widodo are quietly forging a strategic alliance. Last summer the prince offered to build a grand mosque for his Indonesian host, Widodo, during a visit to the tropical gardens next to Indonesia's summer Presidential Palace. And if that seemed like a generous gesture, the two men struck an even bigger bargain within months, appointing the de-facto ruler of the United Arab Emirates to chair the steering committee for a new $34 billion Indonesian capital city. Jokowi, as the Indonesian president is known, is eager to find investors in an ambitious $400 billion infrastructure program. Sheikh Mohammed bin Zayed Al Nayhan is looking to expand his country's presence in fast-growing Asian markets. Australia's government will help charter hundreds of planes full of products such as rock lobster, beef and dairy to key markets including China and Japan, after the coronavirus pandemic led to the cancellation of most commercial flights that usually carry fresh produce. The government will provide A$110 million ($68 million) to get Australian products to key markets, starting with the United Arab Emirates, China, Japan, Hong Kong and Singapore, the government said in a statement. Recent international flight groundings by airlines including Qantas and Virgin Australia have made it impossible to get products including chilled seafood, red meat, dairy products and some fruit and vegetables to offshore markets. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Tracy's interested in this morning Almost one year ago, Goldman Sachs strategist David Kostin wrote a piece of research imagining a world without share buybacks. That world is fast becoming a reality, with Kostin estimating in a new note this week that the coronavirus crisis has caused companies to pull $190 billion worth of buybacks in the past two weeks, effectively removing what's been the "single largest source of U.S. equity demand" for the past few years. (Analysts at HSBC have come up with roughly similar figures, noting that 51 companies have recently paused repurchase programs, an amount that's equal to about 27% of total share buybacks for all of 2019).  Pausing share buybacks has the potential to dent stock prices and forward earnings-per-share growth in a market that's showing some tentative signs of stabilization, of course. But it's worth also pointing out that Goldman's original "world without buybacks" note was sparked by rising political criticism of share repurchases, with some U.S. senators at the time threatening legislation that would limit or even ban them. As the coronavirus sparks fresh scrutiny of corporates, it seems likely that buybacks are going to become a political target once again. You can follow Bloomberg's Tracy Alloway at @tracyalloway. For the latest virus news, sign up for our daily podcast and newsletter. |

Post a Comment