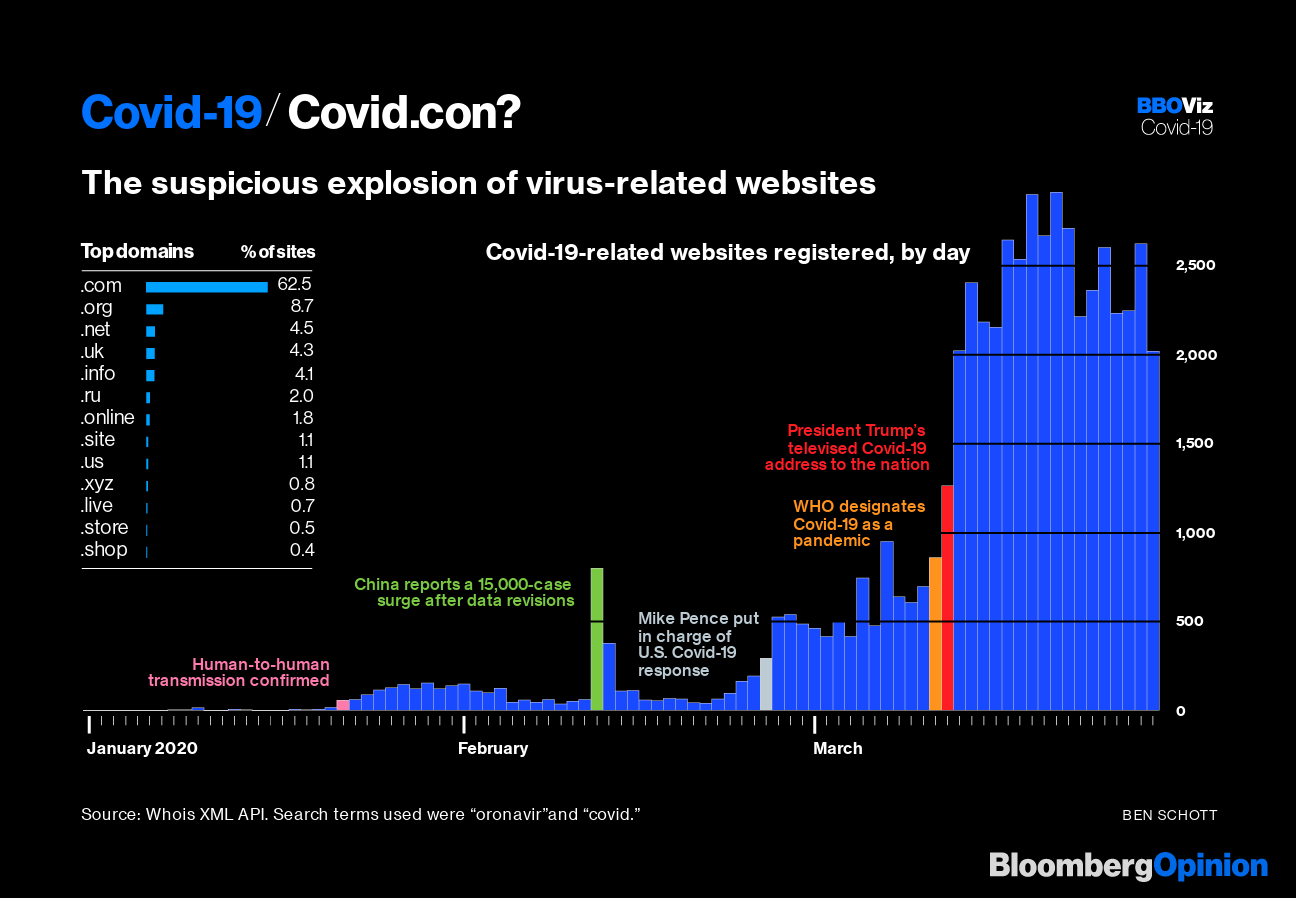

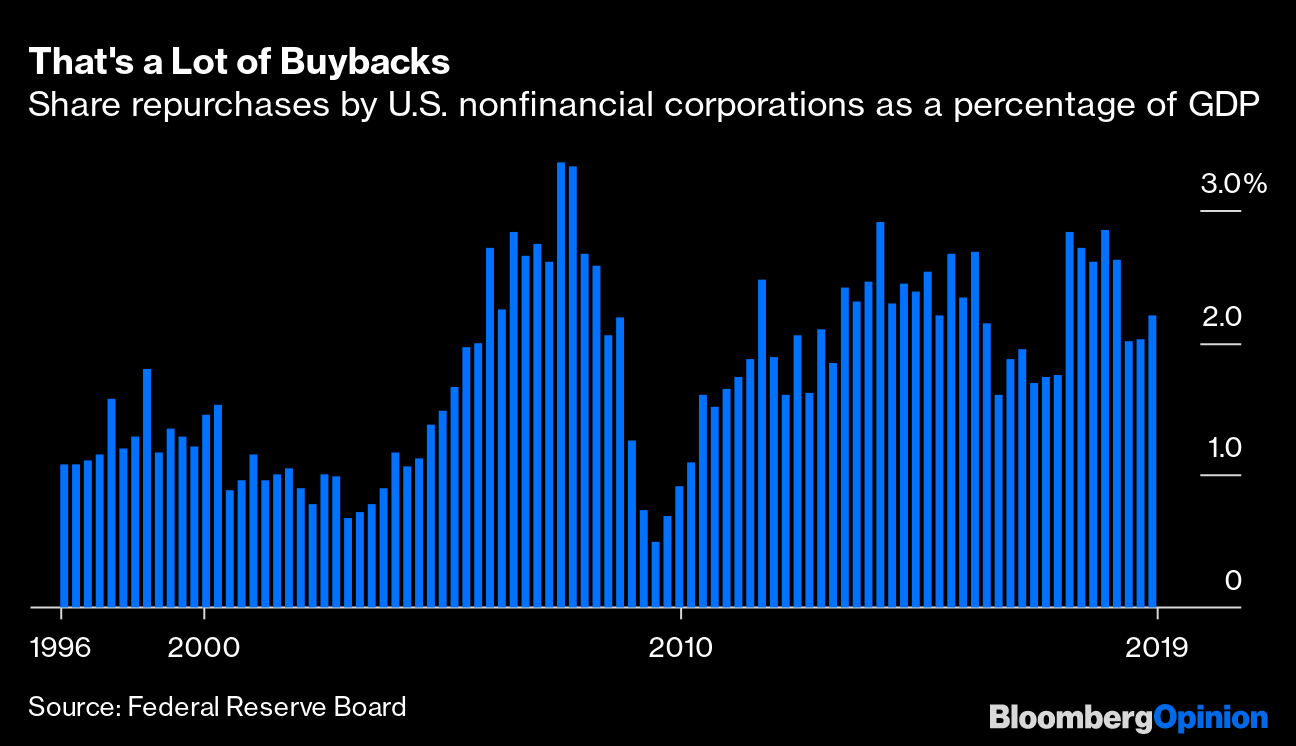

| This is Bloomberg Opinion Today, a sniff test of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  A whole lotta red. The Sell-Off Will Continue Until Morale Improves Just a couple of days ago, it was easy to think the worst of the coronavirus market meltdown was over. A flurry of rescues had helped lift stocks to their best week since 1938. Authorities were finally taking both the health and financial crises seriously. Maybe the bottom was in! Well, maybe not. Stocks have resumed selling hard as the end date of our national coronavirus nightmare keeps getting pushed back. It seems only a matter of time before we hit a new, lower market bottom. What looked like a durable bounce from bedrock was probably just end-of-quarter portfolio rebalancing, writes Mohamed El-Erian. There's still far too much we don't know — from the scope and duration of the health crisis to how quickly government cash can actually get to rapidly dying businesses — to declare the worst behind us. Big parts of the credit market are still in turmoil, and there's still a mad grab for dollars around the world, notes Marcus Ashworth. Nothing's going to settle down until that does. Meet the New Leverage Problem, Same As the Old Leverage Problem One big problem, we're discovering to our horror, is that the leverage fueling the financial crisis a decade ago never really went away; it just changed balance sheets, writes Satyajit Das. Companies and governments loaded up on debt, with investors only too happy to help, in a desperate reach for yield as interest rates sank around the world, sometimes into negative territory. Recovering from this will take much more than just restarting factories and restaurants when social distancing ends. One particular hot spot to watch is auto loans, writes Anjani Trivedi. This isn't the well of toxic-debt nightmares the 2008 mortgage market was, but it will be a source of pain. Lenders got awfully lax about standards in the good times. Now many borrowers are quarantined people facing a choice between making a payment on a car they no longer drive and paying rent on the home where they now spend every moment. Fortunately, banks are at least in better shape than before the 2008 crisis, but regulators are loosening post-crisis curbs to keep them lending. The trade-off, writes Elisa Martinuzzi, is that bankers will have to defer bonuses for a long while. That seems a reasonable price for keeping their jobs. Some Advice for Central Bankers So the Fed will be bailing people out for quite a while, from the unemployed to small businesses to strapped state and local governments. One group they should leave alone, though, is junk corporate borrowers, writes Bill Dudley. These companies levered up in the good times to pay equity investors. Suffering in the bad times was the risk they took, and the Fed will create moral hazard by bailing them out. The world's central bankers can help market confidence by letting everyone know they're not going to dump the risky assets they already own when the going gets tough, write Isabelle Mateos y Lago and Terrence Keeley. One thing central bankers are suddenly not buying a lot of is gold, writes David Fickling. This is really hurting the yellow metal's reputation as a haven. Further Rescue Reading: The small-business bailout won't work without these steps. — Michael R. Strain Sniffing Out the Virus President Donald Trump's suddenly dour assessment of the pandemic, a 180-degree turn from his stance of less than a month ago, helped fuel the pessimism on Wall Street. The good news is the 240,000-death forecast Trump cited is not inevitable, writes Max Nisen. The bad news is that a significantly lower toll depends on more widespread social-distancing measures than we're seeing now. As you're probably sick of hearing, we also need much more testing to grasp the real scope of the pandemic. We may not just be undercounting total cases, but also deaths, if Italy is any guide, writes Ferdinando Giugliano. Until we get more widespread testing, we may have to get creative. A Wall Street veteran has an interesting idea, writes Michael Lewis: putting together a database of people who suddenly can't smell. This could help us track otherwise asymptomatic cases. Further Virus-Fighting Reading: Vulnerable People Now More Vulnerable As usual, the world's most vulnerable people are at the greatest risk in this crisis. That's painfully apparent in India, where a ham-fisted lockdown order by Narendra Modi has millions of desperately poor people trying to rush home, crowding together and dying in the process. It's the latest example of how little Modi cares for the poor in his country, writes Mihir Sharma, and it will make the toll of the crisis worse. It's all reminiscent of the scramble that followed the 1947 Partition, which killed possibly a million Indians, writes Nisid Hajari. Both resulted from governments clueless about how fear could spark mass migration. This crisis will also hammer the world's garment workers, unless retailers and governments entice manufacturers not to lay off staff or lower safety standards, writes Adam Minter. This will also put a tremendous strain on Latin America's overcrowded prisons, where health conditions were already abysmal, writes Mac Margolis. Telltale Charts There's been an explosion of shady coronavirus websites, writes Ben Schott.  Buybacks have always been controversial and often a little shady, writes Justin Fox. Don't expect criticisms to go away after this crisis.  Further Reading Xerox Holdings Corp. has dropped its HP Inc. pursuit, and thank goodness. — Tae Kim Malls and retailers should come to some agreements on rent. — Andrea Felsted Saudi Arabia took a huge gamble pumping more oil at low prices. We'll soon know if it failed spectacularly. — Ellen Wald New York's MTA is smart to jump in line for a handout in this crisis. — Brian Chappatta Scoff at the idea of Trump getting infrastructure done, but the politics later this year could favor it. — Jonathan Bernstein ICYMI U.S. intelligence claims China hid the extent of its outbreak. Many New York virus patients are young. Antarctica once had a rain forest. Kickers AI has some weird ideas for pranks. Goats have taken over a quarantined Welsh town. (h/t Scott Kominers for the first two kickers) Oceans can be restored to past glory in just 30 years, a study has shown. Stop trying to be productive. Note: Please send goats and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment