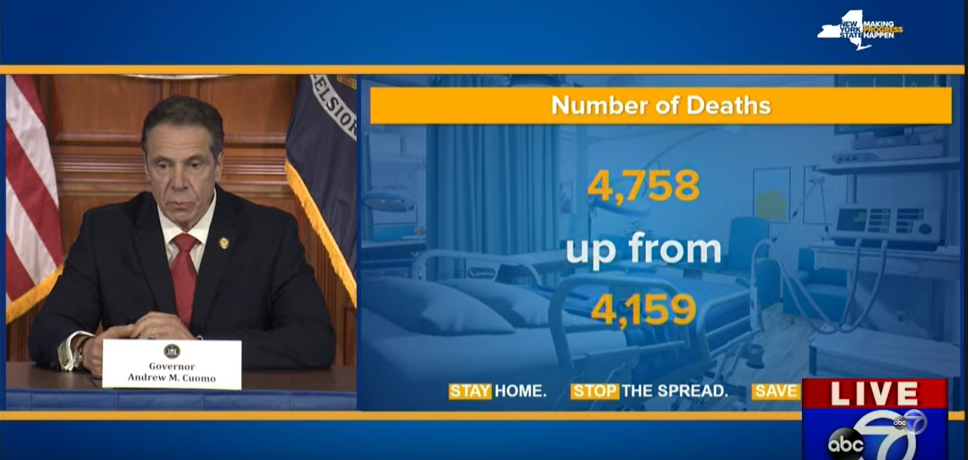

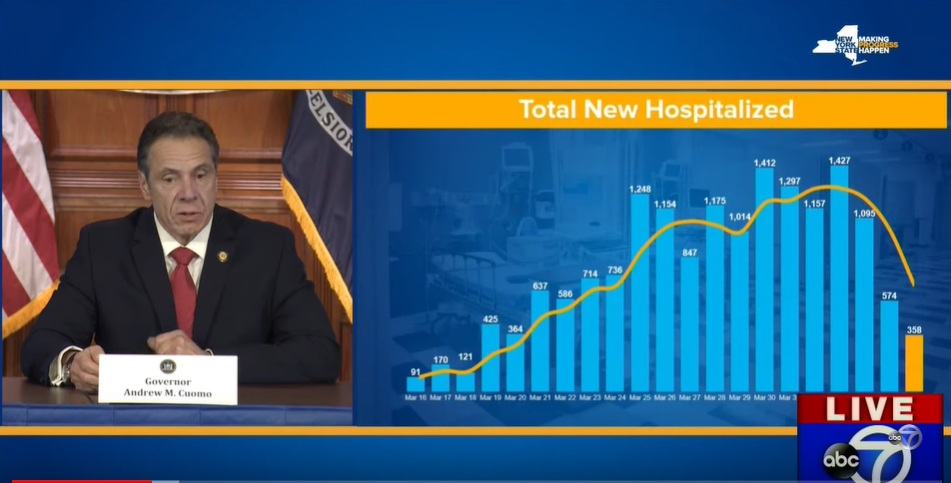

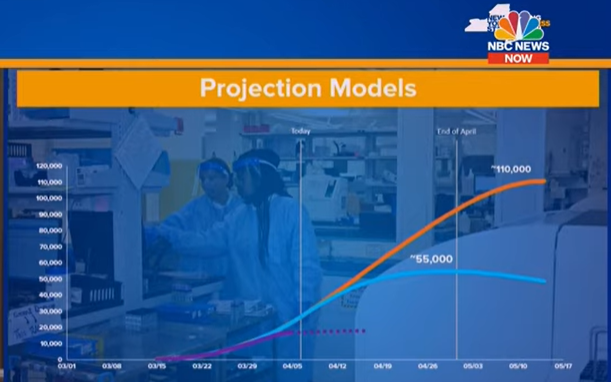

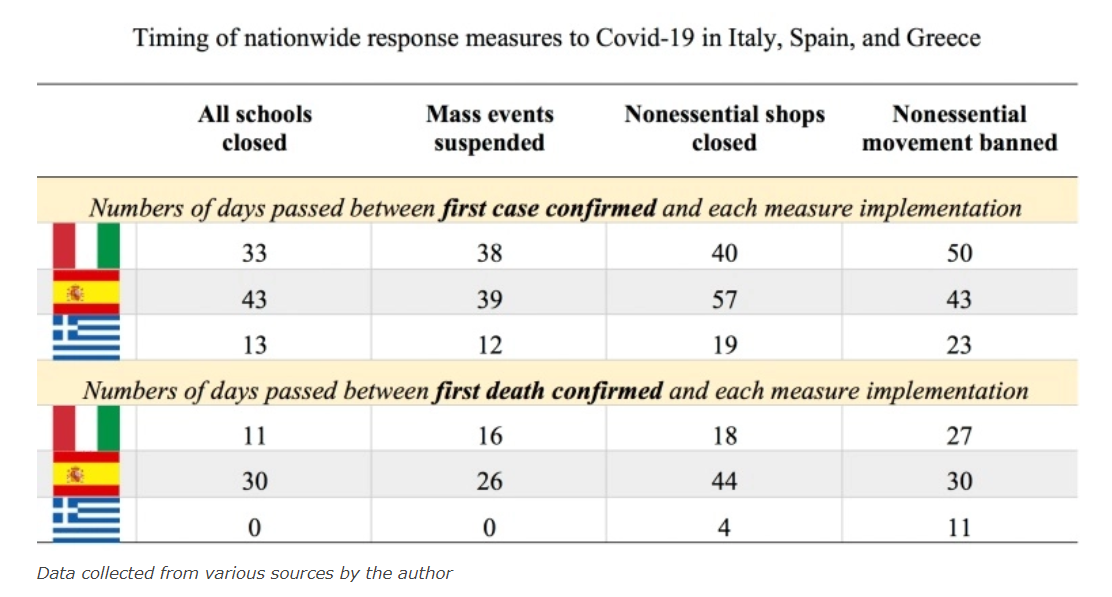

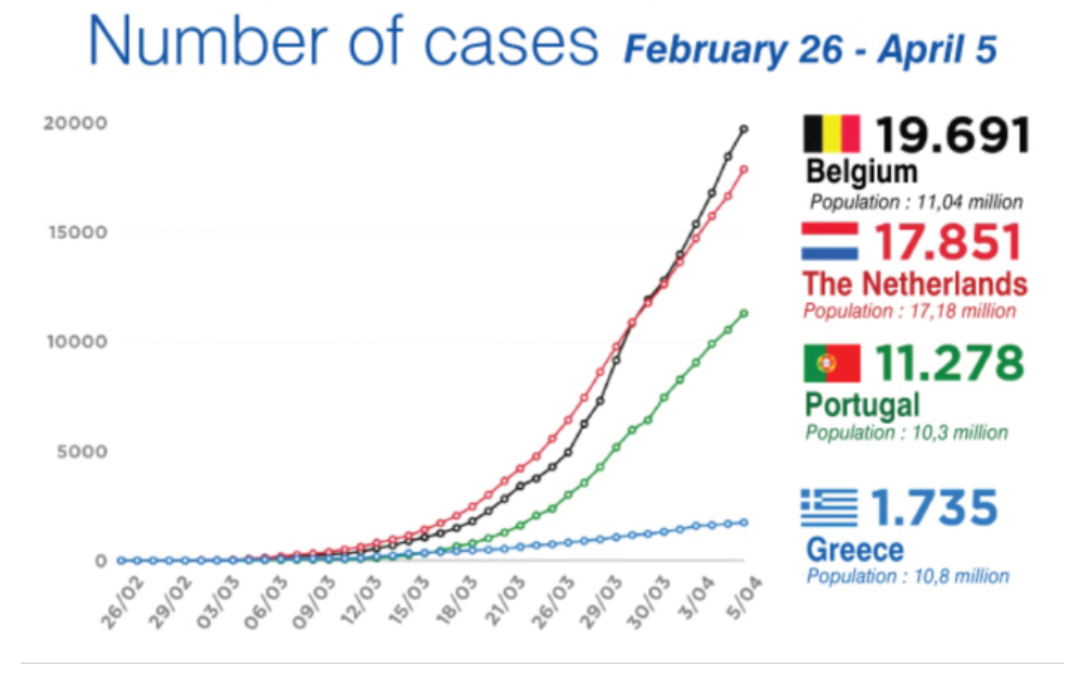

Glimpses of Light Death is a lagging indicator. Of all the sentences uttered during the coronavirus crisis, this is probably the ugliest. It is also accurate. If the rate of increase of deaths in a country is reducing, or particularly if the number of deaths is actually falling from day to day, it suggests that the turning point in the fight against the virus has already been reached. Bear this in mind as the global stock market celebrates one of its best days in history on the back of a continuing appalling global death toll from coronavirus. The S&P 500 gained slightly more than 7% for its third best day in more than a decade — but also, its third best day in three weeks. This was on a day when the biggest news was the horrible announcement that Britain's prime minister had been admitted to an intensive care unit suffering from Covid-19, and when the local news was also grim. This is a screenshot of Andrew Cuomo, New York state's governor, announcing the latest death toll at his daily televised news conference:  This isn't about particular cold-bloodedness among market traders, however. With people around the world growing ever better at understanding the dynamics of an epidemic, glimpses of light from the latest numbers have inspired the latest rally in markets. Italy has definitely flattened its curve; the numbers of daily deaths and new cases are both declining. Spain appears to have done the same. The speed of increase has nudged downward slightly in the U.K.And in New York, home to the world's biggest capital markets, there is hope that a total overload of the hospital system may have been averted. Governor Andrew Cuomo's daily briefings are destined for a privileged place in the annals of political communication. They have even sparked talk that the Democrats could draft him as their presidential candidate. His Monday briefing can be found here. The number of deaths continues to pile up and the day even brought the news that New York City's mayor is considering temporary mass burials. But these are lagging indicators. This slide from Cuomo was probably what sparked the market enthusiasm:  It is possible that this reflects people being less likely to head for hospital at the weekend, even if they do need the help, and not too much weight should be put on a few days' figures. But it does look as though the curve has been flattened. A subsequent slide showed the initial projection for the number of beds that would be needed in New York state at the coronavirus's peak (110,000), plus a revised estimate taking into account the effects of social distancing (55,000), and a line showing the number of beds needed so far. This suggests the peak may not even be half the revised estimate, and that hospitals may be able to cope. In other words, the governor who at present is the public face of the response to the virus in the worst-hit state is predicting that the much-feared public health crisis of swamped hospitals can be avoided. Such a dreadful outcome was the "realistic worst case scenario" — and Monday's rally repriced markets to remove that scenario:  Other fragments of data suggest that social distancing is working. Academic studies of what happened in China also indicate — with caveats for the distrust of the official Chinese data — that aggressive moves to enforce social distancing had a hugely positive effect. One study produced by the University of Southampton in England, not yet peer-reviewed, shows that: if interventions in the country could have been conducted one week, two weeks, or three weeks earlier, cases could have been reduced by 66 percent, 86 percent and 95 percent respectively – significantly limiting the geographical spread of the disease. However, if NPIs were conducted one week, two weeks, or three weeks later than they were, the number of cases may have shown a 3-fold, 7-fold, or 18-fold increase, respectively. The situation is frustrating and the regime of social distancing is hard to tolerate (he typed, settling in to his fourth week working from his bedroom). But there are signs that they have averted a loss of life on a far greater scale. Monday's leap in the markets reflects a tipping point in confidence that social distancing is working, and started just in time to avert a catastrophe. One other example comes from Greece, which has been bracketed together with Italy and Spain in economic misery for a decade now, and generally suffered much more. On the coronavirus it seems to have done something right. Greece closed down its economy at the first sign of trouble, just as tourist resorts were about to reopen. It looks to have worked. This table, produced by Greek Reporter, compares how quickly the Greek government took social distancing actions, compared to Spain and Italy:  So far, Greece has suffered 79 Covid-19 deaths, compared to 13,341 in Spain and 16,523 in Italy. This chart, produced by the government, compares its record to European countries with more similar populations:  Is the market reaction premature? Continuing with a Mediterranean image, Jean Ergas, chief economist of Tigress Financial Partners in New York, suggests that markets are treating the Allies' invasion of Sicily during the Second World War as though it were the D-Day landings in Normandy. There is a long way to go, and many difficult decisions and battles before the virus can be consigned to history. Markets tend to move down before recessions and pick up before the economic recovery has started, so it is natural that they have risen. But the countries of the West still have to deal with peak hospital usage ahead, and in the case of the U.S. there are many parts that may yet face outbreaks as severe as in New York. Then, the issue of "exit strategies" is already on the political agenda. How this is handled could make a huge difference to the ultimate economic damage. The odds are on slow and phased returns to work, with continuing restrictions on fun events like sports games and music festivals. These would test public morale. There is every chance that restrictions would need to be reimposed if there are further outbreaks before a vaccine is available. And in the U.S., there is an election in November that looks likely to revolve around Covid-19. Added to this, the U.K. now has an unavoidable political mess. Obviously the prime minister's condition should concern everyone of good will. Whatever the future holds, someone has to run the country while he is incapacitated, which will presumably be for at least a matter of weeks, when many critical decisions have to be taken. Beyond the frightening reminder of our human fragility, Boris Johnson's illness has also brought a sudden return of political uncertainty, a matter of months after the country appeared to have a fixed route for years ahead. Finally, there is the issue of the emerging world, where the virus has yet to make great inroads. Societies where people do not have jobs that can easily be done from home, where populations are tightly packed, and where health systems are already stretched, could yet face a disaster that the West avoids. For an example from recent history of what might happen, think of AIDS. There are positives. An instant financial crisis has been averted, and it looks like an extreme public health crisis in the U.S. has also been avoided. We appear now to have a consensus that lockdowns are a necessary evil that can help limit long-term economic damage. Stock markets have therefore retraced somewhat less than half of their losses since February. The Allied troops have a beachhead in Sicily. And get well soon, Boris. Survival Tips My tip tonight is to have a reliable internet connection. This is particularly true if you share a house with four other souls, all of whom at different points want to take part in video conferences or stream videos, while you want to take up bandwidth interrogating Bloomberg Anywhere. If you have an internet connection that buckles under this challenge, I can now attest that social distancing is very hard to survive. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment