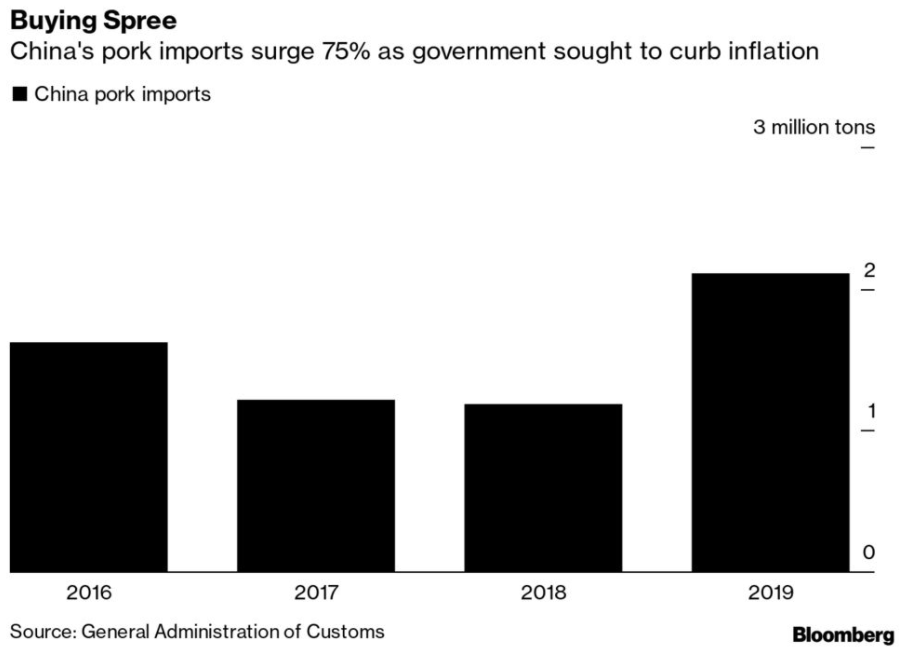

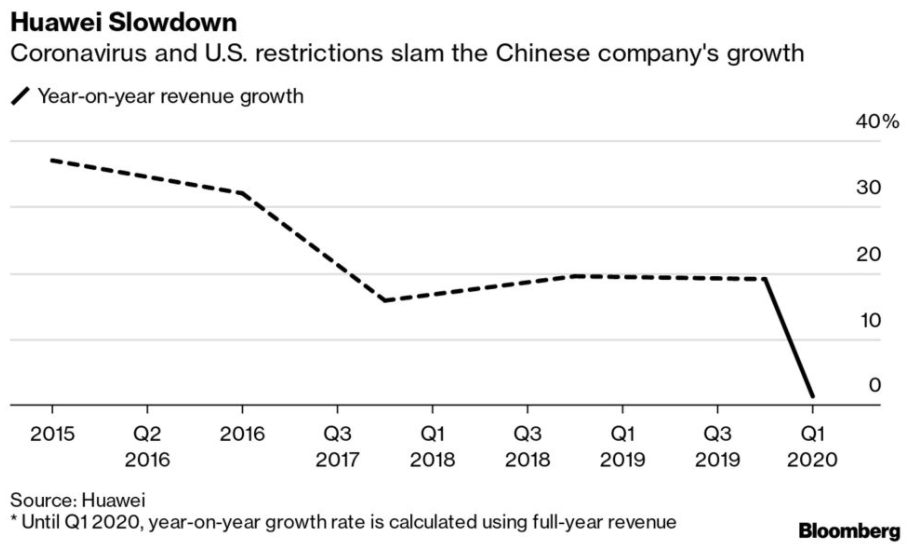

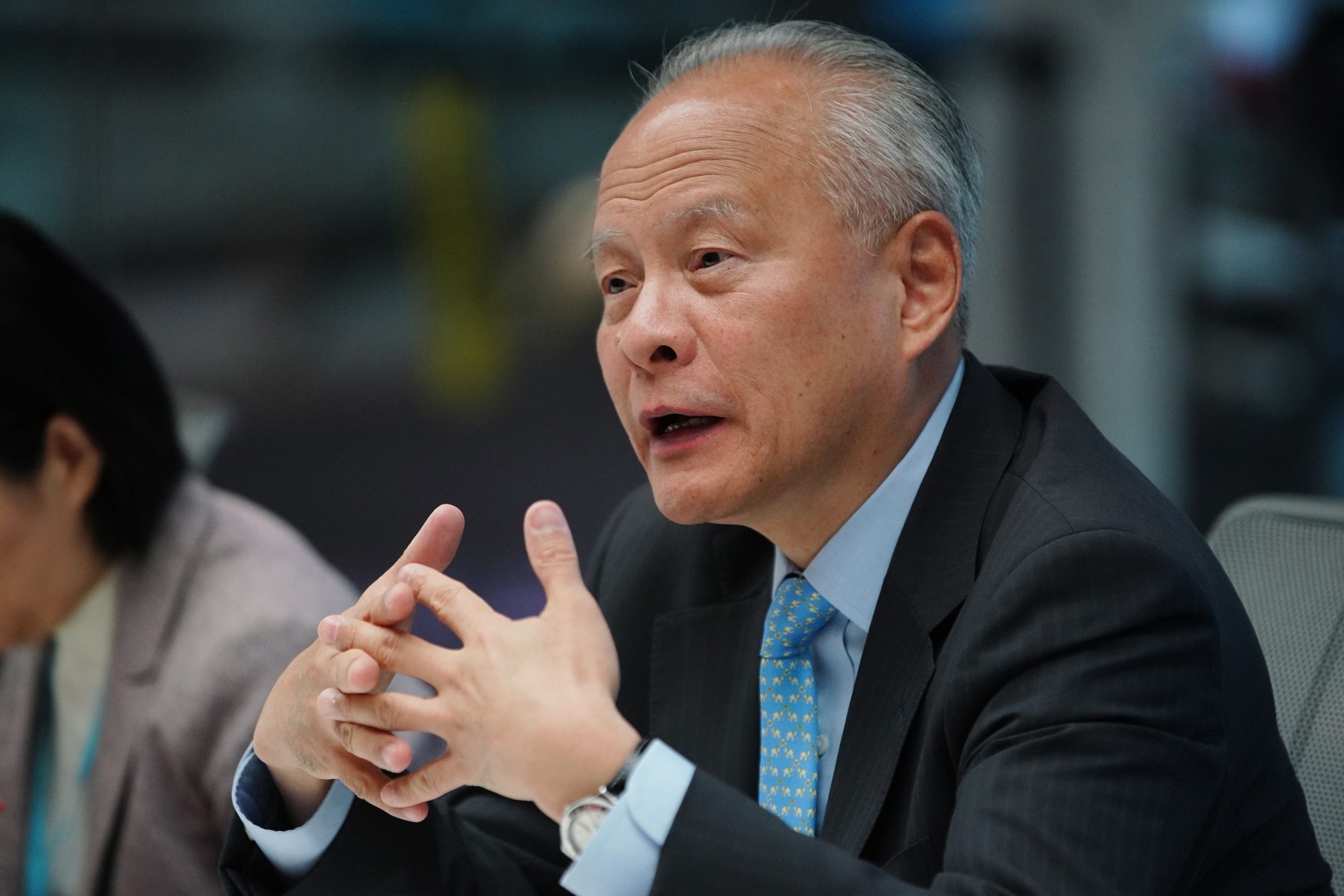

| Covid-19 has sent countries scrambling to secure a long list of goods the world is suddenly short of. One item that threatens to be especially impactful for China is pork. The reasons are twofold. First is pork's place as the staple meat for the vast majority of Chinese families. It is such an important part of daily life that Beijing maintains strategic reserves of it and economists joke that the country's inflation barometer, the Consumer Price Index, would be better named the China Pork Index. The other is that China's shortage predates the coronavirus. Since 2018, its supply of pork has been devastated by another disease, African swine fever. While not harmful to humans, it does kill most hogs it infects. That and the culling of herds to prevent infections has halved the number of pigs on Chinese farms. Prices have surged as a result. In March, the cost of pork in China was 116.4% higher than a year earlier. And because pork is a staple, the soaring cost of the meat has fueled a similar upswing in concern among China's leaders. This is where Covid-19 is making things worse. With domestic production hobbled by African swine fever, China had been leaning heavily on imports to make up for its shortfall. Shipments of meat from overseas in March hit a record 919,000 tons, including 390,000 tons of pork. But that strategy looks ever more under threat.  The U.S. is one of China's main sources for pork imports. But the spread of coronavirus has forced Smithfield, America's largest producer of the meat, to shut three of its plants. That, combined with the closure of facilities belonging to companies such as Tyson Foods and Cargill, has resulted in a tightening of U.S. supplies. So it's not surprising that a Chinese agricultural official warned this week that the "toughest time" for supplies is ahead of us, in the second quarter, and that the country's pork prices won't peak until September. That leaves China in an uneasy bind. With the economy staggered by the coronavirus and millions out of work, the last thing policymakers need is a surge in food prices. Indeed there are signs that Beijing is preparing for an increase in social unrest, with senior officials convening a task force this week designed to "defend political security" from threats related to the outbreak. But this shortage is also not going to last forever. While this year's domestic pork production could fall 7.5% from 2019, the agriculture ministry sees it rebounding to a more normal level next year. That should bring prices down as well. The problem, of course, is how to deal with the unpleasantness between then and now. Cloudy Outlook Two of China's largest companies struck a note of caution this week about what the business environment might look like moving forward. Moutai, maker of the country's most prestigious liquor, forecast revenue growth of 10% for 2020. That would be the weakest pace since 2015, when sales inched up just 1% as an anti-corruption campaign eroded demand for its $500-a-bottle firewater. Tech giant Huawei also warned of a challenging year, citing both the coronavirus and U.S. efforts to limit its access to technologies and markets. For the first quarter, its revenue increased just 1.4% from a year earlier, versus a 19% increase for all of last year. Add to that an uptick in bad loans at China's commercial banks and a lingering lack of demand for air tickets and the outlook for 2020 gets ever gloomier.  Tide Turns Carson Block, the short seller made famous by his bets against Chinese companies, isn't always right. But he is right often enough to be worth listening to. That's especially true now as the Covid-19 pandemic rocks financial markets, tightening funding for companies around the world. That stress, Block argues, will unveil a slew of malfeasance. A few examples have been exposed already. Luckin Coffee, the challenger to Starbucks, was the most high-profile. TAL Education revealed its own accounting problem not long after, which was followed by China's securities regulator punishing two startups newly listed in Shanghai for failing to fully disclose links to a customer that wasn't able to pay its bills. If Block is right, these will not be the last. Serious Rethink China's relationship with the rest of the world was undergoing seismic shifts before the coronavirus struck. Covid-19 seems to have supercharged the process. Signs of this can be seen in China's relationship with Europe, where a rift appears to be growing quickly. The same is true with some of Beijing's Asian neighbors. But the effect is by far the most pronounced in China's relationship with the U.S. Be it spats about the outbreak, trade or technology, the idea of engagement seems to have been relegated to the trash bin. China's ambassador to the U.S. this week urged the two sides to undertake a "serious rethinking" of the foundations of their ties. There would be plenty of supporters in the U.S., China and beyond for just that. Yet with an American presidential election looming, the probability of it happening anytime soon seems low. And with growing bipartisan support for getting tough on China, it is also questionable how much desire Washington has to answer that call.  Cui Tiankai, China's ambassador to the U.S. Photographer: Christopher Goodney/Bloomberg What We're Reading And finally, a few other things that got our attention: |

Post a Comment