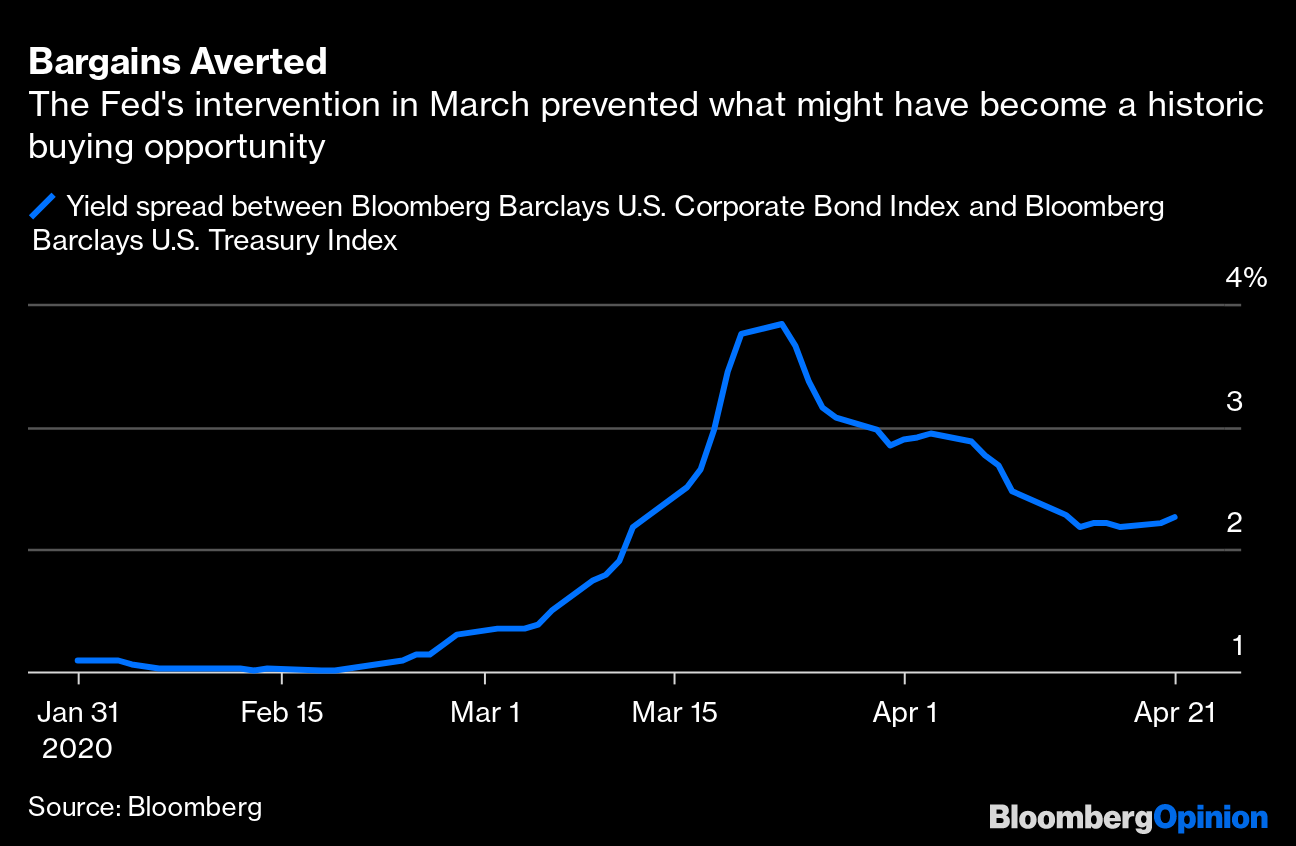

| This is Bloomberg Opinion Today, a hard-luck generation of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  It's been a hard 20 years. Photographer: Smith Collection/Gado/Archive Photos/Getty Images Millennials Can't Buy a Thrill Millennials sure take a lot of flak from the news media and older generations, but maybe we should give them a break. Because the universe sure isn't. Somebody born in 1983 probably graduated from high school just months before the Sept. 11 terrorist attacks. Seven years later, when they'd been working for just a few years after incurring mountains of student debt, the financial crisis hit. A decade later — when maybe they've finally started settling down, maybe with some kids and a mortgage — a pandemic arrives, bringing a possible depression with it. (Three such catastrophes in 20 years sure feels like it's not a coincidence, observes Justin Fox. In many ways it's the product of a U.S. government that has apparently forgotten or rejected its long history as a risk manager.) Anyway, the psychological trauma of enduring all this is bad enough, but millennials keep suffering financial setbacks to boot. A persistent feature of the recovery from the financial crisis was sluggish wage growth, which didn't improve much even when unemployment fell to lows not seen in decades. This was partly a result of years of underemployment, writes Rachel Rosenthal; people were often stuck in jobs for which they were overtrained and underpaid. This cost them leverage when seeking new jobs, even when those were plentiful. Now those wilted salad days are over, with 26.5 million people losing jobs in just five weeks. And unless the economy bounces back immediately from the coronavirus pandemic — which seems unlikely — they will be in for more years of underemployment. That hurts much worse than your tired avocado-toast jokes. Who's Minding the (Money Going to the) Store? At least the Fed, Congress and the White House haven't wasted too much time pumping trillions of dollars into the economy. But they've moved so quickly there's little oversight of how it's all being spent, writes Tim O'Brien. Thus we end up with Harvard and Shake Shack getting relief while poorer businesses and schools go bust. It's hard to feel confident all this money is doing much good without more accountability, but neither President Donald Trump nor Congress seems in a huge hurry to provide it. All this spending has also awakened long-dormant jitters about the federal government's debt mountain, which was at eleventy kajillion dollars at last count. Karl Smith is here to tell you not to worry about that, though: No matter how much Uncle Sam borrows and prints money to cover that spending, the rest of the world is hungry for more of that debt and cash. Whoever is running the country in 2021 may feel tempted to pay for all of this with a wealth tax. Cass Sunstein warns such a thing may not be constitutional. There could be easier ways to raise revenue than fighting a conservative Supreme Court for it. Further Pandemic-Politics Reading: This crisis is bringing formerly fringe ideas such as degrowth and modern monetary theory into the mainstream. — Noah Smith Let's Not Make a Deal With everybody in sweatpants and markets in turmoil, it seems a weird time to think about mergers and acquisitions. It's hard enough just acquiring an Amazon grocery delivery slot, am I right? But be sure there are many sweatpanted deal makers out there looking for bargains in the carnage, and some lawmakers want to stop them, lest they get too predatory or cause mass layoffs in a recession. But a full M&A ban makes little sense right now, writes Tara Lachapelle. Big deals aren't getting done right now, and regulators already have the tools to stop the worst deals, if only they can remember where they left them. M&A lawyers might be a little preoccupied for a while anyway, fighting in court over all the deals that were only half-finished before the pandemic struck, writes Matt Levine. Telltale Charts By rescuing the bond market, the Fed took away a huge opportunity for active bond managers to become stars, writes Nir Kaissar. That makes it harder to hide the fact that most active bond managers aren't too good at managing money.  Diamonds are increasingly nobody's best friend, writes Clara Ferreira Marques.  Further Reading This is the worst possible time for partisan rancor to erupt. — Bloomberg Editorial Board Doctors can save more coronavirus patients' lives by better sharing information. — Faye Flam We can't reopen the economy until we figure out whether businesses are liable if employees get sick. — Tyler Cowen Covid-19 could move wavering Republican voters to favor action on climate change. — Mark Buchanan The process of finding the new head of Norway's wealth fund leaves nobody looking good. It even involves Sting. — Mark Gilbert ICYMI New York found coronavirus antibodies in nearly 14% of people tested randomly across the state. Wuhan's return is kind of a dystopian nightmare. Working from home has destroyed work-life balance. Kickers Pennsylvania factory team working on PPE clocks out after after 28-day shift. "Ghost flights" keep pumping carbon into the atmosphere. 300,000-year-old stick suggests human ancestors were skilled hunters. Ideas may be getting harder to find. Here's Steve Martin playing the banjo. Note: Please send ideas and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment