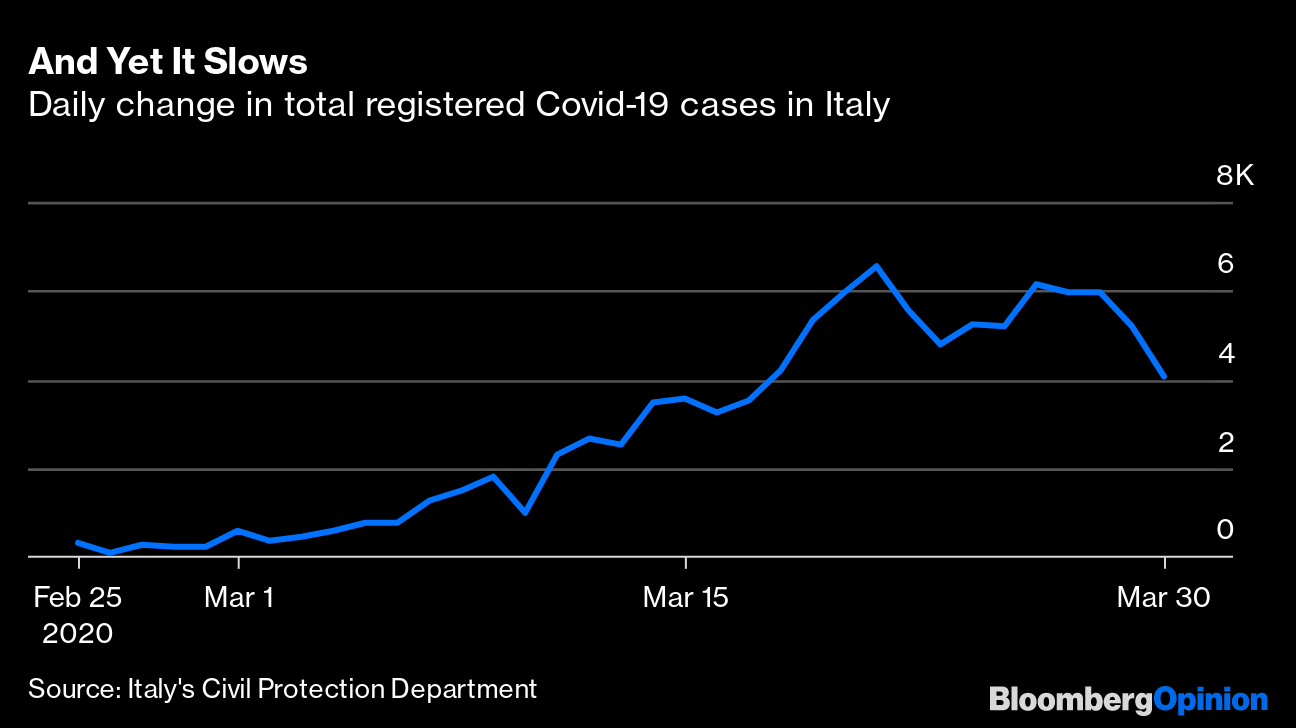

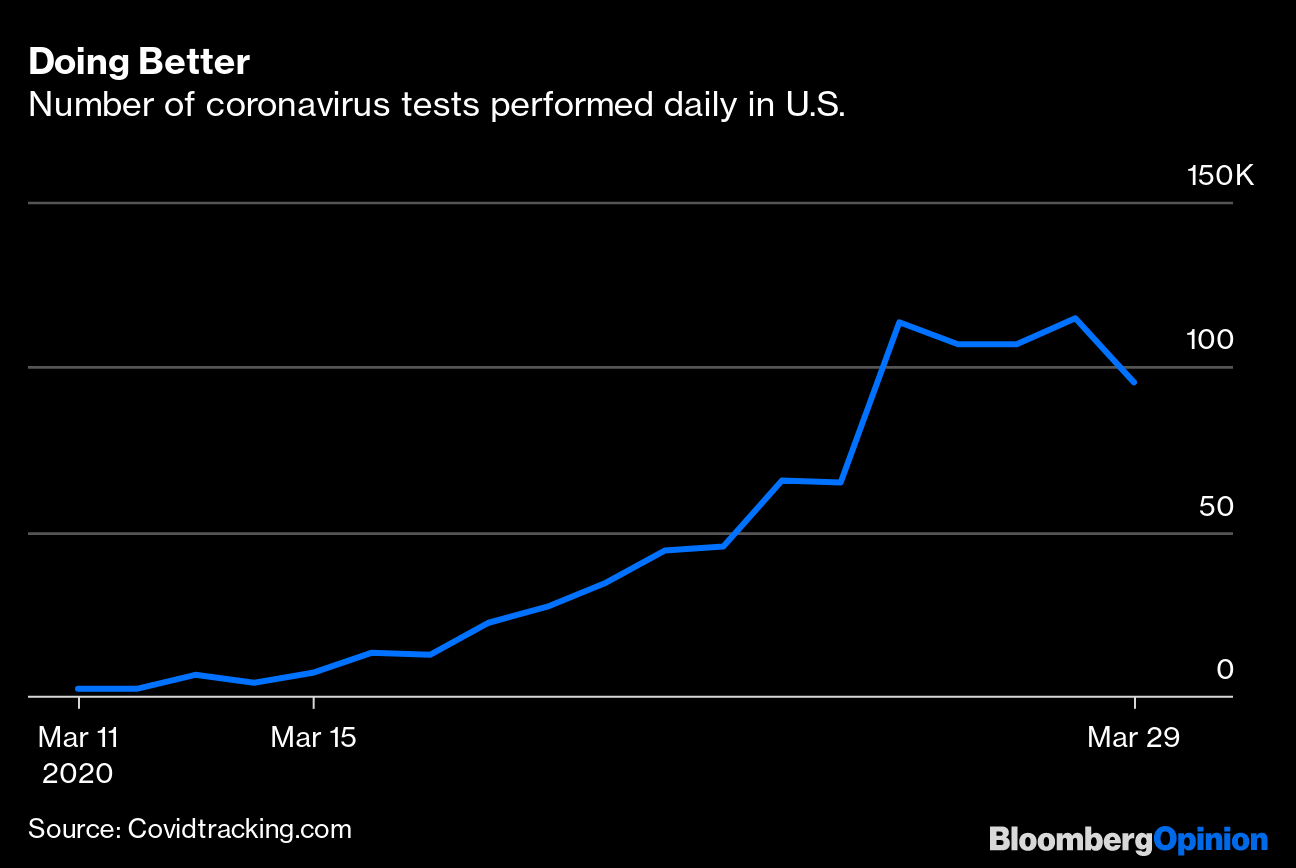

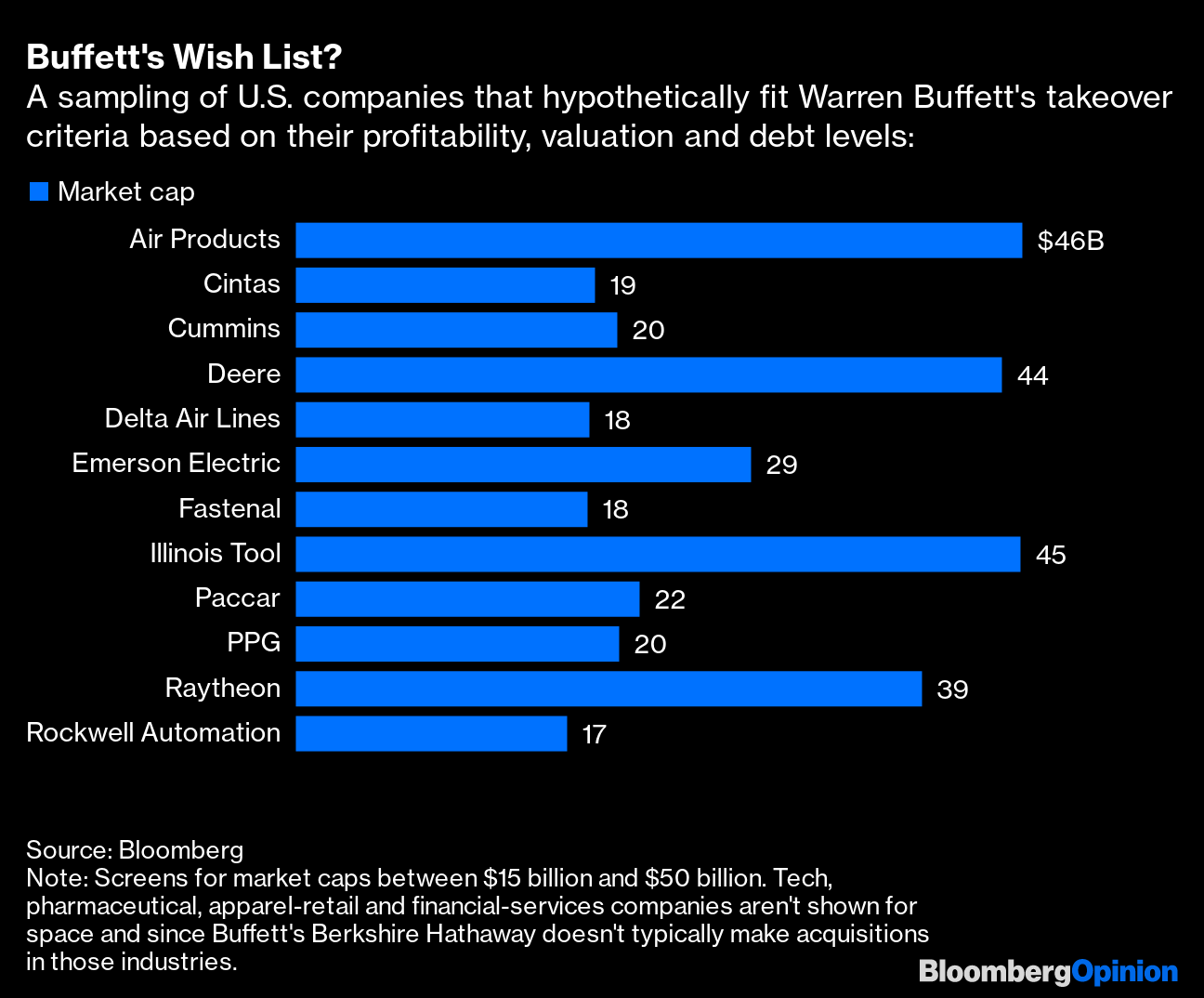

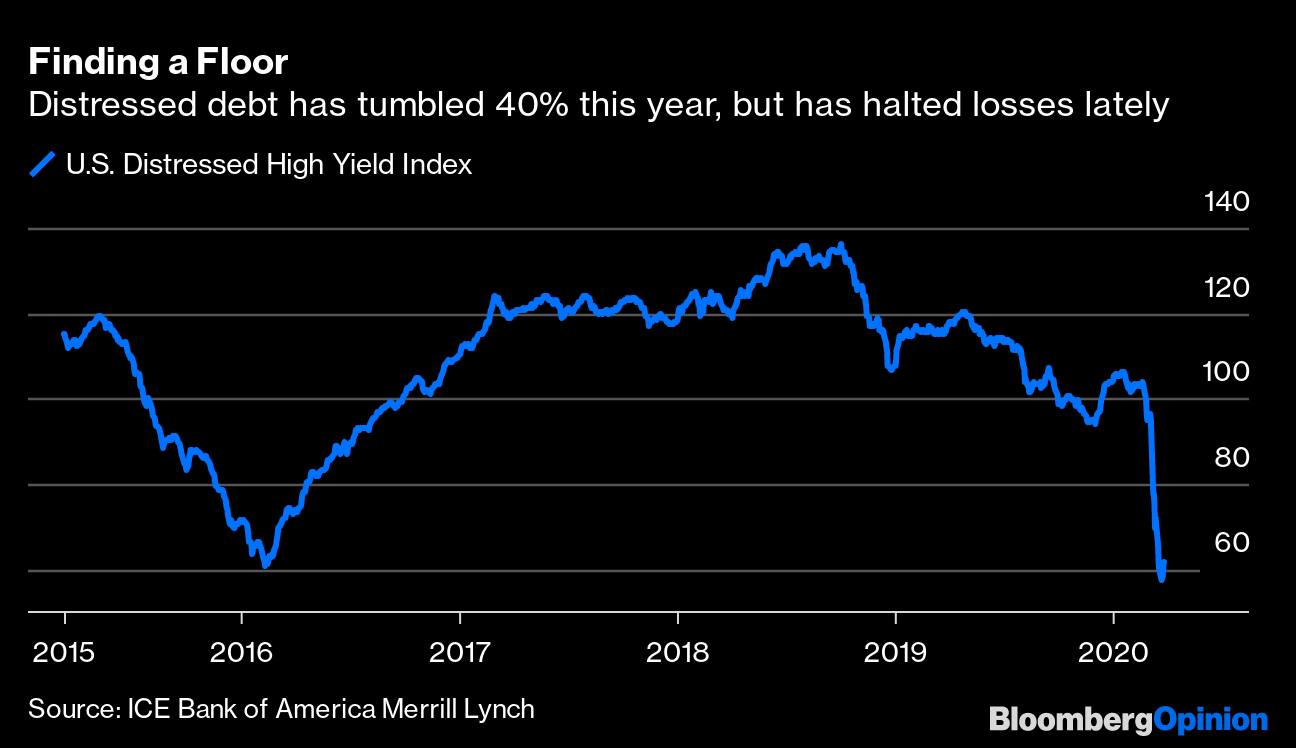

| This is Bloomberg Opinion Today, a road map of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  We'll get there eventually. Photographer: David Dee Delgado/Getty Images North America There, Off in the Hazy Distance, Is Normal Today is the last day of March 2020, a month that lasted approximately 74 years, a record that will likely be broken by April 2020, which experts estimate could last twice as long. It's easy to think we'll never escape this Groundhog Day existence of perpetual quarantine, but we're starting to see a hazy path back to something like normalcy. You can catch a glimpse of it in China, which is slowly returning to work after prolonged shutdowns. Italy is weeks behind that schedule, but its coronavirus case and death numbers are at least flattening, writes Ferdinando Giugliano.  Next comes the hard part: figuring out how to send people back to work without those numbers skyrocketing again. It's the same dilemma facing the U.S. whenever we flatten our curve — maybe at the end of April, maybe not. Fortunately, former FDA chief Scott Gottlieb and others have put together a handy road map for what could come next. Followed properly, it could have many Americans emerging from their cocoons within weeks, not months, Noah Smith writes. It will involve a lot of testing, but Noah notes we have finally ramped that up after a shamefully slow start.  Without widespread testing we can't catch the people who have no symptoms but could be big spreaders, Faye Flam writes. After we identify these people, we can isolate them and trace their movements and contacts, the way South Korea and other Asian countries did. This will involve some privacy intrusion, which we must not forget to roll back when the crisis is over, writes Eli Lake. Otherwise we'll repeat one of the worst mistakes we made after Sept. 11. With Amazon.com Inc., Facebook Inc., Netflix Inc. and other tech giants ruling our daily lives in quarantine, we're forgetting pre-coronavirus concerns about their size and reach, notes Lionel Laurent. Contact tracing would give them even more power, and we must make sure they don't abuse it. We must also be careful how much faith we place in scientific models about the spread of the disease, writes Therese Raphael. As we've already seen, their outputs can change dramatically with small changes in inputs, with massive implications for policy. A vaccine would be a huge help here, and people are working on one as we speak. But there's not much money in vaccines, which is why pharma companies have mostly gotten out of the business. Generous government bounties could help speed a coronavirus vaccine to market, write Hanno Lustig and Jeffrey Zwiebel. And when we're finally getting the economy going again, we must take care of the older workers most affected by this health scare, writes Conor Sen. Pushing them permanently out of the labor force won't just hurt their finances; it will hurt the whole economy. We want to get as many people to the promised land of near-normal as possible. Coronavirus Losers and Winners The Fed and Congress have launched an armada of rescue plans aimed at keeping the U.S. economy from falling into a depression while we fight Covid-19. Despite this, millions of Americans are losing their jobs anyway. That's partly because even the strongest medicine isn't enough for some companies and industries with weak immune systems. Macy's Inc. and Carnival Corp. are examples of businesses that were shaky even before this crisis hit, writes Timothy L. O'Brien. Carnival faces a particularly grim future; three of its ships were coronavirus hot spots, and it's ineligible for U.S. bailouts because it's not incorporated here. No wonder it's having to pay 13% to issue new bonds, notes Brian Chappatta. Even food delivery is an unreliable money-maker these days, writes Tim Culpan, citing the experience of companies in China that learned delivering take-out is tough when restaurants are closed. On the other hand, this is the time for companies such as Zoom Technologies Inc., Slack Technologies Inc. and Smartsheet Inc. to shine, notes Tae Kim. Their work-productivity tools outdo those of bigger, better-known rivals, and they're being rewarded with face-melting growth. They'll lose some new users once this is all over, but they'll also have some new lifelong customers. So Much For Energy Dominance America's shale patch is also not exactly built to withstand the coronavirus shock. It was already suffering from the oil-price war launched by Saudi Arabia and Russia. Now the coming recession will end many frackers. Not long ago, President Donald Trump was crowing about America's "energy dominance." Now he's going hat in hand to Vladimir Putin. Trump, seeking help propping up oil prices, while also slashing fuel-efficiency standards, is making America more dependent on oil, Liam Denning notes. This looks more like submission, or confusion, than dominance. A far better approach would be using America's technological edge to achieve true energy independence, as we tried during the '70s. Certainly talking to Putin won't help, writes Julian Lee. There's nothing he or anybody else can do about crashing oil demand now. Those shaky frackers also want a government bailout, though what they really need is consolidation. They might find future stimulus plans lean more toward green energy anyway, Liam Denning writes in a second column. The Last Days of the Dollar Era? We wrote yesterday about different things the coronavirus could change forever. John Authers has spotted another possible change, though not a very large one: only the dollar's global dominance, that's all. This is no sure thing, and currently the dollar is in higher demand than ever, as investors and governments scramble for greenbacks. But this very funding crisis could make investors look for future alternatives, particularly when we confront the massive debt burden this mess will leave. China may benefit. Further Fading-Empire Reading: The U.S. should set aside money for poor countries, or cede more influence to China. — Mihir Sharma Telltale Charts Warren Buffett has been quiet lately, but he's also been waiting for a moment like this, with a pile of cash and a target-rich environment, writes Tara Lachapelle.  But signs of life in credit markets suggest it may be already too late to snatch up the best bargains in distressed assets, writes Brian Chappatta.  Further Reading The virus is starting to disrupt global food supplies. We'll need government interventions to stop a crisis. — Clara Ferreira Marques If SoftBank is any guide, private equity is scrambling to shore up portfiolios. — Shuli Ren U.S. schools aren't prepared for mass online learning. — Andrea Gabor Trump's failure has people scrambling to get life-saving protection to health-care workers. — Francis Wilkinson Trump's daily press battles are good for the country. — Jonathan Bernstein ICYMI Coronavirus doctors are threatened with firing if they talk to the press. Divorces spike after China quarantines. Prosecutors may use Elizabeth Holmes's affair with Sunny Balwani against her. Kickers Neural implants and AI can turn thoughts into text. (h/t Scott Kominers) Lead pollution in ice cores may track the histories of medieval kings. Why there are 360 degrees in a circle. Why we wish for wilderness. Note: Please send ice cores and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment