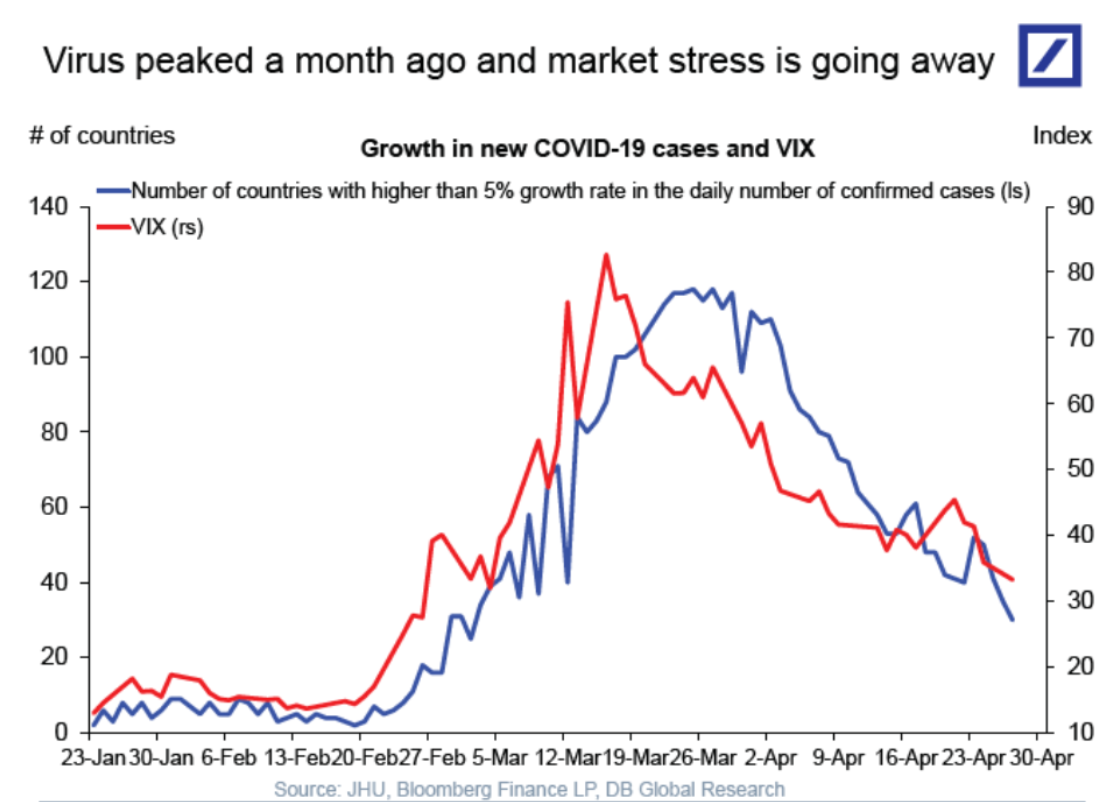

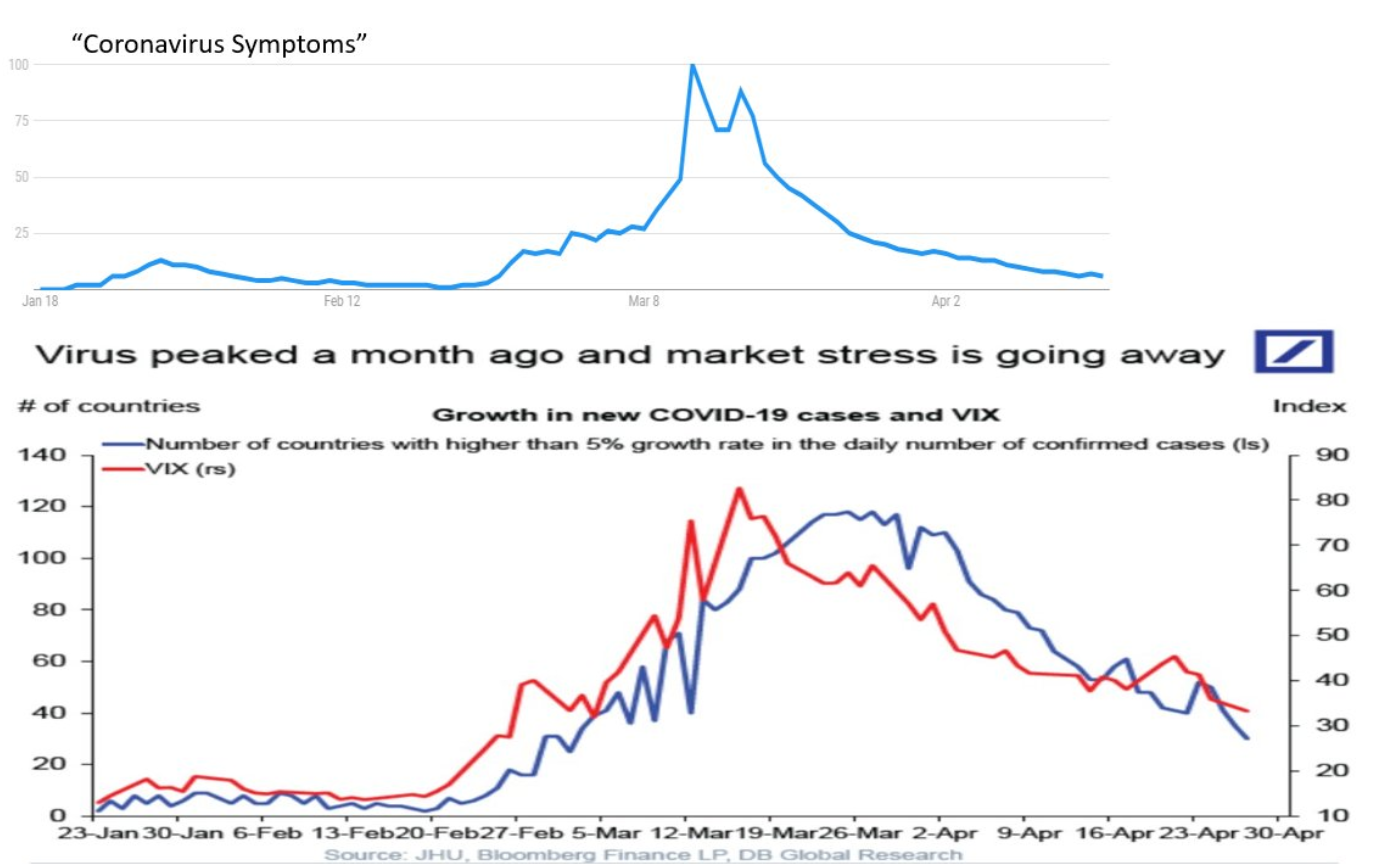

Ex-Post Justifications We had a slight interruption in the mood of optimism Tuesday, as U.S. stock markets took a step back. The main decliners were the tech stocks that had led the advance, and whose rally looked overstretched. There wasn't necessarily much to worry about in this. This was one of those rare "healthy corrections" that was actually healthy and went some way toward correcting something. However, the ex-post explanations for an unremarkable negative day centered on disappointing economic data. There is a lot more data to come this week that may prove disappointing. But I saw little in the Tuesday data that would have disconcerted anyone enough to prompt them to sell stocks. This was the Conference Board's consumer confidence index, which was the worst outcome since 2014 — though barely below the average for the last 20 years:  Given the horrors that roiled U.S. consumers last month, it's impressive that they remain more confident than they were at any point in a six-year period starting early in 2008. I see no reason for anyone who hadn't already sold stocks to do so on the basis of this data. That leads to another issue, which is to try to understand just why the market has rallied as much as it has since its nadir last month. An ex-post justification is taking force that this was down to the external factor of the coronavirus. The markets calmed as evidence multiplied that the virus had peaked. The following chart is from Torsten Slok, chief U.S. economist of Deutsche Bank AG, and it shows that the rise and fall of the VIX volatility index overlapped neatly with the rise and the fall in the number of countries with a daily growth rate of cases of 5% or more:  This probably does capture some kind of truth. While we can all argue about the economic impact of the measures to contain the pandemic, Slok's chart captures a realization that took place a little bit more than a month ago: that social distancing would be effective in stopping the most catastrophic outcomes. As this became clear, stock market volatility reduced. It certainly helps to have removed one disaster scenario. There is more going on than this, however. We have almost unlimited help from the Federal Reserve. The experience of the last decade shows how this could power the stock market forward. Action by the Fed and others didn't just juice up stocks for the future — it also averted a credit collapse. This has a lot to do with recovering stocks and reducing volatility. Then there is the fact that Slok and his team obviously had to work quite hard to find a measure of the pandemic that matched the VIX so closely. It does look like fitting data to a pre-existing hypothesis. There are other Covid-19-related factors that also seem to influence the VIX. The following chart comes from Peter Atwater of Financial Insyghts, and compares Google Trends searches for "coronavirus symptoms" — something you typically look up when you're worried that you or a loved one might have Covid-19 — to Slok's chart of the VIX and the global progress of the pandemic:  Judging by Google, people's fears that they themselves had the coronavirus peaked at about the point that volatility did , and have since declined. Atwater's point is that at least in the initial "panic" stage, much of the selling was driven by personal immediacy or a "me, here, now" mentality. Consciously or unconsciously, the more scared you are that you have Covid-19 yourself, the more this will affect your actions. Since then, we have all learned a lot more about the disease. Viewing it from the "epicenter" of New York City, it looks to me as though a lot of what we have learned is negative. It may be "mild" for 80% of cases, but "mild" for adults still means feeling horribly ill for a week or so, even if it doesn't mean hospitalization. There are far more people with underlying conditions that could make Covid-19 dangerous than had initially been thought. There's really no way we're going to be truly back to normal until someone can vaccinate us. And the impact on health workers is heart-wrenching. I direct readers tothe tragic story of Lorna Breen, the physician who headed our neighborhood emergency room, which I and my family have used on several occasions. Her life ended by suicide last week. She had witnessed what must have been atrocious scenes at a hospital that served one of the most severely affected areas of the city, and had contracted the disease herself. As her father told the New York Times, she was a hero, who did great work to serve her community. I raise this partly because it has deeply moved me. But also because the issue of immediacy matters greatly to any explanation of the market. I am inclined to agree with Atwater that fear intensified into March, when the threat seemed very immediate to many, and then declined as it began to seem less proximate — people got the message that they were unlikely to die themselves, and grew to understand that social distancing was working. Add this basic, almost subliminal human sentiment to the rational reasons to buy the market provided by the Fed, and you have your rally. Those who feel more immediately and personally exposed to the human impact of the virus — such as all of us who live in New York — are likely to feel more bearish. Possibly excessively so. Where does this leave us? The rest of the week will have plenty of earnings announcements and central bank meetings to give rational reasons to buy or sell the market. Beyond that, the reduction in personal fear of the virus, and the unquestionable successes in holding it back, may have led to an irrational reduction in estimates of the economic damage. Scientists in China suggest that Covid-19 could become a recurring seasonal disease; Singapore has been hit by a second wave of infections after apparently fighting off a first successfully; Germany has started to reopen its economy and already faces concerns that it has done so too soon. Production might be able to return to normal reasonably swiftly over the next few months — but surely consumption cannot be anywhere close to normal again until there is a vaccine. Or maybe I am just saying that because I live in a community where the problem is still severe. I fear that the market rally has been driven by people for whom the virus seems less immediate and close, and who have moved from excessive fear to over-optimistic forecasts that the disease will now disappear. That at least is the view from Washington Heights, Manhattan. And rest in peace, Lorna Breen. Survival Tips Sometimes, the claustrophobia of social distancing makes us bottle everything up inside. This is unhealthy. Much of the time it's better just to let it all out. I therefore strongly recommend this video to show how you how one music teacher is helping her students to express their feelings. Let's hope we don't all have the same feelings about Jerome Powell's press conference on the morrow. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment