| |

| |  Image Credits: eleonora galli / Getty Images (Image has been modified) | | For our latest VC survey, we reached out to several top investors in consumer and social apps to get their thoughts on a number of pressing topics, including: - How has COVID-19 impacted social startups operationally?

- Are M&A prospects strong now versus two years ago?

- Has your degree of concern about incumbents copying social startups changed?

Here are the 17 investors who participated: - Olivia Moore, CRV

- Justine Moore, CRV

- Connie Chan, Andreessen Horowitz

- Alexis Ohanian, Initialized Capital

- Niko Bonatsos, General Catalyst

- Josh Coyne, Kleiner Perkins

- Wayne Hu, Signal Fire

- Alexia Bonatsos, Dream Machine

- Josh Elman, Angel Investor

- Aydin Senkut, Felicis Ventures

- James Currier, NFX

- Pippa Lamb, Sweet Capital

- Christian Dorffer, Sweet Capital

- Jim Scheinman, Maven Ventures

- Eva Casanova, Day One Ventures

- Masha Drokova, Day One Ventures

- Dan Ciporin, Canaan

At 9,134 words, this is one of the most comprehensive surveys we’ve ever produced; big thanks to reporter Arman Tabatabai and Editor-at-Large Josh Constine! Thanks very much for reading — have a safe, relaxing weekend. Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist Read more | | | |

| |  | | The news that Robinhood is seeking new capital “at a roughly flat valuation” caught the eye of Senior Editor Alex Wilhelm. This is a rocky time in the capital market for private companies, and the fintech startup experienced some “embarrassing downtime” in recent weeks, but because it’s reached real scale, “the round is more reasonable than you'd think,” writes Alex. Read more | | | |

| |

| |  | | Dear Sophie: I'm an E-3 visa holder and I usually go back to Australia to extend my visa. Given the COVID-19 travel restrictions, how do I extend my immigration status from inside the U.S.? — Aussie Programmer Read more | | | |

| |  | | Extra Crunch Live is a new series of hosted video chats that give EC subscribers an opportunity to interact directly with leading investors and entrepreneurs. If you’re looking for guidance or have a question, become an Extra Crunch member, join one of these upcoming discussions and take part in a live Q&A: - Monday, April 20: Aileen Lee & Ted Wang of Cowboy Ventures

- Tuesday, April 28: Freada & Mitch Kapor of Kapor Capital

- Thursday, April 30: Mark Cuban

- Wednesday, May 6: Roelof Botha of Sequoia Capital

- Thursday, May 7: Hunter Walk of Homebrew

- Tuesday, May 12: Kirsten Green of Forerunner Ventures

Read more | | | |

| |  Image Credits: unomat / Getty Images (Image has been modified) | | If you’ve received an email that contains the phrases “in these uncertain times” or “in the time of coronavirus,” it’s clear that many companies believe traditional outreach strategies will see them through this crisis. But that assumption won’t help you find new customers — and may even cost you business in the long run. Read more | | | |

| |  Image Credits: Peter Cade / Getty Images | | Stimulus funds for the Paycheck Protection Program have already been depleted, but data from Gusto indicate that small business layoffs spiked 1,000% between February and March. The platforms used to distribute these funds weren’t built to handle the demand, but we can “bend the curve for small businesses on the brink of collapse,” writes COO Lexi Reese. Read more | | | |

| |  Image Credits: Matt Anderson / Getty Images | | A stock market bounce earlier this week saw some major indices recover their value, even though “the news from COVID-19 is far from good” and private investors are bullish, writes Alex Wilhelm. To get a better understanding, he explores the “public-private optimism gap.” Read more | | | |

| |  Image Credits: cnsphotography / Getty Images | | Pascal Levensohn, a VC with more than 25 years of experience, says several of his portfolio companies have asked for “emergency bridge” convertible note financings in recent weeks. In a guest post for Extra Crunch, he writes that the trend “creates severe disincentives for any new investors to consider investing” and “misaligns the economic interests between the existing investors who play and those who don't.” Read more | | | |

| |  | | There’s much more to being an Extra Crunch subscriber than exclusive content and live conference calls with tech leaders — our Partner Perks and event discounts offer substantial savings on products and services in high demand, like Amazon Web Services, Brex, Freshworks, DocSend and many others. Read more | | | |

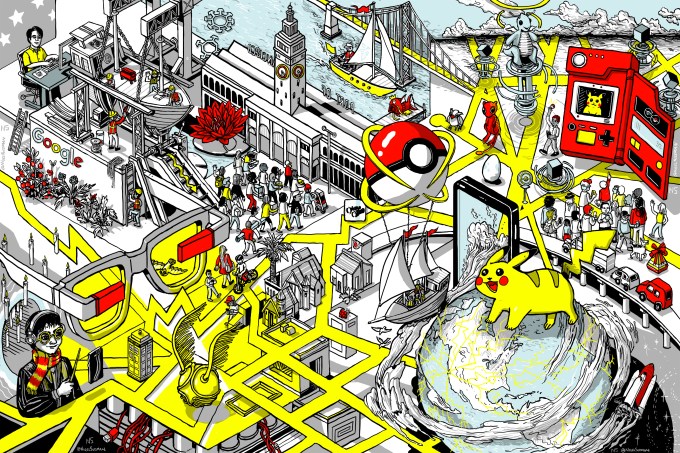

| |  Image Credits: Nigel Sussman | | Reporter Lucas Matney spoke to Niantic’s Head of Engineering Yuji Higaki to find out why the gaming platform bought a company that’s crowdsourcing a 3D map of the globe. “I think this is going to be one of the interesting challenges because the environment changes, the architecture changes and those details matter a lot more when you're actually creating this living, 3D mesh of the world that actually needs to be accurate so that you can interact with it,” says Higaki. Read more | | | |

| |  | | Berlin-based Delivery Hero employs 22,000 people and operates in more than 300 cities. With more than a half million restaurants on its platform, the COVID-19 pandemic has created “an enormous amount of impact in different ways and different regions,” says CEO Niklas Östberg. Read more | | | |

| |  | | Despite the current economic environment, several companies continue to position themselves for IPOs down the road by reaching $100M in ARR, a metric developed by Senior Editor Alex Wilhelm. In his column yesterday morning, he studied eight recent entrants to the club: HeadSpin, UiPath, DigitalOcean, BounceX, Wrike, Aeris, Podium and Lucid. Read more | | | |

| |

| |

| |

| |

Post a Comment