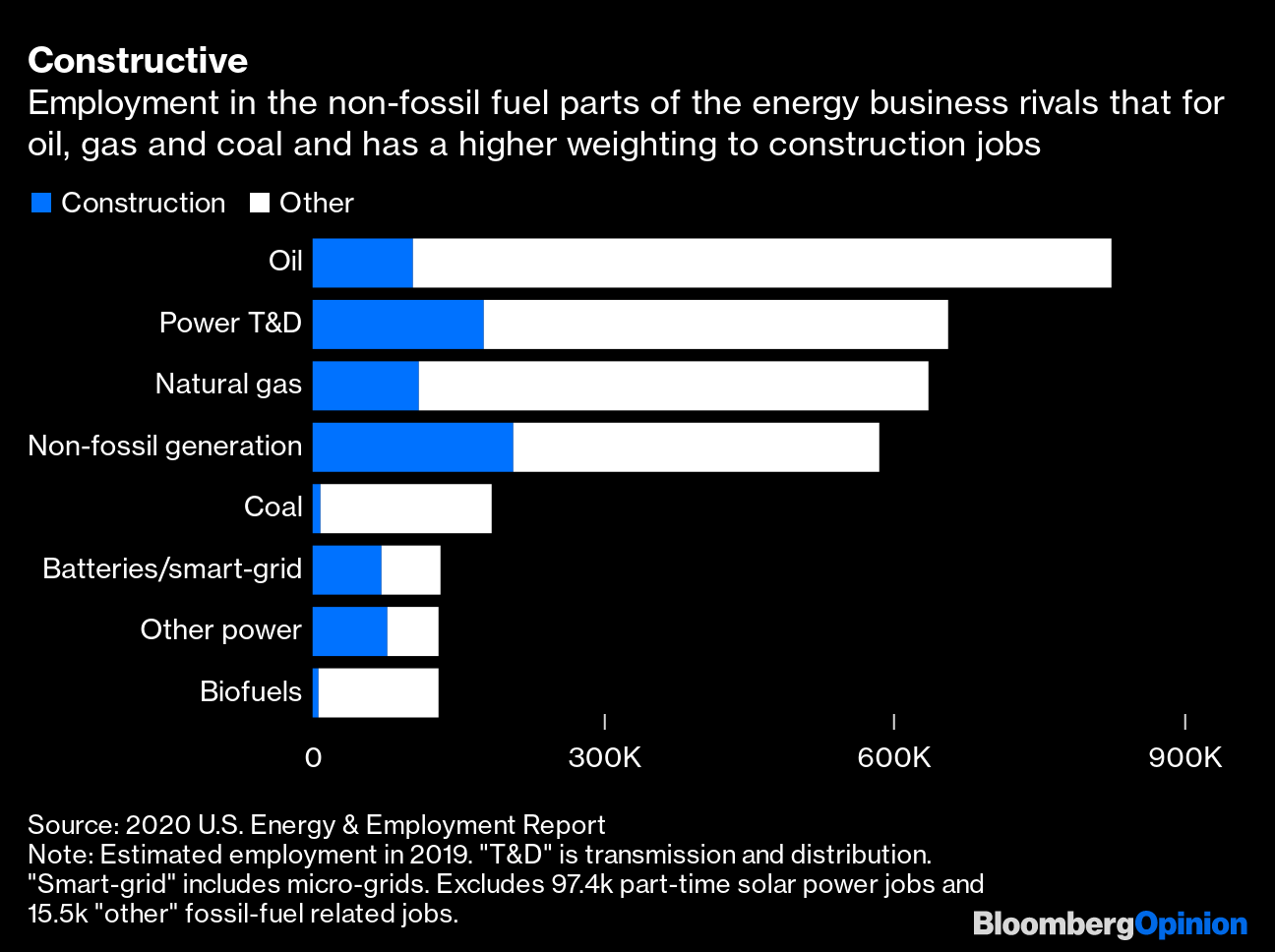

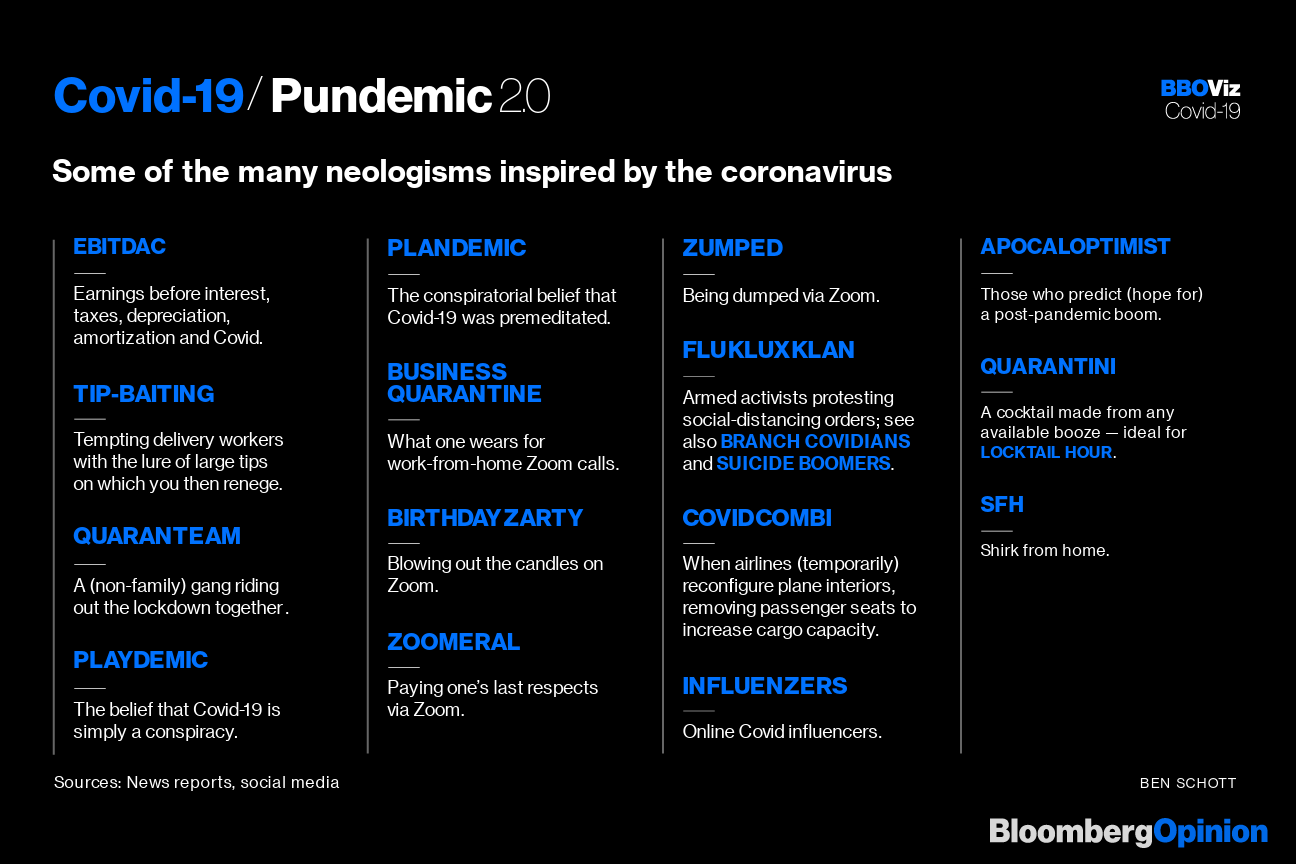

| This is Bloomberg Opinion Today, a failing petro-state of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  Fog of war. Photographer: ROBYN BECK/AFP/Getty Images Energy in the Time of Coronavirus It's pretty tough for the average humanoid to get too worked up about oil prices collapsing. Oh no, gas will be cheap, and oil companies and brutal dictatorships will go broke? How do we stop it, asked no one ever. But what's happening in the oil market today could affect the planet for generations. For one thing, those aforementioned dictatorships and other, less-brutal petro-states could turn into failed states, warns Meghan O'Sullivan, in one of three features today on energy's future. Preventing that, and helping the rest of the world navigate the post-Covid-19 energy wasteland, could be a big opportunity for the U.S. to regain the global leadership role it recently abandoned. Closer to home, the U.S. also has a chance to craft a coherent energy policy, writes Liam Denning. This would involve something other than repeatedly yelling "ENERGY DOMINANCE" while bailing out redundant frackers and slashing fuel-efficiency standards, also known as the Trump administration plan. A better policy would involve electrifying our infrastructure, a big job that will put lots of unemployed voters back to work, hint hint. You might think a Coronavirus Depression would be bad news for clean energy, as we all get back to burning fuel and rebuilding economies, particularly developing ones. But the trend toward cleaner energy can't be stopped, writes Nathaniel Bullard, considering its low cost and other advantages. And did we mention it could employ a lot of people?  Further Energy Reading: The pain of negative oil prices will linger for frackers for years. — Liam Denning Good News or Magical Thinking? A surprising amount of coronavirus news was not terrible today. Gilead Sciences Inc. reported decent clinical-trial results for its drug remdesivir, even getting a thumbs-up from Anthony Fauci. It's no cure; patients recovered four days faster than those with a placebo. But we'll take anything at this point. The Trump administration, meanwhile, is also reportedly launching what it calls "Operation Warp Speed" to pool the brainpower of drugmakers, the government and the military to somehow chop many months from the normally lengthy process of developing a vaccine. Whoa, if true. But it could also be so much magical thinking. There's a reason vaccines take a long time to develop, test and manufacture safely, as Max Nisen has written: You can't just go willy-nilly sticking bits of virus in everybody's arm unless you're sure it won't make them sick. Another risk of moving too quickly is that we waste time chasing easy solutions that would be better spent on more-careful research, warns Lionel Laurent. We saw it with the hype around President Donald Trump's favorite malaria drug, hydroxychloroquine, quick-and-dirty tests of which produced disappointing results. One guy even asked for "Trump's drug" instead of the Gilead drug. Hype can be hazardous to your health. Further Coronavirus Reading: Fed Superheroes Are People Too "It's the End of the World as We Know It (And I Feel Fine)" is the R.E.M. song on everybody's lips these days, but around the Federal Reserve's offices they should be singing "Superman." Those guys can do anything. Well, almost: Corporate bond prices have gone nowhere after soaring on news of Fed credit programs, writes Brian Chappatta. The mere idea of Fed intervention may be more powerful than the actual intervention. The Fed also lacks a cure for the coronavirus. Without significant progress against Covid-19, credit's rally is tenuous anyway, writes Marcus Ashworth. The same can be said for the stock market, which has benefited from both Fed largesse and a surge of hopium about the pandemic, writes John Authers. Stock traders are possibly being too optimistic, which has never happened before. Meanwhile, the Fed's Main Street lending facilities are meant to leverage its superheroic balance sheet to get loans to small and medium businesses. But Bill Dudley warns avoiding a ton of bad debts while distributing the money fairly won't be easy. Telltale Charts It's a new, Covid-19 world, and it already has its own language, writes Ben Schott. Now enjoy a quarantini with your quaranteam, but not before changing out of your business quarantine.  Further Reading Trump just keeps sucking up to Putin, over the objections of the rest of his administration. — Eli Lake Mitch McConnell has a point about the feds not bailing out mismanaged state pension funds. — Ramesh Ponnuru Trump and coronavirus will bring immigration nearly to a halt, hurting the economy in the long run. — Noah Smith Both Boeing and General Electric were in turnarounds before this disaster hit, but GE was further along, and it shows. — Brooke Sutherland Post-lockdown tourism will involve shorter trips to safer places. — Tyler Cowen The biblical plagues of coronavirus, locust swarms and floods threaten food shortages in East Africa. — Bobby Ghosh ICYMI It's official: The U.S. is in a recession. The NIH launched a "Shark Tank"-like contest to ramp up coronavirus testing. Elon Musk is now a lockdown rebel. Kickers Boston nurse's endurance, spirit stronger than her spelling. (h/t Alistair Lowe) Good writing is a business advantage. How to deal with chronic boredom. The best quarantine movies, according to directors. Note: Please send good writing and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment