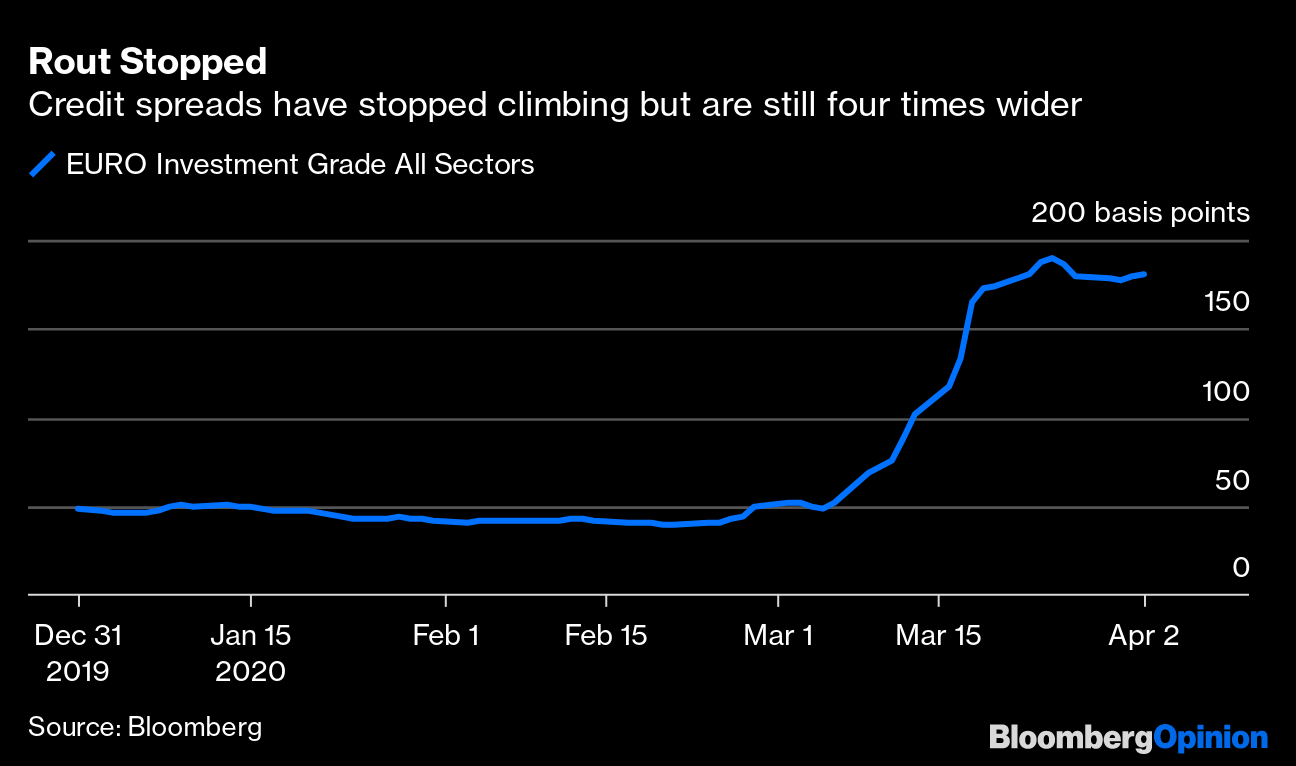

| This is Bloomberg Opinion Today, a severance package of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  Busier than ever. Photographer: JEFF KOWALSKY/AFP/Getty Images Novel Virus, Novel Crisis Need Novel Remedies The coronavirus pandemic is creating an economic crisis the likes of which nobody alive can remember, rendering the tools we used to deal with other crises in recent decades obsolete. For a particularly painful example, see today's jobless claims numbers. Just make sure you're sitting down and looking through one of those solar-eclipse viewers because, hoo buddy, is it hard on the eyes. More than 6.6 million people filed for unemployment benefits last week, doubling the previous record of 3.3 million the week before. Nearly 10 million people have lost their jobs in the past two weeks, more than were lost during the whole 2008-09 recession.  And the real numbers are probably much higher, because the system isn't designed to handle this flood. Many people will have benefits delayed or denied as a result, writes Noah Smith. What's more, those who claim they lost their jobs to the virus may get paid a lot more in unemployment benefits than their usual salaries, according to the terms of the recently passed $2 trillion relief bill. This creates problems in the workforce for essential services. Why risk your life manning a cash register when you can make more staying safely at home instead? There are better ways to help workers and businesses more directly. Congress must fix this issue somehow or risk even more economic disruption, writes Karl Smith. That may mean interrupting a three-week vacation, but we all must make sacrifices in these trying times. Even after the layoffs finally end, we need to watch how quickly hiring returns, warns Tim Duy. The longer coronavirus lockdowns last, the more likely the recovery will be slow. That was a big problem after the 2008-09 recession; we'll have to be much more creative dealing with it this time. For one thing, Congress will probably have to keep the unemployment-benefits-on-steroids pumping for a lot longer than a few months, writes Conor Sen. However imperfect they are. Further Essential-Worker Reading: Agricultural laborers are especially vulnerable, with our food supply at stake. — Francis Wilkinson Trump L'Oil If you were somehow lucky or foolish enough to be long oil this morning, you got a huge payoff when President Donald Trump tweeted words implying Russia and Saudi Arabia had agreed to slash production. Crude oil prices, hammered by a Russo-Saudi price war and global recession, soared 35%. But facts quickly overtook Trump's tweet, as sometimes happens, and we learned there was no such deal. Oil shrugged and kept rallying, but a little less. Trump's claim to broker an oil deal is just so much kabuki theater, writes Liam Denning. It behooves him to pretend he has control over the oil market, but it also behooves Moscow and Riyadh to play along. Deal or no deal, oil production is getting cut, Liam notes. That's because there's such a glut of the stuff that some producers are paying people to take it off their hands, notes Clara Ferreira Marques — meaning oil prices are already negative in some spots. All of this is terrible news for U.S. oil exploration and production companies such as Occidental Petroleum Inc. Oxy's annus horribilis actually began last year, when it overextended itself to buy Anadarko Petroleum Corp., Liam Denning notes in a second column. But never fear: Oxy's executives will continue to get huge bonuses. It's sort of the thing in the oil patch — and something to consider when we get around to bailing these companies out. Markets Not for the Fainthearted Oil's gain helped stocks rally for the first time this week, though nobody really thinks happy days will return as long as Covid-19 rules the earth. In fact, many investors are still inclined to sell everything and hunker down in nests of cash (gross!) and toilet paper until the absolute bottom, if Nir Kaissar's conversations with his money-management clients are any guide. His advice to them is the same advice he gives you: Don't. Just don't do anything. You can't time the market and shouldn't try. There are investment opportunities in credit markets, notes Marcus Ashworth. The worst might be over for high-quality borrowers, and interest rates are suddenly much more attractive than just a month ago.  But be careful: This isn't the good old days of Early March, when any company that could fog a mirror was considered a good credit. For some borrowers, the pain has just begun. Coronavirus Makes Corporate Heroes and Goats It's long been clear cash is a disgusting mode of payment. Dudes carry bills around in damp wallets next to their sweaty butt cheeks, for one thing. But paying with credit cards is possibly even grosser. Either cashiers or wait staff are handling your plastic, or you have to mash buttons on those grubby keypads a million other people have touched. Coronavirus has upgraded this from just a germpahobe thing to a life-or-death thing. That's why this is suddenly a golden age for Apple Pay, which Tae Kim notes lets you pay for stuff by merely waving your phone around, without touching filthy cash or credit cards. At the opposite end of the coronavirus-winner spectrum is Airbnb Inc., suffering as global tourism collapses. Depending on how much our travel habits change, Airbnb might never fully recover, writes Lionel Laurent. On the plus side, that could make housing markets in crowded cities more fair. Similarly, fallen unicorn WeWork is in deeper trouble than ever as co-working spaces become suddenly toxic. Long-time benefactor SoftBank should protect itself and forget plans to throw $5 billion more in good money after bad, writes Tim Culpan. Further Coronavirus Corporate Reading: The U.K. shouldn't be too generous bailing out Richard Branson's Virgin Atlantic Airways Ltd. He has some cash to spare. — Chris Bryant Further Reading Apple's letting Amazon Prime sell videos on its platforms without a big commission is a consumer win. — Tae Kim Unlike a decade ago, China lacks the wherewithal for an enormous stimulus. — Anjani Trivedi Eurobonds won't work unless they're modeled on U.S. Treasuries, but that involves being more like the U.S. — Andreas Kluth Trump shouldn't be too thrilled with the small bounce in his polling numbers. — Jonathan Bernstein There are many apps that can track the virus without being too intrusive. — Elaine Ou ICYMI The world hit 1 million coronavirus infections. Italy's new cases and deaths have leveled off. Google data centers guzzle water. Kickers Five incredibly boring things. (h/t Mike Smedley) Modern meteorology began 60 years ago. Lessons in taking things one day at a time, from people in recovery. The best TV characters of the century bracket is down to the elite eight. Note: Please send boring things and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment