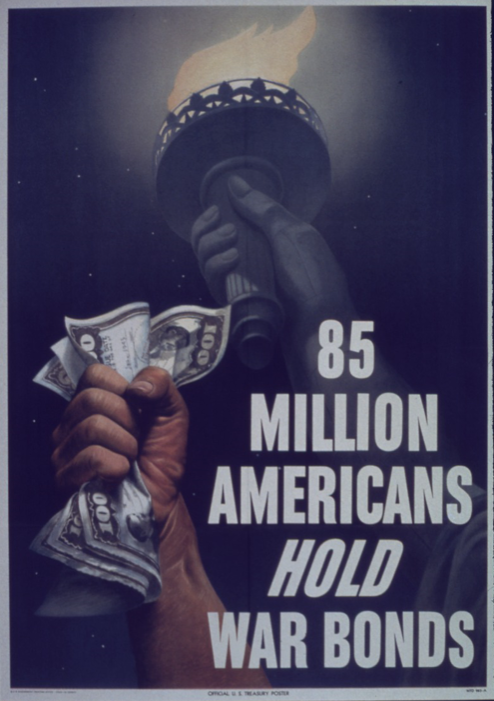

China reports no new virus cases, oil powers eye deal to slash output, and markets rally. SlowingBritish Prime Minister Boris Johnson was moved to intensive care yesterday after his condition worsened. Officials said he was receiving oxygen, but was conscious and not on a ventilator. Foreign Secretary Dominic Raab is now deputizing for Johnson. While the situation in the U.K. — and the U.S. — seems set to worsen this week, there are encouraging signs from previous centers of the outbreak. China reported no new cases of the virus for the first time since the country started publishing the number of infections in January, while some of the worst-hit countries in Europe are showing a clear slowdown. Japan declared a state of emergency in seven prefectures, including Tokyo, and the government of Prime Minister Shinzo Abe announced a stimulus package of nearly $1 trillion. Deal makingTalks between the world's largest oil producers on an unprecedented deal to slash output as the industry is devastated by the coronavirus crisis are continuing with all sides seeking numbers everyone can live with. There is a meeting between all sides scheduled for Thursday, but Saudi Arabia and Russia want the U.S. at the table, something President Donald Trump has shown little willingness to do. So far, investors remain hopeful that a deal can be reached, with oil gaining some ground in markets this morning as the ongoing talks add to hopes of a quick turnaround in the economy. Another trillionHouse Speaker Nancy Pelosi told Democrats on a private conference call that the next House stimulus package will be at least $1 trillion, with the aim to replenish funds for programs established under the last $2.2 trillion virus relief bill. She said that she wants the new stimulus to be passed this month, even though the House is not back in session until April 20. Elsewhere, European finance ministers are meeting today as they try to agree joint measures to combat what German Chancellor Angela Merkel has called the EU's biggest challenge since it was created. Markets riseYesterday's huge 7% rally into the close for the S&P 500 is setting the tone for markets today as global gauges add to gains. Overnight, the MSCI Asia Pacific Index climbed 2.4% while Japan's Topix index closed 2% higher as the government there laid out its stimulus plan. In Europe, the Stoxx 600 Index had gained 2.3% by 5:50 a.m. Eastern Time with national benchmarks rising more than 20% from their recent lows. S&P 500 futures pointed to more green at the open, the 10-year Treasury yield was at 0.744% and gold slipped. Coming up…There is unlikely to be any useful information in February JOLTS job openings numbers when they are published at 10:00 a.m. President Trump today has a meeting with small businesses at 3:00 p.m., with the White House task force briefing at 5:00 p.m. Following a Supreme Court decision yesterday, the Wisconsin primary will go ahead as originally scheduled, blocking Governor Tony Evers' last minute attempt to delay in-person voting by executive order. Levi Strauss & Co. are among the companies reporting earnings. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningYesterday on CNBC, Donald Trump's economic advisor Larry Kudlow endorsed the sales of "war bonds" to help pay for the surge in spending involved with fighting Covid-19. But not only would this be unnecessary, it would actually be harmful. War bonds (which people typically associate with U.S. during WWII) are designed to encourage savings. Why did the government want that? Because the cost of war led to a massive surge in private-sector income, while a rise in domestic spending would have been counterproductive. As much as possible, the government needed the industrial capacity of the nation going towards munitions for the war effort. As such, any increase in spending would lead to a competition for real resources between the end-consumer and the government, which needed factories to churn out goods to fight the war. So the basic proposition with a war bond is the government appealing to patriotism to tell people: "We'll pay you to hold off on spending during the war, so that we don't run into a shortage of goods during the fight." This is the exact opposite of what we're experiencing right now. The income of the private sector is collapsing. Outside of a few niche areas, there is a tremendous amount of idle economic capacity, as the social distancing grinds activity to a halt. The last thing the government needs to do is launch some big patriotic-themed effort aimed at getting people to spend less money on goods and services. Instead of the War Bond, how about a War Box: Every week, every household gets delivered to them a box free of charge consisting of food from local restaurants, toys, and other diversions. This would encourage the public health goal (by making it easier to stay in), as well as the economic goal (by providing income to struggling businesses).  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment