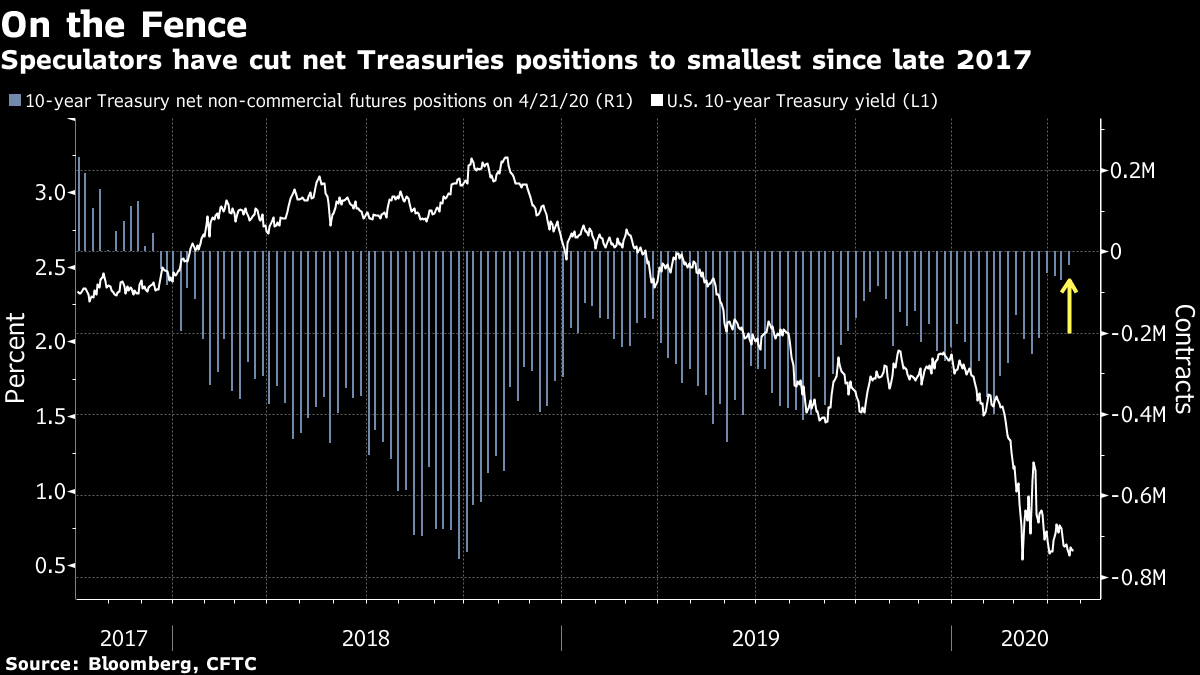

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. Europe is starting to tentatively ease lockdown restrictions, it's a big week for central banks and airline bailouts are beginning. Here's what's moving markets. Tentative Easing Some of the European nations hit hardest by Covid-19 have started to make tentative steps to reopen their economies. Spain is seeking to ease restrictions to allow outdoor exercise and walks, Italy will start to allow people limited movement and plans from France are due to be outlined on Tuesday. Germany is warning against easing lockdown measures too early, as is the U.K.. Prime Minister Boris Johnson is due to go back to work, while the country is also planning to roll out mobile testing units and has been advised by one expert to consider a South Korean model. Central Banks The U.S. Federal Reserve and the European Central Bank are due to meet this week amid ongoing pressure on policymakers to continue supporting economies and with some bond investors concerned that the U.S. is heading into a deflationary spiral. China's central bank intends to provide liquidity and ongoing support to ensure the pandemic-driven downturn is short-lived, and the Bank of Japan has pledged unlimited bond buying as it ramps up stimulus. For Europe, this would go hand-in-hand with a recovery fund from the European Union, which one commissioner said should be worth around $1.6 trillion. Rescues The shape and size of the bailout packages for European airlines is starting to become clearer as the French and Dutch governments pledged 11 billion euros for Air France-KLM and with Germany's Deutsche Lufthansa AG heading into a key week of talks regarding what is likely to be a similar-sized rescue. It's a familiar story for an airline industry battered by lockdown measures, with Richard Branson considering injecting more money into Virgin Atlantic Airways Ltd., Emirates dipping into its cash reserves and plane manufacturer Airbus SE warning it is bleeding cash and will have to cut costs quickly to cope in a shrinking global aviation market. Supply Chains The world's largest wheat shipper, Russia, has hit its self-imposed quota on grain exports two months ahead of schedule, raising the prospect that countries are shut off from Russian wheat for the first time in a decade and at a time when demand is sky-high. It marks another potential rupture in global supply chains which have already shifted into survival mode. Add to this that the Rhine river is drying out, raising the potential that industrial goods will find it tougher to make it to their destination, and the likelihood that swathes of the global oil market are going to shut down. Coming Up… Global stocks are seeing gains going into the new week, with European and U.S. futures higher on positive developments in the virus battle and after the Bank of Japan's stimulus package. European economic data is relatively thin on the ground, but note Chinese industrial profit slumped by more than a third in March. Earnings today include numbers from German sportswear giant Adidas AG and health care and chemicals conglomerate Bayer AG, while Deutsche Bank AG said its results are set to top expectations. And oil prices are are sinking again as markets weigh the glut of crude currently overshadowing the market. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning With the initial shock of the coronavirus over and the unprecedented response from the Federal Reserve well in hand, hedge funds are seemingly sitting on their hands in the Treasuries market, either unable or unwilling to make sizeable bets on the direction of yields. Speculative net short positions in the world's `risk-free' asset have shrunk to the lowest since December 2017 — just below the neutral level, according to the latest Commodity Futures Trading Commission data. Treasuries have stood out as an oasis of calm in recent weeks. The benchmark U.S. 10-year yield, which touched a record low of 0.31% and saw almost a full percentage point swing in March, has traded in a much tighter 24 basis point range in April. A recent JPMorgan institutional survey showed the majority of respondents have moved to more neutral positioning in the securities, at levels near the highest of the last two years. Meanwhile, open interest in bond futures has plummeted to the lowest since 2017, after a purge of positions in March. When it comes to the U.S. bond market, everybody seems to be sitting on the fence.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment