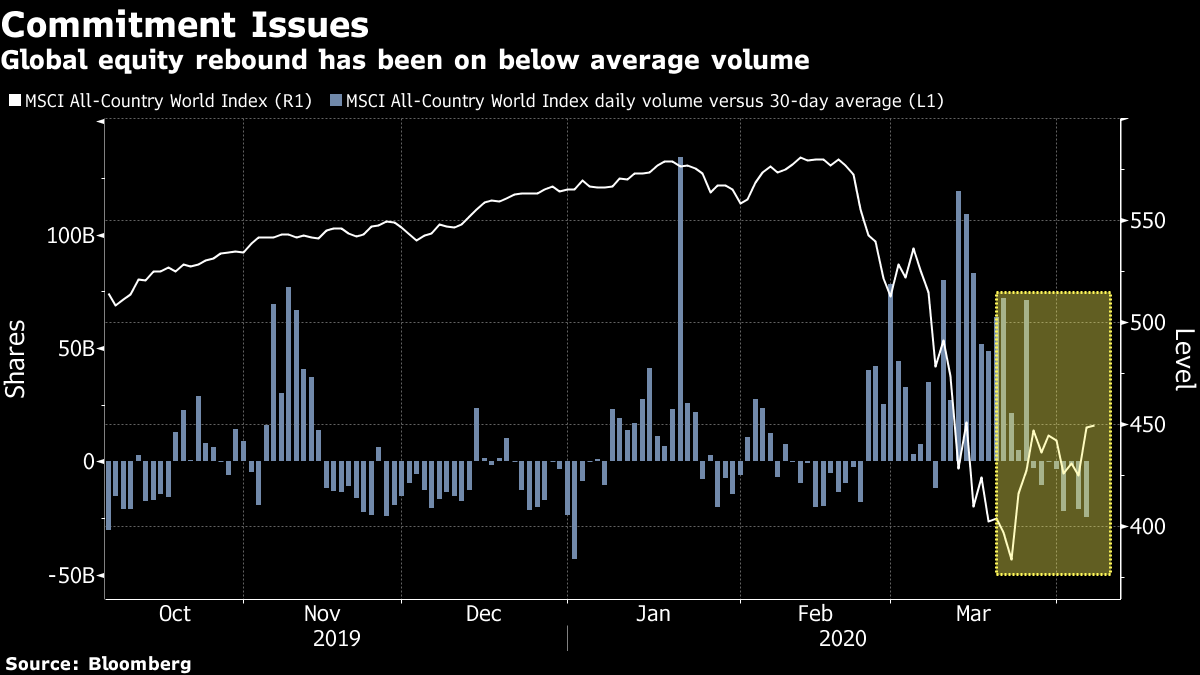

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. The U.K. Prime Minister was moved to an intensive care unit but optimism around virus infection and death rates in a number of countries spurred stocks higher. Here's what's moving markets. Johnson Moved to Intensive Care Boris Johnson was moved to an intensive care unit after his Covid-19 symptoms worsened on Monday. The 55-year-old U.K. prime minister was receiving oxygen, but was conscious and not on a ventilator, officials said last night. The pound slipped but has since recovered most of the decline. Deputizing for Johnson is Foreign Secretary Dominic Raab, a former lawyer who has been both an ally and a rival to his boss. Was this British government built for a crisis? Exit Strategy Debate The lockdown exit strategy debate is on again after deaths in Spain fell for a fourth day and Italy reported the lowest number of new coronavirus infections in nearly three weeks. Denmark has joined Austria in announcing a gradual relaxation of the measures it imposed. But such optimism may well be premature: German Chancellor Angela Merkel said it's too early for her country to set a date for easing restrictions. Here's the latest as China reports no new deaths and infection rates slow in several European hotspots. U.S. Shares Jump Stocks surged the most in almost two weeks on optimism around infection rates in America and abroad, with the benchmark S&P 500 Index surging late in the trading session to close up 7%. That was the highest closing level since March 13. Also of note for investors, House Speaker Nancy Pelosi said on a private conference call that congress's next stimulus bill could amount to at least another $1 trillion, according to a report. European equity futures are showing just minimal gains after Monday's rally. Oil Talks Progress The world's largest oil producers are pressing ahead with discussions on a deal to mitigate the devastating impact of the virus. Ministers and diplomats will spend the next two days talking about who's willing to cut production, and by how much. The most important contributions will come from Saudi Arabia, Russia and the U.S., after a turbulent past week in which Trump's prediction of a historic output cut was followed by sniping between Moscow and Riyadh. But despite signs of progress, here's why Russia is hoarding cash. Coming Up… German industrial production is expected to have dropped in March, and follows similarly weak factory orders statistics from Monday. European Union finance minsters are due to hold a conference call on their pandemic response. Here's what could be discussed. In foreign exchange markets, keep an eye on the Australian dollar which is edging higher after the country's central bank suggested its measures could be tapered if conditions improve. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning Investors aren't buying the global equity rebound, at least not with any great enthusiasm, based on recent trading volumes. Monday saw the MSCI AC World Index post its fifth consecutive session of volumes below the 30-day average, according to data compiled by Bloomberg. And even though volumes climbed during the S&P 500's 7% surge, they too remained below average. The global equity benchmark has rallied about 17% since its late-March low amid signs that the coronavirus crisis may be easing in some areas, unprecedented stimulus from policy makers and what bulls see as attractive valuations. Still, bears continue to fret about dismal economic data and the rising corporate costs of the pandemic and subsequent shutdown. The jury remains out on whether the bottom has been reached in the global stock sell-off, but the below-average volumes suggest a continued reluctance to believe that is the case.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment