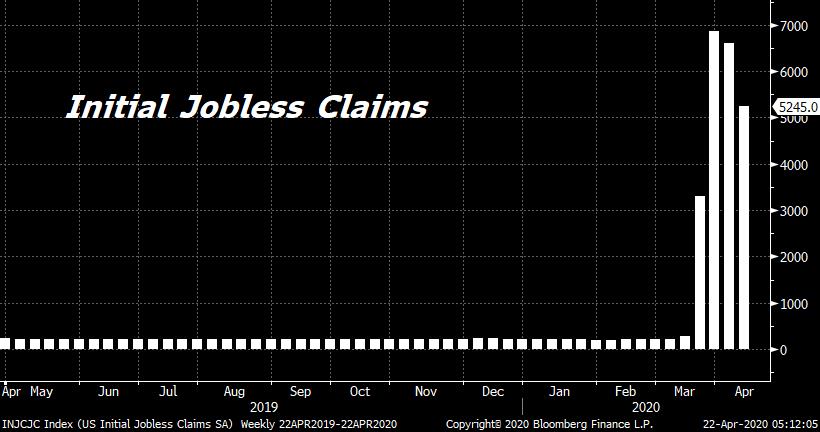

No respite for oil, Trump's immigration measure sows uncertainty, and human vaccine trials to begin in Europe. Down againBrent crude, the international oil benchmark, dropped to a 21-year low in London trading this morning with the June contract briefly trading under $16 a barrel. West Texas Intermediate for June delivery was priced close to $10. The price collapse risks pushing the U.S. shale industry into complete shutdown as producers confront vanishing demand. The immediate problem facing oil companies globally continues to be the lack of storage, with one analyst even warning that prices as low as negative $100 per barrel are possible. A little, maybe moreDonald Trump's immigration ban is turning out to be less severe than his original tweet suggested, with the president announcing that he would halt the issuance of new green cards for two months, but allow temporary workers to enter the country. However, he also hinted that he was considering a second more restrictive order, comments which may reduce willingness to hire foreign workers. The president said he supports the $484 billion stimulus package which was passed by the Senate yesterday which the House is expected to vote on tomorrow. Virus fightOutside the U.S. there was mixed news on the recovery from the coronavirus outbreak. Singapore, once seen as a benchmark for fighting the spread of the virus, saw another jump in cases pushing the total there past 10,000. Italy is set to double the size of its emergency stimulus package while the European Central Bank is set to decide later on whether to ease its rules to further help lenders. Clinical trials of vaccines are getting underway in Germany and the U.K. as deaths in Europe have already topped 100,000. Markets riseWhile the background music has changed little since yesterday, a not-as-disastrous-as-expected earnings season is giving global equities a lift today. Overnight the MSCI Asia Pacific Index added 0.3% while Japan's Topix index closed 0.6% lower with exporters the biggest drag on the gauge. In Europe, the Stoxx 600 Index was 1.4% higher at 5:50 a.m. Eastern Time as positive earnings from tech companies in the region helped boost sentiment. S&P 500 futures pointed to a gain at the open, the 10-year Treasury yield was at 0.588% and gold was back over $1,700 an ounce. Coming up…Once again it is a quiet day on the economic data front. Investors will be interested in earnings from Delta Airlines Inc. and Las Vegas Sands Corp. to gauge the fallout from the shutdown. AT&T Inc., Biogen Inc. and CSX Corp. are among the many others reporting today. For lovers of Fed policy, New York Fed Executive Vice President Daleep Singh will discuss the bank's reaction to the pandemic in a webinar. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningSomething people should understand about the current U.S. economic crisis is that it is in large part a policy choice. People joining food lines all around the country is the result of a policy choice not to supply laid off workers with more income, or easy enough access to income from the government. The spiraling number of small businesses closing up shop is the result of a policy choice to cap the level of payroll support, turning the program into a de facto lottery. The wave of state and local austerity we're already seeing (Los Angeles is the latest) is due to a policy choice, not to include ample money for municipal funding in any of the emergency spending bills that we've seen so far. Of course, the social distancing demands create an exceptionally difficult and disruptive situation for everyone, but the attendant level of economic devastation that this has caused was a choice. The federal government isn't anywhere close to exhausting its fiscal capabilities to supply the private, state and local sectors with replacement income for the duration of the public health emergency. The reasons behind these choices are different and complex. However the economist JW Mason nailed one aspect of it in a blog post, writing: "It seems like one of the deepest lessons of the crisis is that a system organized around the threat of withholding people's subsistence will deeply resist measures to guarantee it, even when particular circumstances make that necessary for the survival of the system itself." Tomorrow another 4.5 million initial jobless claims are expected to be reported.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment