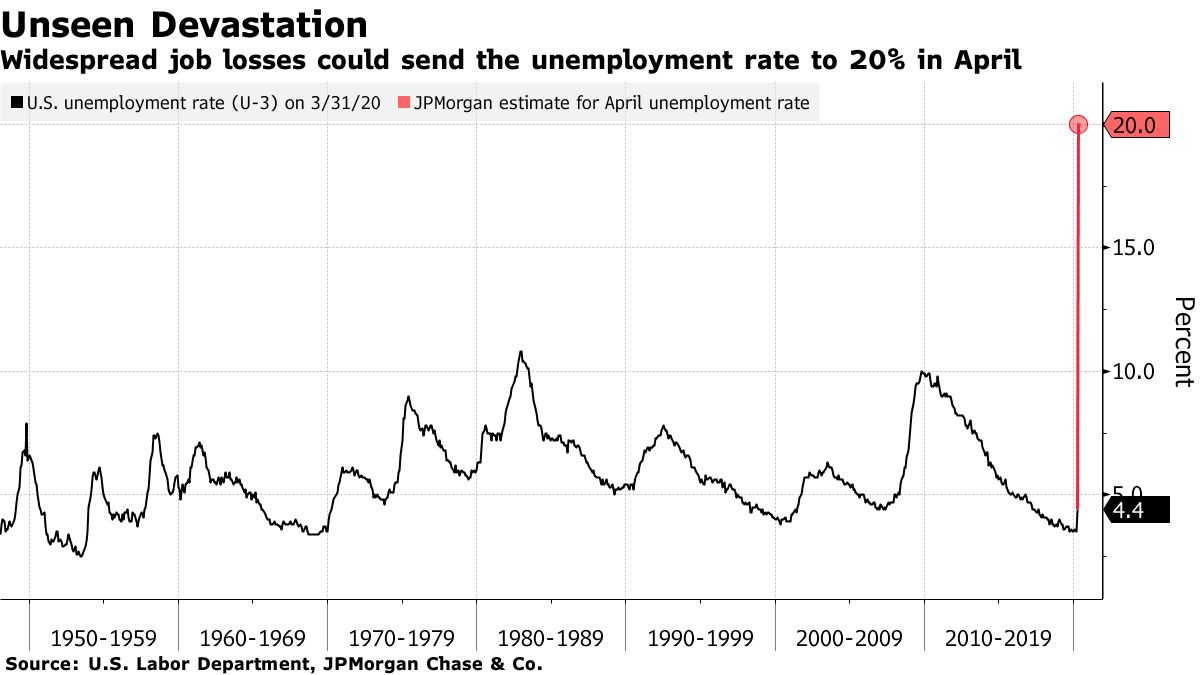

Trump halts payments to WHO, Goldman earnings due, and IEA warns the world may run out of places to store oil. Who pays?President Donald Trump has decided to temporarily halt America's funding for the World Health Organization, accusing the body of failing to share information on the pandemic and taking China's claims about coronavirus "at face value." The move has attracted widespread criticism from health experts, and from China where a foreign ministry spokesman restated his country's support for the organization. Trump's decision comes as the U.S. is now firmly the center of the global outbreak, with more evidence transmission is ebbing in Europe. Bank reportsWall Street earnings season continues today with Goldman Sachs Group Inc., Bank of America Corp, and Citigroup Inc. all due to report before the bell this morning. Yesterday's numbers from JPMorgan Chase & Co. showed profits plunged 69% to the lowest level in more than six years, with the bank setting aside the biggest provision for loan losses in at least a decade. The provisions in today's reports will be watched closely, while investors will harbour hopes of a JPMorgan-style jump in trading revenues. Demand shockThe International Energy Agency said in its latest report on the oil market this morning that the world risks running out of places to store crude as it predicts global demand to fall by 9% this year. The report warned that the logistics of the industry could be overwhelmed "in the coming weeks." Despite the agreement from OPEC and its allies to reduce production by almost 10 million barrels per day, the outlook from the IEA was enough to put further pressure on oil with a barrel of West Texas Intermediate for May delivery trading firmly below $20 in the wake of the release. Markets dropThe drop in oil prices is helping push equity markets further into the red this morning. Overnight, the MSCI Asia Pacific Index slipped 0.4% while Japan's Topix index closed broadly unchanged amid speculation that the Bank of Japan would step in with more ETF purchases. In Europe, the Stoxx 600 Index was 1.8% lower at 5:50 a.m. Eastern Time with energy companies the worst performers as every sector of the gauge traded lower. S&P 500 futures pointed to a similar loss at the open, the 10-year Treasury yield was at 0.682% and gold slipped. Coming up…The median estimate by economists is for an 8% drop when retail sales for March are published at 8:30 a.m., with some predicting a number closer to minus 25%. Empire manufacturing, also due at 8:30 a.m. is expected to produce a similarly gloomy number. U.S. industrial and manufacturing data for March is at 9:15 a.m. The Bank of Canada may announce an expansion of its asset purchases at 10:00 a.m. More news for the oil market with weekly U.S. crude inventories at 10:30 a.m. The Fed's Beige Book is at 2:00 p.m., with February TIC flows data at 4:00 p.m. IMF Managing Director Kristalina Georgieva will hold a press conference later. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningFor a long time, the dominant economic view was that if governments just maintain the stability of their currency and prices, and don't impose too many distorting regulations, then economic activity could kick in at an optimal pace. A robust jobs market would emerge. In other words, full employment was a downstream phenomenon that flowed from getting everything else right. The big question now, and after the crisis, is whether governments around the world will take the opposite approach and prioritize getting people back to work. Last week I wrote about how already there were signs of government attempts in that direction, with regards to things like direct payroll protection, or grants to companies that don't do layoffs. On our latest podcast, Tracy Alloway and I talked to Senator Marco Rubio (R-FL) who said that this budding model at the small business level could theoretically be applied to large corporations as well. The idea put simply is, just give them money to not fire workers. Last week Senator Josh Hawley (R-MO) proposed wage subsidies and bonuses for companies that rapidly rehired workers after the health crisis passes. During his presidential run, Bernie Sanders made a Federal Jobs guarantee part of his policy plank. With unemployment in the U.S. potentially hitting over 20% imminently (up from less than 4% just weeks ago), it will be worth watching to see if the popular economic dogma flips: Instead of keeping prices absolutely stable and letting workers absorb the brunt of the economic volatility, target employment directly instead and allow for volatility to manifest itself anywhere.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment