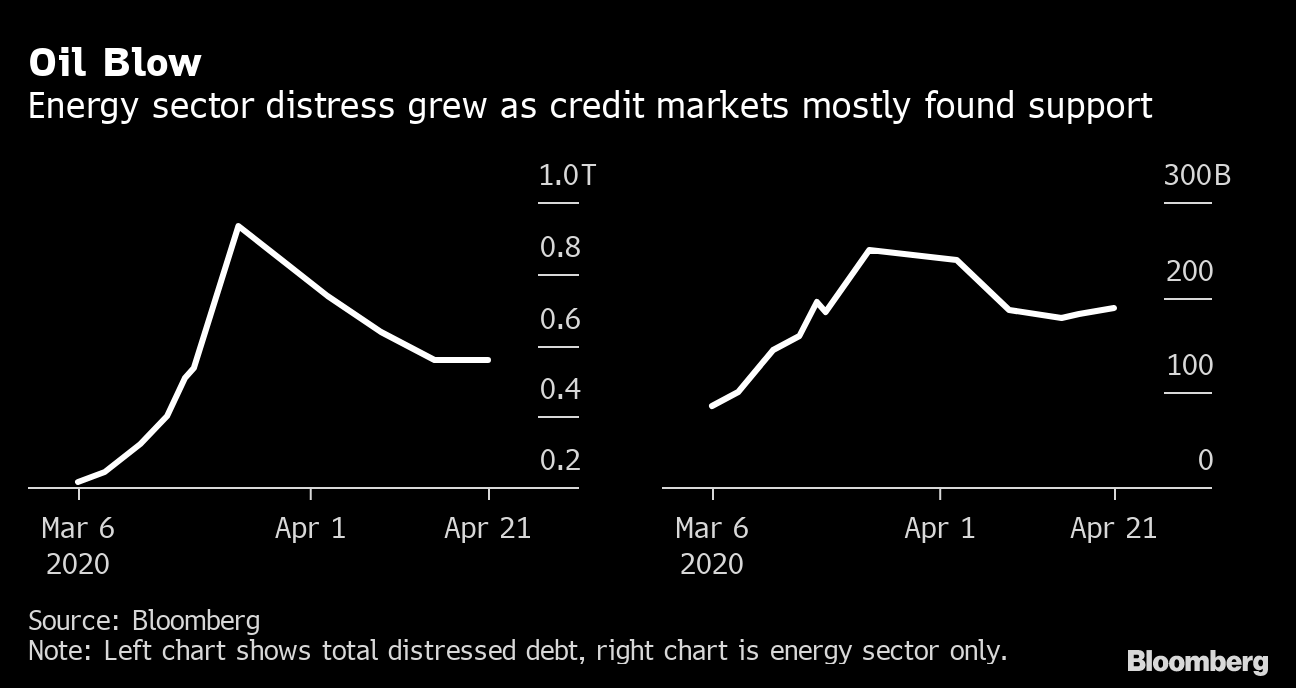

More bad economic numbers, Mnuchin remains optimistic and fears of second viral wave weigh as restrictions ease. Slowdown, stimulusAfter yesterday's dismal PMI numbers, there was more data this morning showing the fierce hit to economic activity. In Germany business confidence dropped to a record low, according to the Ifo Institute's monthly survey. U.K. retail sales suffered their biggest fall ever in March, while sales of alcohol jumped by the largest amount since the Office of National Statistics started tracking the number in 1988. Yesterday's jobless claims number suggest U.S. unemployment is already close to 20%. That's encouraging lawmakers to already start working on the next stimulus package from Washington before the ink is dry on the $484 billion package passed by the House yesterday. European leaders endorsed a short-term 540 billion-euro ($580 billion) plan to support businesses while disagreements remained over a longer-term rebuilding program. Strong reboundTreasury Secretary Steven Mnuchin says he expects the U.S. economy to start reopening in May and June, with a strong rebound in output in the third and fourth quarter. He's also considering the creation of a government lending program for U.S. oil companies that have been devastated by the collapse in crude prices. One of the options on the table is for the administration to take equity stakes in exchange for some loans, according to a person familiar with the matter. A Treasury Department statement published late yesterday said the government could accept debt instruments or other financial interests in companies that tap bailout money. Second wave?The coronavirus outbreak, while trending lower in much of Europe, is still showing worrying signs of resilience in the face of social distancing measures leading to increased worries of a second wave of infections should restrictions be lifted too early. Germany saw its largest jump in new cases and deaths in nearly a week, while Russia also reported an increase. Spain reported the lowest number of deaths in nearly five weeks. Drugmaker Gilead Sciences Inc.'s shares dropped after a summary of a Chinese trial of its Covid-19 drug appeared to show it was a failure. President Donald Trump said he disagreed with the decision by Georgia's governor to start reopening the state this week. Markets slipThe mounting evidence of the size of the global economic decline is renewing pressure on equities. Overnight the MSCI Asia Pacific Index fell 0.7% while Japan's Topix index closed 0.3% lower. In Europe, the failure of EU leaders to agree a wider stimulus package and more disappointing economic data helped push the Stoxx 600 Index 0.4% lower by 5:50 a.m. Eastern Time. S&P 500 futures also pointed to a drop at the open, the 10-year Treasury yield was at 0.607% and oil, for once, was broadly unchanged. Coming up…March durable goods orders are expected to show a plunge of 12% when the number is published at 8:30 a.m. University of Michigan sentiment for April is forecast to show another drop at 10:00 a.m. President Trump will sign the aid bill passed by Congress yesterday with drafting of the next stimulus measure getting underway as soon as today. Verizon Communications Inc. and American Express Co. are among the companies announcing results. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Luke's interested in this morningOne way to analyze U.S. credit these days is through the lens of a "gotcha" question that originated on internet forums and eventually ascended to interrogations of presidents and Supreme Court justices: Would you rather fight one horse-sized duck, or a hundred duck-sized horses? To overgeneralize, this is a way of asking if you'd rather tackle the big, scary, freakish problem or an agglomeration of smaller irritants. The Federal Reserve, known for its use of blunt tools, has slayed the horse-sized duck that is systemic credit risk with the proverbial sledgehammer: a backstop for investment grade and less-than-high-grade credits alike. Investors are still left to navigate a slew of industry-specific or micro, company-level risks. The dispersion in the junk market shows the degree to which this phenomenon has manifested itself. Michael Anderson at Citigroup Inc. puts it that the "high" in high yield comes primarily from extremely beaten-down groups that yield more than 150 basis points over the index yield -- with 40% of that universe in energy. Bargain-hunting is difficult, in other words. The high-yield market appears to have reached a point where it's difficult to buy individual credits or the asset class in its entirety, even when you cut out its most troublesome component. An example of the extreme separation in high-yield debt: negative West Texas Intermediate oil futures saw the amount of distressed energy debt jump by $11 billion earlier this week. And then Netflix's dollar-denominated bonds were issued at a 3.625% yield, among the lowest ever for U.S. junk bonds. Somehow, despite all this, the gap between ex-energy spreads and energy has actually narrowed this week. Such is the conundrum facing credit investors: although the dispersion among individual credits is immense, analysts aren't pounding the table on buying opportunities. And to make matters more exasperating, energy and ex-energy will tend to trend together. Bespoke Investment Group pointed to the correlation between HYG, the broad high-yield ETF, and HYXE, which excludes energy, as evidence of the practical difficulties in treating the asset class as a cohesive whole even when its problem child is excluded. "The fact that these two ETFs track each other so closely is evidence of why the weakness in oil markets can't be shrugged off by high-yield bond markets, equity markets, or the broader economy itself," the analysts write. "Leverage, supply chains, and other factors are all at play."  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment