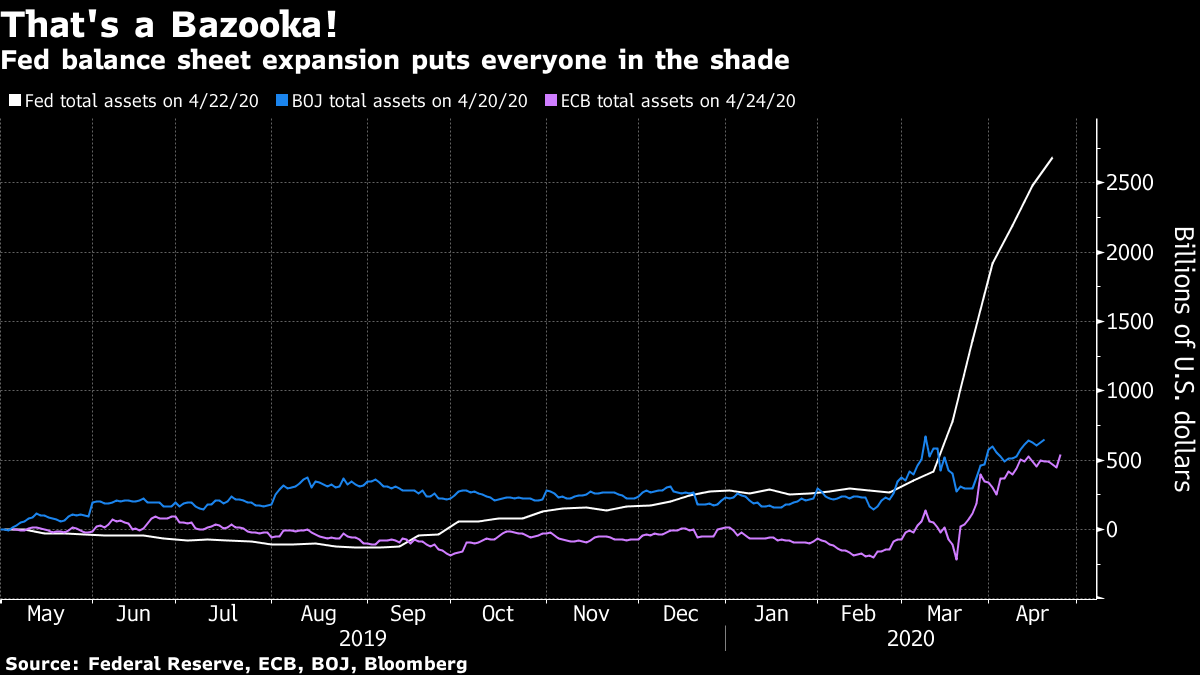

Welcome to your morning markets update, delivered every weekday before the European open. Good morning. Details of lockdown exit plans are becoming clearer, it's a huge day of global corporate earnings and U.S. GDP is in focus. Here's what's moving markets. Exit DetailsEurope took another step toward life after lockdown as France, Spain and Greece unveiled details of their exit plans. French shops will begin reopening from May 11, while most Spanish restrictions will be removed over the next eight weeks, but schools are to remain closed until September. Some Greek stores and hair salons will resume operations in May, but the all-important tourism sector faces a longer wait. The U.K. is eyeing May 7 for a formal review of its measures, but won't have the "test, trace and track" tool it needs until the middle of the month. Google, SamsungAlphabet Inc. shares surged in post-market trading after first-quarter results and upbeat executive comments showed the company's cloud and YouTube businesses kept growing in the midst of the Covid-19 pandemic. The world's largest internet company said quarterly sales came in at $33.71 billion, up 14% from a year ago and ahead of Wall Street estimates. YouTube revenue jumped 33.5%. But it wasn't all positive for big tech: In Asia, Samsung Electronics Co. warned earnings may decline this quarter after the coronavirus hurt demand for its smartphones and gadgets, trimming income gained from surging server-chip orders. Stocks and Crude RiseEuropean equity futures are rising as Wednesday's gains in the Asia-Pacific region pushed stocks there up 20% from recent lows, set to join global peers in a bull market. Oil climbed after losing more than a quarter of its value over the past two days with volatility likely to continue on concern prices may drop below zero again as investors and a major fund exit the June contract. Meanwhile, Italy's sovereign bonds may get off to a rough start today after Fitch downgraded the nation's rating.U.S. GDPData are expected to show U.S. first-quarter gross domestic product declined for the first time in six years, and while the real damage from Covid-19 is expected to be seen from the second quarter onward, today's report will preview the pandemic's impact. The focus of the latest Federal Reserve policy meeting, which concludes today, will be how long the recession lasts. Even so, equity investors are likely to look beyond the downturn, according to Goldman Sachs. Coming Up…Other data scheduled include euro area economic confidence and German inflation, which are both expected to decline. And it's a massive day for earnings with lenders Barclays Plc and Deutsche Bank AG updating after Standard Chartered Plc put aside $956 million against potential losses earlier. Look out for big names including AstraZeneca Plc and liquor firm Remy Cointreau SA. Planemaking giant Airbus SE says it burned through 8 billion euros ($8.7 billion) of cash in the first quarter, while IAG SA will slash the work force at its flagship British Airways by almost 30%. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Garfield Reynolds is interested in this morningU.S. equities are up more than 10% in April, on course to surpass October 2011 as the best month in almost 30 years. And they are putting major peers to shame -- the MSCI gauges for Europe and Asia are up by "merely" 6% or so. That's despite the U.S. becoming the epicenter of Covid-19. A key driver here is probably the Federal Reserve. Not only did it cut interest rates 150 basis points -- the ECB and BOJ could go no lower and other major peers had much less space to lower benchmarks. The Fed also blew everyone away with the scope of its QE and other balance-sheet expanding stimulus. That helps explain some of U.S. equities' exceptionalism, but it raises concerns about sustainability. Especially as financial conditions retightened this week to levels only previously seen in 2008.  Garfield Reynolds is a Markets Live reporter and editor for Bloomberg News in Sydney. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment