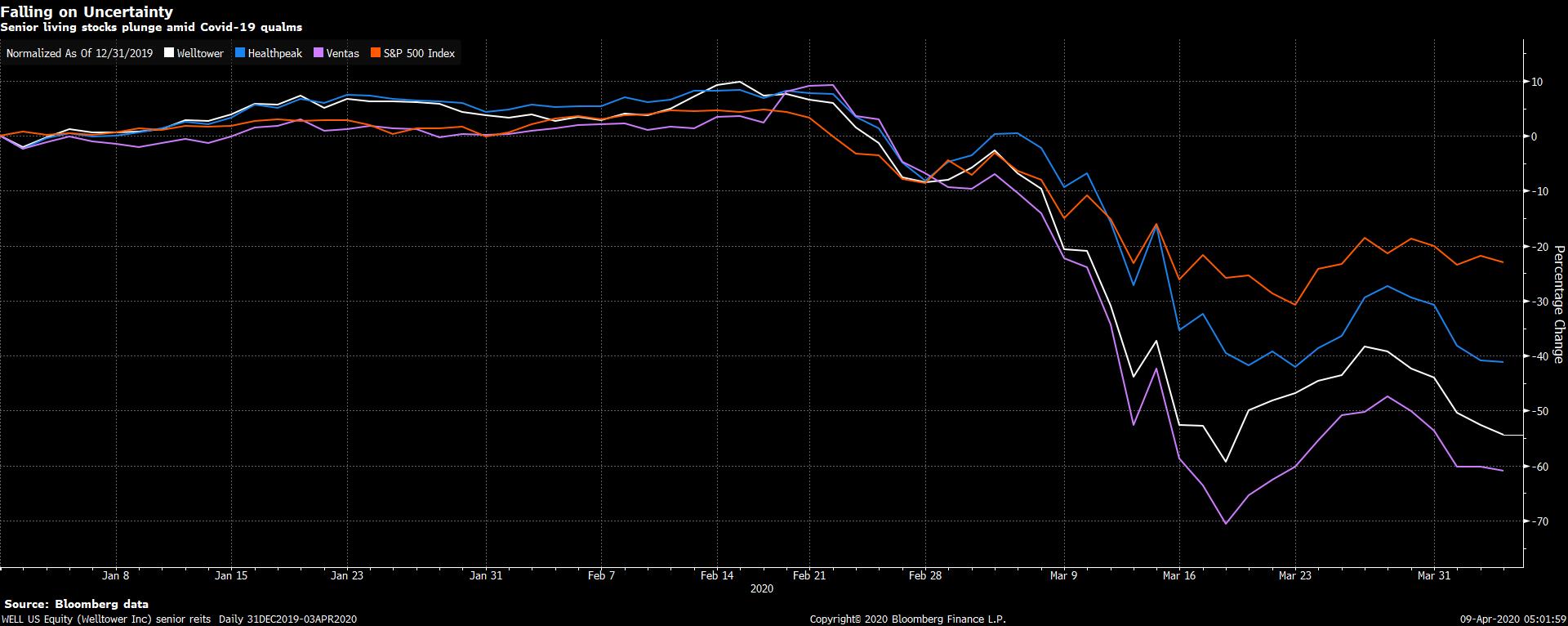

Another mammoth jobless number expected, oil producers meet to agree on cuts, and Powell due to speak. ClaimsWeekly jobless numbers, fast becoming the closest-watched economic data point of the coronavirus crisis, are expected to post another multi-million number when the data is published at 8:30 a.m. Eastern Time. The median estimate from economists surveyed by Bloomberg is for 5.5 million new claims which, on top of the combined 9.96 million from the previous two reports, clearly shows the breakneck speed of the economic slowdown in the U.S. due to the shutdown. OPEC++ meetingThe world's largest oil producers may thrash out a deal today on cutting output in the face of a huge collapse in the price of crude as global demand evaporates. Russia yesterday said it is willing to reduce production by 1.6 million barrels per day, a breakthrough that saw oil futures in New York jump 6.2%. A few problems remain, however, as the U.S. is not going to be joining talks today despite calls for President Donald Trump to commit to American production cuts too. More importantly for the price of oil is the growing market view that the proposed 10 million barrels-per-day reduction simply will not be enough to keep prices supported. Monetary pushFederal Reserve Chairman Jerome Powell will speak at a webinar hosted by the Brookings Institution at 10:00 a.m. where he is likely to expand on the bank's reactions to the coronavirus shutdown which has seen its policies move into unusual parts of financial markets. Minutes of the Fed's Mar. 15 meeting showed that policy makers at that point saw downside risks to the economy warranting a "forceful" response. In Europe, ECB President Christine Lagarde once again called for strong fiscal measures from euro-area governments as finance ministers are set to meet again today to try to come to agreement after the most recent attempt ended in failure. Markets mixedYesterday's climb back into bull market territory on the S&P 500 has not led to a gush of exuberance across global markets. Overnight, the MSCI Asia Pacific Index added 0.7% while Japan's Topix index closed 0.6% lower as the virus outbreak there continued to worsen. In Europe, the Stoxx 600 Index was unchanged at 5:50 a.m. as investors possibly were unwilling to take on too much risk ahead of the four-day Easter weekend. S&P 500 futures pointed to a slightly lower open, the 10-year yield was at 0.743% and gold was higher. Coming up…As well as jobless claims at 8:30 a.m., we also get March PPI numbers for the U.S. and Canadian payrolls. The latest University of Michigan consumer sentiment number is expected to be a stinker when it is released at 10:00 a.m. The latest WASDE report is published by the U.S. Department of Agriculture at 12:00 p.m., with the Baker Hughes rig count at 1:00 p.m. expected to show another decline in activity. San Francisco Fed President Mary Daly speaks later, and the Senate may vote on an aid package for small businesses. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningIt was still less than a month ago (March 11) when the NBA canceled its season. Historians will probably pinpoint that day as the day everything seemed to change in the US. In addition to the cratering market and economic devastation, one thing that's been striking is the degree, certain "can't lose" trends have seemingly gone into complete reverse. For example, people have been talking about how much people prize experiences vs. things. And yet experiences, at least in the physical sense, were the first to go: whether it's restaurants, sporting events, concerts, or as tech investor Leigh Drogen pointed out, trendy upscale in-person workout classes. There's numerous examples of this kind of extreme 180 playing out. A couple years ago, people were talking about the end of the old fashioned packaged food brands that specialized in salty, sugary snacks. So many people were supposedly switching over to fresh foods or niche, organic brands. And yet now everyone's stress eating cheaper, processed foods. Another trend that seemed like a no-brainer not too long ago was anything having to do with the aging of American society. And yet some of the biggest market losers have been companies that run senior living facilities, due to the skewed threat to the elderly posed by the virus. Some of these trends will reverse or abate as the curve bends. But it's been astonishing to see just how much a crisis can undermine so many seemingly obvious theses all at the same time.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment