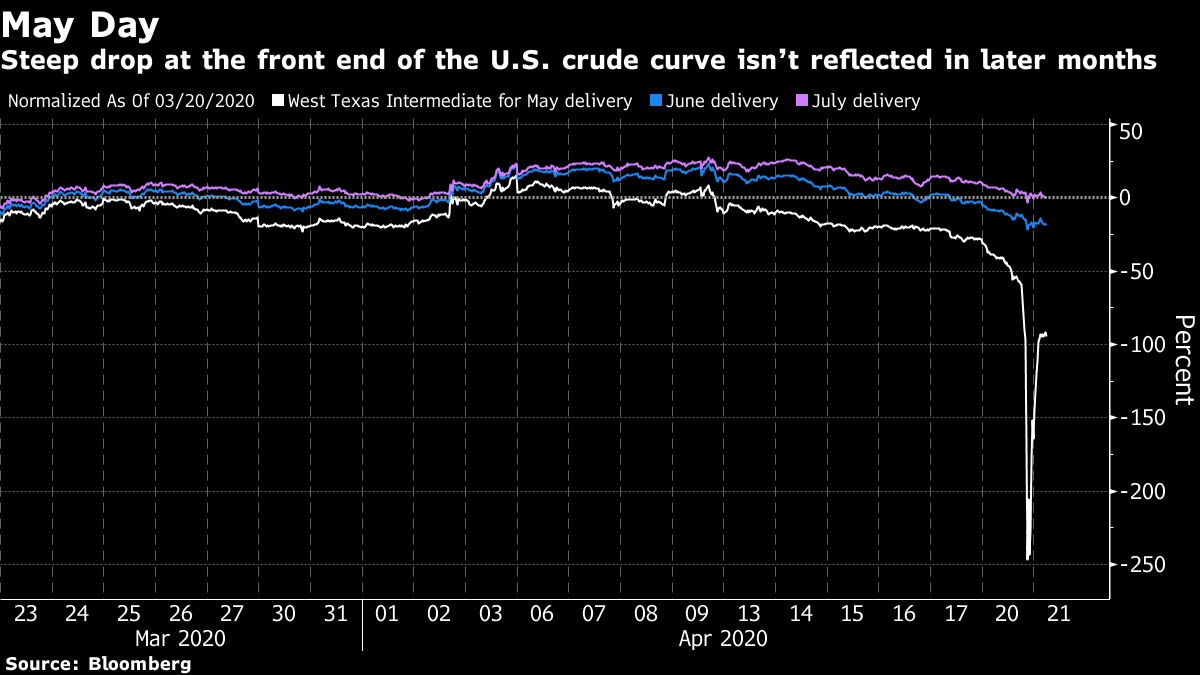

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. Oil rebounded from its wipeout, Kim Jong Un's health is in focus and Europe's earnings season is in full swing. Here's what's moving markets. Historic Oil Crash Monday was an historic day for the oil market: Crude crashed into negative territory for the first time ever, signaling the extreme disconnect between supply and demand as storage tanks brim to capacity and the coronavirus-led economic slowdown pushes demand to a standstill. Here's three charts that sum up the meltdown, and here's what negative oil really means . It's also worth noting that the May contract in focus expires today, with the sell-off representing very short-term concerns. It rebounded back into positive territory this morning while the June contract rose above $21. Kim Jong Un's Health The U.S. is seeking details about Kim Jong Un's health after receiving information that the North Korean leader was in critical condition after undergoing cardiovascular surgery last week. The Trump administration wasn't sure of Kim's current condition, according to U.S. officials, though one said the White House was told that Kim had taken a turn for the worse. South Korea's benchmark Kospi gauge fell on the news and U.S. and European futures are also lower. Virus Latest U.S. President Donald Trump tweeted that he'll sign an executive order temporarily suspending immigration into the United States in order to contain the spread of the virus, though he did not offer specifics, such as the time frame or the scope of who would be affected. Infection and death rates are continuing to improve in the U.S., as they are in Europe's hardest hit countries like Italy and the U.K. Data released on Monday showed Britain's daily recorded deaths at a two-week low. Here's a map showing the state of lockdowns on this continent. Clouded Earnings Picture Europe's first-quarter earnings season is under way, and you don't need to look far for gloom: Strategists at Goldman Sachs Group Inc. say updates are likely to to disappoint investors, even against tempered expectations. Just like in the U.S., executives here have been reluctant to give proper sales and profit forecasts under the shadow of Covid-19. Today we'll get reports from German software giant SAP SE, consumer-goods group Danone SA, Primark owner Associated British Foods Plc and London Stock Exchange Group Plc. Coming Up… The German ZEW survey is expected to show a continued hit to investor sentiment, while U.K. unemployment data for February is unlikely to yet show the devastating impact of the virus that's expected in the months ahead. British parliament returns, mostly remotely, as bad news keeps coming for the pound. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning The word unprecedented is close to being worn out from overuse this year but there is no other way to describe oil buyers being given $37.63 and a barrel of crude for their trouble, which is where May contracts closed in New York Monday. The panic over scarce storage saw traders frantically offload futures set to expire Tuesday, lest they be forced to take delivery of actual barrels with no place to put them. But while June contracts held up relatively well -- closing at $20.43 -- they now become the focal point for traders in a world where demand has collapsed yet the wells keep pumping. Then the circus will move on to July. So while risk assets came under only modest pressure from Monday's unprecedented (apologies again) oil price collapse, a repeated occurrence of the sell-off could increase the threat of contagion. While oil is likely to remain exceptionally volatile in the coming weeks, all investors will be hoping for solutions to the structural problems affecting its market, lest the panic start to spread to other asset classes.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment