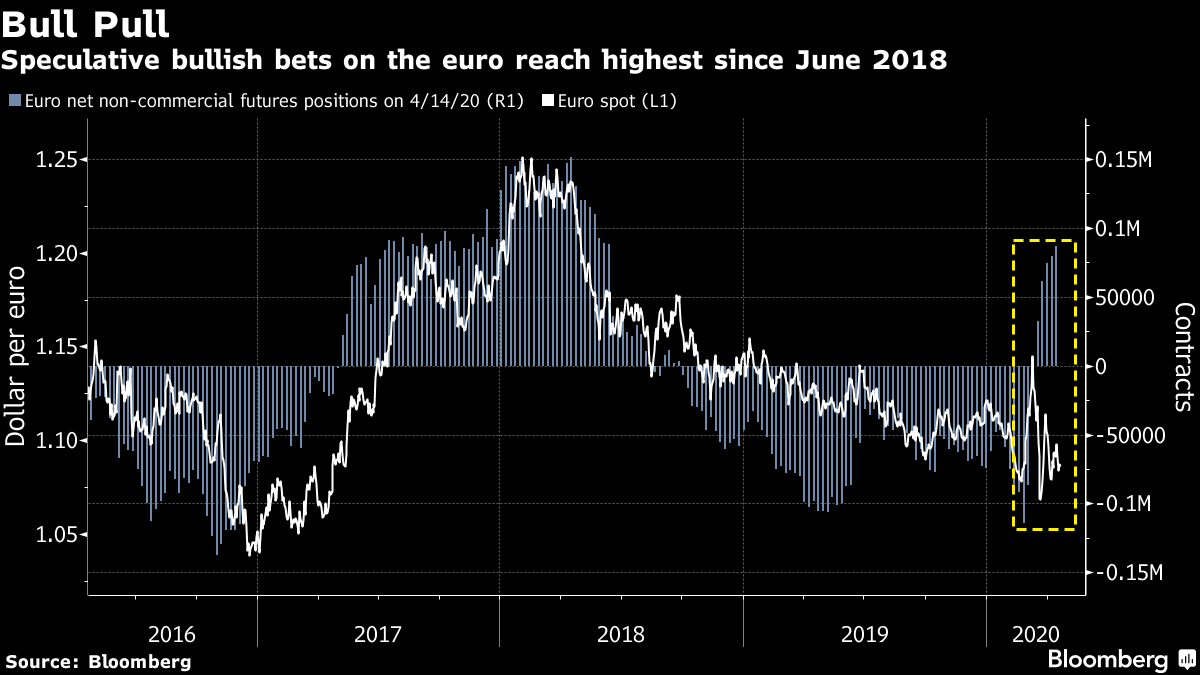

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. Oil is plunging again, lockdown exit plans are developing and there's fresh virus infection concerns in some Asian countries. Here's what's moving markets. Oil Collapse Oil is collapsing again, falling to the lowest in more than two decades, on concern the world is rapidly running out of places to store crude after output cuts proved insufficient to cope with plunging demand. Futures in New York fell as much as 21% to below $15 a barrel after also losing almost a fifth of their value last week as the deal by OPEC+ and other producers failed to counter the demand hit from a crippled global economy. In equities, European futures are higher after mixed trading in Asia. Here's five views in defense of the recent rally. Different Speeds European countries' lockdown exit strategies are developing at different speeds. Germany is allowing smaller stores to reopen and France will unveil within two weeks a plan to lift restrictions, but persistently high levels of cases in Milan are complicating Italy's plans to restart the country's economy and Spain's measures could be extended well into May. Sweden says its controversial approach — with schools and restaurants left open — is starting to pay off, with stabilizing cases and deaths. Asia Concerns While there are more signs that the pandemic is easing in several hot spots including New York, some Asian countries are wrestling with worsening conditions. Singapore detected hundreds more victims among low-wage foreign workers, India recorded its largest daily spike and cases in Japan surpassed 10,000. In the U.S., President Donald Trump raised the prospect that China deliberately caused the outbreak. A World Health Organization envoy, meanwhile, cautioned that there's no guarantee a vaccine can be developed. U.K. Defense Boris Johnson's U.K. government issued a furious defense of his handling of the coronavirus crisis. After a report in the Financial Times criticizing the procurement of ventilators and a Sunday Times story which suggested Johnson failed to take the virus seriously in its early stages, the government published two separate rebuttals, one 2,900 words long and the other 2,100 words. Ministers in Britain — where 16,060 people had died by Sunday afternoon — have struggled to deliver on their own targets, with shortages of tests and protective equipment for health workers. The government has also refused to put a timeline on lifting the U.K. lockdown. Coming Up… French media group Vivendi SA and Dutch health technology giant Koninklijke Philips N.V. are on the earnings calendar. Rightmove U.K. housing data is meaningless at the moment and while today's statistics slate is clear, there's plenty ahead later in the week. The second round of EU-U.K. trade deal talks are also due to take place. What We've Been Reading This is what's caught our eye over the weekend. And finally, here's what Cormac Mullen is interested in this morning Hedge funds are ramping up their bets on the euro, even as it languishes against its major peers. Net-long speculative bets on the common currency have climbed to the highest since June 2018, according to the latest data from the Commodity Futures Trading Commission. The euro is the worst-performing Group-of-10 currency against the dollar so far this month -- down about 1.5% -- amid struggles among European nations to agree on a joint response to the coronavirus outbreak and investor concern that the pandemic could cause a renewed debt crisis. Speculative positions tend to roughly track the currency's performance suggesting that while the hedge funds aren't likely underwater yet with their bullish bets, they may be of a mind to reduce the size of their wagers if the euro continues to lag. At the same time, any recovery in the currency could embolden them to double down and increase their bets further. That means the euro will be closely watched in currency markets this week -- and either scenario could exacerbate its next move.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment