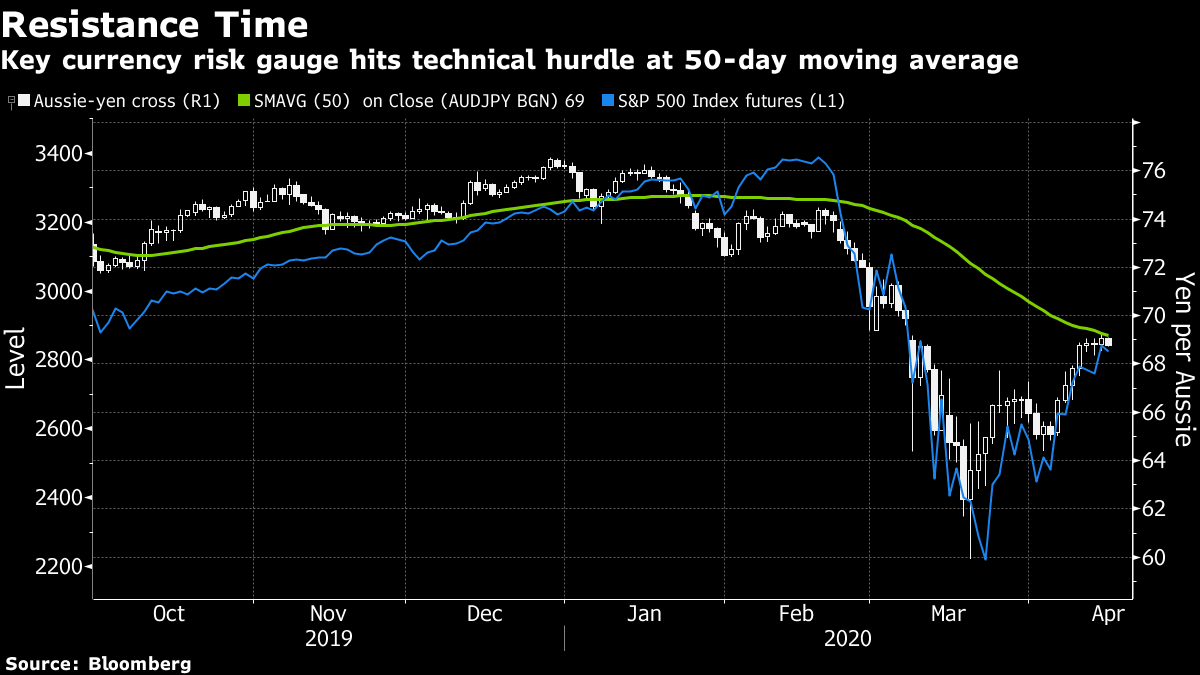

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. Donald Trump has halted payments to WHO, European leaders are drafting plans to get people back to work and earnings season continues apace. Here's what's moving markets. Payments Halted U.S. President Donald Trump has temporarily halted payments to the World Health Organization, accusing the group of failing to share information about the pandemic as it spread and claiming it could have been cut off at its source. Back home, New York Governor Andrew Cuomo attempted to de-escalate tensions with Trump, saying the president is wrong on constitutional grounds in his assertion that he has authority to decide when states go back to business-as-usual but that he won't engage on the issue. Elsewhere, New York is turning to its garment industry to make surgical gowns, New Jersey reported a record number of virus deaths and U.S. states could be facing $500 billion in deficits over the next two years due to the economic slowdown caused by the virus. Plans European leaders are sketching out plans on how to get their countries back to work, attempting to balance the need to mitigate economic damage while avoiding a resurgence in cases. France reported the highest number of new cases and deaths in four days but Italy reported the fewest new cases in a month. In the U.K., the government is set to expand testing for residents and staff in care homes following criticism for failing to protect the elderly and for under-reporting the number of deaths the virus has caused. Meanwhile, the pound could emerge as an unlikely currency winner from the turmoil. Earnings Continue The European earnings season will start warming up with chip equipment maker ASML Holding NV topping the agenda. More will come as the week progresses but the focus is likely to remain on the next volley of American banks to report. JPMorgan Chase Co. and Wells Fargo & Co. got the season started yesterday, providing a reality check for investors on just how big a hit the pandemic is going to have on profit outlooks. Goldman Sachs Group Inc., Bank of America Corp. and Citigroup Inc. will all update on Wednesday and the same themes, including how much they are setting aside for bad loans, will dominate the day. Gloom These earnings arrive against a backdrop of epic gloom. The International Monetary Fund says the recession spurred by the pandemic will be the worst for nearly a century, Europe's economy could contract by 10% in 2020, cash positions are at the highest since the 9/11 terror attacks and the worst-case scenario for the hit to U.S. jobs is becoming reality. The IMF is urging countries to ramp up fiscal stimulus when the virus abates in order to avoid the mistakes of the past, though note the U.S. stimulus oversight panel currently only has one member. Coming Up... Asian shares were mixed and European and U.S. futures are lower as the earnings season gets underway and with China pumping more liquidity into the banking system. There's inflation data on the way from France, Italy and Spain plus a bevy of numbers for the U.S., including industrial production and retail sales, though it seems that bad data currently means very little to traders. Oil prices regained some ground after slumping on Tuesday as concerns about a drop in demand outweighed the output cut agreed by producers. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning A key gauge of risk appetite in the currency market — the Australian dollar-Japanese yen cross — has risen to an important technical level, its 50-day moving average. The Aussie has rallied more than 10% against the yen since mid-March as unprecedented stimulus from the world's central banks and a slowdown in the rate of new coronavirus infections in many countries boosted risk assets. The pair has closely matched the rebound in U.S. equities since they fell to year-to-date lows last month. Investors should keep a eye on whether the cross can power through the resistance — not only because technical analysis is closely followed in the FX world — but also because currencies are one of the last `independent' financial barometers in the market right now. The government bond and corporate credit markets have essentially been nationalized by central banks, while key stock indexes in the U.S. are disproportionately affected by megacap technology companies and in some Asian countries by purchases from policy makers. Of course FX has its own influences, but the market is likely large enough to overcome these limitations, making currency moves an even more important source of risk signals in these unprecedented times.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment