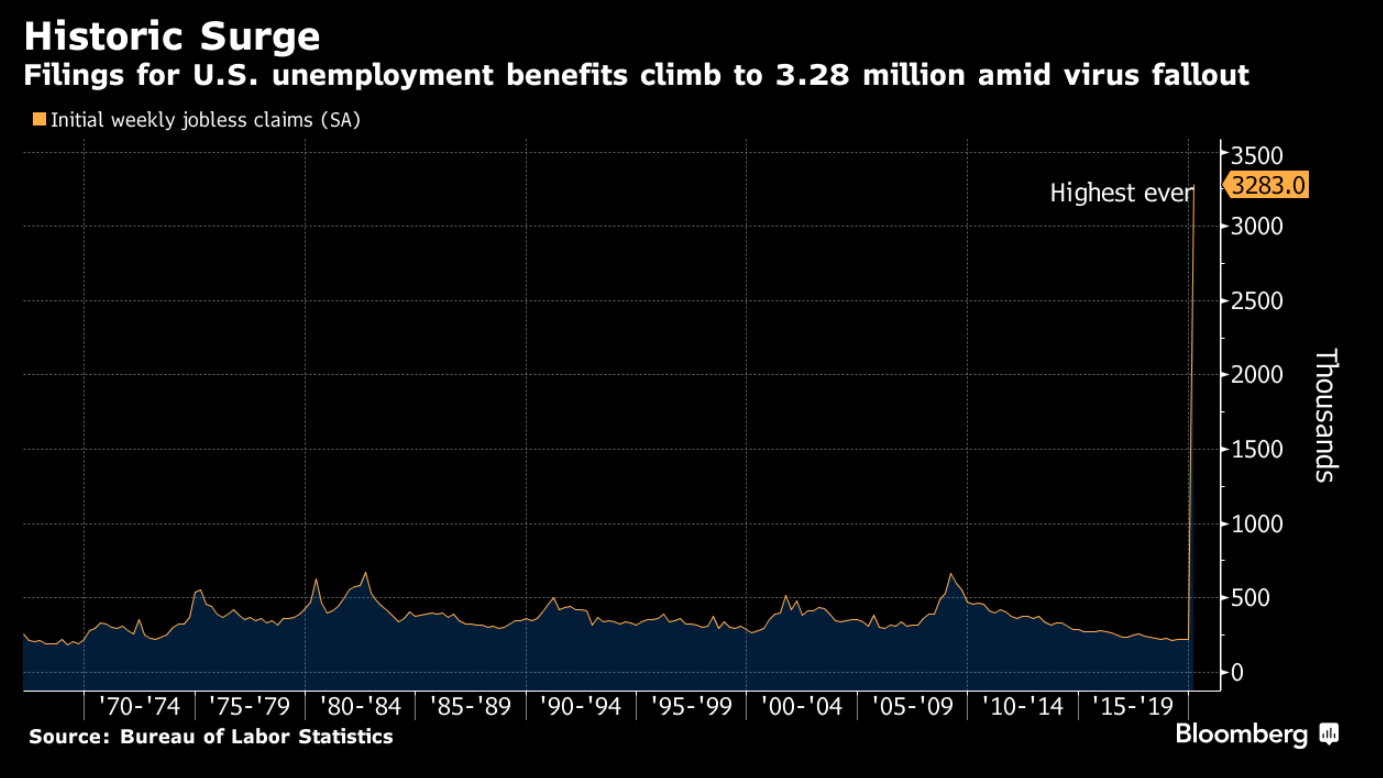

Trump warns of painful two weeks, bank shares slump on dividend halt, and Saudi Arabia moves ahead on plan to flood oil market. Reality sets inThere was a notable change in tone from President Donald Trump when he addressed the nation yesterday, warning that there was a "painful two weeks" coming as latest projections suggest as many as 240,000 Americans will die from coronavirus. Those projections hinge on social-distancing measures remaining in place, with some signs already emerging on the West Coast of their effectiveness, with California Governor Gavin Newsom saying they have given the state time to prepare for the worst. Globally, the death toll from the virus now stands at over 42,000, with 860,000 confirmed cases, according to data from Johns Hopkins University. Dividend haltBank shares are tumbling this morning after the British Prudential Regulation Authority wrote to lenders asking them to halt dividend payments. HSBC, Standard Chartered Plc, Royal Bank of Scotland Group Plc, Barclays Plc and Lloyds Banking Group Plc all cancelled outstanding payments and said there would be no dividends in 2020. Regulators in Europe are also pushing back against bonus payments to to senior staff. Limits halted Today marks the end of the agreed production limits by OPEC and its allies. Saudi Arabia has boosted output to more than 12 million barrels a day, while other major producers such as Iraq also plan increases. Russia, however does not intend to ramp up production, according to a government official. The moves come as the oil market faces something close to a wipeout in demand, meaning the next month could be a game-changer for the industry. In trading this morning, a barrel of West Texas Intermediate for May delivery held close to $20 a barrel. Markets dropThe new quarter is not starting on a hopeful note for global stocks with gauges around the world firmly in negative territory. Overnight the MSCI Asia Pacific Index dropped 2.1% while Japan's Topix closed 3.7% lower after the country's health minister said the coronavirus outbreak there is getting more severe. In Europe, the Stoxx 600 Index was down 2.5% at 5:50 a.m. Eastern Time with banks the hardest hit. S&P 500 futures pointed to more red at the open, the 10-year Treasury yield was at 0.616% and gold was recovering some ground. Coming up…With all investors taking a very keen interest in the fallout from the virus for the U.S. economy, today's ADP employment change number for March — expected to come in at minus 150,000 — at 8:15 a.m. will be closely watched. U.S. manufacturing PMI is at 9:45 a.m., with ISM manufacturing at 10:00 a.m. Already frazzled oil traders have U.S. inventories data at 10:30 a.m., while auto sales numbers are expected to show a sizable decline. Boston Fed President Eric Rosengren will hold a virtual talk on the effects of the virus at 2:00 p.m. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningOn October 19 1987, the Dow Jones Industrial Average fell 22.6%. What became known as "Black Monday" was so fast and severe, and so outside of the range of what anyone thought plausible in such short of a time, that it permanently changed how asset markets price. As the quantitative finance pioneer Emanuel Derman wrote in his memoir, from that point on there emerged the so-called "volatility smile" whereby options protecting against downside risk permanently richened relative to options designed to capture market upside. Once the awareness that such a swift crash was possible in such a short period of time, traders were awakened to the existence of new possibilities and never went back to their previous operating patterns. Everyone's grasping for analogies to what we've just seen in markets and the economy (and basic human life) over the last several weeks. If you just look at the chart of weekly initial jobless claims the surge that we got last Thursday (and which we will see repeated tomorrow) is on such a different scale than anyone thought possible. The y-axis has been extended so far that previous recessions don't even show up as blips. From that you could say we've just experienced a Black Monday, but for the real economy. This raises the question of what will be the real world corollary to the volatility smile? What type of permanent change will we see to the economic behavior, now that everyone has been awakened to the possibility of a collapse like this? We can make some educated-sounding guesses, like, we'll change supply chains so that this country never faces a shortage of basic masks again. But at this point, nobody really knows. So what does this mean for the economic recovery? On our recent podcast we spoke with Zoltan Pozsar of Credit Suisse along with the economist Perry Mehrling. Merhling likes to compare the financial system -- the complex web of future financial obligations we all enter ourselves into -- as being something akin to a bridge to the future. But as he put it in our discussion "....the last mile of that bridge has just all collapsed, and the shore that we thought we were building towards it turns out is not there. We have to build in another direction." Mehrling's bridge is metaphorical. But there's a real world corollary that I keep coming back to when thinking about the economic challenges ahead. When we talk about an 'exogenous shock' to the system, we might think about a hurricane destroying a hotel in a popular tourist area. But there's a playbook for what you do. We rebuild a new hotel, and maybe it's a nicer one, on the expectations that the tourists will eventually come back. The experience is costly, but we know the way back. Economically, this is kind of like a hurricane. But we don't yet know the economy that we want to rebuild. Yes, some of it will be the same, but because of the potential real-world corollary to the volatility smile, there are so many ambiguous questions. How much will we travel? How much will people prize living in dense urban areas? How much domestic manufacturing will we do? These are just the start. None of us know, and not only that, some of these fights will be intensely fought politically, leaving tremendous uncertainty for anyone involved with investing in and building that future.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment