| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. More signs of stabilization in Europe's virus battle, Trump proposes more big spending and what will the second quarter hold? Here's what's moving markets. Leveling Off The number of new virus cases in Italy leveled off at a two-week low, providing more evidence that the outbreak in the country is starting to come under control as it prepares to extend lockdowns. Spain reported record deaths, but also said it sees signs of stabilization. In the U.K., the government is scrambling to catch up on testing and the chancellor has removed taxes on medical equipment in a bid to get ventilators and testing kits to front-line staff more quickly. And Dutch scientists have discovered a potential early warning sign for Covid-19 in wastewater, indicating environmental testing may also prove useful. $2 Trillion U.S. President Donald Trump dusted off an early policy from his time in office, calling on Congress to approve $2 trillion for infrastructure spending in order to create jobs at a time when many workers are being laid off. The president is also set to announce a 90-day deferral of certain tariff payments by some businesses and there is a battle brewing between payments companies on which will handle the delivery of relief money due to be sent to millions of Americans. Elsewhere, social distancing is clobbering retail, hotels and restaurants, hospitals are burning through cash as they await further stimulus steps, deaths keep jumping in New York and the Federal Reserve has become the world's central bank. Deal Ends Put up against any major asset in the world, oil had a bad start to the year, and things don't look to be improving anytime soon. Crude prices suffered their biggest quarterly drop on record as Saudi Arabia and Russia engage in a price war and the virus outbreak crushes demand. On the former, Trump making a call to Russian President Vladimir Putin this week raised cautious hope that a truce could be in sight, yet Saudi Arabia is making good on its pledge to pump more in April as the OPEC+ deal on output cuts expires and Iraq is planning to follow suit. On demand, look no further than Italy and Spain for how deeply the outbreak has hit. Neatly encapsulating it, one key grade of U.S. oil is at the lowest price in the modern era and Trump is considering letting oil drillers store their glut of crude in federal facilities. New Quarter It was the worst quarter for European equities since 2002, and the question now is what's to come in the next three months and what investors will bet on. The assets that won the quarter were the safest of safe havens and a key issue to consider is whether the turmoil is over for now, for which a look at history could be helpful. The outlook doesn't offer much consolation. Economists are starting to lose conviction in a 'V-shaped' recovery, some say the U.S. is headed for its heaviest quarterly recession since records started in 1947 and Goldman Sachs thinks the slump will be much worse than anticipated. Be prepared. Coming Up… European and U.S. stock futures are pointing to another down day in markets following a mixed session in Asia. The latest data to pore over will mostly be around manufacturing, for Europe, the U.K. and later for the U.S., and it's likely to show similar levels of shock to what we've already seen amid the virus fallout. We'll also have U.S. car sales from most of the automakers, now a quarterly report, and where the March figures are likely to provide little solace. What We've Been Reading This is what's caught our eye over the past 24 hours. - E-commerce is undergoing seismic change.

- Bitcoin's March drop is the worst since the crypto bubble burst.

- The manager of the Lego family's money isn't betting on stocks.

- No divorces in Russia until June.

- Theater streamed into living rooms.

- Liquor giants are helping out bartenders.

- Radio DJs on broadcasting from home.

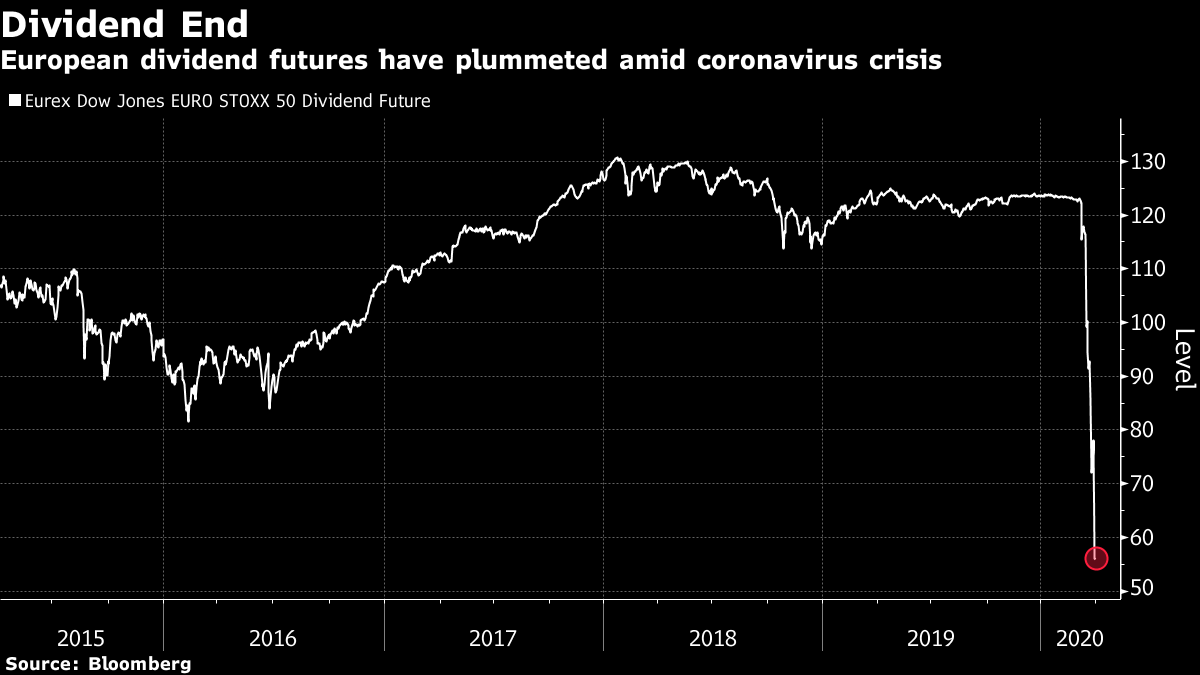

And finally, here's what Cormac Mullen is interested in this morning The dividend cull has begun in earnest. HSBC, Barclays, Glencore and WPP are among the heavyweights announcing a suspension, cancellation or deferment of interim payments this week as the corporate desire to preserve cash reigns supreme. Europe's analysts have been slow to price in a slump in payouts with the 12-month forward dividend estimate for the Euro Stoxx 50 down by just 4% this year. But derivatives traders are another matter with dividend futures on the benchmark gauge plunging about 55%. While dividends tend not to fall as much as corporate earnings, high payout ratios along with the corporate prioritization of balance sheets and employees could mean a halving of European dividends, Citigroup strategists including Robert Buckland wrote in a note this week. They fell by 30% during the financial crisis, the strategists added. The cuts are a further blow to income investors, already suffering from low bond yields — now likely capped by central bank purchase plans. They also put a dent in the recent stock bull argument that equities had risen to record relative attractiveness versus bonds based on the yield comparison. Payouts will of course resume once the crisis passes, but it could take a while before they return to past levels should companies decide to first repair battered balance sheets and pay down debt.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment