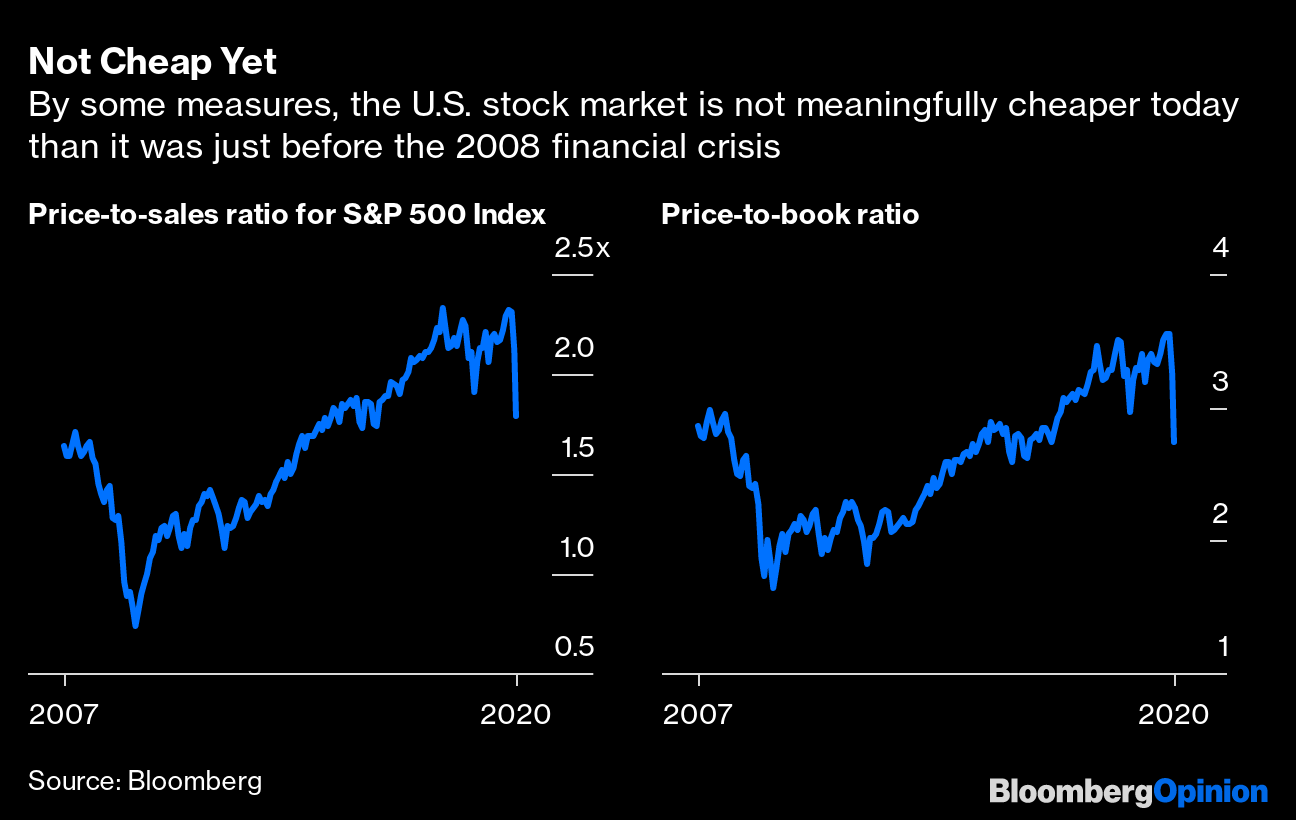

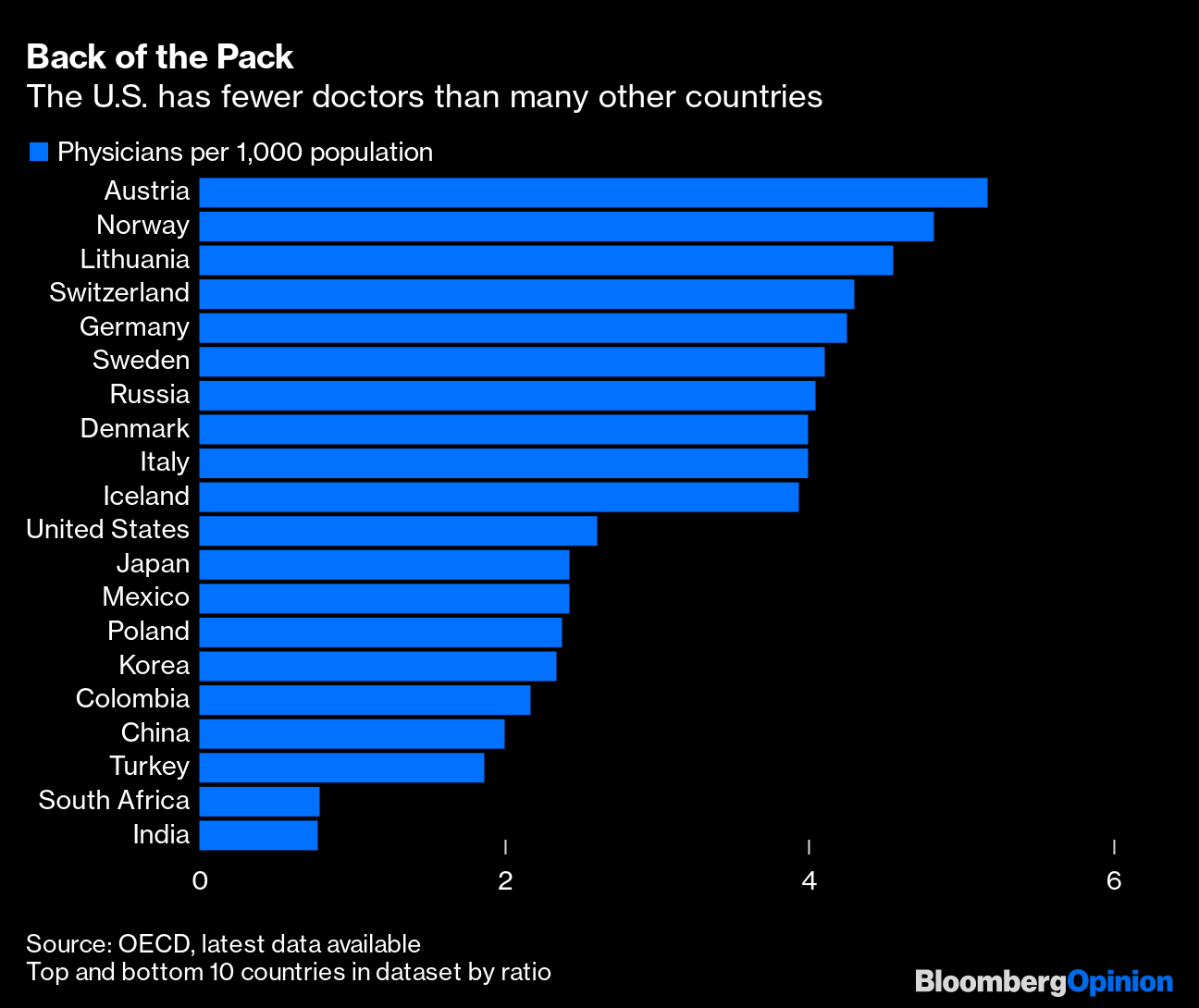

| This is Bloomberg Opinion Today, a Costco line of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  We know the feeling, dude. Photographer: Spencer Platt/Getty Images North America People Crunch Becomes Credit Crunch A couple of weeks ago, before the Working From Home Era, we compared the coronavirus's economic effect to the credit crisis, saying that stopping the flow of people would devastate economies as badly as, if not worse than, stopping the flow of credit. Now that this thesis has proved alarmingly true, it seems also to be causing one of those original credit crises, involving, you know, credit. Businesses and banks are scrambling for cash, and investors are dumping their winners to cover their losses, notes John Authers. It all has that very fall-of-2008 feel. Some of the winners being dumped may include super-safe Treasury bonds, which might help explain why their rates are jumping (bond yields and prices move in opposite directions), which isn't what you'd expect in a doomsday-prepping scenario. There are some potential benign explanations — hopes for stimulus, worries about deficits — but the market could also be pricing in deflation, writes Brian Chappatta. A different spike in interest rates, those on junk debt, is easier to explain. Investors hungry for yield and seeing only blue skies ahead had piled into high-yield bonds for years, figuring any reckoning would be far away, notes Brian Chappatta. Well, the reckoning has arrived all at once, and suddenly everybody wants to be socially distanced from junk bonds. Fortunately the Fed and other authorities are finally starting to take big, coordinated steps that could help limit the economic damage and knock-on credit effects, writes Mohamed El-Erian. These won't stop a recession, though, and we'll have to see more such creativity and cooperation in the days ahead. For one thing, as Shuli Ren notes, foreign companies are struggling to get their hands on dollars, something the Fed must address. However familiar this may feel, brace for more surprises. Further Economic Meltdown Reading: Testing > Sheltering in Place The fate of the economy still depends mainly on getting people moving again, into restaurants, offices and airplanes. That won't happen until we have better control of the coronavirus. And that feels like it could still be 18 intermittently claustrophobic months away, based on that scary Imperial College study making the rounds. One thing that could change this calculus for the better is widespread testing in the U.S., writes Faye Flam. It has been woefully inadequate so far and is ramping up only now. But Singapore has proved diligent testing can limit the spread of the disease and time spent sheltering with increasingly annoying loved ones. There are many possible explanations for why Singapore and other Asian countries have fought this virus so much better than the U.S. has, but the one common denominator seems to be that all have recent experience fighting other, scarier epidemics, writes Justin Fox. I for one will never forget to wash my hands before touching my face again. Further Pandemic-Response Reading: Coronavirus Worse Than Brexit for Europe The American response to the virus has been disappointing, but the European response has arguably been worse. Rich states have all but abandoned Italy in its time of need. National borders are being rediscovered. Stimulus efforts seem grudging at times. Coming right on the heels of Brexit, this raises doubts about the European Union's continuing relevance, writes Andreas Kluth. If its bonds are too weak to help in this crisis, then they may not be long for this world. Further European Vexation Reading: Europe tried to flex its geopolitical might in Libya. It's not going well. — Bobby Ghosh Telltale Charts The stock market may have much further to fall than you think, judging by how far its relative valuation fell in past crises, writes Nir Kaissar.  The U.S. has a shortage of doctors to go along with its shortages of test kits, protective gear and hospital beds, writes Max Nisen.  Retailers will need help from lenders and landlords to survive the wave that's swamping them now, writes Andrea Felsted.  Further Reading Joe Biden should pick a running mate who's already been vetted in a national campaign. — Jonathan Bernstein Active money managers are not exactly covering themselves in glory, driving even more investors to passive funds. — Mark Gilbert The obsolete MLP structure for pipeline companies was doomed before the coronavirus. Now it's disappearing. — Liam Denning Everybody working from home has WeWork looking fondly on the days when it was merely a laughingstock. — Matt Levine Here are some pro tips to make working from home not be so awful. — Sarah Green Carmichael ICYMI Hospital workers make masks out of office supplies. Life in Italian lockdown. Blue Apron stock is booming. Kickers Not to be outdone by Shedd Aquarium, Chicago's Field Museum lets a dinosaur walk around it. (h/t Stacey Shick) Researcher proves one of Darwin's theories. How the brain encodes landmarks that help us navigate. The 100 best movies on Netflix, and all the HBO shows, ranked. Note: Please send Blue Apron boxes and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment