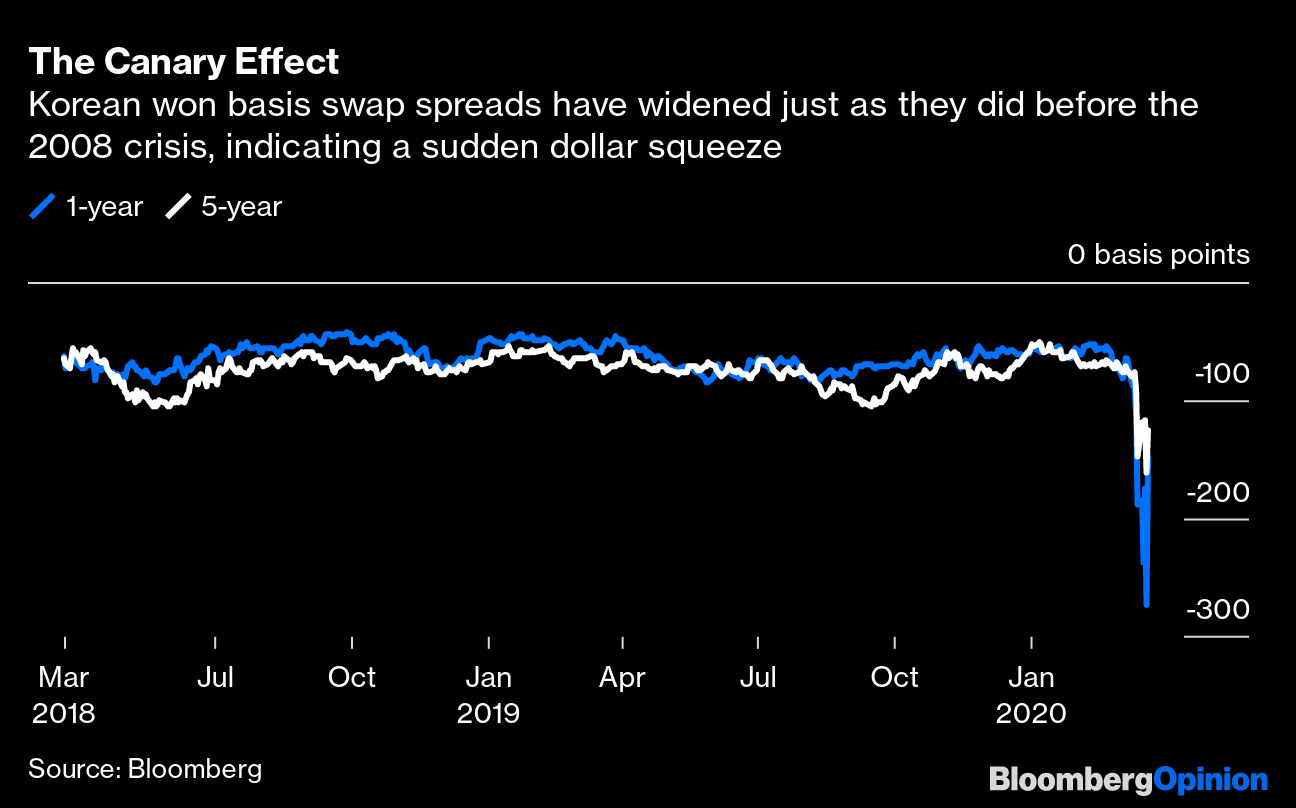

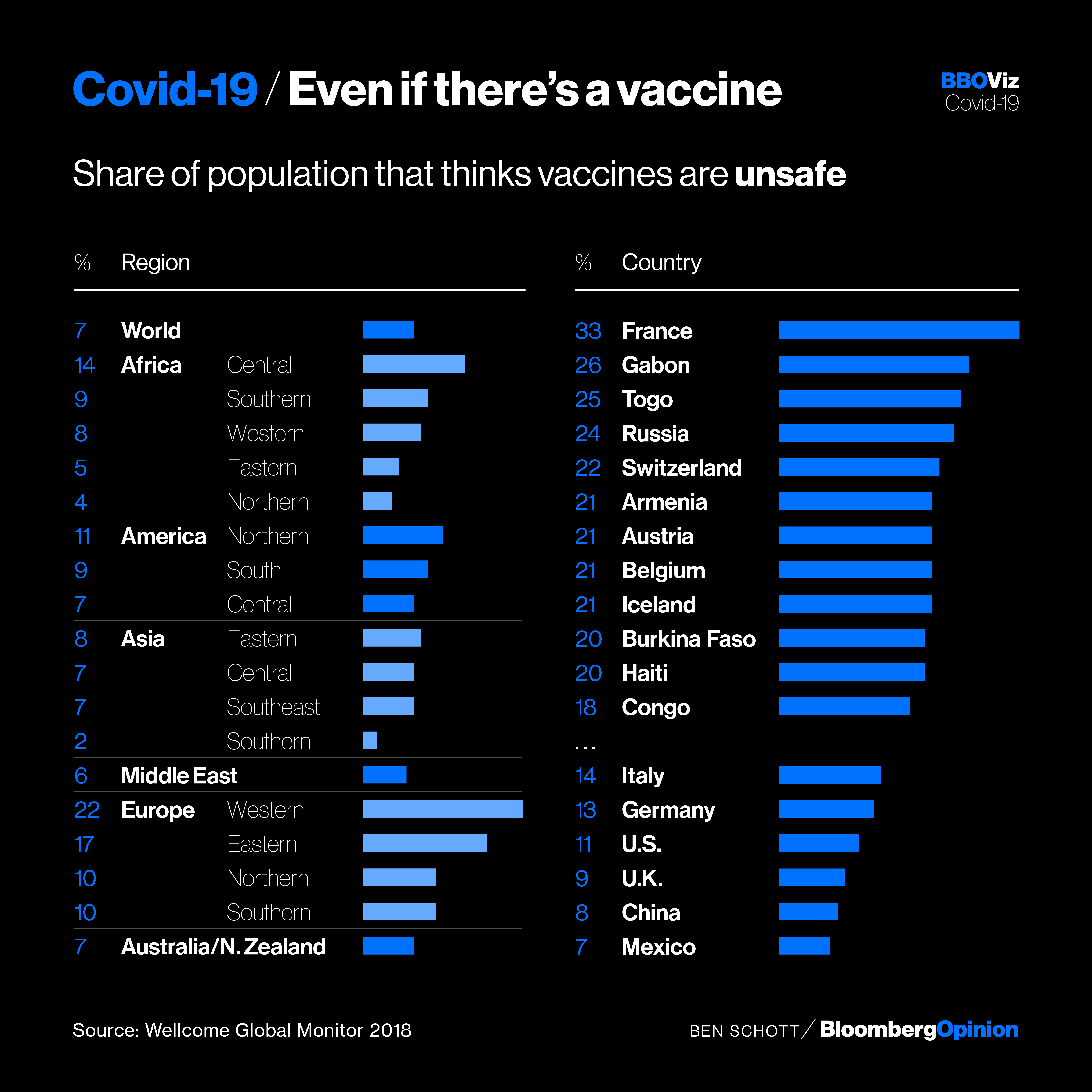

| This is Bloomberg Opinion Today, a Corporate Credit Facility of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  Keep 'em coming. Photographer: Jeff J Mitchell/Getty Images Europe Another Day, Another Enormous Economic Rescue For years after the 2008 financial crisis, we told ourselves such a thing wouldn't happen again soon because we were no longer building freaky instruments of mass financial destruction. We were just lending ungodly mountains of money to governments and businesses at rock-bottom interest rates, and when had that ever gone wrong? Oops. It has now gone wrong, all at once and spectacularly. All that credit risk we accumulated is blowing up in our faces, writes John Authers. That's why the Fed is basically launching jaw-dropping new rescue plans almost every other day now, notes Brian Chappatta. The latest is a promise of near-eternal quantitative easing, along with just flat-out lending money to corporations. That latter part feels weird, given that banks usually lend to companies, writes Matt Levine, but makes sense when you think about how companies skip banks for the bond market these days. Of course, not every company will qualify for Fed lending, which means there will be many bankruptcies and bailouts ahead, writes Mohamed El-Erian. How we deal with those could affect faith in "liberal democracies" and "the fabric of society," Mohamed warns. No pressure! To protect such things and prevent abuse, the bailouts will need a strict government watchdog, argues former TARP watchdog Neil Barofsky. Bailouts should come with strings, such as the ones we attached to the General Motors Corp. bailout, writes Barry Ritholtz. We also may need to rethink the Fed lending program, if it turns out to be simply another bailout that bypasses congressional oversight, as Narayana Kocherlakota argues is the case. Such debates are partly holding up the latest stimulus package in Congress, one reason stocks tanked again today. Unfortunately, we don't have much time to think this through, given the need for speed and creativity. We haven't even talked yet about protecting real people, who can't be asked to hunker down for months without financial relief, writes Peter Orszag. For one thing, the government should freeze the financial system for people as much as it can, writes Noah Smith, by forgiving debts it collects and by helping people make other payments. If we learned nothing else from the prior crisis, hopefully it's that we can't just rescue banks and companies. How Not to Fight a Coronavirus Beating Covid-19 will take patience. Unfortunately, President Donald Trump already seems to be losing his. After mere days of lockdowns meant to avoid swamping the health-care system and killing possibly 600,000 people, Trump is already itching to loosen such restrictions. This defies the advice of health-care experts, who according to the Upside Down logic of these times are echoed by Steve Bannon and doubted by Lloyd Blankfein. The argument for just letting coronavirus have its way is that the economic damage of extreme social distancing will be worse. This conflict is especially acute in countries with a more individualistic bent, notes Therese Raphael. The trouble is that the human costs quickly become unbearable, forcing the abandonment of lax approaches. Trump's faltering and dismissive response to the crisis arises from his own distrust of experts, writes Noah Feldman. Our system gives the executive branch power to handle a crisis, but it also expects experts to do the hard work, Noah notes. That's not possible if they have all been fired or marginalized. The president has at least started taking seriously the need to use America's corporate might to end a shortage of life-saving medical equipment, despite what Joe Nocera calls misplaced small-government ideology. True to form, he signaled his willingness confusingly, and via tweet. For a model of how such a public-private war-fighting partnership should be run, look to President Franklin D. Roosevelt's War Production Board, writes Stephen Mihm. American companies swamped the Axis in less than four years and reaped the profits. Ending the pandemic will require less patience than that. Further Antiviral Reading: The Inequities of Quarantine For now, much of the U.S. is still being asked to work and study from home. The trouble is that too many Americans can't do so because they lack access to high-speed Internet, writes Tara Lachapelle. We have been so distracted by the race to roll out 5G networks that we let this glaring inequity fester. Closing schools in particular will worsen inequality, writes Andreas Kluth, setting some kids behind permanently if they lack the technology or the close parenting to see them through home-schooling. Further Life-Under-Quarantine Reading: Oil War: What Is It Good For? It's not even such great news that gasoline is going for less than $1 a gallon in at least one Kentucky town. It means demand has collapsed, with a helpful shove from the price war being waged by Russia and Saudi Arabia. Trump has shown an affinity for cheap oil, but this threatens to hollow out the shale industry, warns Julian Lee, who urges the president to strike a peace deal. But teaming up with Moscow and Riyadh would mainly help Moscow and Riyadh, warns Liam Denning. For one thing, it would help Saudi Arabia maintain the oil-fueled budget that keeps its royal family in power. Governments throughout the Gulf face a similar worry as oil prices collapse, writes David Fickling. But the trends won't end with oil-war peace or a pandemic vaccine. Telltale Charts An indicator of stress in the dollar-funding markets is flashing red, warns Andy Mukherjee.  Even when we get a coronavirus vaccine, we may have trouble getting some parts of the world to use it, notes Ben Schott.  Further Reading We still have no idea how many families Trump separated at the border. — Francis Wilkinson Globalization survived world wars and will survive coronavirus. — James Gibney We're learning you can't rely on bond ETFs to track indexes when things get weird. — Brian Chappatta Germany claims its cash-hoarding is paying off, but it's still being too selfish. — Andreas Kluth and Ferdinando Giugliano A quarantine reading list. — John Authers ICYMI Rand Paul defended wandering the Capitol while infected with coronavirus. Loss of smell could be a sign of Covid-19. Chinese factories are building ventilators for Milan and New York. Kickers FINALLY, someone has created a toilet-paper calculator. (h/t Ellen Kominers) NASA fixes a Mars probe by hitting it with a shovel. (h/t Zoe DeStories) Scientists discover a fragment of a lost continent. (h/t Scott Kominers) Daily meditation may slow brain aging. Note: Please send TP calculators and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment