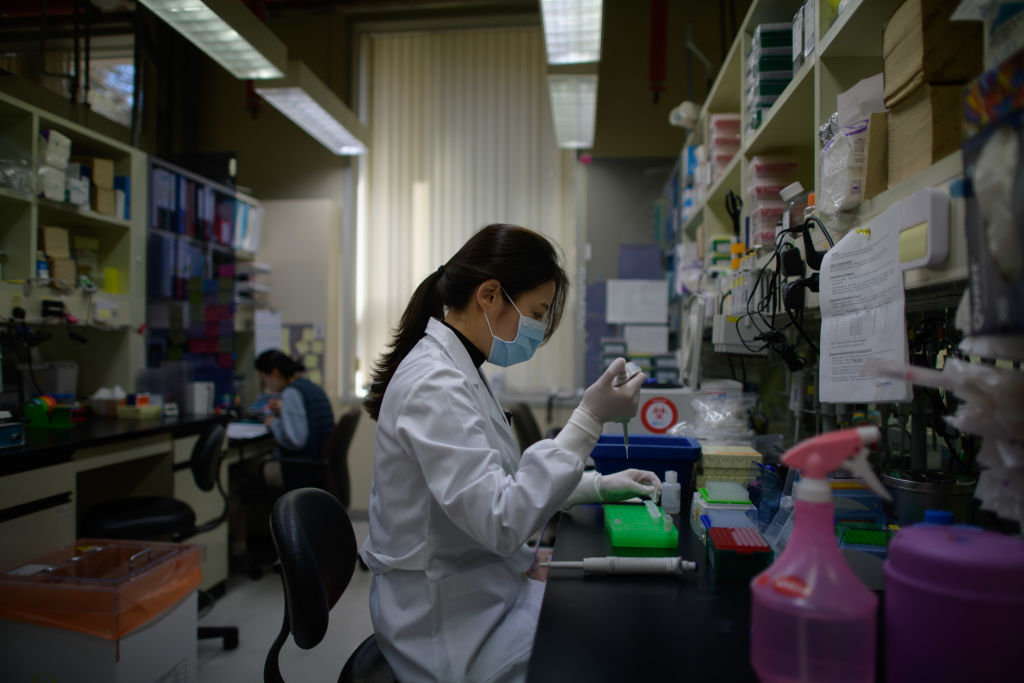

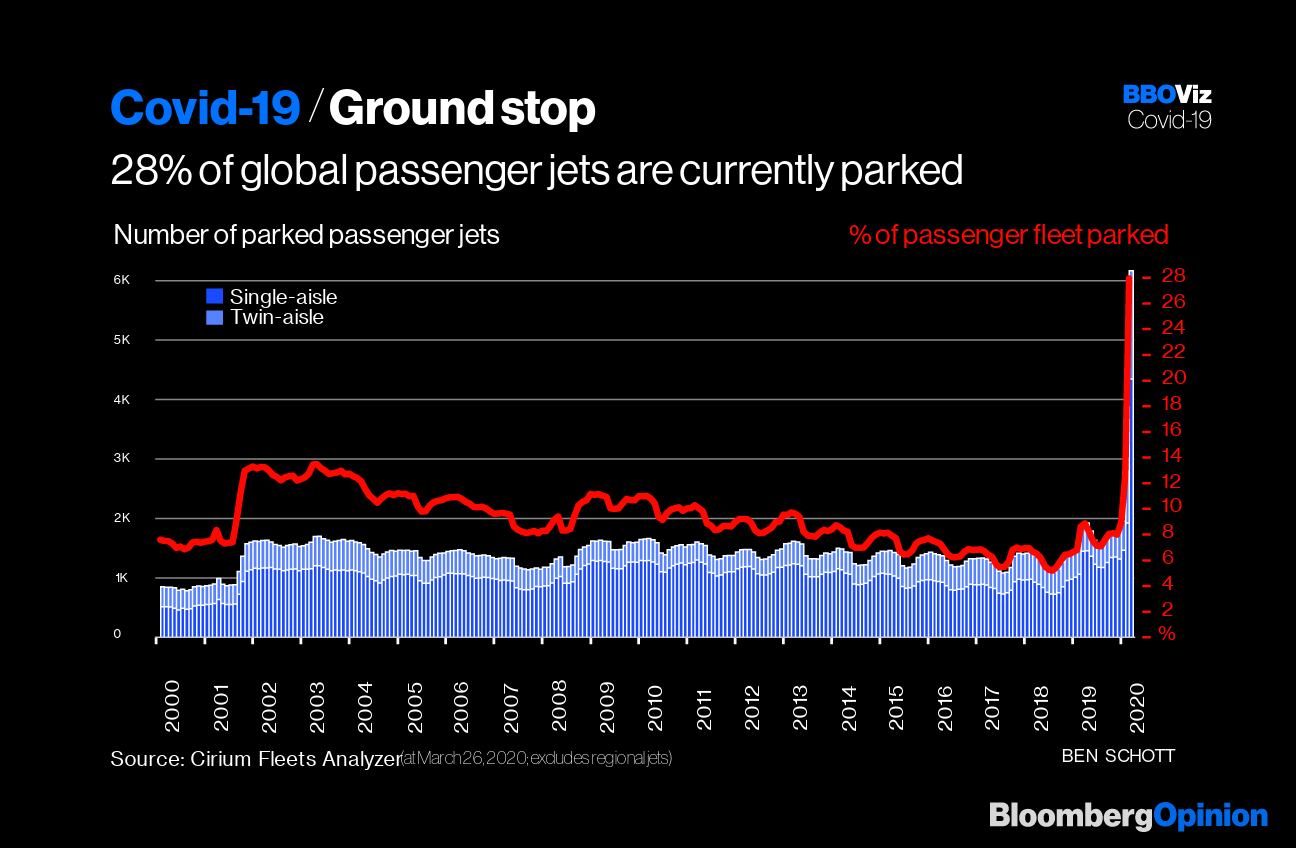

| This is Bloomberg Opinion Today, an airplane parking lot of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  Testing a secret weapon. Photographer: ED JONES/AFP/Getty Images First, Figure Out Who's Immune We have harped repeatedly in this newsletter about the lack of adequate testing for the coronavirus, without which it could be a long time before any of us get back to grocery-shopping without a hazmat suit. But relief could come from a different kind of test: one that determines not whether you have the disease now but have had it in the past. Testing for coronavirus antibodies could identify the potentially millions of Americans who catch the bug without developing symptoms. These people could theoretically get back to work, including treating active coronavirus patients, without fear of catching or spreading the disease. As Joe Nocera and Max Nisen write, several companies are working on such tests right now. Unlike tests for the virus, which are often complicated, dangerous and time-consuming, antibody tests could be quick and simple — meaning they could scale up in a hurry. Read the whole thing. How Not to Handle a Pandemic Yesterday, Francis Wilkinson wrote that coronavirus is President Donald Trump's Vietnam. Today, Stephen Myrow, who was part of the Coalition Provisional Authority in Iraq, writes that he sees parallels with the botching of the Iraq War too. In both cases, poor leadership and dismissal of experts led to unnecessary chaos and death. Myrow also worked at the Treasury Department during the financial crisis, where he saw much better leadership under Hank Paulson. President George W. Bush's Treasury secretary was humble, flexible and nonpartisan, Myrow writes — qualities absent from the White House now. Today, just hours after dismissing the need for tens of thousands of ventilators to handle an overflow of coronavirus patients, Trump turned around and excoriated General Motors Co. for not making them fast enough. He confusingly threatened to "Invoke 'P,'" presumably the Defense Production Act, which he should have done long ago (and finally, finally did late this afternoon). Trump has essentially abdicated leadership to Corporate America, writes Brooke Sutherland, which now must also figure out how to distribute equipment to where it's needed most. Of course, Trump isn't the only world leader making bad choices in this crisis. Sweden, for example, is just going on about its business, taking a huge risk it might have to lock everything down anyway, but after the virus wreaks havoc first, writes Lionel Laurent. China, now climbing out of the worst of its lockdowns, got off to a terrible start too, notes Shuli Ren. It's at least evidence even incompetent leadership is survivable. Further Bad-Response Reading: The Weird Physics of Weird Markets It's a sign of how crazy things are now that bull and bear stock markets are winking in and out of existence like particles in an accelerator. After the fastest bear market in history, yesterday the Dow capped a three-day bull market. The only other comparable bounces happened during the Great Depression, notes John Authers, which tells you something. Government action fueled this rally, particularly the dollars the Federal Reserve has sprayed on the world to ease a global funding crisis, writes Robert Burgess. But all is not entirely well, as today's stock market dip suggests. Fed action has helped the traditionally safer corners of the bond market, but the riskier parts are still suffering, writes Brian Chappatta. Those include high-yield debt, which in Europe is hurting the most since 2012, writes Marcus Ashworth. We may be due for yet another government rescue, this time of junk bonds by the European Central Bank.  Of course, all of this willy-nilly rescuing carries risks. Jim Bianco suggests the Fed's foray into corporate credit could end up destroying the village in order to save it, potentially making financial markets the plaything of "your new Fed chairman, Donald J. Trump." Maybe the answer, which we've heard before, is to just shut market functions down for a while, suggests Matt Levine. Markets exist to process information, but maybe that's not so useful when all the information is so obviously terrible. Further Market TMI Reading: SoftBank's fight with Moody's over its credit downgrade is a sign of things to come as ratings agencies navigate the chaos. — Chris Hughes Time to Socially Distance From Social Media Has this ever happened to you? You jump on Twitter to catch up on coronavirus news, half hoping for a miracle breakthrough, and within minutes you're a gelatinous mass of panic on your kitchen floor? Locked up inside with little to do, we're all using social media much more. But this is bad for our mental health, Sarah Green Carmichael writes, particularly as there's almost no information out there that will make us do anything besides hunker down and wash our hands. So maybe put that phone to better uses: Do a crossword, call a friend. Or maybe you could play Animal Crossing, a video game about raising adorable animals you can play with friends. It's understandably popular right now, writes Tae Kim, a boon for its maker Nintendo. Stimulus Shortcomings The House today passed the $2 trillion coronavirus relief package and sent it on for Trump to sign. The bill is a good start, but Noah Smith warns it will get burned up in two months. It also doesn't do enough for workers in big cities, for local governments or to meet urgent medical needs. What we really need to do is fully compensate the people being asked to sacrifice their jobs for the duration of this health crisis, writes Clive Crook, and this bill doesn't. Further Stimulus-Suggestion Reading: Forcing rescued companies to stop buybacks may be unfair, but if it keeps stimulus packages politically popular, then that's a price worth paying. — Conor Sen Telltale Charts The world's airports have become vast parking lots, writes Ben Schott.  Further Reading Boris Johnson catching coronavirus highlights how hard it will be to get regular political business done. — Lionel Laurent The auto industry is in worse trouble than it was in 2008. — Anjani Trivedi The airlines likeliest to survive have big governments and/or wealthy patrons on their side. — David Fickling Coronavirus has stalled the Second Arab Spring's momentum. — Bobby Ghosh ICYMI How Trump came up with Easter as a target date for ending lockdowns. Bosses panic-buy spy software to watch remote workers. Meet the last rich people on the Upper East Side. Kickers Scientists find a microbe that might eat plastic. For $750,000, you can ride to the bottom of the Marianas Trench. Upgraded Google Glass helps autistic kids "see" emotions. 40 classic sports moments worth reliving. Note: Please send plastic and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment