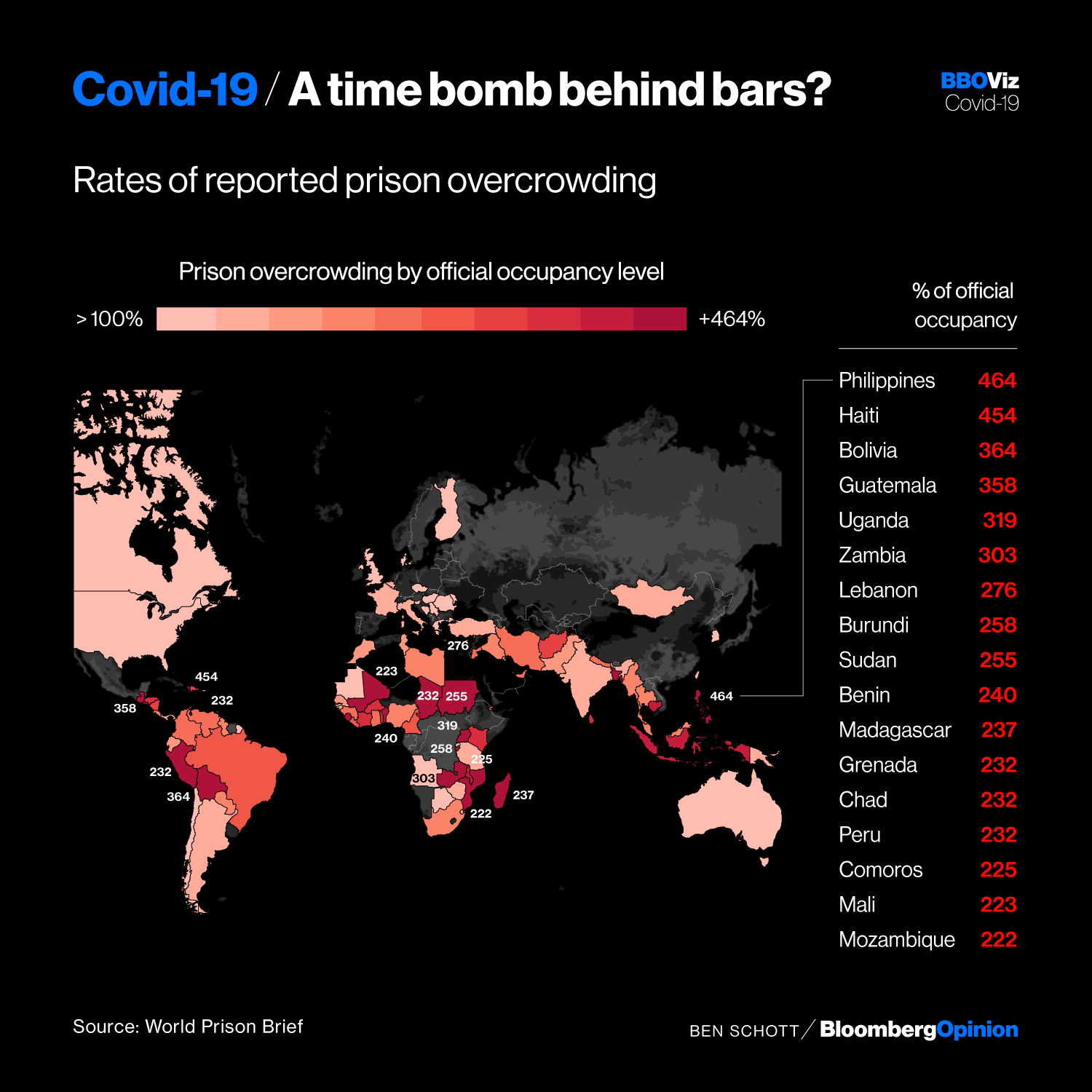

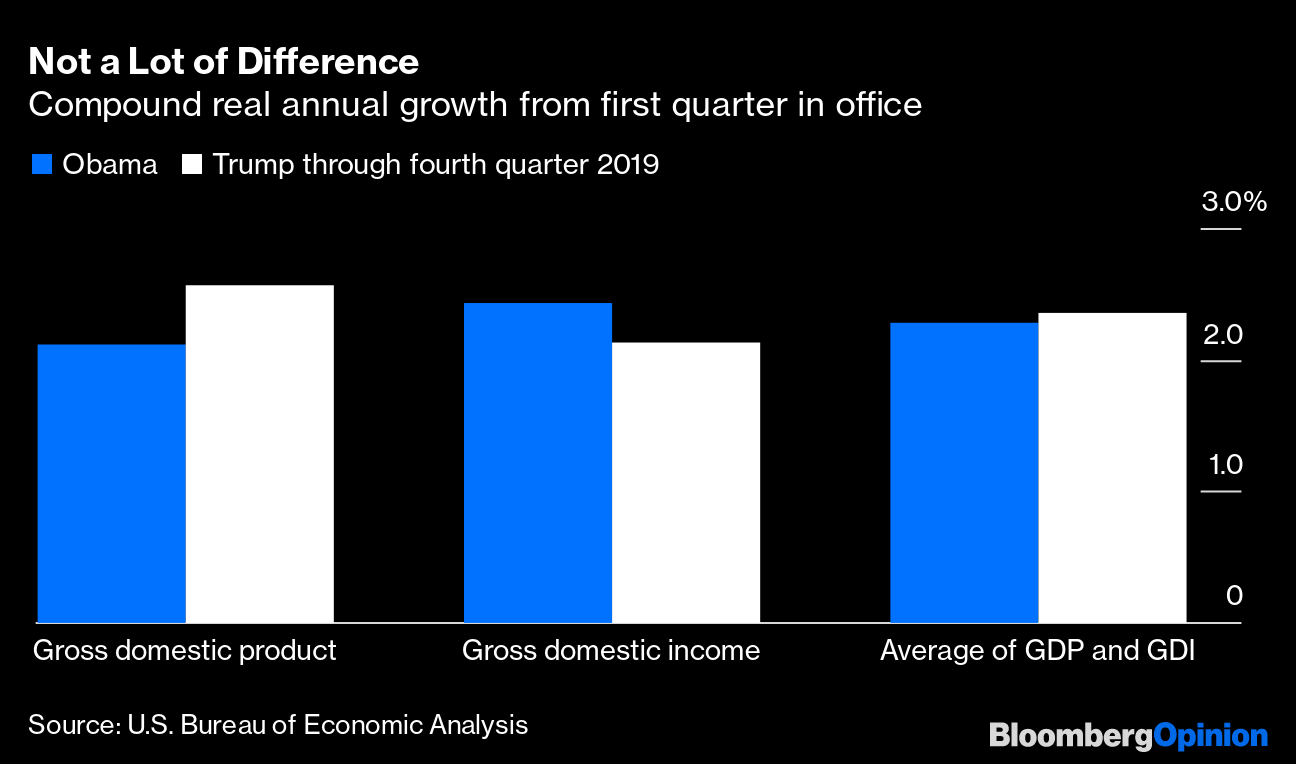

| This is Bloomberg Opinion Today, a Hamptons jitney of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  Just how we roll. Photographer: Chung Sung-Jun/Getty Images AsiaPac Our New Coronavirus Way of Life The headlines these days are full of stories promising coronavirus will change us forever. They're probably not wrong. It's a bit early to tell what will stick — shoe bumps replacing handshakes? toilet paper silos in every home? — but we can already see some changes coming. There's ample precedent. The Black Death changed the course of history, right down to consumer buying patterns, wages and interest rates, writes Andy Mukherjee. Covid-19 is no bubonic plague (knocking furiously on wood), but its economic changes could be profound, including raising the bargaining power of people doing the hands-on labor we suddenly recognize as not only essential but also heroic. On a more prosaic level, those struggling to acquire Cheerios and Clorox wipes have a newfound appreciation for the long-lost days of Early March, when you could get almost anything delivered quickly and free. But those expensive delivery and return policies were crushing profit margins in e-commerce, writes Brooke Sutherland. This could be a chance for retailers to permanently lower our expectations about the ease and cost of zipping stuff to our houses. While avoiding any injury that will send us to packed ERs during this time of quarantine, we must also be careful not to break our phones, cars or other critical equipment, which are now impossible to fix without special degrees from Hogwarts School of Wizardry and Tractor Repair. Apple Inc., Deere & Co. and other manufacturers should make it easier to fix stuff at home, writes Adam Minter, and not just during this pandemic. And while we're all inhaling content from Netflix Inc. and the like, we're also reminded that watching a real human face is far better than watching CGI Joe Pesci, notes Tara Lachapelle. For that we are increasingly turning to Instagram, TikTok and others offering user-generated content. Post-coronavirus, streaming services will most likely offer some of both. Some of the rich New Yorkers fleeing for the Hamptons in Joe Nocera's firsthand account might consider permanently abandoning the Big Apple. But it's a mistake to think city density is to blame for the virus's spread, writes Noah Smith. Dense Asian cities have fought the epidemic well simply by practicing better hygiene. Our new way of life could include wearing a mask. Further Life-Under-Quarantine Reading: This is the time for introverts to shine. Just look at Keats and Newton. — Andreas Kluth So Much for the Trade-Off History also offers a lesson about the fake trade-off between fighting a pandemic and protecting an economy. President Donald Trump has fortunately dialed back that controversy by extending social-distancing measures until at least the end of April. A study of 1918, when the world was gripped by the Spanish Flu, suggests this is the wise choice, both for public health and the economy, notes Scott Duke Kominers. The data show places with tougher lockdowns had stronger economic recoveries once it was all over. Meanwhile, extraordinary measures from Congress and the Fed make the shutdowns much less painful anyway, writes Bill Dudley. So they're saving lives and the economy. In fact, these rescue measures are so unusual and far-reaching, they're starting to worry some people. There's been talk of having the Fed buy junk bonds, for example, which Brian Chappatta feels is an intervention too far. It's better in his view to let the market sort out which companies should survive. And Narayana Kocherlakota is anxious about the Fed being involved in corporate finance at all, suggesting it's making it too easy for companies to build up risky leverage again. And these rescues will leave the U.S. with a mountain of debt. Fortunately, it can be addressed with smart taxes, writes Karl Smith — on carbon and national income, say — that are progressive and won't hurt the recovery. Further Extraordinary Rescue Reading: Bad Coronavirus Reactions Not all coronavirus responses are so constructive. In Eastern Europe, autocrats are taking this opportunity to seize more power, writes Andreas Kluth. Fortunately, no matter how flawed his response has been otherwise, at least Trump isn't acting like an autocrat, writes Noah Feldman. We should also be glad Trump has stopped calling Covid-19 the "Chinese virus." Such slander is part of a long, sad historical pattern of xenophobic responses to disease, as David Fickling writes. It's also another example of how racism against Chinese abroad has always strengthened China's unity at home and its determination to assert power in the world, writes Pankaj Mishra. Fast Tests Offer a Ray of Hope Last week we suggested immunity tests could help pave a relatively quick (quicker than 18 months, anyway) path out of our coronavirus nightmare. This weekend we learned there may be another route: Abbott Laboratories got FDA approval for a 5-minute virus test, using machines already in widespread use. If a woeful lack of testing has us all sheltering in place, as Faye Flam notes, then more testing can get us back to semi-normalcy, writes Max Nisen. This Abbott Labs test could make that easier, which is one reason stocks jumped today. Telltale Charts The world's overcrowded prisons are especially dangerous during a pandemic, writes Ben Schott.  A look at pre-virus GDP data shows Trump's economic record hasn't been all that different from Obama's, writes Justin Fox.  Further Reading Banks are avoiding layoffs now, but they're still too cost-heavy; job cuts will come eventually. — Elisa Martinuzzi Banks stress tests are serious business again. — Mark Whitehouse It doesn't matter for the election what Joe Biden does right now; nobody's paying attention. — Jonathan Bernstein OPEC, Russia and the U.S. missed their chance to stop the bleeding, and now the oil market is free to plunge. — Julian Lee Norway's sovereign wealth fund shows you don't have to sacrifice returns for social good. — Mark Gilbert Putting 60% of your portfolio in U.S. stocks and 40% in bonds is no longer a sensible idea. — Nir Kaissar Coronavirus exposes America as a civilization in decline. — Noah Smith Debates over virus shutdowns are new versions of old philosophical arguments. — John Authers ICYMI A 100-year-old vaccine could help with coronavirus. David Geffen Instagrams his yacht, outrage ensues. We're running out of condoms. Kickers Pablo Escobar's cocaine hippos may help the environment. (h/t Mike Smedley) Thieves stole a Van Gogh from a locked-down Dutch museum. Matter particles come in threes. Joseph Pilates worked on his exercise system in a WWI POW camp. Note: Please send cocaine hippos and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment