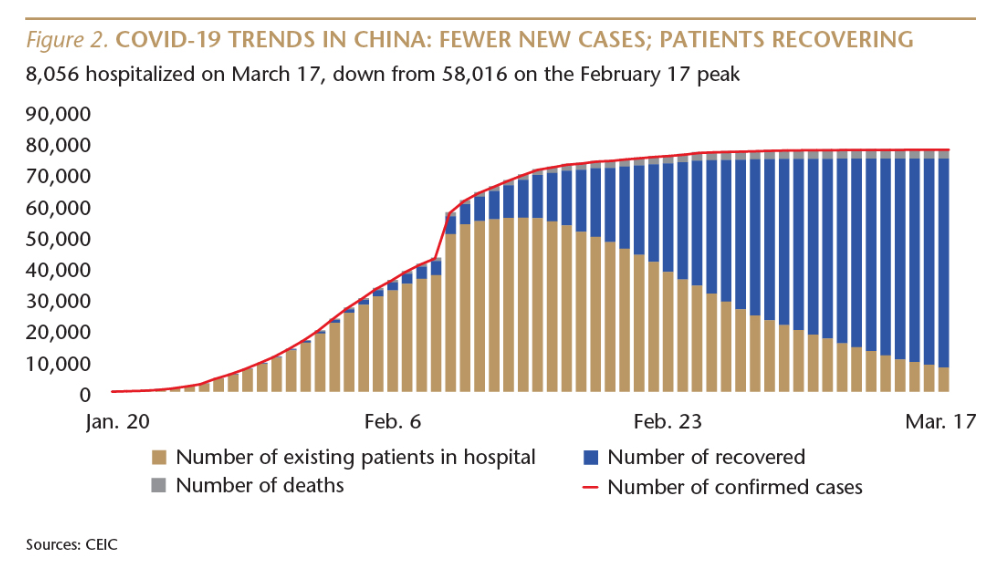

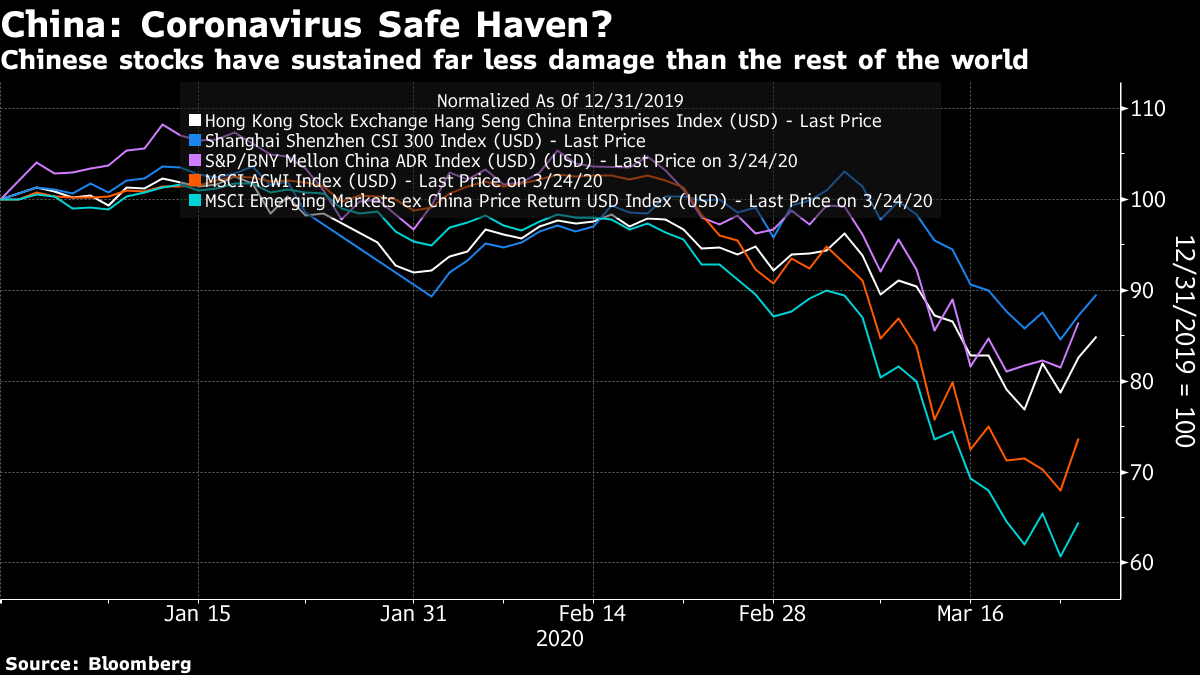

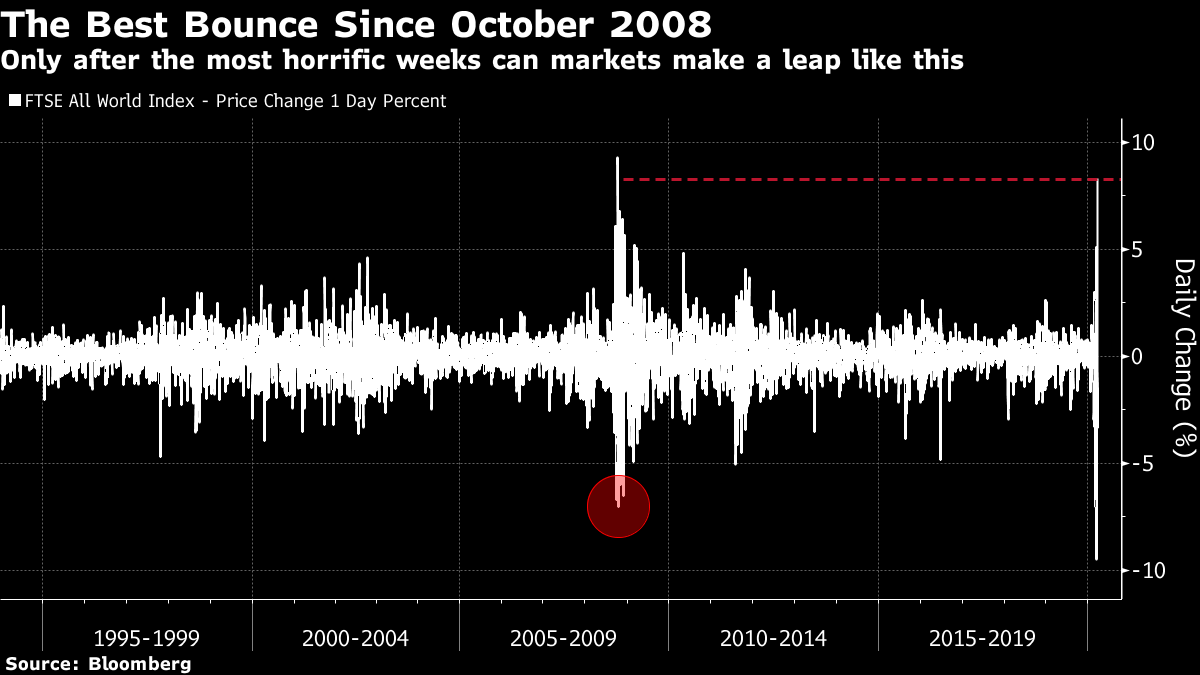

The New Abnormal Much of the Western world is now in different degrees of lockdown. In the process, we are imposing a recession upon ourselves — a recession by decree. How swiftly should we attempt to return to normality? President Trump has set a goal of getting the U.S. back to business as usual by Easter. Good Friday falls on April 10, so this implies that the country can be back to ordinary business in only two more weeks after this one. Easter is of course a hugely important point in the calendar for many (as is Passover, which overlaps with it, for many others). Raising hopes of an early return by that date is an understandable way for the president to attempt to raise the nation's spirits. Like most other people who cover financial markets, and indeed like the president, I am not an epidemiologist. As a resident of New York City, I am already rather tired of working in the confines of my apartment, and would like this to end. And this newsletter is edited in Hong Kong, where Bloomberg staff have been working from home for the best part of two months. But as far as I can see, it would be a mistake to try to go back to normal too soon. Commenting on Tuesday's strong market rally, the president said that "a very big part of it is that they see we want to get our country open as soon as possible." There is plenty of anxiety in the business community that the shutdowns will have an unnecessarily great economic cost. The quicker businesses reopen, the less interruption to corporate profits and the less damaging the inevitable recession. Clearly, markets would like to see America get back to work sooner rather than later, all other things being equal. But all things aren't equal. Given a choice between being sure that the virus was beaten, or taking a risk by reopening the economy as soon as possible, I have heard plenty of voices in the last few days arguing for caution. These aren't only from the medical community, but also frombusiness and Wall Street. It is uncertainty that roils markets. The great imponderable of the moment, which explains the fastest descent into a bear market in history, is the coronavirus. Reopening, seeing the virus proliferate, and then returning to lockdown would be a disaster. Neither business nor investors are likely to deploy capital and start to grow again if they are still worried about the pandemic. They might rather attempt to adapt to lockdown conditions. The biggest argument in favor of caution comes from China. The country that gave the virus to the world also now appears to have beaten it. This chart, from fund management group Matthews Asia, clearly shows how cases reached a plateau in late February:  Now, look at the performance of Chinese stocks. The following chart includes indexes for A shares, quoted in the domestic markets of Shanghai and Shenzhen, as well as H shares, quoted in Hong Kong, and American depositary receipts, quoted in New York. A shares have done best of late, which probably reflects some attempts by authorities to boost the market. Beyond that, though, all classes of Chinese shares tell a similar story. They dipped alarmingly in the early days of the crisis. A particularly ugly moment came when the domestic market reopened after being shuttered for a week over lunar new year. But Chinese stocks, whether in Shanghai, Hong Kong, or New York, began to recover in early February, as signs came from Wuhan that the virus was coming under control, and that it wasn't proliferating as badly as feared in the rest of the country. By the final week of February, when the situation had plainly stabilized, indexes were back level for the year. They then started to fall again as the problem spread outside China. Yet, remarkably, Chinese indexes have done comfortably better this year than the rest of the world.  How can we explain this? Chinese stocks recovered despite an economy that has produced, to quote Andy Rothman, a veteran China-watcher now at Matthews Asia, "the worst macro data since the Tang Dynasty" (which lasted from 618 to 907). What mattered to investors was to gain some confidence that the virus was under control. Then the return to work could begin. Note that the lockdown in Wuhan and the surrounding province started almost exactly two months ago, on Jan. 23, and still hasn't completely ended. China is even enjoying the opportunity to repair its public image, exporting medical supplies to countries in need and developing the appearance of a haven. In 2008, China embarked on a huge fiscal stimulus that helped save the world from a second Great Depression, but has given it problems ever since, as John-Paul Smith, founder of Ecstrat Ltd. in London, put it. Now, the argument goes, China can watch as others take on piles of debt having kicked the disease. It is even prepared to risk losing international goodwill by expelling American journalists, a sign of confidence given that two months ago the virus seemed to be out of control, and calling into question the legitimacy of the regime. China is back in the ascendant, for now at any rate, because it is perceived to have done what was necessary to beat the virus. (And it could return to deep trouble if the virus recurs.) The message for others is to err on the side of caution. Stock markets enjoyed a huge relief rally across the world Tuesday. It was the second best day ever in the quarter century that FTSE has maintained its all-world index. Only Oct. 13, 2008, the day of the first great post-Lehman bounce, beats it:  Nothing in particular happened on Oct. 13, 2008, and the market still had a long way to fall after that date. It was simply the moment when prices, having dropped about 20% in a week, at last bounced. Not coincidentally, that day followed the only week to have been worse for stock markets in recent history than the one we lived through last week. That doesn't mean Tuesday's developments should be dismissed as meaningless. This week's rally reflected some confidence that the dreaded secondary impact of a credit crisis to follow the public health crisis will be averted, following massive central bank intervention. It also reflected confidence that fiscal stimulus is arriving and will help. It also suggests (as was also the case on that bounce day in October 2008) that the initial extreme panic phase of vertical losses is over. An initial traumatic low in confidence appears to have been reached. As I suggested two days ago: "It is reasonable to expect that some kind of relief rally will get underway in the next few days." Unfortunately, I also felt it necessary to add: "It is also reasonable to expect that the final low is still a ways off. The bottom comes when all hope has been lost, and resignation sinks in." I still don't know when that point will be, but it it cannot come until the virus is under control. Which is why I continue to think it unwise to raise the hope of Americans that all can be back to normal by Easter.

Exit Uderzo

And finally a word to acknowledge the passing of Albert Uderzo, one of the creators of Asterix. The artist who drew the indomitable Gaul was 92. Rene Goscinny, who wrote the books, died more than 40 years ago. If you haven't discovered the Asterix books, you have a treat in store. They are works of genius, which function brilliantly as political and social satire, as well as very funny comic strips. With the possible exception of The Simpsons, nothing comes close. There is one particular reason for hailing Uderzo at this juncture. A few years ago, he decided to retire, and chose two young French comic book artists to take over the franchise. They have shown an uncanny ability to combine both a satire set in the time of Julius Caesar with an ability to foresee the future. In 2017, they published Asterix and the Chariot Race. This is the name of the masked Roman charioteer who was their chief opponent:  To get a good handle on future risks, read the Asterix books. My thanks to the many on Twitter who pointed this out. And rest in peace, Albert Uderzo. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment