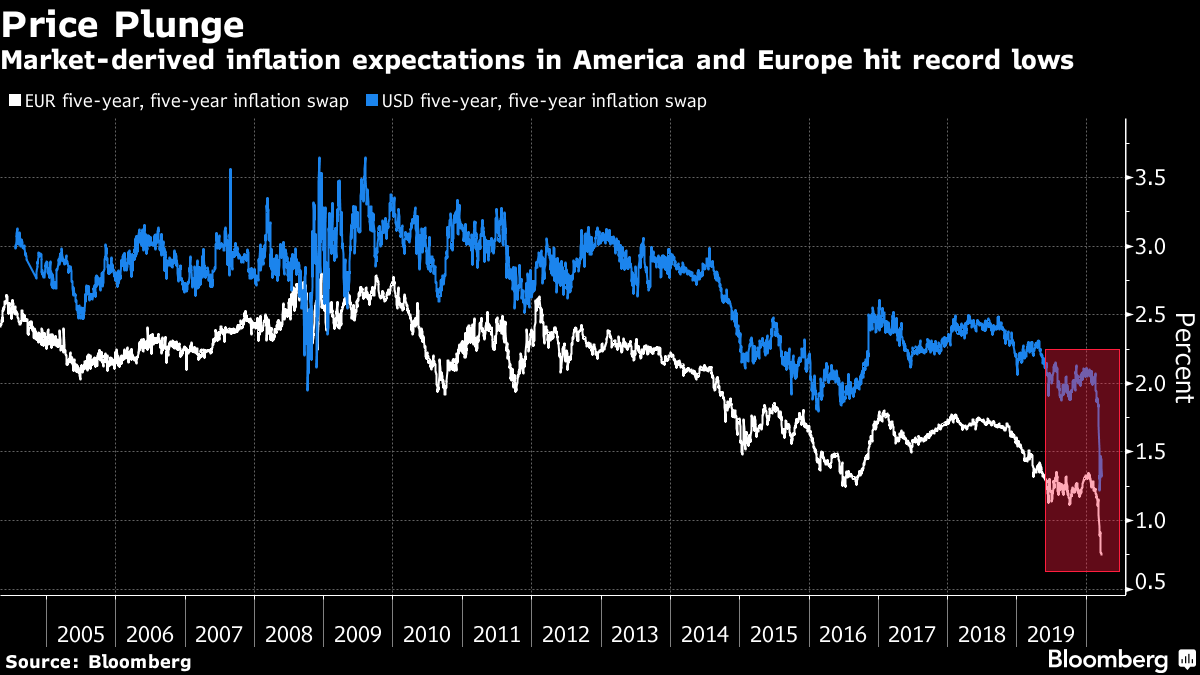

| Traders brace for more market mayhem as policy makers race to cushion the economic blow from the coronavirus, Australia shuts its pubs, restaurants and cafes, and China begins to talk up green shoots in its economy. Here are some of the things people in markets are talking about today. More Market Pain The dollar slipped in early trading in Asia on Monday as investors took stock of the latest developments on the coronavirus's spread and more stringent measures from countries to control it. The New Zealand dollar fell after its central bank joined other countries in saying it will start buying bonds to stimulate the economy. The yen and Swiss franc edged up against the greenback. U.S. equity futures extended losses to trade limit down Monday after the S&P 500 lost more than 4% on Friday, when Asian futures signaled more declines to come. As investors attempt to assess the severity of the upcoming downturn, Federal Reserve Bank of St. Louis President James Bullard predicted the U.S. unemployment rate may hit 30% in the second quarter because of shutdowns to combat the virus. And Morgan Stanley economists said the coronavirus will inflict a deeper recession on the U.S. than previously expected, including a record 30.1% drop in gross domestic product in the second quarter. China Talks Up Economy China's government is talking up the prospects for a rapid economic rebound from the coronavirus, even as the global economy sees further lockdowns to curb the spreading disease. Since Friday, the premier, who leads economic policy making, and a senior central-bank official, have pointed to the control of the outbreak and the resumption of activity as reasons for optimism with regards to China's outlook. At the same time, the nation is facing the risk of further job losses and slumping external demand as the U.S., the U.K. and the European Union all tighten restrictions on human activity as the virus exacts a rising death toll. Economists expect China to post the slowest growth since the end of the Mao era this year. Australia Closes Venues Australia will enforce more stringent controls to slow the spread of the coronavirus, closing pubs, casinos, restaurants and other venues from Monday after the number of infections surged past 1,000. Prime Minister Scott Morrison said authorities were compelled to ramp up their response after many Australians flouted social-distance guidelines, with thousands of people flocking to beaches at the weekend and socializing in bars. Classrooms should remain open until the end of this term, though parents could take their children out of school if they preferred, Morrison said. Casinos, nightclubs, gyms, churches and other places of worship are among other venues that will be closed under the Stage 1 measures that will be reviewed monthly. How RBA's Easing Backfired Just when investors thought central banks were beginning to calm a global bond rout, the epicenter of chaos shifted to Australia as its market went into meltdown on March 19. The trigger was the announcement of the country's own quantitative easing program, which should have soothed nerves, not frayed them. The episode underscores the continuing vulnerability of markets as policy makers push into uncharted territory to protect their economies from a viral pandemic they have never faced before. While the worst of the violent price moves were over in minutes, the impact is still reverberating. Low liquidity, algorithmic trading and a mismatch between investor expectations and the central bank's plan all played a role. Merkel in Quarantine Angela Merkel's ability to effectively direct Germany's coronavirus response was thrown into question after the chancellor quarantined herself at home following contact with a doctor who later tested positive for the disease. The doctor gave Merkel, 65, a precautionary immunization against bacterial pneumonia on Friday and the chancellor decided to self-isolate once she learned of his positive test, government spokesman Steffen Seibert said Sunday. Merkel, who suffered a health scare last year with unexplained shaking fits, will be regularly tested in coming days and perform her duties from home, Seibert added. Meanwhile, Germany banned gatherings of more than two people. Keep up to date with all the latest virus news here. What we've been reading This is what's caught our eye over the last 24 hours. And finally, here's what Tracy's interested in this morning In the aftermath of the 2008 financial crisis, some analysts warned that quantitative easing would result in massive inflation. It didn't, of course, and after years of price increases that have tended to come in below central banks' targets, warning about inflation has basically fallen out of economic fashion. So, enter Oliver Harvey and Robin Winkler, two Deutsche Bank strategists who mount a rare inflationist argument in a note published on Friday.  That argument is that while the coronavirus is both a supply and a demand shock, trying to boost demand (giving everyone money to spend) while keeping supply fixed (telling people to work from home, or not go into work at all) will inevitably result in price increases, as well as worker shortages that push the cost of labor up. Or, as they put it: "What matters is that at present supply is inelastic — unlike in traditional Keynesian formulations — because while the government might be handing out $100 bills, it won't be allowing workers to work regular days, restarting flights or reopening factories until the virus subsides." Of course, the riposte to the above is that the uncertainty caused by the coronavirus is likely to lead to a much larger-than-anticipated dent on demand (one that cannot be offset completely by fiscal measures) and potentially a permanent loss of output. Judging by market-based measures of inflation expectations — now hovering at record lows — the inflationist argument isn't convincing many just yet. You can follow Bloomberg's Tracy Alloway at @tracyalloway. Follow Bloomberg on Telegram for all the investment news and analysis you need. |

Post a Comment