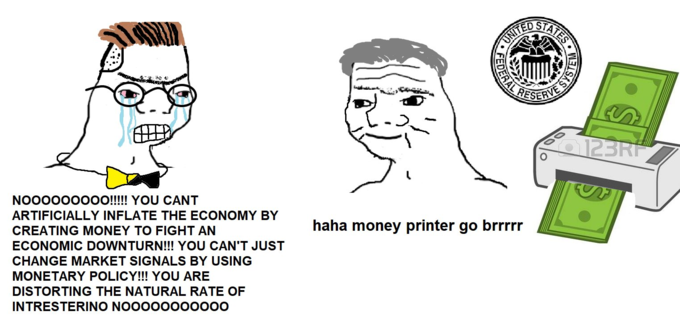

| Pelosi pushes $2.5 trillion bill, it's PMI day, and markets rally. Stimulus House Speaker Nancy Pelosi unveiled a $2.5 trillion spending bill as she attempts to take control of negotiations over the second stimulus package debate after the Senate failed to agree on measures yesterday. Pelosi's plan includes measures to support home owners and renters, and would see $10,000 in loan forgiveness for student borrowers. There are no plans for the House to vote on the measures, which are seen as a list of Democrat demands for inclusion in the Senate bill. President Donald Trump, speaking at a press conference yesterday, said that he was looking to get the U.S. back to work as soon as possible as his administration becomes increasingly concerned about the economic damage caused by the virus. PMIs There are obvious signs of that damage in the purchasing managers indexes already published today. A gauge of activity in Japan's service sector shrunk to 32.7, a record low. In Europe, a similar number for France crashed to 29, with manufacturing PMI there dropping to 42.9. There were also signs of a steep recession in German data, while a composite number for the euro area showed it may be headed into the biggest economic crisis in its history. March manufacturing, services and composite PMI numbers for the U.S. economy are also expected to show a sharp contraction when the data is released at 9:45 a.m. Eastern Time. Lockdown The U.K. finally joined most of the rest of Europe by imposing an almost complete lockdown, with Prime Minister Boris Johnson telling people that they must stay at home. The restrictions on movement seem to be effective in controlling the spread of the virus with Italy, the country with the largest outbreak in the region, reporting slower growth in the number of cases and deaths. Chinese authorities are preparing to lift the lockdown in Wuhan, the city where the outbreak was first reported earlier this year. In the U.S. there isn't a national lockdown in place, but many states have introduced stay-at-home measures and travel has become curtailed. Stocks rally Global equity investors are reacting to unprecedented stimulus from the Federal Reserve, and possibly trying to get ahead of good news on controlling the coronavirus and fiscal packages today. S&P 500 futures hit the upper limit of their trading range after an Asian session which saw the regional benchmark gain 4.9%. In Europe, the Stoxx 600 Index was 5% higher at 5:50 a.m., with every industry sector gaining, led by a huge jump in energy stocks. The 10-year Treasury yield was at 0.812% and gold jumped. Oil rises The on-again, off-again possibility of a detente between the America and OPEC seems to be very much on again today after U.S. Energy Secretary Dan Brouillette said the possibility of a joint U.S.-Saudi oil alliance is one idea under consideration. That, coupled with the sweeping measures announced to support the economy by the Federal Reserve, is helping push oil higher for a second day, with a barrel of West Texas Intermediate for May delivery trading as high as $25. There are also growing signs that some producers do not have the firepower needed to fully engage with the price war, possibly meaning the expected flood of crude onto the market could be lower than feared. What we've been reading This is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morning Folks, I regret to inform you that a popular and enjoyable meme right now contains an inaccurate representation of monetary policy. It's too bad, because one of the few enjoyable things in the world these days is the "haha money printer go brrrrr" meme featuring the Fed printing up a bunch of cash to save the economy. There's different variations of it, but my favorite version features a bowtied devotee of Austrian economics spouting dogma, while the Fed laughs in their face printing up cash. There's a large kernel of truth to this! We can save the economy by creating a lot of cash. The cash should go to households to meet basic budgetary needs while people stay inside. And the cash should go to businesses, so they can afford to shut down for a few months and keep people on payroll, so that there is productive capacity to turn back on when the public health crisis fades. But here's the problem, the Fed can't make the money printer go brrrrr like we need it to right now. At least not under its existing legal structure. Because while it can create reserves at the stroke of a key, it does so buy buying assets from the private sector. So if the Fed, say, buys $1 billion worth of Treasury bonds, then yes, some entities in the private sector get $1 billion in reserves. But they've handed over $1 billion worth of Treasury bonds to the Fed. And so the net wealth position of the counterparty hasn't changed. All those charts you see of the Fed's balance sheet you always see are assets that the Fed has TAKEN away from private holders, leaving their overall balance-sheet position roughly the same. Even yesterday's historic actions were slightly more aggressive versions of the same principle. You can get cash from the Fed, but you have to sell the Fed something, or pledge some asset as collateral. Unfortunately the meme doesn't capture any of this. I regret that I must award this meme 3 Pinocchios, for not fully characterizing monetary-policy operations. Two last quick points. There is probably more that can be done by the Fed, and in fairness efforts to backstop private or muni credit does help get actual cash in people's hands. But if we really want the money printer to go brrrr (which we need!) under our existing system, Congress needs to act. Only Congress really has the current capability to just put cash in people's pockets, which is what so many people desperately need.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment