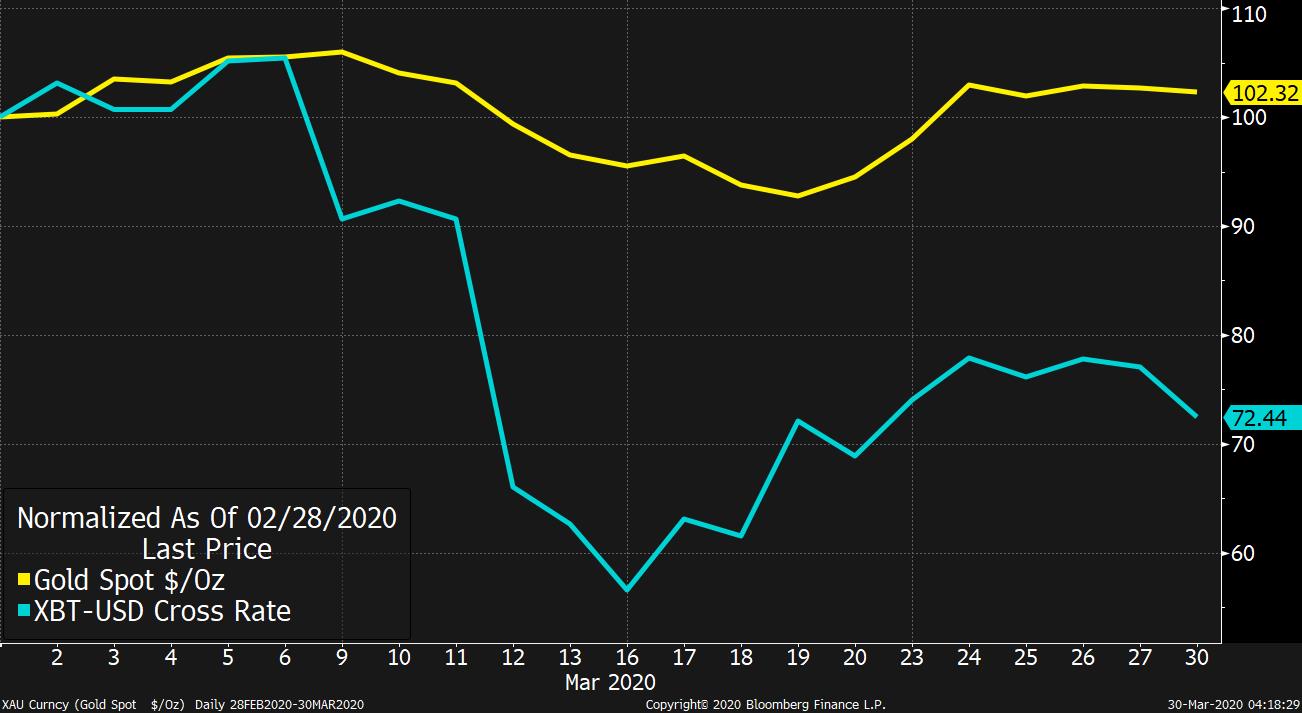

Trump extends virus guidance to end of April, countries add more stimulus, and the oil market is just broken. Changing plansPresident Donald Trump abandoned his goal to reopen the U.S. economy in two weeks time, saying the guidelines for Americans to practice social distancing will now remain in place until April 30. National Institute of Allergy and Infectious Diseases Director Anthony Fauci warned that the death toll in the U.S. could hit 200,000, with the latest data showing over 140,000 cases of the virus in the country. President Trump did not impose a quarantine on the hardest hit areas, including New York City, after earlier floating the idea that it was a measure he was considering. Throwing money at itThe moves from fiscal and monetary authorities across the globe to try to cushion the impact of the hard stop to economic activity continue to widen. Australia announced a record stimulus program as that country faces its biggest drop in output since 1931. Singapore's central bank took unprecedented steps to adjust its exchange rate target, China's top leaders pledged to widen the fiscal deficit and the Bank of Japan purchased a record amount of ETFs for the fourth time. In Europe, the push to issue so-called "coronabonds" is gaining support among leaders, with the countries opposed to the measure looking increasingly isolated. Dead oilThe world is drowning in oil that nobody needs and it is causing huge problems for the market. Demand has collapsed, with the grounding of much of the world's aircraft contributing to a drop of 5 million barrels a day in consumption alone. Gary Ross, an influential oil watcher and chief investment officer of Black Gold Investors LLC, said "the physical oil market has seized up," comments backed up by numbers showing that some producers are having to pay to have their crude taken away. While major benchmarks are still some way from such levels, West Texas Intermediate for May delivery briefly traded below $20 a barrel this morning. Markets dropThe huge volatility in global equity markets shows little sign of disappearing, with gauges again posting losses. Overnight, the MSCI Asia Pacific Index slipped 0.7% while Japan's Topix index closed 1.6% lower. Australia's S&P/ASX 200 gained 7% on the government stimulus announcement. In Europe, the Stoxx 600 Index was 0.7% lower at 5:50 a.m. Eastern Time with banks hit hardest as the ECB stepped up pressure on lenders to halt dividend payments. S&P 500 futures pointed to a drop at the open, the 10-year Treasury yield was at 0.638% and gold was lower. Coming up…There is more probably-very-stale economic data at 10:00 a.m. when February pending home sales numbers are published. President Donald Trump continues his media blitz with an appearance on Fox News at 7:55 a.m. The Federal Reserve will once again offer up to $1.5 trillion of liquidity across three repo operations today. Germany reports inflation for March at 8:00 a.m. What we've been readingThis is what's caught our eye over the weekend. And finally, here's what Joe's interested in this morningWe're at the point where the world's richest people can't get their hands on physical gold. Just like with every other commodity in the world, its supply chain is disrupted left and right. But unlike other commodities, demand is absolutely soaring, because that's what happens when people are nervous and want a safe haven. This is the point where Bitcoiners come in and say "Aha! Don't you know there's a new safe haven, store of value that doesn't rely on age-old physical supply chains." But the Bitcoin argument doesn't hold up, even by Bitcoin's own logic. To refresh, the coins are created and the network is secured through a "mining" process, where computers use enormous amounts of electricity to solve pointless math problems. The underlying principle is called "proof of work." And while outside critics assail the process as a useless waste of energy, Bitcoiners understand that within the context of a secure system, the waste makes sense. But expending energy on something seemingly wasteful to manufacture money isn't a new idea. Gold is basically the same. There's no real point to going through all that effort to get shiny rocks out of the ground. But for thousands of years, people have accorded monetary value to the end fruit of that labor. There's one other important element here. You need a system of remembering who did the work. With gold, it's simple, you either have the stuff or you don't. With Bitcoin, the blockchain serves as the system's collective memory of who mined what, and who transferred coins to whom. Thus we get to the key idea that a monetary system is really a collective memory bank of past work. This is true, in the abstract sense, even for U.S. dollars. And even in the absence of Bitcoin and gold, people have understood and articulated this. In his book 'Understanding Media' the theorist Marshall McLuhan wrote that money is created when "some work has been done to some material." In a seminal paper, the economist and former Minneapolis Fed President Narayana Kocherlakota taught us that "money is memory." So now to Bitcoin vs. gold. The work we do today will form the basis of tomorrow's memories. And tomorrow's memories will be stamped and turned into money in some collective mint. All Bitcoiners should ask themselves this question: "A year from now, who's work am I more impressed with: The person who moved heaven and earth to acquire a physical gold coin during a period of unprecedented supply chain tumult? Or the person who logged into Coinbase and entered in their bank account data?" The answer is obvious, and it explains why one safe haven has held its value over the last month, while the other has declined significantly.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment