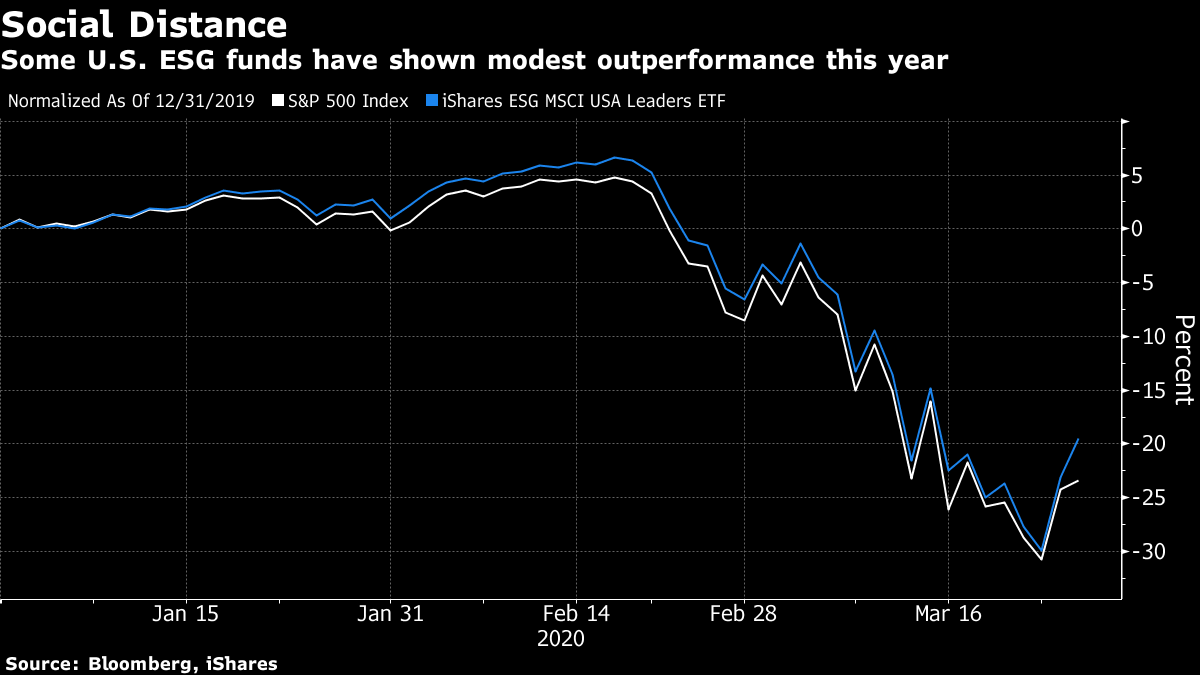

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. The U.S. Senate approved a rescue plan, Spain's crisis is escalating and the U.K. continues to be criticized over its virus response. Here's what's moving markets. U.S. Senate Approves Package The U.S. Senate approved a historic $2 trillion rescue plan, putting pressure on the Democratic-led House to pass the bill quickly and send it to President Donald Trump for his signature. The massive legislation passed on a 96-0 vote just before midnight Wednesday after days of intense negotiations and is now set for a House vote on Friday. Here's a look at what's in the package. Note that U.S. and European equity futures retreated this morning, though, as investors focus on the mounting human impact of the outbreak. Still, here's why some say European stocks might have bottomed. Spain's Crisis Deepens Spain's virus crisis is deepening by the day. Stories from one of Madrid's biggest hospital's paint a grim picture as intensive-care wards overflow and new rules dictate that older patients miss out on treatment to younger people with a better chance of surviving. Spain's death toll has already overtaken China's and authorities reported another 738 people had lost their lives Wednesday, a new high. Over in Italy, the country with the most deaths, new coronavirus cases fell, as did fatalities, of which there were 683 in 24 hours, compared with 743 on Tuesday. Pressure on Johnson Pressure is building on U.K. Prime Minister Boris Johnson over the country's lag in virus testing, on top of a comparatively slow implementation of lockdown measures. Britain's chief medical officer said testing efforts are being hobbled by global supply chain bottlenecks, as he dampened optimism that home test kits could be available within days. Meanwhile, Chancellor of the Exchequer Rishi Sunak will announce assistance to the self-employed on Thursday, amid reports of some contractors in industries like construction still working. End Game Lockdowns are now commonplace across the world, with India, a nation of 1.3 billion people, New Zealand and Thailand among the latest nations to impose restriction its citizens. But while many countries have just introduced the measures, an eventual resumption of normal life is already being eyed in some. U.S. President Donald Trump's vision of "packed" churches on Easter Sunday has been questioned, though, with Wuhan in China only just starting to open up after two full months of strict rules. Still, here's what some experts say it would take to lift coronavirus restrictions. Coming Up… The Bank of England will hold its first scheduled policy announcement under new governor, Andrew Bailey, though it's already slashed rates to a record low in an emergency move. The Czech central bank is expected to announce easing measures today, while in data, France manufacturing confidence plunged and U.S. weekly jobless claims could soar into the millions. French retailer Casino-Guichard Perrachon SA gives an earnings update. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning ESG investing is proving its worth in the current sell-off with stocks ranking highly on environmental, social and governmental metrics outperforming the broader market, according to Bank of America. U.S. stocks in the top quintile of ESG scores have beaten the S&P 500 Index by 5 percentage points since its February peak, while ESG gauges in Europe have topped broader benchmarks this year, wrote strategists including Savita Subramanian in a note Wednesday. The U.S. outperformance holds even adjusting for size and sector, and stocks with lower ESG rankings are seeing bigger earnings downgrades, they added. The results push back at critiques that ESG investing is "nice to have" not "need to have," the strategists contended. While stocks across the world have been pummeled amid the coronavirus spread, the iShares ESG MSCI USA Leaders ETF -- the biggest U.S. exchange-traded ESG fund -- has modestly outperformed the S&P 500 this year, according to data compiled by Bloomberg. The fund is down 20% compared to a more than 23% slump in the U.S. stocks benchmark. Unlike during the financial crisis, when good governance was a critical determinant of performance, social factors such as reliable products and good workforce policies appear to be what is driving the divergence in stock returns today, according to Bank of America.

Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment