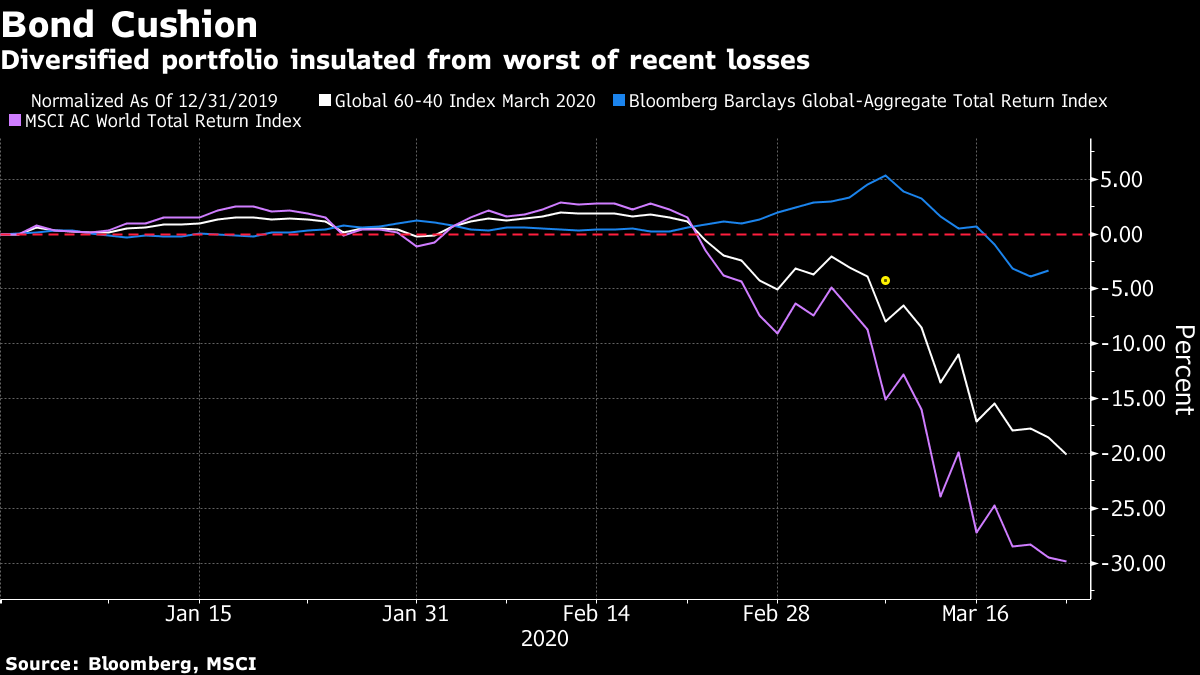

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. European nations are cracking down on daily life to stem the virus's spread, a U.S. rescue package hit a stumbling block and there's more brutal forecasts of the illness's economic impact. Here's what's moving markets. Crackdown European nations are tightening restrictions on citizens in latest attempts to stem the coronavirus's spread. Germany — whose chancellor, Angela Merkel, has quarantined herself — banned gatherings of more than two people, while Spain moved to extend a state of emergency, Italy ordered a halt to domestic travel, and Greece will impose a national lockdown from 6 a.m. The U.K., deemed by some as having reacted slowly, said it could impose stricter measures after reports people were still gathering in parks and making trips to coastal towns. U.S. Package Blocked Over in the U.S., Senate Democrats blocked Majority Leader Mitch McConnell's attempt to advance a coronavirus economic rescue package Sunday after leaders in both chambers disagreed on how to spend nearly $2 trillion. The vote puts in question McConnell's plan for the Senate to pass the bill Monday. Republicans and Democrats differ on key sections of the plan, including a $500 billion chunk of the bill that could be used to help corporations, including airlines, or state and local governments. Contraction Size Europe's largest economy could be headed for its biggest output contraction in more than a decade, with Germany's finance ministry forecasting that the pandemic will see its economy shrink by at least 5% this year, according to people familiar with the figures. That compares with the current estimate of 1.1% growth. And there's been some even more brutal economic estimates for the U.S. Goldman Sachs Group Inc. expects a 24% plunge in second quarter gross domestic product, while Morgan Stanley anticipates a 30% drop. Stocks Slide European and U.S. equity futures tumbled this morning along with Asian stocks as the global death toll from the pandemic continues to rise. Contracts in Europe fell more than 6%, while S&P 500 futures hit limit down and panic buying saw the dollar surge against emerging market currencies. Traders will continue to monitor infection rates, particularly in Italy, but that's far from the only potential rebound signal to be aware of. Here's a sector by sector breakdown of how the pandemic is impacting European equities. Coming Up… Europe will get a first glimpse of how badly the coronavirus has already scarred its economy this week, starting with a reading of consumer confidence from the euro area today. We'll also get consumer confidence data from Turkey, along with an interest rate decision from Kenya. The corporate earnings schedule is light. In the U.K., regulators may request companies delay financial statements due to virus chaos. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning Bonds are not dead as a diversifier. Despite the sell-off in global debt last week, a traditional 60-40 equities-bonds global portfolio still outperformed an equivalent basket of stocks last week, as it has for the last five in a row amid the coronavirus-induced volatility. That means the sizeable bonds component is still acting as ballast, cushioning investors from the depths of the sell-off in stocks alone -- just as intended. A Bloomberg Barclays gauge of global bonds is down just 3% in the year through Friday, meaning a custom global 60-40 portfolio has fallen 19% in comparison to the 30% plunge in the MSCI World Index. Furthermore, Friday's collapse in benchmark Treasury yields (with declines continuing in Asia trading Monday) suggest the bond sell-off may be temporary -- in part due to forced liquidations from under pressure hedge funds. While the potential for global debt issuance to deal with the impact of the outbreak is going to be staggering, central banks are increasingly undertaking bond buying programs to provide stimulus and will want to keep a cap on yields. Long-term global diversified investors are still seeing the benefits of bonds in their portfolio, even if on occasion they fall alongside stocks.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment