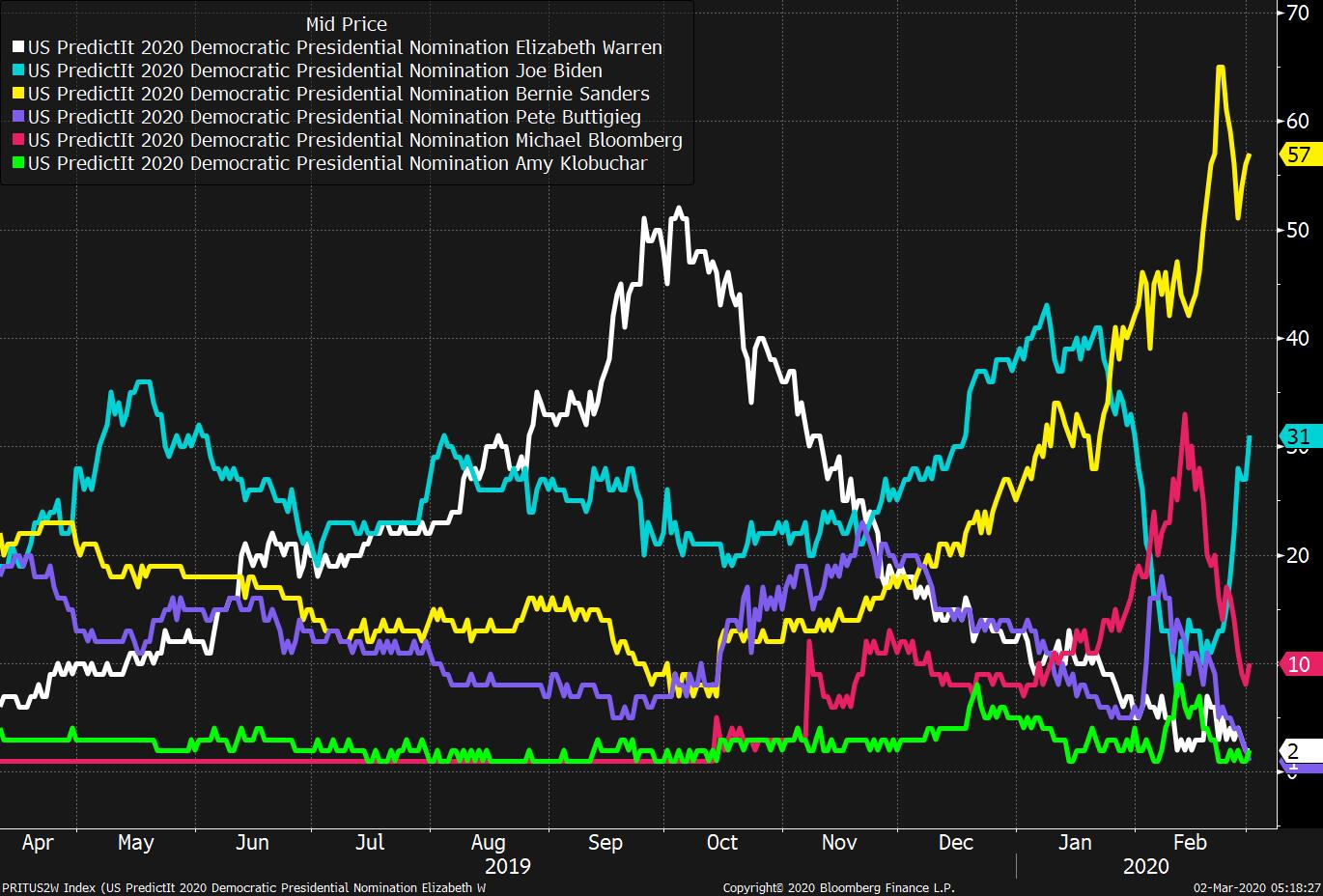

Policy makers push back, market rebound fizzles out, and virus continues to spread. Promises and actionA rare statement from Federal Reserve Chair Jerome Powell promised action should it prove necessary, and heralded a round of responses from central banks on how they will cope with coronavirus risk. In the wake of the Fed's remarks before the close of trading Friday, the Bank of Japan said it would "ensure stability in financial markets" and followed up with a $4.6 billion repo operation, with data showing it had also bought a record amount of stock funds. The Bank of England also said it was working to ensure steps are taken to protect financial and monetary stability. France's Finance Minister Bruno Le Maire said that the Group of Seven finance ministers will hold a teleconference this week to discuss a coordinated response. Bounce?The initial reaction from markets to the policy-maker interventions was positive, with Asian stocks staging something of a recovery, but the move is fading during the European session. The MSCI Asia Pacific Index rose 0.8%, with Japan's Topix index closing 1% higher. In Europe the Stoxx 600 Index rallied as much as 2.3% before reversing those gains to trade broadly unchanged by 5:50 a.m. Eastern Time. It is a similar story with S&P 500 futures that are well off their earlier highs. The conviction trade getting one-way traffic? Treasuries with the yield on the 10-year benchmarks falling below 1.1%. SpreadingThe death toll from the outbreak has passed 3,000 with new cases continuing to emerge around the world. New York City, Brussels and Berlin reported their first infections. The OECD this morning slashed its GDP forecast, warning that a contraction in global growth is possible this quarter. It now predicts a 2.4% expansion for this year, which would be the weakest since 2009. Concerns are growing in the U.S. that the policy response from the White House may not be sufficient, with medical experts and lawmakers warning that a surge in cases could quickly overwhelm hospitals and lead to supply shortages. Buttigieg quitsThe large field of candidates for the Democratic presidential nomination was thinned further when both Pete Buttigieg, who had won the delegate race in Iowa, and billionaire Tom Steyer ended their campaigns. Front-runner Bernie Sanders is still heavily favored to come out on top in tomorrow's Super Tuesday, despite Joe Biden's overwhelming victory in South Carolina at the weekend. Michael Bloomberg said that he would continue his campaign even if he doesn't finish in the top three tomorrow. (Bloomberg is the founder and majority owner of Bloomberg LP, the parent company of Bloomberg News.) Coming up…Investors will be looking for confirmation of a continued expansion in U.S. manufacturing when Markit PMI for the sector and ISM Manufacturing are published at 9:45 a.m. and 10:00 a.m. respectively. Also at 10:00 a.m., construction spending for January is expected to show a return to growth. Among the companies reporting earnings today are Eagle Pharmaceuticals Inc. and Tilray Inc. What we've been readingThis is what's caught our eye over the weekend. And finally, here's what Joe's interested in this morning Tomorrow is Super Tuesday, when 1344 of the 1991 delegates needed to win the Democratic nomination will be up for grabs. According to the popular online prediction market PredictIt, Bernie Sanders has a 57% chance of winning the nomination, followed by Biden at 31%. Now there's a lot of controversy about these markets and whether they actually "work" or not. A couple of weeks ago, Vox ran a piece saying these markets tend to be pretty bad at predicting who will win, and ultimately they aren't any better than the pundits. However, I believe this is the wrong test of their success. Part of the confusion comes down to the name. Because they're called prediction markets, it's assumed that the goal is prediction. That's incorrect. The prediction part is what any given trader makes when entering a bet, and the end-price is just the numerical synthesis of all the different predictions that traders are making at any one time. As such, the markets basically quantify a snapshot of conventional wisdom. So the question of whether the markets "work" or not is basically a question of how far off they are from conventional wisdom at any given time. And as you can see from the chart below, they track it pretty well. Last summer there was a perception that Warren was riding high. Then her campaign started to fizzle as Sanders surged. Biden's campaign was seen as almost dead after New Hampshire, and then started bouncing after Nevada. All that is in the chart. Bloomberg's campaign was seen as surging up until the first debate -- again, all in the charts, and so on. What's useful is not that there's some new information that wasn't being caught by the chatter, it's that we have a way of measuring something vague. Prediction markets could only be said to have "failed" if there were major, obvious mispricings that were easily exploitable. (FWIW, because of their size and illiquidity, there do tend to be minor, exploitable mispricings but rarely gross errors.) Ultimately, they're like any other markets. The price doesn't tell you anything about the future. Instead, numerous market participants make their own bets and predictions, and the market price is simply the residual of all those bets and predictions. And if you have confidence in a view that's outside the conventional wisdom, then perhaps you can make money making a wager on it.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment