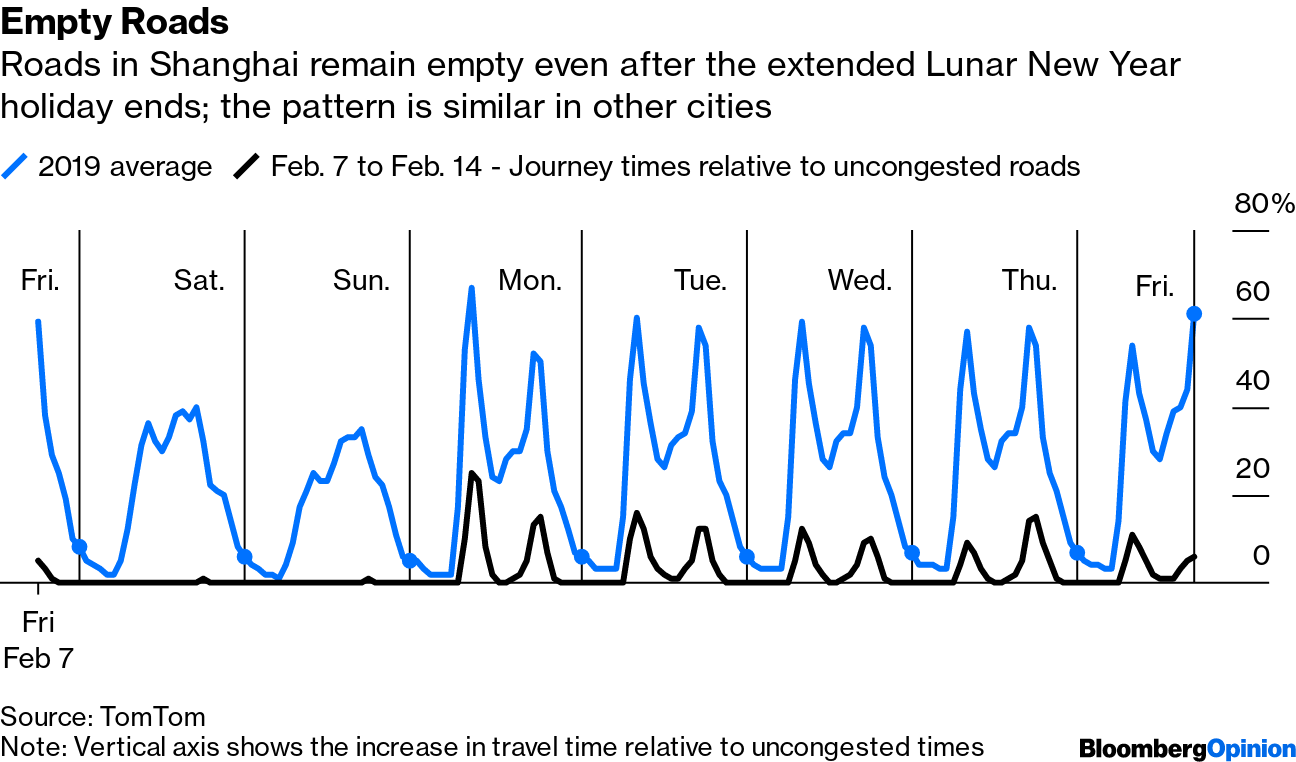

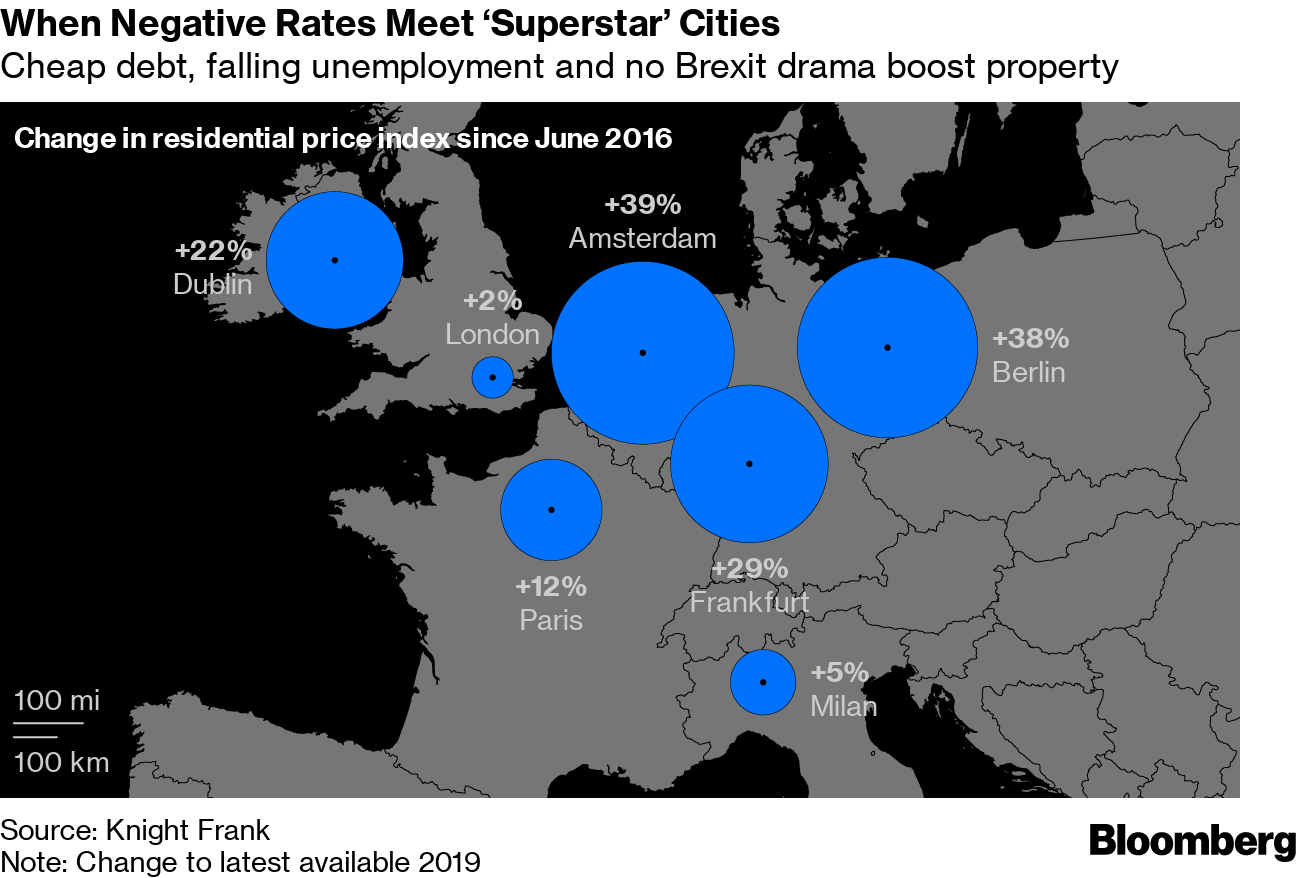

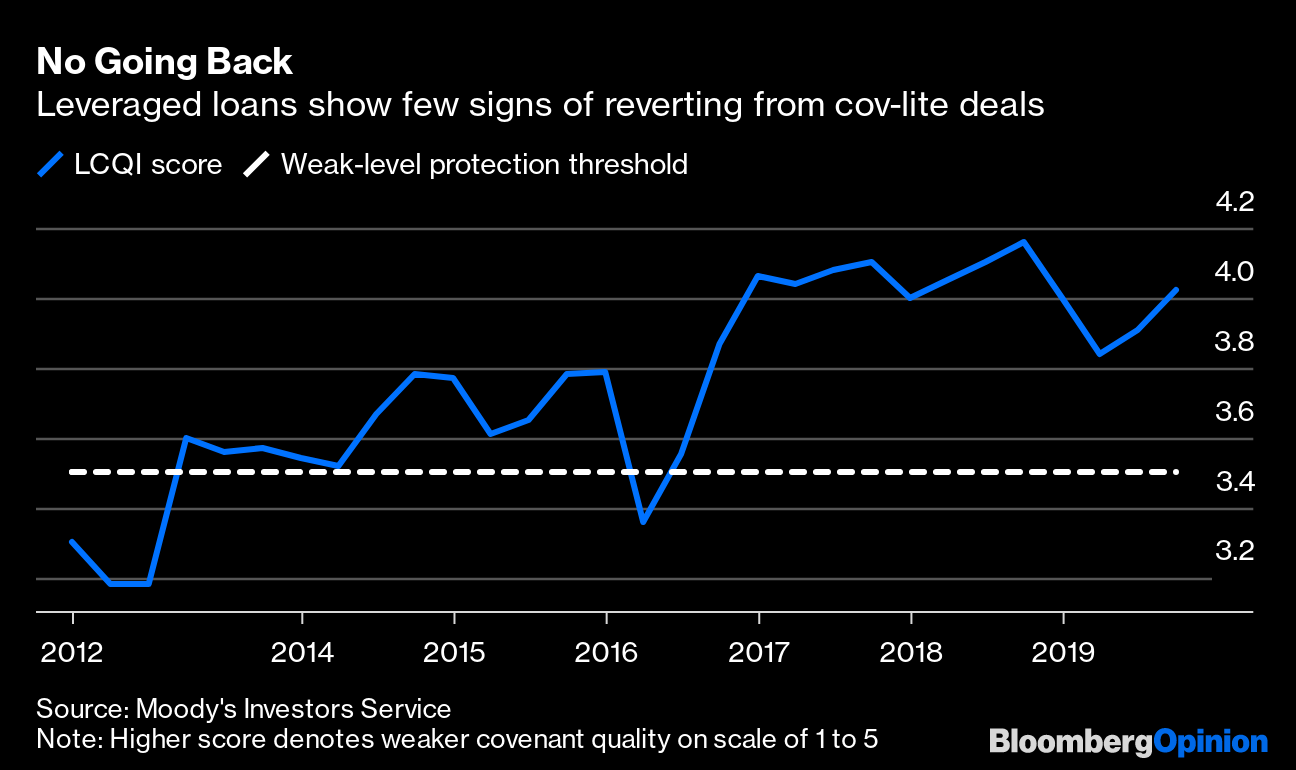

| This is Bloomberg Opinion Today, an epidemic of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  Still getting a handle on things. Photographer: Getty Images/Getty Images AsiaPac This Is Your Brain on Coronavirus The novel coronavirus Covid-19 causes flu-like symptoms in its patients. For the rest of us, it induces a kind of creeping cluelessness. Markets and economists — frequent bedfellows of bewilderment — assume the economic impact of the coronavirus epidemic will be as neatly V-shaped as in past crises, notes Mohamed El-Erian. But the slowdown is still widening from its epicenter in a hobbled China, making this different from such quickly resolved debacles as the financial crisis. Central banks have promised to carpet-bomb the global economy with cash, but that may be the only hope for markets and will leave them increasingly detached from the real world. Not even OPEC is immune: The oil cartel, apparently drunk on V-shaped Kool-Aid (which is a thing; don't bother looking it up), is badly underestimating the hit to demand from the virus this year, writes Julian Lee. Its obstinance will only make future supply cuts deeper and more painful.  China, meanwhile, appears to be handling this crisis as it has so many others, by simply shoveling fresh credit to struggling companies, notes Anjani Trivedi. But many of these businesses were already staggering under difficult debt loads before the crisis, and Beijing's reaction will only make its debt problem, and associated zombie-company problem, even worse. The World Health Organization is the one entity you might expect to competently handle a threat to, you know, world health. But it has been far too deferential to China during this crisis, writes Adam Minter. That has slowed its response and made the epidemic more threatening. To be fair, responding to the disease is made much more difficult by the inability to track it with perfect accuracy, notes David Fickling. Last week's big jump in the patient tally was a troubling reminder that a world accustomed to letting Big Data handle everything isn't built for this level of chaos. Unfortunately, though China deserves some criticism for its handling of the disease, people are taking things way too far, as usual, and blaming all Chinese people for it, notes Stephen Mihm. It's what humans tend to do in pandemics, often with tragic consequences. But at least one group is behaving wisely in this health crisis. You guessed it: We're talking about hedge funds. Bridgewater's Ray Dalio and others have sent millions of dollars in aid to China, almost certainly out of the goodness of their hearts. It's probably just a coincidence this also helps them get on Beijing's good side, as Shuli Ren writes, where it will be easier to benefit from a stimulus-fueled, post-virus boom. Apple Just Can't Quit You, iPhone Apple Inc. is certainly feeling the pain of the virus. Today it warned that sales would be hit by the double whammy of slowing China sales and a nearly frozen iPhone supply chain. The warning momentarily perturbed the stock market, which has not fully absorbed how this disease will hurt corporate profits. (Taiwan Semiconductor Manufacturing Co., a key supplier for Apple and other tech giants, will likely make its own warning soon, writes Tim Culpan.) Wall Street generally dismissed this as a one-off problem for Apple, but Alex Webb writes it's a reminder that, as much as Apple has diversified from the iPhone, it still depends on the gadget for most of its revenue. Bonus Corporate Bellwether Reading: Walmart Inc.'s disappointing sales report suggests its struggle with Amazon.com Inc. is far from over. — Andrea Felsted Stocks Now Only Slightly Less Dangerously Overinflated Despite today's mild spot of bother, U.S. stocks are still near record highs. They are also still wildly overpriced relative to sales, notes John Authers:  At the same time, corporate profit margins are shrinking. Put the two together, et voila: You have a recipe for disappointing market returns, John writes. Good luck guessing when those will appear, though. Further Investment Reading: It Takes a Village to Fix the Climate The Republican Party's current position on global warming is basically that it is a Chinese hoax designed to murder America's economy. So it's notable that House Minority Leader Kevin McCarthy has introduced a climate-change proposal at all, writes Justin Fox, much less one that is actually somewhat constructive. It's not a great plan. And it will probably anger party die-hards without swaying any environmentalists, Justin notes. But McCarthy deserves credit for producing what could be a template for bipartisan compromise if and when we're finally ready. No rush! Until then, we're relying on states, the generosity of billionaires such as Jeff Bezos, and the steady pressure of investors on companies such as BHP Group. The world's biggest miner has committed to cutting emissions, but has the wherewithal to go even further, writes Clara Ferreira Marques. Further Climate Action Reading: Telltale Charts Europe's superstar cities face skyrocketing housing prices, and mere handouts to buyers won't solve the problem, writes Lionel Laurent.  The fight over investor protections for leveraged loans is over, Brian Chappata writes, and investors have lost.  Further Reading President Donald Trump is laying the groundwork for a false panic about voter fraud to undermine the election. — Francis Wilkinson Trump's budget calls for vouchers that will hurt both public and charter schools, though Betsy DeVos loves them. — Andrea Gabor EU regulators hate Facebook Inc.'s business model, but aren't doing much to threaten it. — Lionel Laurent HSBC making huge cuts under an interim CEO will hurt its chances of finding a permanent one. — Nisha Gopalan The Equal Rights Amendment may seem outdated, but its passage would still have a gravitational effect on the law. — Noah Feldman A coming decline in Arab oil wealth could actually be healthy for Arab countries. — Amr Adly ICYMI Trump pardoned everybody, basically. Elon Musk trash-talked Bill Gates's Porsche purchase. East African locust swarms are the size of cities. Kickers "Werewolf" mouse hunts scorpions, howls at the moon. (h/t Alexandra Ivanoff) Seven-thousand-year-old well is the oldest wooden structure ever discovered. Floating farms may reshape our food ecosystem. Does space exploration require a lunar pit stop? Note: Please send pardons and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment