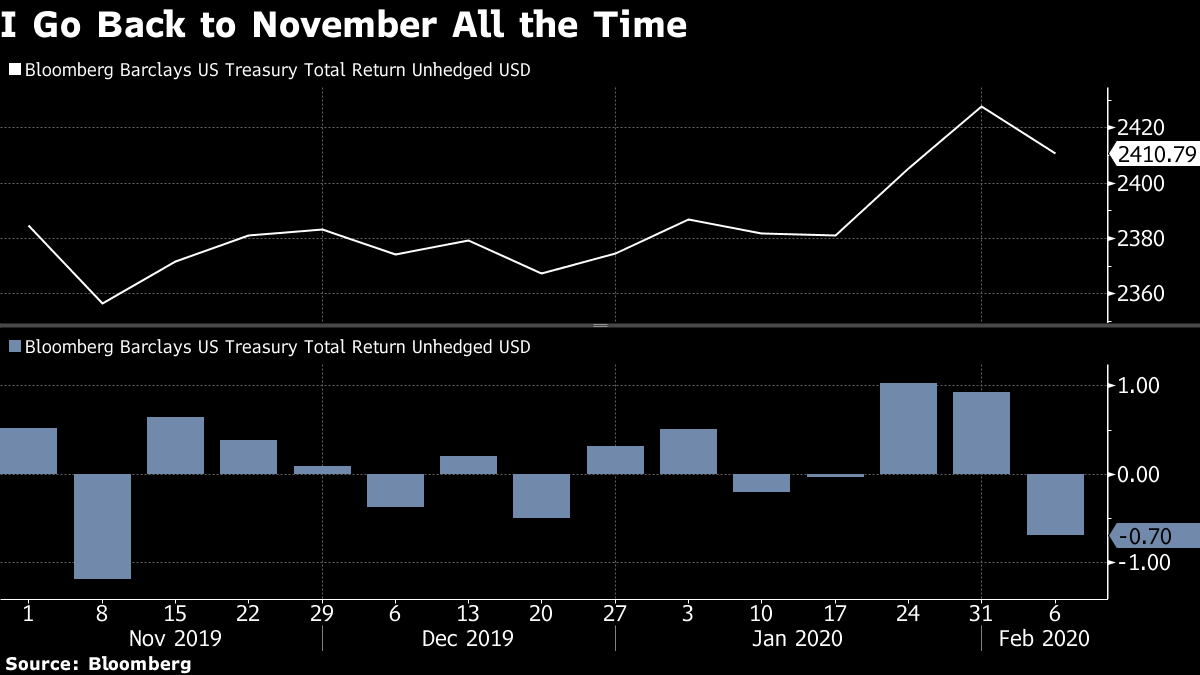

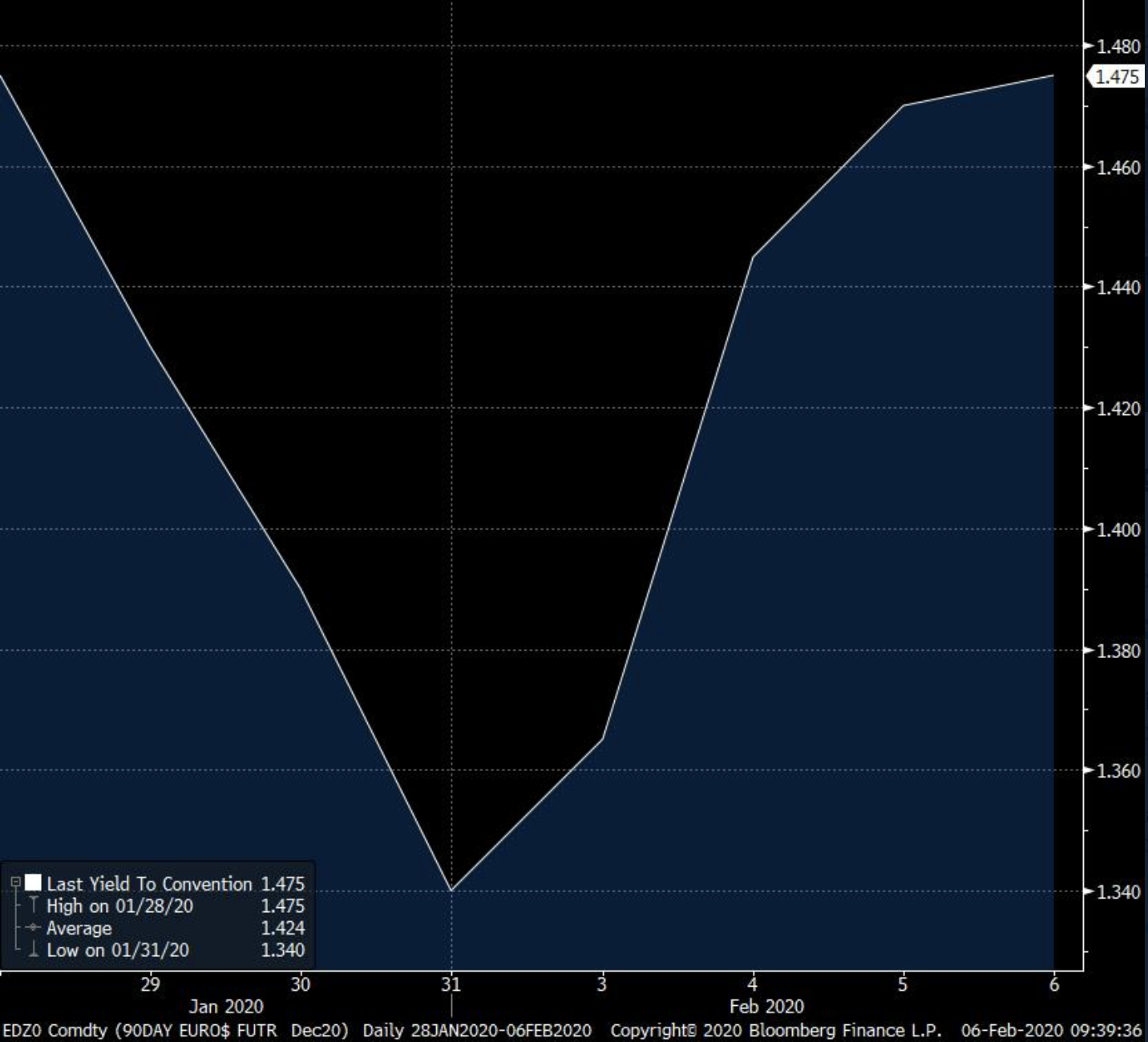

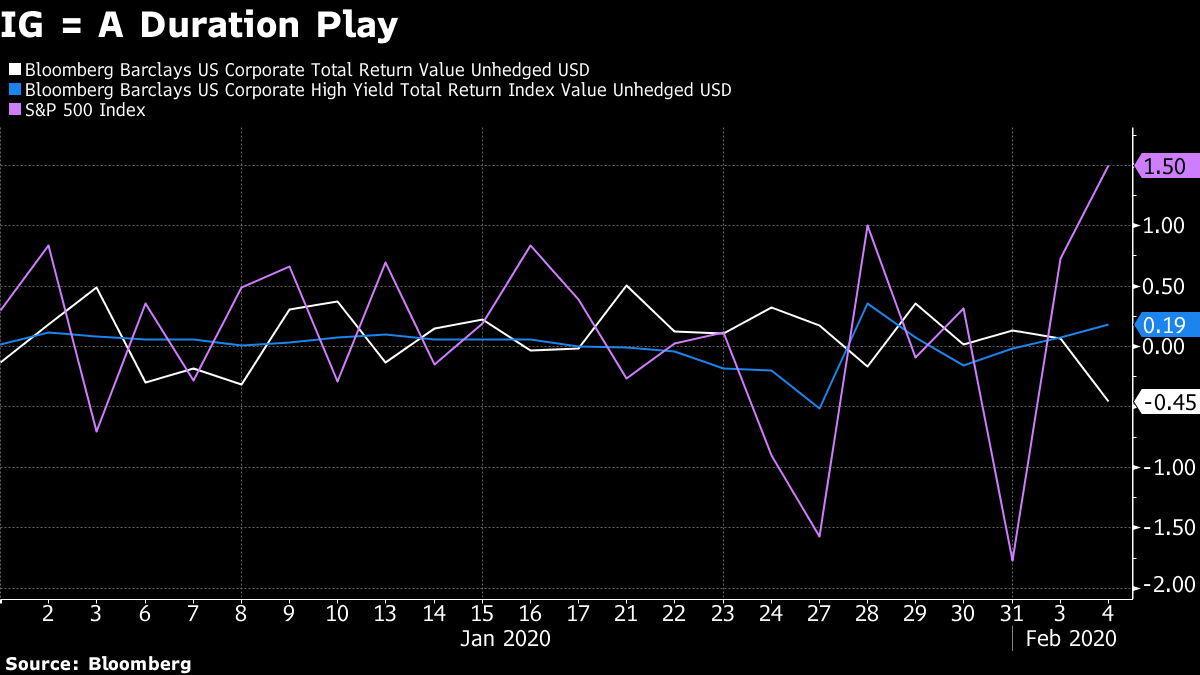

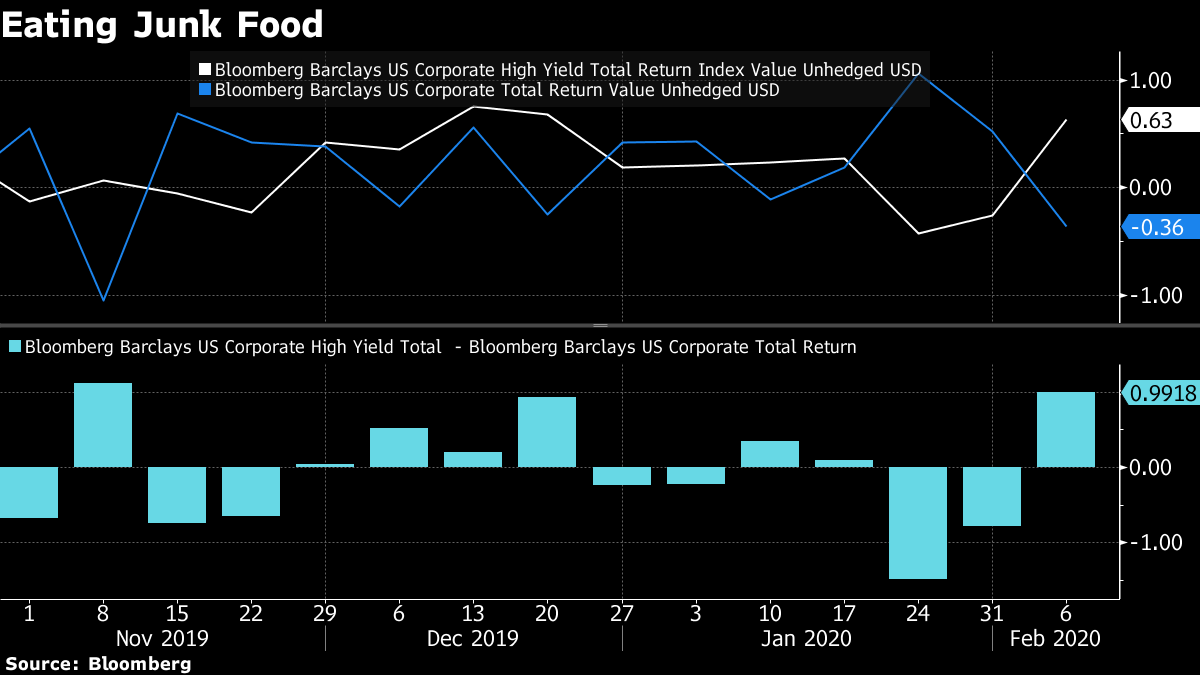

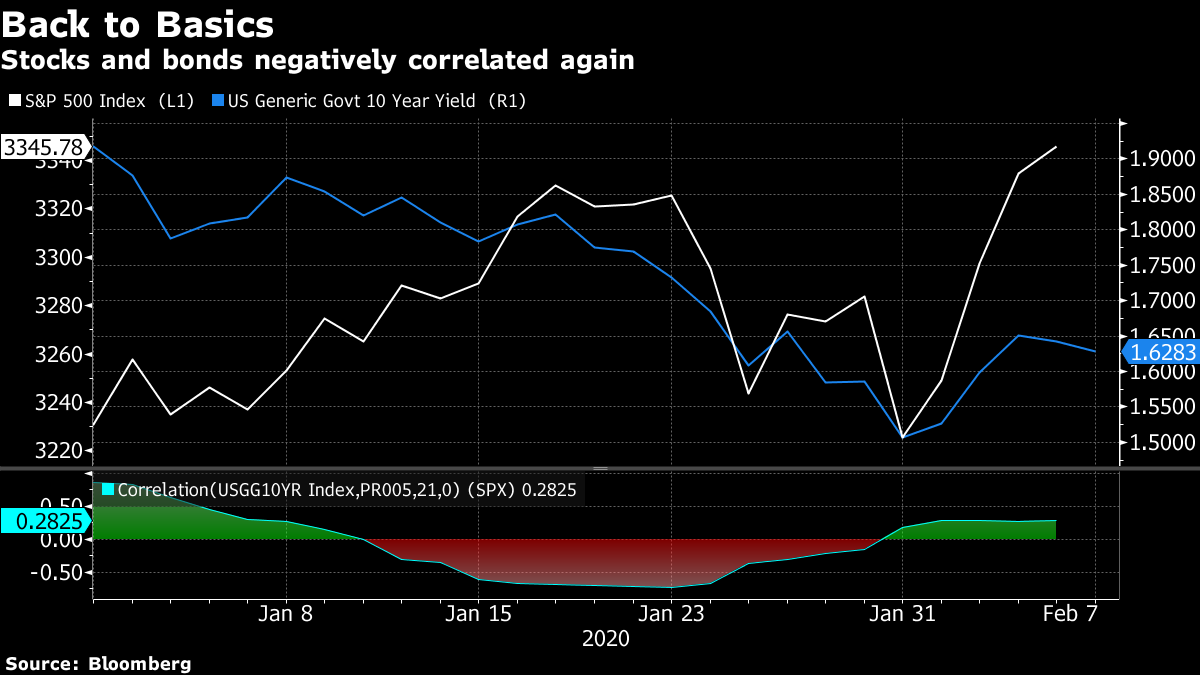

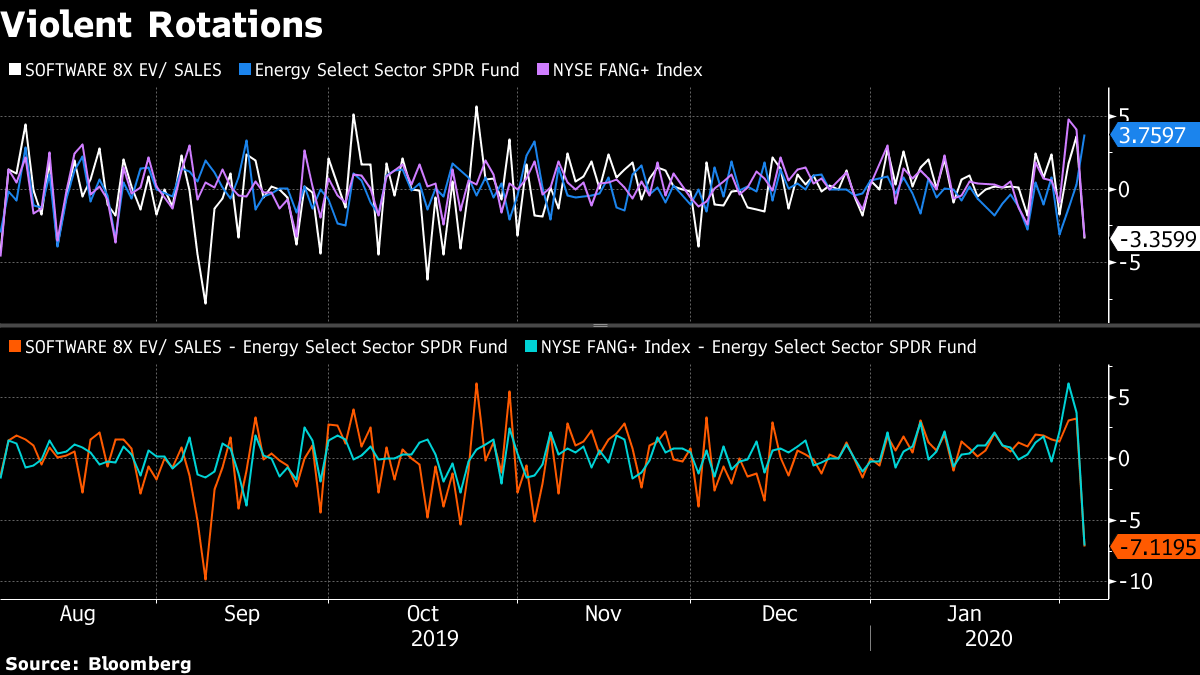

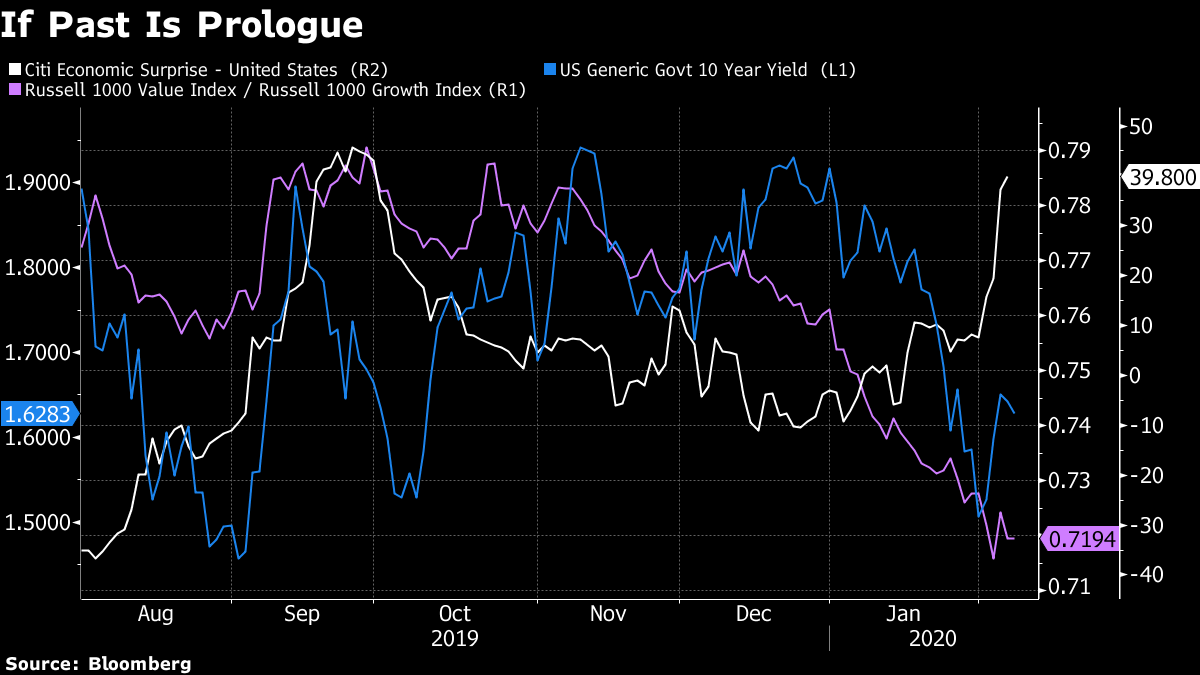

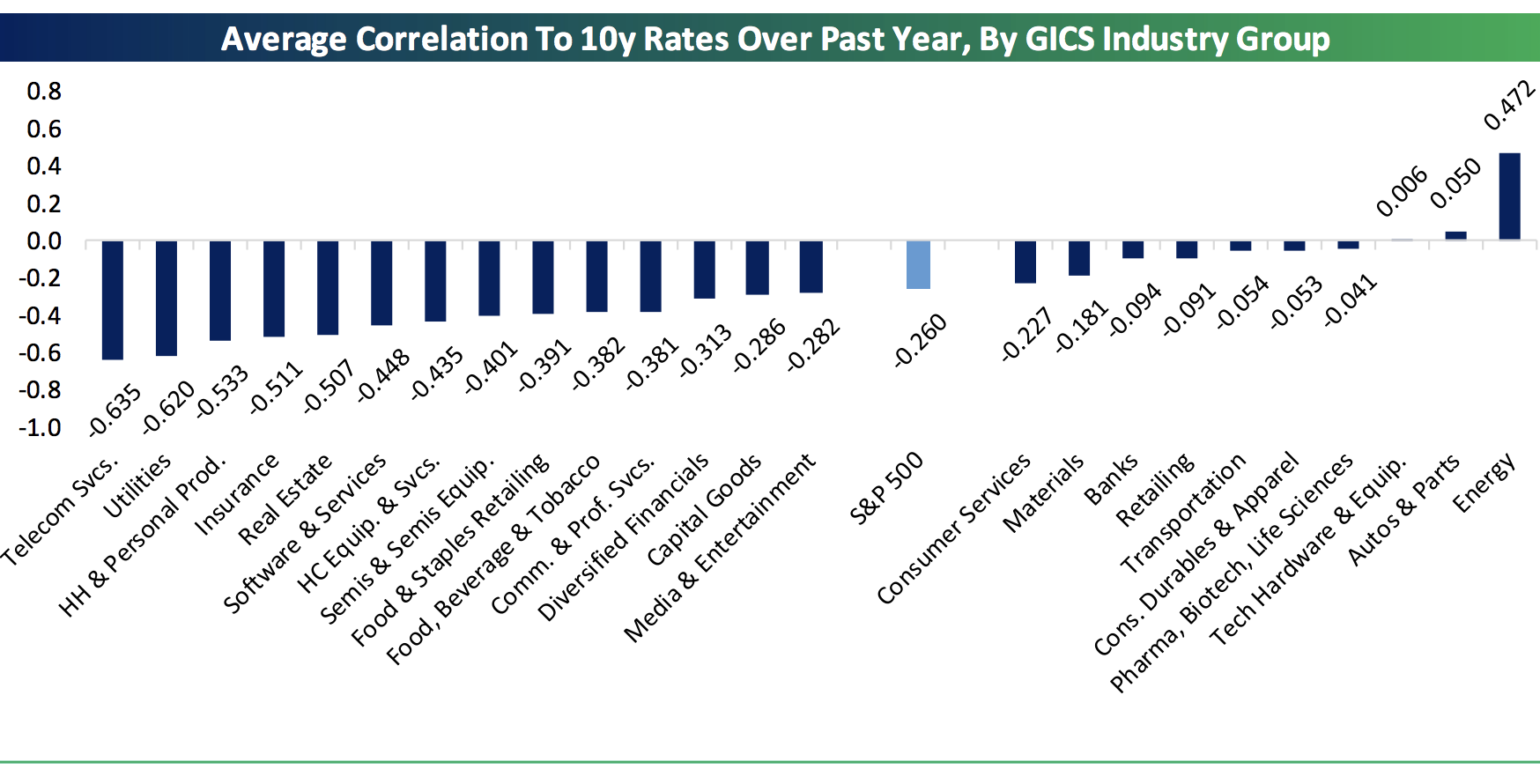

| Welcome to the Weekly Fix, the newsletter that's glad the price action in Tesla's bonds wasn't as insane as the stock. –Luke Kawa, Cross-Asset Reporter. Weak Worst Week U.S. Treasuries are on track for their worst week since November – but that's not saying much: the decline was smaller than either of the rises in the prior two weeks.  Charlie McElligott at Nomura Holdings Inc. outlines the reasons for the Treasuries reversal as follows: markets are presently "numb" to news about the coronavirus, stimulus is coming to offset its effects, economic-surprise indexes are turning up, and what's known of the results of the Iowa caucuses in the Democratic party's presidential-nomination campaign are being perceived as a win-win "Maybe we are complacent, but it looks like 2019-nCoV is peaking as a market important element," says Jeremy Hale at Citigroup Inc. "We are starting to lift hedges and expect risk appetite to fully return." Expectations for the Federal Reserve certainly reflect this. The December 2020 Eurodollar futures contract traded on Thursday with a higher yield than prior to the central bank's last meeting.  Bloomberg Bloomberg This retracement is nowhere near as violent as the rally, but there are some early signs that bonds are willing to react to data differently than during January. Bonds extended losses following Monday's ISM manufacturing report, which showed American factories returned to expansion for the first time since July, and again following a blowout ADP report on private-sector payrolls on Wednesday. Ian Lyngen at BMO Capital Markets cautions those expecting Friday's official employment report to act as a major catalyst for yields. For one thing, a strong ADP report doesn't necessarily mean January jobs will be gangbusters. "The operative question isn't the net level of job creation seen during the month of January, but whether or not the market cares at this stage," Lyngen writes. "Our baseline assumption has been that any strong economic indicators will be readily dismissed as 'old news' by virtue of the simple fact they occurred pre-nCov." However, Lyngen concedes that an extremely robust print could reaffirm investors' feelings that the domestic economy is in a much better starting point to deal with any downside that might arise. Key to watch: whether the 10-year yield can break its Jan. 24 closing level, which has proved elusive thus far.  Duration Sensation This week, we got a reminder of just how duration-dominated the investment-grade credit space is. On Tuesday, the S&P 500 enjoyed its best day since August. High yield had its second-best day of 2020, to that point. And yet it was the worst day since 2020 began for the investment grade bond index, amid a 7 basis point rise in 10-year yields.  High yield is besting investment grade by the most since November this week (the obvious corollary of Treasuries having their worst week since then, too).  It looks to be a similar story as last year, in which the AAA index suffered a bigger drawdown than junk BBs. Duration Counts in Stocks Too That duration dominance is also key to what's going on under the hood of the stock market. The intensely negative correlation between the S&P 500 and Treasury yields in mid-January has shifted back positive. That is, the spread of the coronavirus brought about a situation in which sinking bond yields were more indicative of fear about the growth outlook than a positive force for equity valuations. This week, it might be vice versa.  The growth-over-value trade that dominated January suffered a massive setback on Wednesday – when 10-year yields posted their biggest advance of the year. Eternally beaten-down energy stocks had their best relative performance against the NYFANG Index since the latter's inception in 2014, and beat expensive software stocks by the most since September.  How far can this dynamic go? Well, you should probably ask the Treasuries market. The last time that economic surprise indexes were turning up and yields were rising, value trounced growth.  Bespoke Investment Group observed that the average software and services stock has been twice as correlated to 10-year yields as the market over the past year. "It's pretty plausible, in our view, that tech names are at risk from rising yields," they write. For higher rates therefore, groups like telecom services or software and services should be avoided in favor of energy, which would be quite a dramatic reversal of recent trends."  Bespoke Investment Group Bespoke Investment Group It's noteworthy that these duration-proxy growth companies never really had any drawdown to speak of during the recent risk-off run. As Conor Sen, a New River Investments portfolio manager and Bloomberg Opinion columnist, puts it, "Back to that dynamic where the absolute worst thing that could happen to tech/momentum stocks is economic data strong enough to make interest rates go up." This doesn't necessarily distill into "good news [about the economy or the coronavirus] is bad news [for the S&P 500]." But it seems as though we're heading into an environment in which good news could be bad news for the relative performance of the stock-market kingpins, meaning the rest of the equity universe would need to do a lot to pick up the slack. |

Post a Comment